FAQs on Axis Bluechip Fund

Consumption funds may carry higher risk compared to more diversified funds, as they are focused on specific sectors related to consumption. However, Axis Consumption Fund mitigates some of this risk by diversifying investments across multiple sectors within the consumption theme.

Investors with a long-term investment horizon (5+ years) who are looking to tap into the growth potential of India's consumption sector should consider investing in consumption funds. These funds are suitable for those seeking exposure to high-growth sectors driven by increasing consumer spending.

There is no exit load for up to 10% of investments if redeemed or switched out within 12 months. For the remaining investments, a 1% exit load applies within this period. No exit load applies if redeemed or switched out after 12 months.

The minimum application amount for the Axis Consumption Fund is Rs. 100 and in multiples of Rs. 1 thereafter.

A consumption fund is a type of thematic mutual fund that invests in companies engaged in or expected to benefit from consumption and consumption-related activities. This can include sectors such as FMCG, automobiles, consumer services, consumer durables, telecommunications, healthcare, power, and realty.

You can invest in the Axis Consumption through Axis Mutual Fund's official website or the mobile app.

It is recommended to stay invested in thematic consumption mutual funds for a typical investment horizon of 5+ years to fully benefit from the long-term growth potential of the consumption sector.

The Axis Consumption Fund invests in equity and equity-related securities of companies engaged in or expected to benefit from consumption and consumption-related activities across various sectors like FMCG, automobiles, consumer services, consumer durables, telecommunications, healthcare, power, and realty.

The fund follows a bottom-up, fundamentals-based stock selection process. The fund seeks to identify companies across three segments of the Indian economy: companies investing in production capacity and R&D for future gains, those within industries with a rising demand trajectory, and those that are likely to benefit from India’s growing integration into the global supply chain.

The Indian manufacturing sector is poised for significant growth in the coming years backed by a strong confluence of reforms, policies, and sectoral priorities by the government. Initiatives like the National Infrastructure Pipeline, Production Linked Incentive schemes, and privatization drive will provide an impetus through increased infrastructure spending and manufacturing incentives. Focused programmes under the Atmanirbhar Bharat and Make in India 2.0 missions aim to empower local manufacturers, reduce imports dependence, and enhance production capacities.

The scheme follows the NIFTY India Manufacturing TRI as benchmark.

The fund is ideal for investors with high risk appetite and seeking capital appreciation over the long term with a 5-year investment horizon.

Axis India Manufacturing Fund is predominantly an equity-oriented scheme. Under normal circumstances, the fund will allocate 80-100% to equity & equity-related instruments including derivatives, 0-20% to debt & money market Instruments, and 0-10% to units issued by REITs & InvITs.

Axis India Manufacturing Fund is an open-ended equity scheme representing the India manufacturing theme. The scheme aims to generate long-term capital appreciation by investing primarily in equity and equity related instruments of companies engaged in manufacturing.

The following persons are eligible and may apply for Subscription to the Unit(s) of the Scheme:

• Resident adult individuals, either individually or jointly (up to a maximum of three individuals), or on an "Anyone or Survivor" basis.

• Minors can invest, but they must be the first and sole holder, and the investment should be made through their natural guardian (father or mother) or a court-appointed legal guardian. Investments with minors cannot have joint holding.

• Non-Resident Indians (NRIs), Persons of Indian origin (PIOs), and Overseas Citizens of India (OCIs) residing abroad can invest, either on a repatriation or non-repatriation basis.

• The AMC (Asset Management Company) and Trustee may specify other categories of individuals permitted to make investments from time to time.

Axis India Manufacturing Fund aims to generate long-term wealth by investing within the manufacturing space in India. The fund aims to capitalize on growth opportunities in manufacturing created by rising demand and supply, government reforms, and the current geo-political scenario.

Long-term capital gains tax of 10% is applicable if the mutual fund units are held for more than one year. Short-term capital gains tax of 15% is applicable if the units are held for one year or less. Aforementioned tax rates shall be increased by applicable surcharge and health and education cess.

*The information is provided for general information only. For further details on taxation please refer to the clause on Taxation in the SAI. In view of the individual nature of the implications, each investor is advised to consult his or her own tax advisors with respect to the specific amount of tax and other implications arising out of his or her participation in the schemes.

India’s manufacturing sector is poised for growth with enabling conditions like surging domestic and export demand, improving supply capabilities, and India’s rising geopolitical presence. The fund aims to leverage this theme and invest in sub-sectors of manufacturing that are likely to propel this boom over the coming years.

Returns may be in line with the growth achieved by India's manufacturing sector over the long term which is expected to outpace broader markets. However, actual returns depend on future performance.

Investors can transact through the below modes:

• Axis MF Online / Axis MF Mobile

• MF Utility

• Channel Distributors

• Stock Exchange Platforms

• Other Electronic Mode

India is expected to become a global manufacturing hub on the back of policy push, investments, and rising domestic demand. Manufacturing's share in the GDP can rise substantially from the current 17% to around 25%.

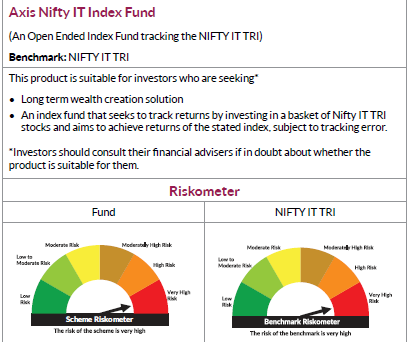

The Nifty IT Index is a sectoral index on the National Stock Exchange (NSE) of India that tracks the performance of the Information Technology (IT) sector. It includes major IT companies listed on the NSE, providing a snapshot of the sector's performance and reflecting the trends and movements within the Indian IT industry.

The Axis Nifty IT Index Fund is a mutual fund that aims to replicate the performance of the Nifty IT Index. It invests in the same IT stocks that constitute the Nifty IT Index, providing investors with exposure to the performance of the Indian IT sector.

The Axis Nifty IT Index Fund is suitable for investors who are interested in exposure to the Indian IT sector. Also, for those who believe in the growth potential of IT companies and want to invest in a sector-specific fund rather than a broad market index.

A person can opt for a lump sum which starts from ₹100 and in multiples of Re. 1/- thereafter. The minimum monthly SIP investment is ₹100 and in multiple of Re. 1/-.

The Axis Nifty IT Index Fund can fit into an investment portfolio as a sector-specific investment focused on the IT industry. It offers exposure to a specific sector, allowing investors to capitalise on the growth potential within the IT space. This fund can complement a diversified equity portfolio by adding sectoral exposure, but it also comes with the risk associated with sector-specific investments.

To invest in the Axis Nifty IT Index Fund, you can use various methods including the Axis Mutual Fund website, online mutual fund platforms, or through financial advisors. Investments can be made via lump sum or through a systematic investment plan (SIP), based on your investment preferences and goals.

Investing in the Axis Nifty IT Index Fund involves sector-specific risks, primarily associated with the IT industry. These include market risk due to fluctuations in the technology sector, regulatory changes affecting IT companies, and economic conditions impacting the sector. Additionally, the fund is subject to tracking errors, and adverse developments in the sector.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

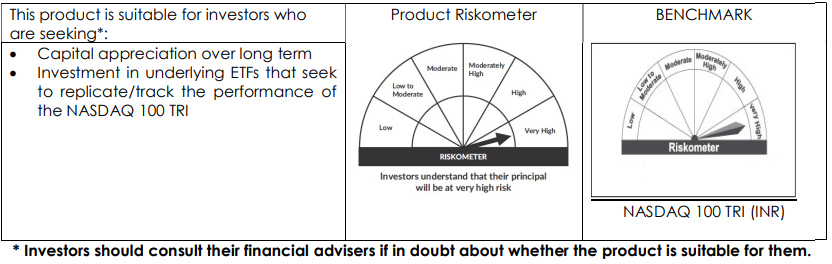

Axis NASDAQ 100 Fund of Fund is an open ended fund of fund scheme investing in units of ETFs focused on the Nasdaq 100 TRI. The fund aims to mimic movements and returns of NASDAQ, subject to tracking errors.

The following people are eligible to apply to Axis NASDAQ 100 FoF for subscribing to the Scheme units:

• Resident individuals over 18, can singly or jointly (limited to three) or on anyone or survivor basis.

• Minor (as sole/first holder only) through a natural guardian (father or mother) or a legal guardian appointed by a court. There cannot be a joint holding with a minor investor.

• Non-Resident Indians (NRIs) / Persons of Indian origin (PIOs) / Overseas Citizen of India (OCI) residing abroad can invest on a repatriation basis or non-repatriation basis;

• Such other category of person(s) permitted to make investments and as may be specified by the AMC / Trustee from time to time.

• For further details, investors are requested to refer Scheme Information Document / Key Information Memorandum.

A fund of fund is a mutual fund scheme that invests in other funds.

Transactions in this fund can be through:

• Axis MF Online

• Axis MF Mobile

• MF Utility

• Channel Distributors

• Other Electronic Mode

The Nasdaq 100 is one of the world’s preeminent large-cap growth indexes. It includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. While technology is a dominant segment in the index, it is well-balanced by sectors such as consumer services, healthcare, consumer goods, and industrials amongst others.

The minimum application amount is Rs. 500 and in multiples of Re. 1/- thereafter. The minimum additional purchase amount is Rs. 100 and in multiples of Re. 1/- thereafter. Minimum application amount is applicable only at the time of creation of new folio and at the time of first investment in a plan.

The scheme follows NASDAQ 100 TRI (INR) as a benchmark.

• If redeemed / switched-out within 7 Days from the date of allotment, exit load is 1%;

• If redeemed / switched-out after 7 days of allotment, exit load is Nil.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Axis NASDAQ 100 Fund of Fund will invest in one or more in one or more ETFs mentioned below to achieve its investment objective:

• iShares NASDAQ 100 UCITS ETF

• Invesco EQQQ NASDAQ-100 UCITS ETF

• Xtrackers Nasdaq 100 UCITS ETF

The fund is suitable for investors seeking exposure to the international market and innovative companies to generate capital appreciation over the long term.

Investing in international markets enables access to opportunities not available in India. It also helps diversify portfolio risk due to lower correlation of Indian and US markets.

India’s geo-political situation and INR’s tendency to depreciate would have a positive impact on your returns. However, considering that the equity risk is far greater than the currency risk involved, investors should not base their investment only on the currency viewpoint.

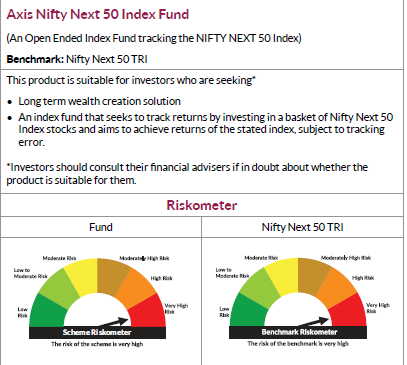

The NIFTY Next 50 is an index provided and maintained by NSE Indices. It represents the next level of liquid securities after the NIFTY 50.

The Axis Nifty Next 50 Index fund is a fund that replicates the performance of the Nifty Next 50 index. The fund offers exposure to a diverse range of sectors and companies that are considered to have growth potential.

The fund is suitable for investors looking for long-term wealth creation. It is suitable for investors who are comfortable with taking significant risks. Also, the fund requires a long-term approach, so one has to stick with it for at least 5 years, as it’s subject to volatility.

The minimum investment required for the fund is a lumpsum investment of ₹100 and in multiples of Re. 1/- thereafter. The minimum investment for monthly SIP is ₹100 and in multiples of Re. 1/- thereafter.

One can invest in the Axis Nifty Next 50 Index Fund in various ways. One of the ways is through the Fund’s official website. Another is through online mutual fund platforms. These investments can be done through lump sum or SIPs.

The Axis Nifty Next 50 may be more volatile than the Nifty 50, which is more susceptible to market fluctuations.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

Multi cap funds are suitable for investors with a medium to long-term investment horizon. While short-term fluctuations may occur, the diversified nature of these funds may make them suitable for investors looking to build wealth over time.

Unlike funds that focus on a specific market capitalization, multi cap funds allow investors to invest in all market caps and sectors simultaneously. This provides more comprehensive equity exposure within a single fund. This makes the fund positioned to benefit from changing market cycles where different market segments may potentially outperform at different times.

According to SEBI, multi cap funds are obligated to keep at least 75% of their assets invested in equity and equity-related instruments at all times. Therefore, their portfolios must ensure that at least 25% of their assets are invested in large cap stocks, 25% in mid cap stocks, and 25% in small cap stocks respectively.

While returns from multi cap funds can vary based on market conditions, the aim is to make the most of various market segments during different market cycles. It is important to note that multi cap funds come with very high risk and past performance is not indicative of future results.

Market capitalization, or market cap, is a measurement of a company's size. According to SEBI, all companies that are listed on the stock exchanges are ranked based on their market cap. The top 100 companies are categorised as large cap companies. Companies ranked from 101st-250th as mid cap companies, and those from 251st onwards as small cap companies.

Investing in multi cap funds offers several advantages.

• The first is simplicity and convenience of investing in multiple companies across market capitalization and eliminating the need to choose between large cap, mid cap, and small cap stocks.

• Second, these funds can help capitalize on varying market cycles where one market cap may outperform others.

• Third, these funds allow access to companies of all sizes – while large caps are predominantly well-established companies with relatively low volatility, small and midcaps come with greater potential to grow albeit at a higher risk. The combination offers a risk-adjusted portfolio that does not compromise growth prospects.

Large cap companies generally have an established track record and tend to be less volatile. Mid cap companies are typically riskier than large caps and are in a growing phase. Small cap companies carry even more risk compared to mid -cap companies and have higher growth potential.

Yes, multi cap funds are suitable for first-time investors as they provide an opportunity to have exposure to all market capitalizations—large cap, mid cap, and small cap stocks with professional management. This approach allows new investors to access a broad spectrum of growth opportunities across different segments of the market without the need for extensive market knowledge.

Multi cap funds help to manage risk through diversification. By investing in stocks of companies with varying market capitalizations and sectors, they spread risk across different segments of the market.

Investing in multi cap funds is simple. You can invest directly through the websites of fund houses or through online platforms offering mutual fund investment services. Additionally, you can approach banks, financial advisors, or mutual fund distributors to help you with the investment process. Before investing, it's essential to research different funds, consider factors such as risk profile, fund performance vis-à-vis benchmark and peers, expense ratios, and investment objectives. Consult with a financial advisor to align your investments with your financial goals.

Multicap funds are managed by experienced fund managers who adjust the portfolio allocation based on prevailing market conditions, aiming for the fund to be positioned for optimal performance.

Multi cap funds attract equity taxation as they invest at least 75% of their assets in equity and related instruments. Each investor is advised to consult his or her own tax consultant with respect to the specific tax implications arising out of his or her participation in the scheme.

Multicap funds provide a balanced approach, aiming for stable returns and managed risk by capturing opportunities across the entire market, regardless of company size.

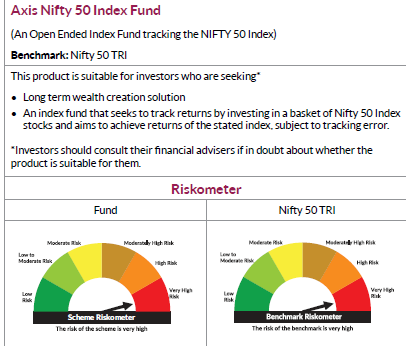

Investing in the Axis Nifty 50 Index Fund offers several advantages.

1. It provides exposure to a diversified portfolio of 50 large-cap stocks across various sectors, which helps in spreading risk.

2. The fund aims to replicate the performance of the Nifty 50 Index subject to tracking error, ensuring that investors benefit from the growth of the top companies in India.

The Nifty 50 is a diversified index of 50 stocks across 13 sectors, used for benchmarking, derivatives, and index funds.

The Axis Nifty 50 Index Fund is suitable for investors who are looking for long-term capital appreciation and want to invest in a portfolio that mirrors the Nifty 50 Index. It is ideal for those who prefer a passive investment strategy and want to benefit from the performance of the top 50 companies in India without actively managing their investments

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

The Axis Nifty 50 Index Fund is a mutual fund that aims to replicate the performance of the Nifty 50 index. Nifty 50 index consists of the 50 largest and liquid stocks listed on the National Stock Exchange (NSE) of India. The fund seeks to offer investors returns that closely match the performance of the index, providing diversified exposure to major blue-chip companies in India.

Since its inception, the Nifty 50 index fund has performed quite similarly to the Nifty 50 index, which represents the performance of the top 50 large-cap stocks.

The minimum lump sum investment is ₹100.

Axis Nifty 50 Index Fund fits well into an investment portfolio as a tool for gaining broad exposure to the Indian equity market with minimal management fee. This is suitable for investors looking for diversified investment options.

Investment in Axis Nifty 50 Index Fund can be done through SIPs and lump sums, through the fund’s official website or Axis Mutual Fund App. Besides this, one can also consider investing in these funds through online mutual fund platforms, and financial advisors.

Investing in the Axis Nifty 50 Index fund carries multiple risks, including market risk, as the fund’s performance is directly tied to fluctuations of the Nifty 50 index. If the index declines, the fund’s value will also decrease.

Axis Value Fund offers several reasons to consider it:

- Valuations: It seeks out companies trading at lower multiples in their industries.

- Fundamentals-Based: The fund focuses on opportunities to improve Return on Equity (ROE) during economic cycles, potential long-term earnings growth, and prudent leverage management.

- Medium to Long-Term Focus: It aims to create wealth through multiples re-rating and by navigating economic cycles effectively.

- Integrated Risk Management: The fund emphasizes portfolio risk management.

- Strong Management: It benefits from a management team with solid execution capabilities and a commitment to good governance.

Axis Value Fund stands out due to its value investing approach. It actively seeks companies with strong fundamentals trading at reasonable valuations. This focus allows the fund to identify opportunities, especially during market volatility.

Axis Value Fund helps you find good deals in the market, especially when it is overpriced. It lets you invest in stocks that are undervalued but have potential to grow, especially when the market is low.

As per the fund manager's view, earnings in sectors like banking, industrials, and auto have been largely in line with market estimates. However, the IT sector has faced challenges due to global economic conditions. Axis Value Fund is well-positioned to navigate these market dynamics and identify value stocks. *

*Current portfolio allocation is based on the current market conditions and is subject to changes depending on the fund manager’s view of the markets. Please refer SID, for detail Asset Allocation & Investment strategy of the Scheme

Axis Value Fund is an open ended equity scheme following a value investment strategy. It aims to achieves this by constructing a diversified portfolio using the principles of value investing. The fund aims to identify stocks with potential for improvement and re-rating over the long term.

Axis Quant Fund is an open-ended equity scheme following a quantitative model. The investment objective of this fund is to generate long-term capital appreciation by investing primarily in equity and equity related instruments selected based on a quantitative model. However, there can be no assurance that the investment objective of the Scheme will be achieved.

Quant funds may turn out to be a good investment option for those investors who are looking for a mutual fund scheme that generates capital appreciation over the long term and works without any human emotional judgment or biased errors. The quant fund aims to deliver by making investment decisions purely based on its investment objective. Even if the fund house undergoes management changes, investors need not get triggered because quant funds are purely data driven based on an automated system.

Usually, with active mutual funds, the fund managers carefully pick stocks that have growth potential and keep shuffling the portfolio to suit the changing market cycles. However, when it comes to quant funds, the entry and exit decisions for its underlying securities are computer based. Quant fund managers are given the task of crafting a predefined investment strategy that automatically picks securities to allow the quant fund to achieve its investment objective. Since the entire portfolio of a quant fund is built using an algorithm, the scope for human error is mitigated.

Quant funds aim to generate capital appreciation over the long term without any human emotional judgment or biased errors. Decisions are entirely based on the quant scheme’s nature and its investment objective. Investors do not have to worry about human biases as these funds function on a predefined algorithm. AI technology has no scope for human error and quant funds function on this data driven technology.

A quant fund is a type of equity mutual fund. It tries to generate returns by investing in stocks using data driven artificial intelligence technology. Investors can invest in Axis Quant Fund either by making a lumpsum investment or they can also opt for Systematic Investment Plan (SIP). Axis Quant Fund is an open ended scheme that doesn’t have a lock-in period. Investors can enter or exit Axis Quant Fund at any given time by placing a request to the AMC.

The benefits of investing in Axis Balanced Advantage Fund include:

- Capital appreciation while generating income over the medium to long term.

- Active management of asset allocation to balance risk and return.

- Investment in a mix of equity, debt, and money market instruments.

Yes, dividends received from Balanced Advantage Funds are subject to tax. The tax rate can vary based on the prevailing tax laws. It's advisable to consult with a tax advisor for the latest information on dividend taxation.

Choosing between equity funds and Balanced Advantage Funds depends on your investment goals and risk tolerance. Equity funds are more suitable for investors looking for higher growth potential and are willing to take on higher risk. Balanced Advantage Funds offer a more balanced approach, with a mix of equity and debt to manage risk while aiming for growth.

You can invest in Axis Balanced Advantage Fund through various channels such as online platforms, mutual fund distributors, or directly through the Axis Mutual Fund website. It's advisable to consult with a financial advisor to guide you through the process.

The tax liability on gains from Balanced Advantage Funds depends on the holding period and the nature of the gains (short-term or long-term). Short-term capital gains (STCG) are taxed at 20%, while long-term capital gains (LTCG) exceeding ₹1.25 lakh are taxed at 12.5% without the benefit of indexation.

As per the current portfolio (September 30, 2024), 69.72 % of the net assets are invested in equity. Hence, equity taxation would apply

Balanced Advantage Funds, also known as dynamic asset allocation funds, are hybrid mutual funds that invest in both equity and fixed-income asset classes. The allocation between these asset classes is adjusted based on market conditions to balance risk and return.

The minimum amount required to invest in Axis Balanced Advantage Fund is Rs. 100 and in multiples of Re. 1/- thereafter. It's best to check the latest information on the Axis Mutual Fund website or consult with a financial advisor for the current minimum investment amount.

Axis Balanced Advantage Fund, is an open-ended dynamic asset allocation fund. It aims to provide capital appreciation while generating income over the medium to long term by investing in equity, equity-related instruments, debt, and money market instruments.

Yes, Axis Balanced Advantage Fund allows for Systematic Transfer Plan (STP), Systematic Investment Plan (SIP), and Systematic Withdrawal Plan (SWP) to provide flexibility in managing your investments.

Investing in a Balanced Advantage Fund can be suitable if you are looking for a balanced approach to investing in both equity and debt, which can help manage risk while aiming for growth. However, it's always best to consult with a financial advisor to determine if it aligns with your investment goals and risk tolerance.

There shall be no entry load for all Mutual Fund schemes. The exit loads for Axis Balanced Advantage Fund are if redeemed / switched-out within 12 months from the date of allotment:.

For 10% of investments: NIL. For remaining investments: 1%

If redeemed / switched-out after 12 months from the date of allotment: NIL

It's best to check the latest information on the Axis Mutual Fund website or consult with a financial advisor for the current charges.

Balanced Advantage Funds are actively managed. The fund manager actively adjusts the allocation between equity and debt based on market conditions and investment strategies.

Balanced Advantage Funds are suitable for a wide range of investors, including those looking for a balanced approach to investing in both equity and debt, and those aiming for capital appreciation with managed risk.

Axis Short Duration Fund is an open ended short duration debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1 year to 3 years. The investment objective of this fund is to generate stable returns with a low risk strategy while maintaining liquidity through a portfolio comprising of debt and money market instruments. However, there can be no assurance that the investment objective of the scheme will be achieved.

A short duration debt fund might work well when the interest rates are high but may drop unexpectedly. Short duration debt funds may be a good investment option in a market where the interest rates are unpredictable. Since the average portfolio maturity is shorter than long term debt funds, fluctuations in the interest rates do not affect the performance of short duration debt funds. A short duration fund invests in a basket of debt instruments, thus offering diversification to investors. This fund can be a good option for someone looking to park their money for a short duration. Short duration funds have high liquidity which is why they are considered for building an emergency fund.

A short duration debt fund invests in a range of debt securities such as government securities, derivatives, corporate bonds, etc. To ensure that the portfolio maintains liquidity, these funds may also invest in money market instruments like commercial paper, treasury bills, certificates of deposits, etc. There are no norms that oblige these funds to invest in securities with high credit ratings. Hence short duration funds can invest in low credit quality debt instruments that may have the ability to generate better returns.

Axis Short Duration Fund invests in shorter duration debt and money market instruments which give the potential to generate relatively stable returns with comparatively lesser risk. It is a short duration debt fund investing in high quality papers that allows participation in the short duration part of the curve which is a large and highly traded space.

Axis Short Duration Fund is a debt mutual fund that invests in a portfolio of securities that mature over the short duration.

Axis ESG Integration Strategy Fund aims for long-term capital appreciation by investing in quality companies with sustainable growth prospects. It places a strong emphasis on incorporating ESG considerations into its investment approach. Additionally, the fund has the flexibility to invest internationally, capturing ESG opportunities across the global landscape.

Axis ESG Integration Strategy Fund follows a stringent screening process, ensuring that companies included in the portfolio meet ESG criteria. The fund focuses on sustainable companies with strong fundamentals and a positive social impact. Moreover, the fund provides exposure to global sustainable companies, diversifying opportunities for investors.

Axis ESG Integration Strategy Fund has the flexibility to invest up to 30% of its portfolio in globally sustainable companies. This exposure allows investors to benefit from ESG opportunities on a global scale and diversify their investments across international markets. *

Axis ESG Integration Strategy Fund looks for companies with strong fundamentals that not only offer the potential for alpha generation but also have a positive social impact. A minimum of 80% of the portfolio comprises stocks that rate highly on an internal ESG review, indicating their sustainability. *

To stay informed about the ESG performance and holdings of Axis ESG Integration Strategy Fund, you can regularly review the fund's reports, visit the Axis Mutual Fund website, or contact their customer support for updates.

* Current portfolio allocation is based on the current market conditions and is subject to changes depending on the fund manager’s view of the markets. Please refer SID, for detail Asset Allocation & Investment strategy of the Scheme.

The minimum investment amount for the Axis Nifty 100 Index Fund typically starts at around ₹100 for a lump sum investment, with subsequent investments allowed in smaller increments such as ₹100. In addition to this, one can also do a minimum SIP of ₹100.

The Axis Nifty 100 Index Fund fits into an investment portfolio as a tool for achieving broad equity market exposure. It offers diversification across 100 stocks, which can help reduce risk compared to investing in a narrower set of stocks.

Investing in the Axis Nifty 100 Index Fund can be done through the Axis Mutual Fund website or Axis Mutual Fund app, various online mutual fund platforms, or through financial advisors. Investors can choose to invest via a lump sum or through a systematic investment plan (SIP), depending on their investment strategy and preferences.

Investing in the Axis Nifty 100 Index Fund involves several risks, including market risk, tracking error, economic downturns, and changes in market conditions, also company-specific issues can affect the performance.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

The Nifty 100 Index is a broad market index representing the performance of the top 100 large-cap companies listed on India's National Stock Exchange (NSE). It combines the Nifty 50 Index and Nifty Next 50 Index, providing a comprehensive view of the Indian equity market's largest and most liquid stocks.

The Axis Nifty 100 Index Fund is a mutual fund that aims to mirror the performance of the Nifty 100 Index. By investing in this fund, investors can gain exposure to the top 100 companies in the Indian stock market, reflecting the performance of a diversified basket of large-cap stocks.

Investors looking for broad market exposure focusing on large stocks might consider the Axis Nifty 100 Index Fund. It's suitable for those who want to invest in a diversified portfolio of 100 major companies and prefer a passive investment strategy that seeks to replicate the index’s performance.

You can visit Axis Fund’s house official website or Axis Mutual Fund app to invest in the Axis Aggressive Hybrid Fund. These investments can be done in two ways either through lump sums or SIPs.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

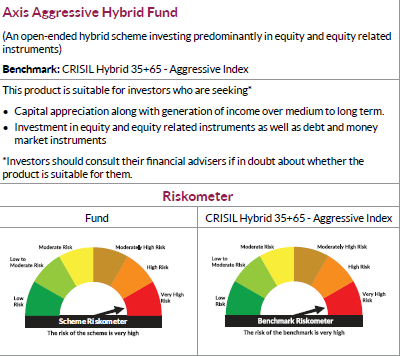

An Aggressive Hybrid is a type of mutual fund that invests in both stocks and fixed-income securities, typically maintaining a higher allocation to equities (usually 65%-80%). This blend aims to provide the potential for capital appreciation from stocks while offering some stability from the debt component.

Axis Aggressive Hybrid Fund is an open-ended hybrid scheme investing predominantly in equity and equity-related instruments. It invests 65-80% of the funds in equity and the remaining in debt. The scheme seeks to generate long-term capital appreciation by investing in a mix of equity and equity instruments, debt instruments and money market instruments.

Investors who can stay with the fund for at least 5 years or more should invest. They are a suitable option for conservative equity investors or first-time equity investors, due to their less volatile nature.

The minimum SIP investment amount for Axis Aggressive Hybrid Fund is ₹100 and in multiple of Re. 1/-; lumpsum investment is ₹500 in multiples of Re. 1/- thereafter.

The Aggressive Hybrid Fund invests 65-80% of its assets into equity stocks and the remaining 20-35% in debt & money market instruments. It offers a balanced approach to investing, combining equity for growth potential with debt for stability.

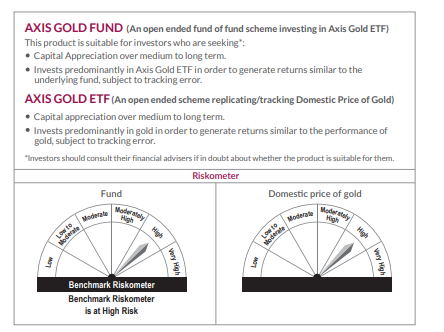

A Gold Fund is a type of mutual fund that invests directly or indirectly in gold. These funds can invest in physical gold, or gold related instruments. They offer investors a way to gain exposure to gold without having to physically own it.

Axis Gold Fund does not have an entry load, but it does have an exit load of 1% if redeemed within 15 days from the date of allotment.

Axis Gold Fund is an open-ended fund of fund scheme investing in Axis Gold ETF. The objective is to generate returns that closely correspond to returns generated by Axis Gold ETF.

Anyone looking for capital appreciation over the medium to long term and willing to invest in gold ETFs can invest in the Axis Gold Fund. It is suitable for investors seeking to generate returns similar to the underlying fund, subject to tracking error

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Investors will be bearing the recurring expenses of the scheme in addition to the expenses of other schemes in which Fund of Funds scheme makes investment

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Gold Funds can be either actively or passively managed. However, the Axis Gold Fund is passively managed as it invests in the units of Axis Gold ETF and aims to replicate its performance. Axis Gold ETF, tracks the domestic price of gold.

Investing in Axis Gold Fund offers several benefits:

- Convenience: Invest in gold without the hassles of storage or concerns about quality.

- Low Cost: Lower holding costs compared to physical gold.

- Transparent Pricing: Prices are based on international gold price movements.

- Flexibility: Invest any amount, starting from the minimum investment requirement of Rs. 100.

The choice between NIFTY 50 and Gold Fund depends on your investment goals and risk tolerance:

- NIFTY 50: Offers higher returns but comes with higher risk and volatility. It is suitable for investors looking for capital appreciation and willing to take on more risk.

- Gold Fund: Provides potentially stability and generally acts as a hedge against inflation and economic uncertainties. It is suitable for investors prioritizing capital preservation and lower risk

You can invest in Gold Funds through various methods:

- Mutual Funds: Purchase shares of a mutual fund that invests in gold.

- ETFs: Buy shares of a gold ETF on the stock exchange.

- Financial Institutions: Some banks and financial institutions offer gold funds.

The minimum investment required for Axis Gold Fund is ₹100, and the minimum additional investment is also ₹100. The minimum SIP (Systematic Investment Plan) investment for a monthly frequency is ₹100.

Yes, Axis Gold Fund allows for Systematic Transfer Plan (STP), Systematic Investment Plan (SIP), and Systematic Withdrawal Plan (SWP)

Arbitrage funds can be a suitable choice for investors who want to profit from volatile markets without taking on too much risk. They are relatively low risk, but the payoff can be unpredictable. These funds are taxed like equity funds, and investors need to keep an eye on expense ratios, which can be high.

The Axis Arbitrage Fund has an exit load of 0.25% if redeemed within 15 days from the date of investment/allotment. If redeemed/switched out after 15 days from the date of allotment, there is no entry load.

Arbitrage funds are actively managed. Fund managers actively seek out and exploit arbitrage opportunities in different markets to generate returns.

Arbitrage funds can be suitable for investors looking for relatively low-risk investment options to park their short-term money. They are ideal for cautious investors, active investors, and those who want to keep an emergency fund.

Investing in the Axis Arbitrage Fund offers several benefits:

• It utilizes the price differential in the cash and derivatives segment of the equity market to generate returns with relatively low volatility.

• It seeks to capture the cash-futures spread in the equity market without being affected by market direction.

• It can be suitable for parking short-term money

Arbitrage funds can be considered relatively safer as they aim to exploit price differentials in different markets, which typically involves lower risk compared to other equity investments.

Choosing between equity funds and arbitrage funds depends on your risk tolerance and investment timeline. Arbitrage funds offer lower risk and for short to medium term objectives, while equity funds unlock the potential for higher returns but demand a longer horizon and tolerance for volatility.

You can invest via Website or Mutual Fund App

An arbitrage fund is a type of mutual fund that aims to exploit price differentials in different markets or instruments to generate returns. These funds typically buy and sell the same or similar securities simultaneously in different markets to profit from the price differences.

Arbitrage funds are taxed like equity funds. If you hold the investment for more than one year, the gains are subject to long-term capital gains tax. If held for less than a year, short-term capital gains tax applies

The Axis Arbitrage Fund is an open-ended scheme that invests in arbitrage opportunities. It aims to generate income through low volatility absolute return strategies by taking advantage of opportunities in the cash and derivative segments of the equity markets. The scheme also invests between10-35% of its total assets in debt and money market instruments.

The minimum investment required for the Axis Arbitrage Fund is ₹500 for both lump sum and additional investments. The minimum SIP (Systematic Investment Plan) amount is ₹100

Arbitrage funds work by generating profit from price differentials in the derivatives and cash (or spot) markets through simultaneous buy and sell transactions. For instance, an arbitrage fund could buy an asset in today's cash market and simultaneously sell it in the futures market at a higher price, thereby locking in its gain right away.

While an equity mutual fund has the leeway to decide how many stocks to invest in, focused funds can invest in up to 30 stocks. Axis Focused 25 Fund builds its investment portfolio by investing in 25 stocks that have growth potential. The fund invests across market capitalization as there are no restrictions on that front. The AMC accumulates financial resources from investors sharing a common investment objective and invests this accumulated sum across market capitalization. In exchange, the investors receive units in accordance with the scheme’s existing Net Asset Value (NAV). The Axis Focused 25 Fund may invest in large, mid, and small stocks that have growth potential and can offer long term earnings to investors.

Here are some of the primary benefits of investing in Axis Focused 25 Fund:

- Axis Focused 25 Fund is a scheme that invests in a concentrated portfolio of high conviction ideas (up to 25).

- Axis Focused 25 Fund focuses on companies that have the capability to sail through their business cycles without being affected by short term market volatility.

- While Axis Focused 25 Fund offers the benefit of higher exposure to the best ideas, the portfolio is well diversified across sectors to manage risk.

- Axis Focused 25 Fund invests in equity, which, as an asset class holds the potential to beat inflation and generate long term wealth.

- Axis Focused 25 Fund can help investors achieve their life’s on long-term financial goals such as children’s education and their future, retirement, or any other long term growth that needs a wealth creation plan.

Axis Focused 25 Fund is an equity mutual fund that falls under the focused fund category. Focused funds are those equity mutual funds that target up to 30 stocks to build their investment portfolio. Here, the fund manager can only shuffle between 30 company stocks to help the scheme achieve its investment objective. Although the focused fund has a concentrated portfolio limiting to 30 stocks, the fund can invest across market capitalization.

Axis Focused 25 Fund is an open ended multi cap equity scheme which invests in a maximum of 25 stocks of large cap, mid cap, and small cap companies. Axis Focused 25 Fund aims to generate long term capital appreciation by investing in a concentrated portfolio of equity & equity related instruments of up to 25 companies. Investors with a very high risk appetite who are seeking capital appreciation over the long term with exposure to equity markets may consider investing in equity funds like Axis Focused 25 Fund.

Investing in Axis Focused 25 Fund is a good option as this scheme aims to generate capital appreciation by picking the best 25 stocks. This fund is ideal for investors who wish to invest in a scheme that invests across market capitalization. Investing in Axis Focused 25 Fund may allow investors to create wealth however, investors may need to have a long term investment horizon spanning over three years to five years minimum so that this equity fund can perform and deliver decent returns over in the long run. Also, only investors who carry a very high risk appetite should consider investing in Axis Focused 25 Fund. Investors can target their life’s long term financial goals like buying their dream home, building a commendable retirement corpus, securing their child’s financial future, building a marriage corpus for their child, etc. by investing in Axis Focused 25 Fund.

While large cap funds invest in financially stable and well-established companies and small cap funds predominantly invest in companies with small market capitalization, mid cap funds are open ended equity schemes that invest a majority of their investible corpus in mid cap company stocks. Axis Mid Cap Fund is an open ended equity scheme predominantly investing in mid cap stocks. The investment objective of this mutual fund scheme is to achieve long term capital appreciation by investing predominantly in equity and equity related instruments of mid cap companies.

Axis Mid Cap Fund might prove to be a good mutual fund investment option as this scheme has the potential to offer risk adjusted returns over the long term by predominantly investing in equity and equity related instruments of mid cap companies. Axis Mid Cap Fund may give investors and opportunity to create long term wealth however, they may need to have a long term investment horizon spanning over five years or more so that this mid cap fund is able to perform and generate decent capital appreciation. Also, only investors who carry a very high risk appetite should consider investing in Axis Mid Cap Fund. One may consider investing in Axis Mid Cap Fund for the long term and target their life’s financial goals like retirement planning, securing their child’s financial future, building a marriage corpus for their child, etc.

Axis Mid Cap Fund works pretty much like any other equity mutual fund scheme. The fund invests a majority of its investible corpus in equity and equity related instruments of companies with medium market capitalization. The scheme may invest the remaining corpus in other equity related instruments in quantum with the scheme’s investment objective. The Asset Management Company running a mid cap fund collects money from investors sharing a common investment objective and the fund manager invests this accumulated sum across mid cap companies. In exchange, the investors receive units in accordance with the scheme’s existing Net Asset Value (NAV). The NAV of the scheme may vary based on the mid cap scheme’s overall performance. Axis Mid Cap Fund invests in stocks of mid cap companies that have growth potential and can offer long term earnings to investors.

Here are the benefits of investing in Axis Mid Cap Fund:

- The mid cap mutual fund invests predominantly in midcap companies.

- Midcap companies have the potential to deliver superior returns due to the potential of faster earnings growth. Having said that, such companies are emerging companies, and hence it is crucial to be vigilant about their business and growth prospects and hence carry risk.

- Axis Mid Cap Fund has an actively managed portfolio diversified across sectors for keeping the risk well managed.

- This scheme allows you to complement your portfolio focusing on large cap companies.

- By investing in equity, this mid cap fund provides asset class benefits. Equity as an asset class holds the potential to beat inflation and generate long term wealth.

- Investing in a scheme may allow investors to target long-term goals such as children's education & their future, retirement, or any other long term growth that needs a wealth creation plan.

Equity mutual funds can be largely categorized based on market cap. Large cap, mid cap and small cap funds are the different types of equity funds each of whom tap into companies belonging to specific market capitalization. Axis Mid Cap Fund is an equity mutual fund that specifically targets credible stocks of companies with medium market capitalization. This equity fund is different than a large cap, small cap, or multi cap fund each of which possesses unique traits.

Bluechip funds predominantly invest in the equity market. This makes them a very high volatile investment. This mutual fund scheme may hold the potential to offer risk adjusted returns over the long term, but it doesn’t guarantee returns. Hence, investors with a very high risk appetite and a long term investment horizon may consider investing in a bluechip fund. If you are someone who wishes to invest in a diversified portfolio of bluechip stocks you should consider investing in a bluechip fund.

Investing in Axis Bluechip Fund is a good option as this scheme has the potential to offer risk adjusted returns over the long term. Investing in Axis Bluechip Fund may allow investors to create wealth however, investors may need to have a long term investment horizon spanning over five years to seven years at least so that this equity fund is able to perform and deliver decent returns over in the long run. Also, only investors who carry a very high risk appetite should consider investing in Axis Bluechip Fund. Investors can target their life’s long term financial goals like retirement planning, securing their child’s financial future, building a marriage corpus for their child, etc. by investing in Axis Bluechip Fund.

Here are the primary benefits of investing in Axis Bluechip Fund:

- Blue chip mutual funds invest predominantly in large companies

- Such companies are traded frequently and hence liquid and also less volatile as these stocks have a proven track record, business models and are capable enough to deliver long term consistent returns.

- The Axis Bluechip Fund aims to outperform the benchmark with risk lower than the benchmark.

- Asset Class benefit - Equity as an asset class holds the potential to beat inflation and generate long term wealth.

- Target Goals- Long-term goals such as children's education & their future, retirement, or any other long term growth that needs a wealth creation plan

Axis Bluechip Fund works pretty much like any other equity mutual fund scheme. The fund invests a majority of its investible corpus in equity and equity related instruments of companies with large market capitalization. The scheme may invest the remaining corpus in money market instruments in quantum with the scheme’s investment objective. The AMC collects money from investors sharing a common investment objective and the fund manager invests this accumulated sum across large cap companies. In exchange, the investors receive units in accordance with the scheme’s existing Net Asset Value (NAV). The NAV of the scheme may fluctuate depending on how the scheme performs over time. Axis Bluechip Fund invests in large cap stocks that have growth potential and can offer long term earnings to investors.

A bluechip fund is an open ended equity scheme that predominantly invests in equity and equity related instruments of large cap companies. Also referred to as large cap fund, bluechip funds invest a minimum of 65% of their total investible corpus in equity and equity related instruments of financially well-established companies. Bluechip funds mostly invest in stocks of companies that have a proven track record. Of its total assets, a bluechip fund allocates a majority of its assets to companies with large market capitalization.

One way to earn long term capital appreciation is by investing in Axis Bluechip Fund. Follow these simple steps to invest in Axis Bluechip Fund online:

1. Log on to https://www.axismf.com website

2. Hover on the ‘All Schemes’ tab and when you get a drop down click on ‘Equity’

3. You will see all the equity mutual funds offered by Axis Mutual Fund

4. ‘Select Axis Bluechip Fund’

5. Click on ‘Start SIP’ if you want to start a SIP

6. Then Select the SIP amount, Tenure, SIP date, and Growth / Regular plan and click ‘Continue’

7. If you want to start investing right away, you can even click select the ‘Add Lumpsum’ feature

8. You can now start investing in Axis Bluechip Fund

Axis ELSS Tax Saver Fund is a diversified equity linked saving scheme (ELSS) that invests in a mix of large caps and select midcaps. This tax saver fund has a 3-year lock-in which is one of the lowest amongst other tax saving instruments. A 3-year lock-in ensures that the money stays invested in equities and does not get perturbed by market ups and downs. Add to it, the fund manager can take much informed decision and look through the interim volatility. Being an ELSS scheme, the scheme comes with dual advantages of building wealth and saving tax. The long term mutual fund has a 3-year lock-in which is one of the lowest amongst other tax saving instruments. Also, equity as an asset class holds potential to beat inflation and generate long term wealth. By investing in Axis ELSS Tax Saver Fund, investors can target long-term goals such as children's education & their future, retirement or any other long term growth that needs wealth creation plan.

Axis ELSS Tax Saver Fund is a tax saving mutual fund scheme that comes with a statutory lock-in of three years. A lock-in period in mutual funds is a duration where the investor cannot sell his or her mutual fund scheme investments. This means investors cannot redeem their Axis ELSS Tax Saver Fund units for a minimum duration of 36 months from the time of investment. Upon the completion of the lock-in period, retail investors can redeem their Axis ELSS Tax Saver Fund units, or they can even consider this ELSS fund for long term investment.

Axis ELSS Tax Saver Fund is a mutual fund scheme that invests a majority of its investible corpus in equity and equity related instruments of various companies. The scheme may invest the remaining its corpus in money market instruments in quantum with the scheme’s investment objective. The AMC collects money from investors sharing a common investment objective and the fund manager invests this accumulated sum. In return, investors receive units in accordance with the scheme’s current NAV (net asset value). The fund manager will try to balance the portfolio between large caps and mid caps while searching for investment opportunities across market cap. The scheme tries to invest in stocks that have growth potential and can offer long term earnings to investors.

Axis ELSS Tax Saver Fund is an ELSS mutual fund scheme. This is an open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit. The investment objective of this tax saver fund is to generate income and long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities. However, there can be no assurance that the investment objective of the Scheme will be achieved.

One of the best to way to save tax is by investing in tax saving mutual funds like ELSS. Follow these simple steps to invest in Axis ELSS Tax Saver Fund online:

1. Log on to https://www.axismf.com website

2. Hover on the ‘All Schemes’ tab and when you get a drop down click on ‘Equity’

3. You will see all the equity mutual funds offered by Axis Mutual Fund

4. ‘Select Axis ELSS Tax Saver Fund’

5. Click on ‘Start SIP’ if you want to start a SIP

6. Then Select the SIP amount, Tenure, SIP date and Growth / Regular plan and click ‘Continue’

7. If you want to start investing right away, you can even click select the ‘Add Lumpsum’ feature

8. You can now start investing in this ELSS mutual fund and save tax

Axis ELSS Tax Saver Fund is an ELSS scheme that falls under the Section 80C of the Indian Income Tax Act, 1961. It is an open ended equity mutual fund scheme which is ideal for investors with a long term investment horizon and a very high risk appetite. Investors seeking tax exemption for the ongoing fiscal year may consider investing in equity linked savings scheme like Axis ELSS Tax Saver Fund. This tax saver fund comes with a predetermined lock-in period of three years and invests in equity for generating long term capital appreciation. Investors who are alright with investing in tax saving instrument that invests in equity may consider diversifying their portfolio with Axis ELSS Tax Saver Fund.

Axis Liquid Fund is an open ended liquid scheme whose investment objective is to provide a high level of liquidity with reasonable returns commensurating with low risk through a portfolio of money market and debt securities. However, there can be no assurance that the investment objective of the Scheme will be achieved.

Investing in a liquid fund is a good option for those who wish to park their money for a very short term. These funds are ideal for investors who wish to give their investment portfolio some liquidity. Some fund houses offer an instant redemption facility where the investor, upon redeeming his/her liquid fund units can receive the sum equivalent in their registered savings account within 24 hours. Hence, a lot of investors consider investing in liquid funds for building an emergency fund for life’s unforeseen exigencies.

Liquid funds work similarly to how most debt mutual funds work. We already know that debt funds have interest rate risk, credit risk, and liquidity risk. The investment objective of a liquid fund is to provide the investor with stable returns while maintaining a highly liquid portfolio. They invest in debt securities with high credit ratings. Debt securities have credit ratings based on that define their credibility and a liquid fund mostly invests in AAA and higher credit rated securities. They ensure that the average portfolio maturity is no longer than 91 days. This means that debt funds invest in debt instruments that have a very short maturity. They might be able to generate better capital appreciation than some conventional investment schemes.

Axis Liquid Fund invests primarily in money market instruments such as certificate of deposits (CoD), treasury bills, commercial papers, etc. One should look at Axis Liquid Fund to park one's idle money or very short term money. The fund offers a highly liquid and low risk investment option for investors. This fund has an ‘insta redemption’ feature that allows you to redeem your money instantly with a simple online request and the money is credited to the account in few minutes. Investors can redeem up to 90% of the current value of available units or a maximum of Rs. 50,000 per day, whichever is lower.

Axis Liquid Fund is a type of debt mutual fund that aims to offer high liquidity by investing in debt instruments while maintaining an average short portfolio maturity.

Small Cap Funds are ideal for aggressive investors who have very high-risk appetite and long time horizon to invest.

Minimum investment required for Axis Small Cap Fund is Rs. 100 and in multiples of Re. 1/- thereafter.

Small Cap Fund can form an integral part of your mutual fund portfolio if you have a long term investment horizon. Small Cap Fund invest at least 65% of their portfolio in small cap stocks.

You can invest in the Axis Small Cap Fund directly from the Axis Mutual Fund website. You can also invest through platforms like MF Central and MF Utility.

Small cap funds are equity funds that invest in companies with a market capitalization of Rs. 500 crores or less. These funds are like large cap funds and mid cap funds both who invest a majority of their investible corpus in large cap and mid cap companies respectively. Axis Small Cap Fund is an open-ended equity scheme predominantly investing in small cap stocks. The investment objective of this equity scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly equity & equity related instruments of small cap companies.

All equity mutual funds, including the Axis Small Cap Fund, carry investment risk. Small-cap funds are considered riskier than large-cap funds because of market volatility and economic fluctuations.

Axis Small Cap Fund offers these benefits for retail investors:

- This small cap fund offers a bottom up approach to investing in small caps aimed at identifying long term businesses

- Axis Small Cap Fund aims to generate alpha with a diversified portfolio of stocks

- This equity mutual fund scheme builds a portfolio keeping in mind risk and reward by containing mistakes and navigating volatile stock movements

- Axis Small Cap Fund might be ideal for small cap investors who can patiently invest and those willing to absorb short term volatility

- This scheme can also be considered by investors with an investment horizon of 5 years or more

Axis Small Cap Fund works pretty much like any other equity mutual fund scheme. This small cap fund invests a majority of its investible corpus in equity and equity related instruments of companies with small market capitalization. The scheme may invest the remaining corpus in other money market instruments in accordance with the scheme’s investment objective.

The Asset Management Company running a small cap fund collects money from investors sharing a common investment objective and the fund manager invests this accumulated sum across the small cap sector. In exchange, the investors receive units in accordance with the scheme’s existing Net Asset Value (NAV). The NAV of the scheme may vary based on the mid cap scheme’s overall performance. Axis Small Cap Fund invests in stocks of small cap companies that have growth potential and can offer long term earnings to investors.

Equity mutual funds can be largely categorized based on market cap. Large cap, mid cap, and small cap funds are the different types of equity funds each of whom taps into companies belonging to specific market capitalization. Axis Small Cap Fund is an equity mutual fund that specifically targets credible stocks of companies with small market capitalization. This equity fund is different than a large cap, mid cap, or multi cap fund each of which possesses unique traits.