Bond markets were influenced by a dovish than expected monetary policy by the US

Federal Reserve (Fed) and weaker macroeconomic data in the US. The yields on US

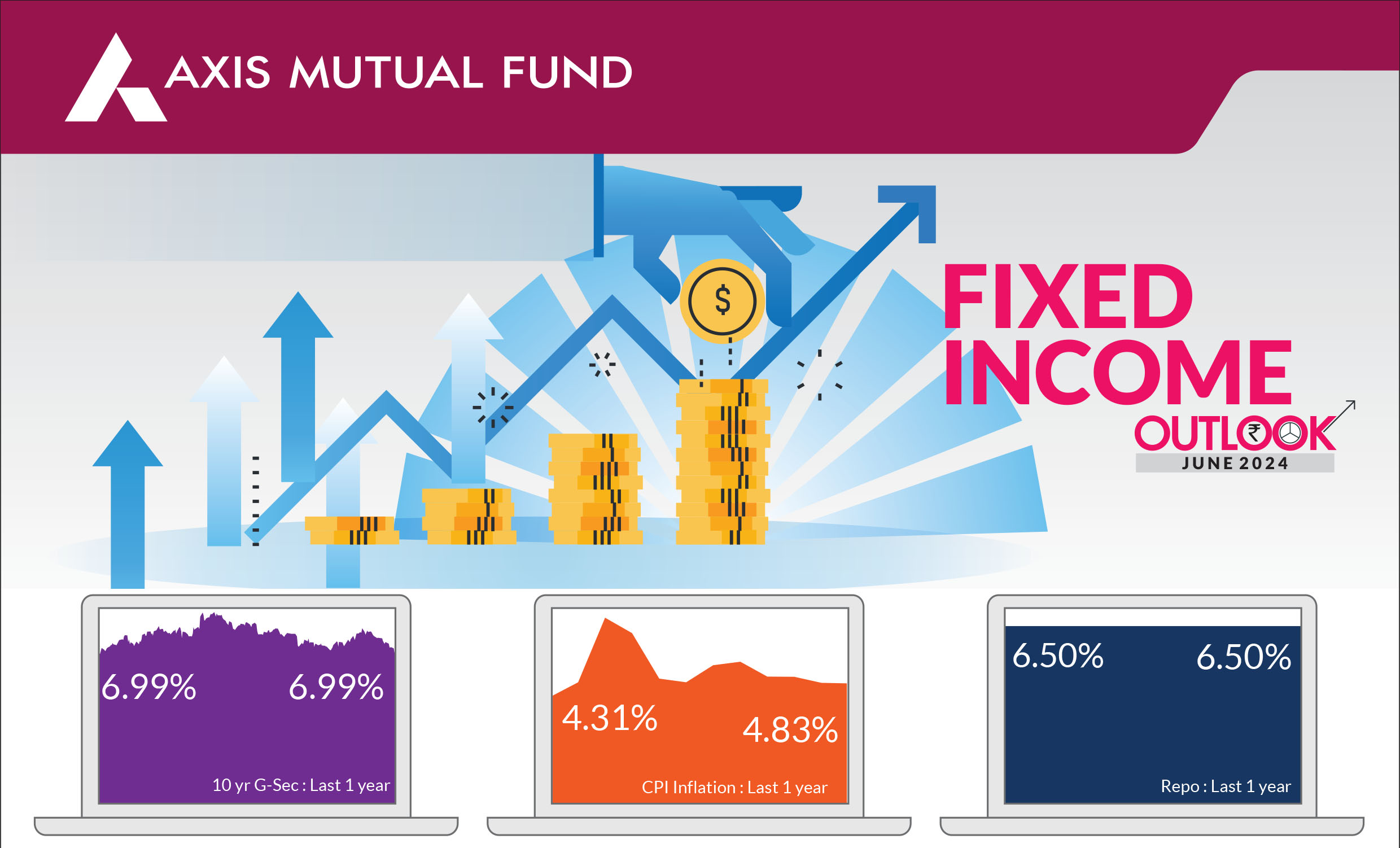

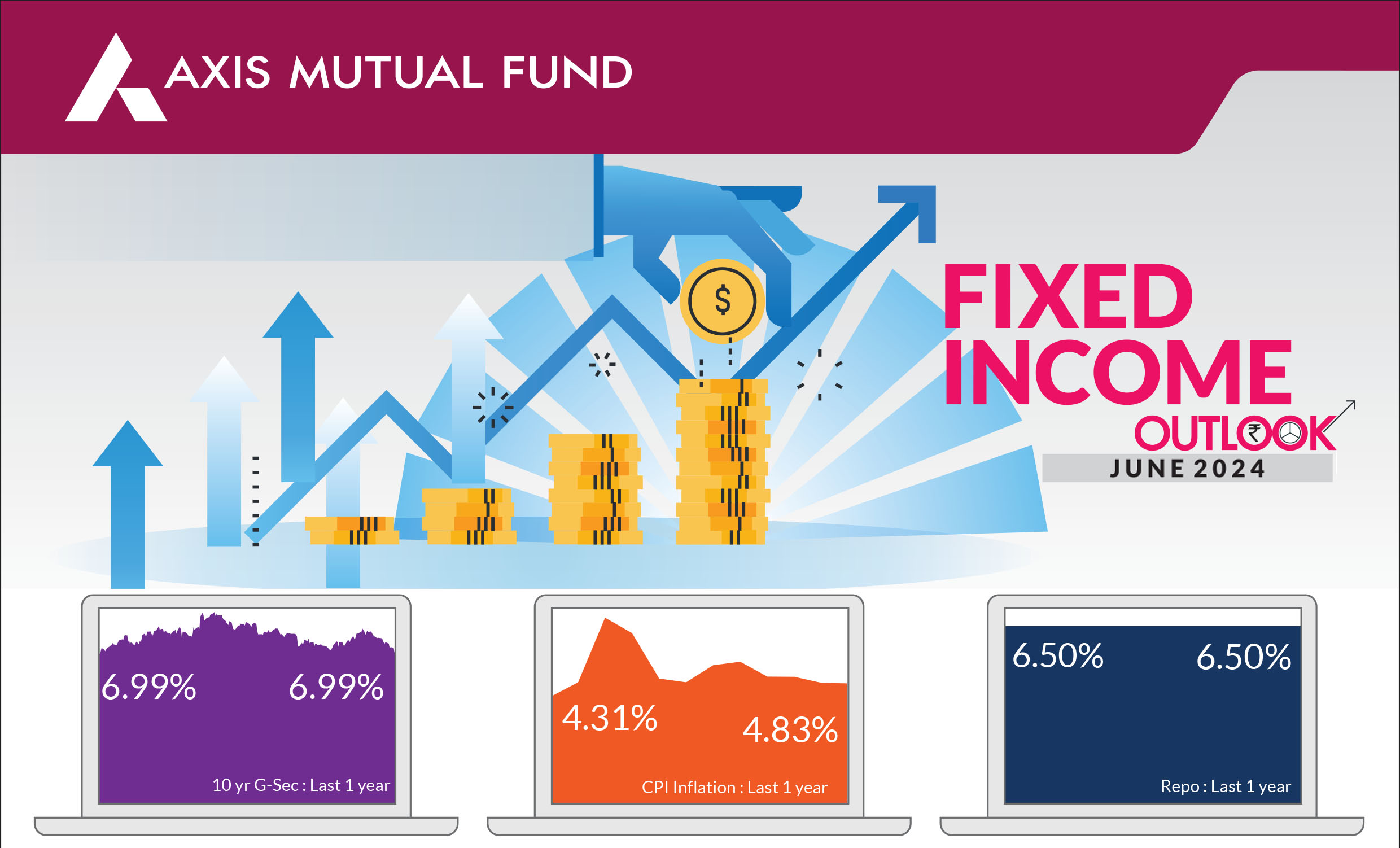

Treasuries fell 20 bps, closing the month at 4.50%. In India, the Reserve Bank of India's (RBI)

transfer of Rs 2.1 trillion by way of dividend to the government had a positive impact on

bond yields, bringing them lower. Indian government bond yields fell 20 bps to 6.99%.

Foreign Portfolio Investors (FPI) flows turned positive in May and stood at US$1 bn over

the month. Year to date, cumulative debt inflows amounted to US$6.4 bn.

The ruling party secured a third consecutive term albeit with a lower number of seats than

expected. In response to the surprising outcome, bond yields moved up approx. 10 bps on

fears that a government led by a weak mandate could impact the fiscal consolidation

trajectory. However, we believe that the

government would likely remain committed to

its path of fiscal consolidation.

► Banking liquidity continues to be in deficit : Banking liquidity for month was in deficit given that April-May were the election season and as such there was a lack of government spending. In consultation with the central bank, the government announced buyback programs of short dated government bonds and also reduced size of Treasury bill auction calendar by Rs 60,000 cr to improve the banking liquidity.

► GDP growth and sovereign rating upgrade paints a positive picture : The 4QFY24 GDP growth surprised on the upside at 7.8%, even as GVA growth remained relatively muted at 6.3%. Consequently, FY2024 real GDP growth also surprised on the upside at 8.2%. The GVA-GDP gap remained wide, owing to higher net indirect taxes growth. Furthermore, S&P Global Ratings upgraded India's sovereign rating outlook to positive from stable while retaining the rating at 'BBB-' on robust growth and improved quality of government expenditure. The ratings agency said it could upgrade India's sovereign rating in the next two years if the country adopts a cautious fiscal and monetary policy that diminishes the government's elevated debt and interest burden while bolstering economic resilience.

Market view

A dovish than expected Fed's monetary policy in May, weaker macro data in the US and the RBI's surprise gift to government in form of Rs 1.25 trillion higher dividend then expected has led to rally across bond and swap markets both in the US and India. Yields are down in long tenure bonds by more than 20-30 bps in last one month. US 10-year treasuries are down from 4.75% to 4.30% and India 10-year bond yields traded below 7% after almost a year. Yields on money market (short term upto 1 year) saw an uptick earlier in the month because of tight banking liquidity which also rallied post announcement of T-bill borrowing cut and surplus RBI dividend. Government bonds and swaps outperformed corporate bonds/SDL's this month due to expected cut in government borrowing and rally in US treasuries.We believe, in lieu of strong US and India growth, run up in commodity prices and geo political uncertainty, central banks across including RBI would not be in a hurry to cut rates. As expected, the RBI maintained a status quo in its June policy.

Short-term outlook

We expect bonds (10 year G-sec) to remain volatile and trade in a range 7-7.20%.

Fear of higher allocations to welfare schemes and higher borrowing in budget will lead markets to trade in a range. We are of the view that there will not be any significant changes in borrowing and fiscal deficit (5.1% of GDP) in final budget to be announced next month

Higher government spending and reversal of CIC will keep banking liquidity surplus in near term, which would be positive for short end of the curve (money market and short bonds 2- 4 years)

Medium term outlook

Favorable demand supply dynamics for bonds and falling CPI trajectory will slowly and gradually take bond yields to 6.75-85% range

Investors will have to be patient for further rally in yields as it would commensurate with actual FPI flows, global rate cuts in second half of the year and sustained low inflation.

Risks to view

Higher than expected borrowing announcement in budget next month

FPI outflows in near term leading to INR volatility and depreciation

Positioning & Strategy

The fixed income curve in India is pricing in no rate cuts till March 2025. We have retained our long duration stance across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to trade in a narrow range of 7.00-7.20% in the near term and to soften to 6.75% over the next few quarters. Investors need to be patient on the rate cut cycle which could be delayed to the second half of FY25.

From a strategy perspective, the overall call is to play a falling interest rate cycle over the next 6-12 months. Accordingly, investors should continue to build and hold duration across their portfolios. In addition, investors should be patient for further rally as rate cuts have been delayed to H2FY25. With positive demand supply outlook for bonds, FPI flows via JP Morgan Indices starting June 2024 and possibility of a lower government borrowing in July, investors could use this opportunity to invest in Short to Medium term funds with tactical allocation to gilt funds.

Source: Bloomberg, Axis MF Research.