•

Broadly interest rate cycles

have peaked both in India and

globally.

• Investors should add duration

with every rise in yields.

•

Mix of 10-year duration and

2-4-year duration assets are

best strategies to invest in the

current macro environment.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals.

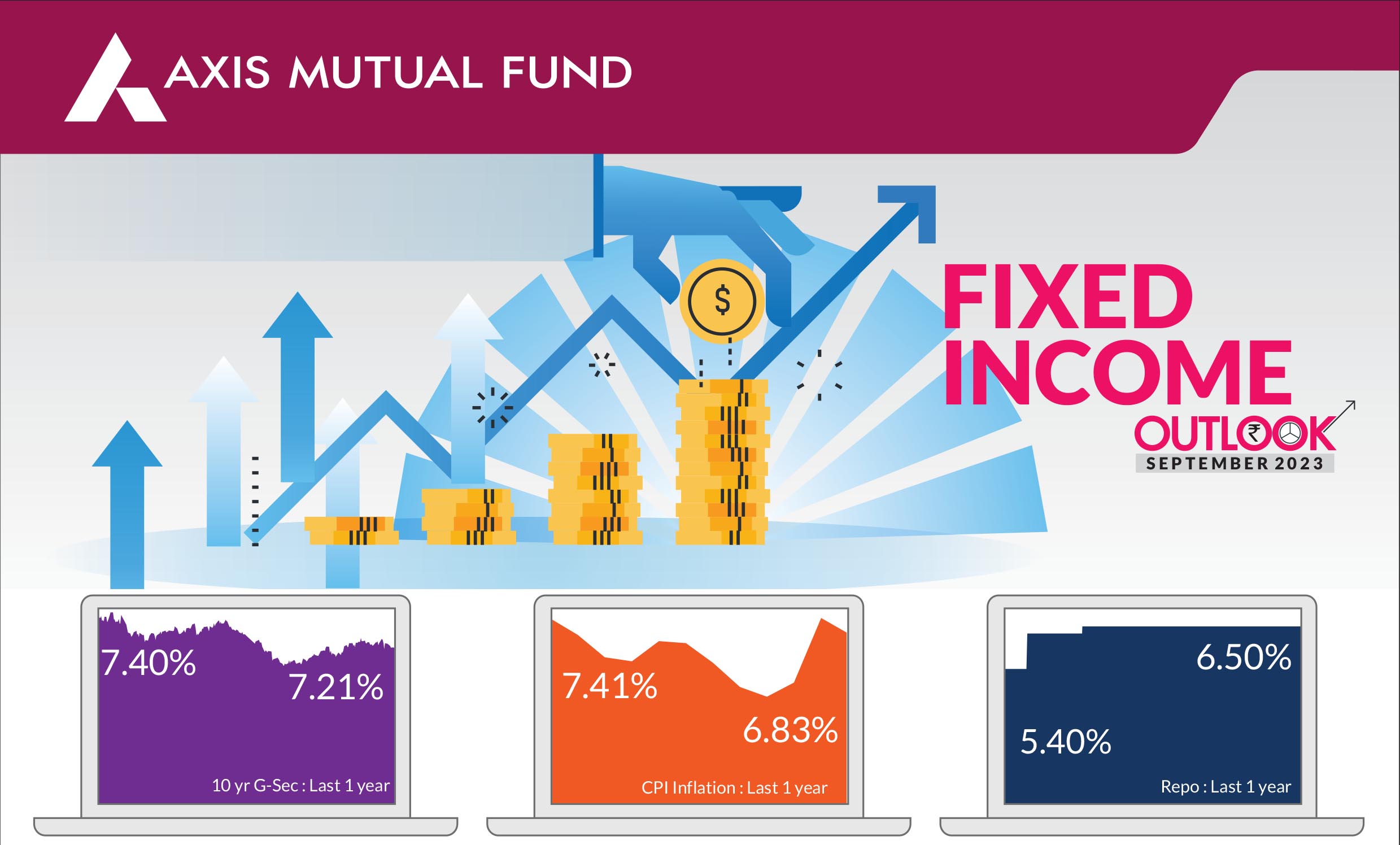

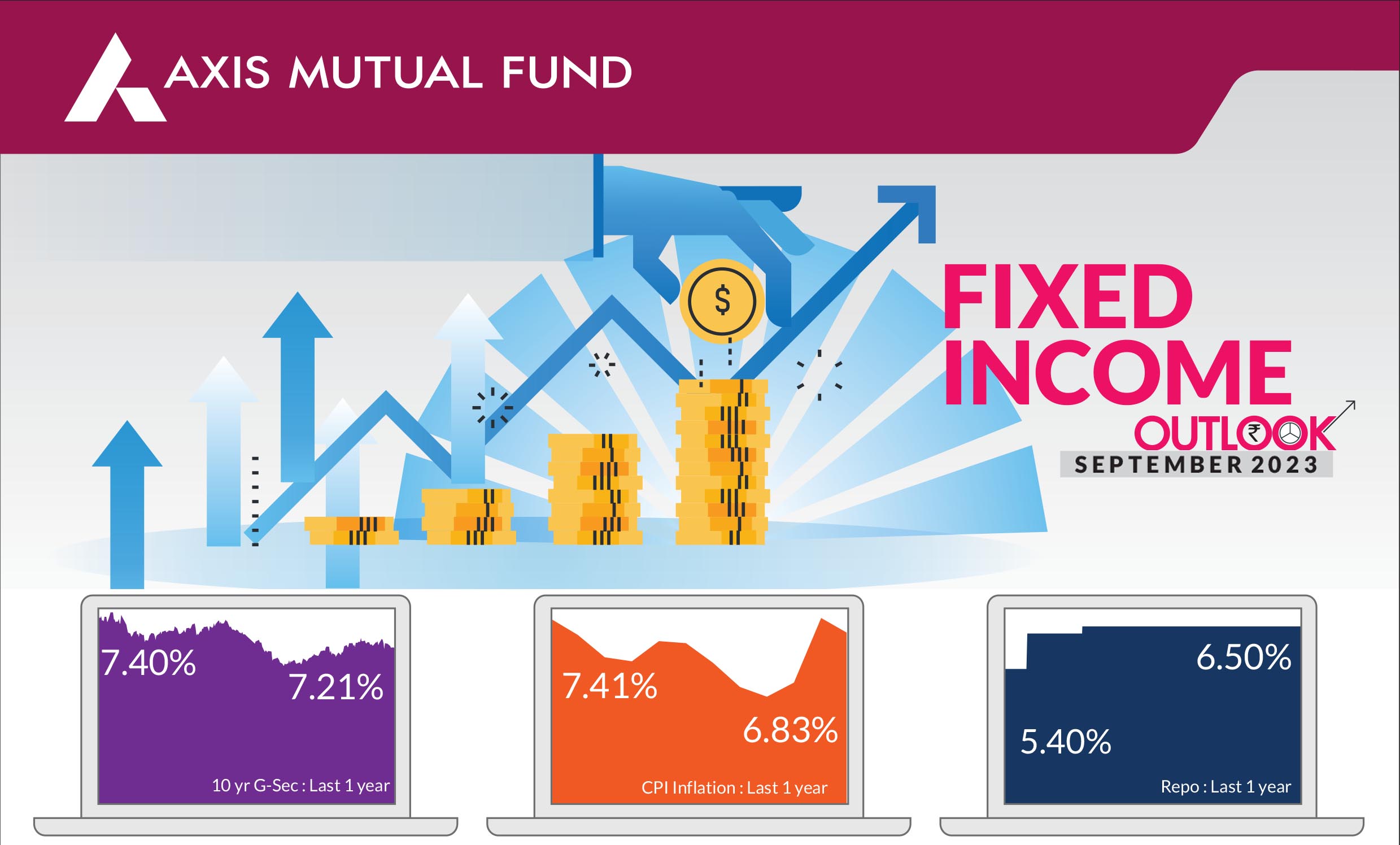

Indian government bond yields traded in a band of 8-9 bps through most of the month and ended higher at 7.21%. The key factors driving the bond markets were the inclusion of India in JP Morgan Emerging Markets Indices, rising US Treasury yields and higher oil prices that kept Indian bond yields elevated.

► India's inclusion in JP Morgan

indices buoys sentiment:

The

news that Indian government

bonds will be included in JP

Morgan's Emerging Markets

indices boosted sentiment. As per

the index review, 23 bonds meet

the Index eligibility criteria, with a

combined notional value of approximately Rs 2.7 lakh Cr/ US$ 330 billion. As

a result, India's weight is expected to reach the maximum weight threshold of

10% in the GBI-EM Global Diversified Index, and approximately 8.7% in the

GBI-EM Global index. The staggered approach over the 10-month period

beginning June 2024 implies an inflow of US$ 1.5 - 2 billion per month in the

identified bonds. This flow is likely to boost India's profile on the world stage

and further strengthen local fundamentals. Another positive outcome will be

that the rupee could be more stable and the impact of rising oil prices will be

moderated.

► US Treasury yields rise over the month:

US Treasury yields rose 45 bps over

the month following concerns that the US Federal Reserve could raise

interest rates once again after the pause maintained in September.

Expectations of persistent inflation and higher rates for longer thereof

weighed down sentiment. The potential US government shutdown on 1

October 2023 also led to worries and elevated yields. However, over the

weekend, the government averted the shutdown by passing a spending bill

that allows the government to stay open for 45 days giving the House and the

Senate more time to finish their funding legislation.

► Inflationary pressures cool while oil prices heat up: Headline inflation moderated to 6.8% as against 7.44% seen in July due to a sharper than expected fall in vegetable prices. Core inflation, too retreated to 4.8% vs 5% in July. The measures prompted by the government earlier last month did help in tempering the prices as did the arrival of fresh stock. However, crude oil prices advanced 10% touching the $96 mark due to production cuts by Saudi Arabia and this could act as a dampener to receding inflation. Rains resumed in September and the rainfall deficit now stands at 6% in contrast to the 10% in August and as opposed to the 6% surplus of last year. However, concentrated heavy rains in some parts of India may impact the yield and the quality of kharif crops.

► Central banks screech to a halt: Central banks of the US and the UK held interest rates on pause while the European Central Bank raised rates, but all reiterated a hawkish mode and data dependency. The focus has moved from how high interest rates can go up to how long will interest rates stay elevated. Meanwhile, in the upcoming meeting on 4-6 October the Reserve Bank of India (RBI) is expected to keep interest rates on hold. The RBI has remained on a pause in the last three monetary policy meets.

► Inflationary pressures cool while oil prices heat up: Headline inflation moderated to 6.8% as against 7.44% seen in July due to a sharper than expected fall in vegetable prices. Core inflation, too retreated to 4.8% vs 5% in July. The measures prompted by the government earlier last month did help in tempering the prices as did the arrival of fresh stock. However, crude oil prices advanced 10% touching the $96 mark due to production cuts by Saudi Arabia and this could act as a dampener to receding inflation. Rains resumed in September and the rainfall deficit now stands at 6% in contrast to the 10% in August and as opposed to the 6% surplus of last year. However, concentrated heavy rains in some parts of India may impact the yield and the quality of kharif crops.

► Central banks screech to a halt: Central banks of the US and the UK held interest rates on pause while the European Central Bank raised rates, but all reiterated a hawkish mode and data dependency. The focus has moved from how high interest rates can go up to how long will interest rates stay elevated. Meanwhile, in the upcoming meeting on 4-6 October the Reserve Bank of India (RBI) is expected to keep interest rates on hold. The RBI has remained on a pause in the last three monetary policy meets.

Market view

We believe the global slowdown is becoming more apparent and the transition from resilience to slowdown is showing though. Higher policy rates have impacted activity and this can be witnessed all the more in the US with the increasing number of corporate filings for bankruptcy, rising delinquencies on credit card loans, growing number of labour strikes and the widening fiscal deficit of the government. In addition, while the shutdown has been averted, the government faces heightened pressure. Europe through its core economy Germany is also facing moderating growth. China is definitely slowing down and while the authorities are stepping up on stimulus on the policy front and the real estate sector, the recent technical default by China's largest private property developer shows how deep the stress runs.The central banks of the developed economies have finally maintained a pause with a hawkish stance. However, we believe that interest rates hikes may be a thing of the past and the Fed particularly would remain on a pause for a longer period of time. While inflation has been falling globally, the rising crude oil prices make us believe "never say never" and this could be a key challenge over the short term.

In India, headline inflation declined in August but remains above RBI's comfort zone. Expectations are that it could fall further but rising crude oil prices could undermine the fall. We expect the RBI to maintain rates on hold in the policy meeting in the first week of October. Most part of the fixed income curve is pricing in no cuts for the next one year. As reiterated earlier, we do believe that interest rates have peaked globally as well as in India and probability of further hikes are limited. With policy rates remaining incrementally stable, we have added duration gradually across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to touch 6.75% by April - June 2024.

From a strategy perspective, we have added duration across portfolios within the respective investment mandates. We expect our duration call to add value in the medium term. Investors could use this opportunity to top up on duration products with a structural allocation to short and medium duration funds and a tactical play on GILT funds.

Source: Bloomberg, Axis MF Research.