Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

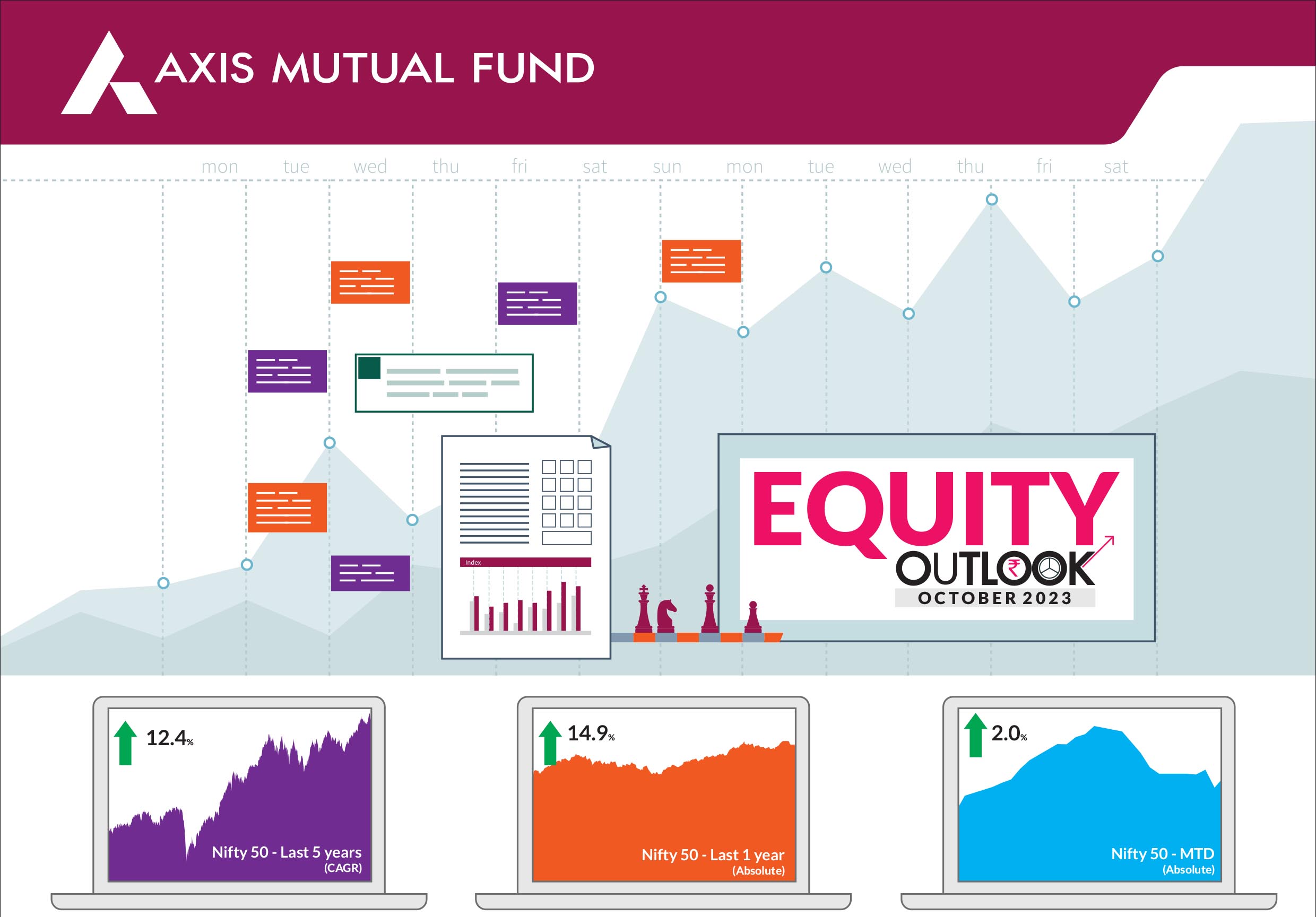

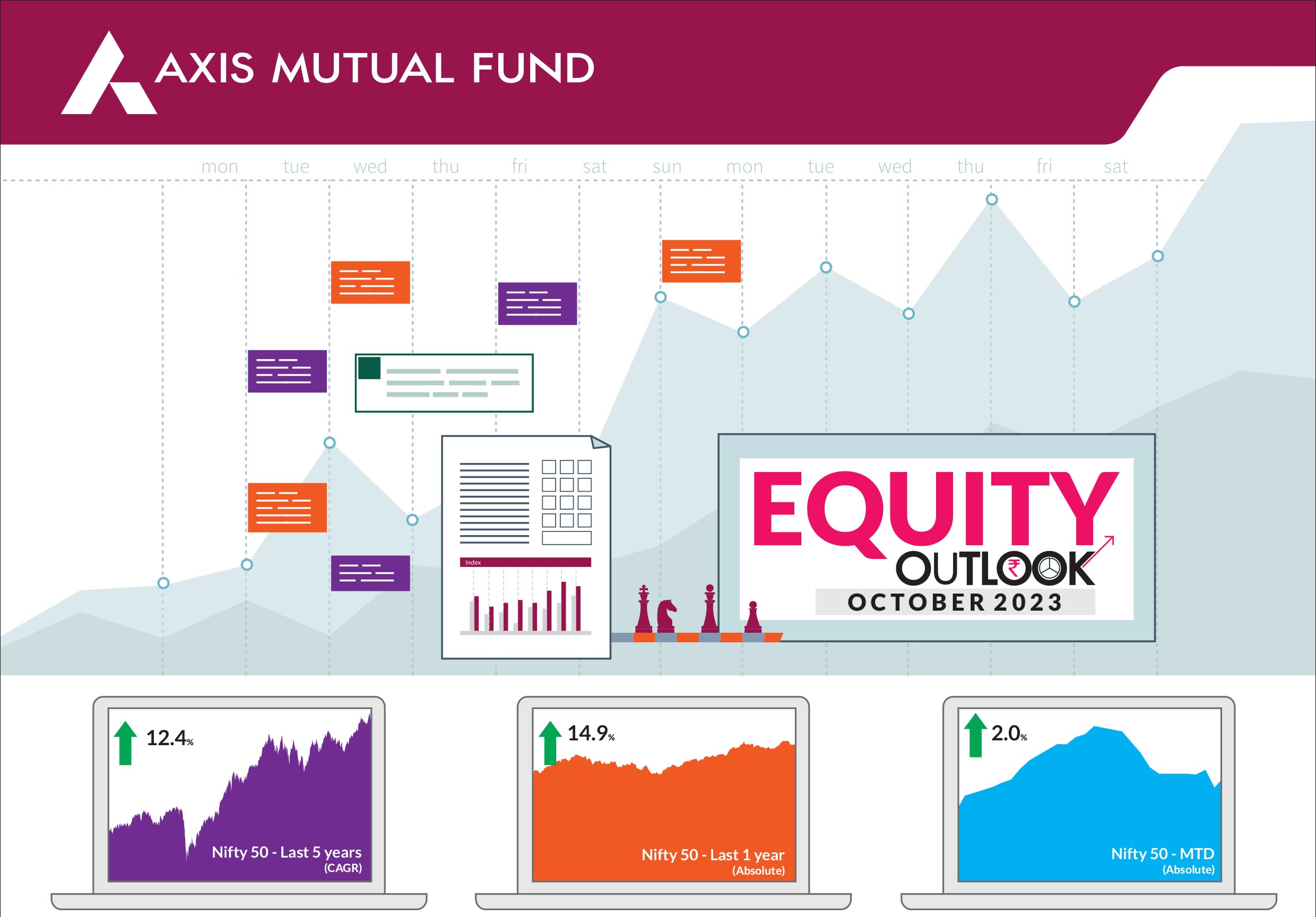

After declining in August, Indian equities regained their positive streak of last few months on the back of better than expected macroeconomic data, slowing inflation and inclusion of Indian government bonds in the JP Morgan Emerging Markets Indices. Key benchmark indices made fresh lifetime highs this month; the S&P BSE Sensex gained 1.54% while the NIFTY 50 ended 2% higher. NIFTY Midcap 100 & NIFTY Smallcap 100 continued to outperform their large-cap peers, up 3.6% and 4.1% respectively. Market breadth remained strong with the advance/decline ratio up over the month while volatility was lower compared to the previous month. |

|

Crude oil prices rose approx. 10% over the month and this could create worries on the current account deficit front. Higher prices could likely have a negative impact on the corporates that are consumers of crude and the resultant products thereof. Separately, rains played hide and seek over the monsoon season, but ended the season well above normal in September thereby bringing down the overall deficit to 6% below normal. Macroeconomic data remains strong and this can be seen in the PMIs, GST collections, automobile sales, real estate registrations etc. Industrial production data showed a better set of numbers aided by expansion in the manufacturing segment. This can be seen in the capital goods segment where the order book remains strong. A significant announcement that buoyed investor sentiment was the inclusion of Indian government bonds in the JP Morgan Emerging Markets Indices from June 2024. Going forward, the pace of gains could moderate given the sharp rally that has led to stretched valuations across sectors. Rising crude prices coupled with higher US Treasury yields could cap the gains in the near term. The upcoming results season could likely provide fresh triggers and set the trajectory for the markets while consumption will be buoyed by the festive season. Nonetheless, India remains on a strong footing compared to its regional peers and the resilient growth outlook despite a cyclical slowdown is likely to limit downside. Markets will keenly await the outcomes of state elections later this year. B2B growth remains strong and construction activity has become more broad-based. The upcoming elections could likely boost public capex and could result in improved demand for steel and cement. The correction seen in commodity prices could help earnings outlook for these companies. We believe that companies in the investment oriented sectors as well as select stocks in consumer discretionary could likely do well. Furthermore, given India's thrust towards manufacturing, we expect exposure to the export oriented stocks that could benefit from the China plus one theme can prove beneficial. We have been diversifying our portfolios from concentrated holdings to a broader number which has led to a wider exposure across sectors. Markets have run up sharply in the last six months, particularly the mid and small cap segments. Our advice to our investors is to maintain a diversified approach to investing wherein risks from one asset class are balanced by the other. Furthermore, large, mid and small caps all complement each other, and rather than viewing these sectors against each other, investors should maintain their exposure to all these and keep rebalancing over a period of time. As reiterated time and again, investing through SIPs is the ideal approach to investing as the compounding effect can amplify the wealth creation potential. |

Source: Bloomberg, Axis MF Research.