Axis Large Cap Fund

Scheme Type: Equity

Investment Objective

Benefits of

Large Cap mutual funds invest predominantly in large companies

Such companies are traded frequently and hence liquid and also less volatile as these stocks have proven track record, business models and capable enough to deliver long term consistent returns.

The Axis Large Cap Fund aims to outperform the benchmark with risk lower than the benchmark.

Asset Class benefit - Equity as an asset class holds potential to beat inflation and generate long term wealth.

Target Goals- Long-term goals such as children's education & their future, retirement or any other long term growth that needs wealth creation plan.

Fund Manager

Entry Load

Exit Load

- Capital appreciation over long term.

- Investment in a diversified portfolio predominantly consisting of equity and equity related instruments of large cap companies.

- Lumpsum Investment :₹ 100

- Additional Investment :₹ 100

Goal Planning

Access all the goal features and benefits at No Cost.

Choose your goal

Top 5 sectors

Issuers

IDCW

IDCW (₹ Per Unit) | NAV Per Unit |

| Record Date | Option | Individuals/HUF | Others | Cum IDCW | Ex IDCW |

| Jan 17, 2025 | Dividend | 0.960 | 0.960 | 18.850 | 17.890 |

| Feb 08, 2024 | Dividend | 1.600 | 1.600 | 18.760 | 17.160 |

| Mar 13, 2023 | Dividend | 1.600 | 1.600 | 16.410 | 14.810 |

Investment Packs

FAQs on Axis Large Cap Fund

A Large cap fund is an open ended equity scheme that predominantly invests in equity and equity related instruments of large cap companies. Also referred to as large cap fund, Large Cap funds invest a minimum of 65% of their total investible corpus in equity and equity related instruments of financially well-established companies. Large Cap funds mostly invest in stocks of companies that have a proven track record. Of its total assets, a Large Cap fund allocates a majority of its assets to companies with large market capitalization.

One way to earn long term capital appreciation is by investing in Axis Large Cap Fund. Follow these simple steps to invest in Axis Large Cap Fund online:

1. Log on to https://www.axismf.com website

2. Hover on the ‘All Schemes’ tab and when you get a drop down click on ‘Equity’

3. You will see all the equity mutual funds offered by Axis Mutual Fund

4. ‘Select Axis Large Cap Fund’

5. Click on ‘Start SIP’ if you want to start a SIP

6. Then Select the SIP amount, Tenure, SIP date, and Growth / Regular plan and click ‘Continue’

7. If you want to start investing right away, you can even click select the ‘Add Lumpsum’ feature

8. You can now start investing in Axis Large Cap Fund

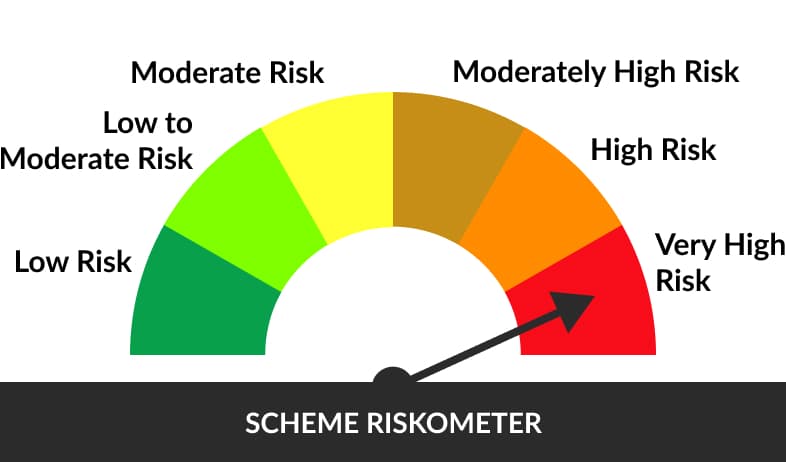

Large Cap funds predominantly invest in the equity market. This makes them a very high volatile investment. This mutual fund scheme may hold the potential to offer risk adjusted returns over the long term, but it doesn’t guarantee returns. Hence, investors with a very high risk appetite and a long term investment horizon may consider investing in a large Cap fund. If you are someone who wishes to invest in a diversified portfolio of largecap stocks you should consider investing in a largecap fund.

Investing in Axis Large Cap Fund is a good option as this scheme has the potential to offer risk adjusted returns over the long term. Investing in Axis Large Cap Fund may allow investors to create wealth however, investors may need to have a long term investment horizon spanning over five years to seven years at least so that this equity fund is able to perform and deliver decent returns over in the long run. Also, only investors who carry a very high risk appetite should consider investing in Axis Large Cap Fund. Investors can target their life’s long term financial goals like retirement planning, securing their child’s financial future, building a marriage corpus for their child, etc. by investing in Axis Large Cap Fund.

Here are the primary benefits of investing in Axis Large Cap Fund:

- Large Cap mutual funds invest predominantly in large companies

- Such companies are traded frequently and hence liquid and also less volatile as these stocks have a proven track record, business models and are capable enough to deliver long term consistent returns.

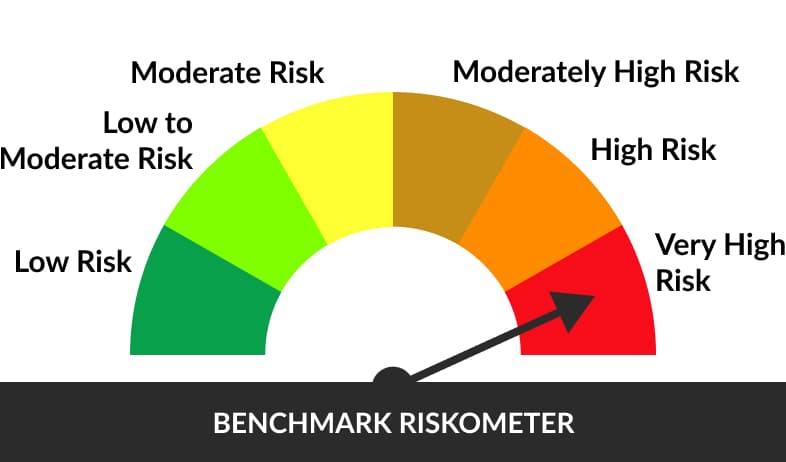

- The Axis Large Cap Fund aims to outperform the benchmark with risk lower than the benchmark.

- Asset Class benefit - Equity as an asset class holds the potential to beat inflation and generate long term wealth.

- Target Goals- Long-term goals such as children's education & their future, retirement, or any other long term growth that needs a wealth creation plan

Axis Large Cap Fund works pretty much like any other equity mutual fund scheme. The fund invests a majority of its investible corpus in equity and equity related instruments of companies with large market capitalization. The scheme may invest the remaining corpus in money market instruments in quantum with the scheme’s investment objective. The AMC collects money from investors sharing a common investment objective and the fund manager invests this accumulated sum across large cap companies. In exchange, the investors receive units in accordance with the scheme’s existing Net Asset Value (NAV). The NAV of the scheme may fluctuate depending on how the scheme performs over time. Axis Large Cap Fund invests in large cap stocks that have growth potential and can offer long term earnings to investors.