► Valuations in India remain expensive relative to Asian peers.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Expect lower interest rates in the second half of Fy25.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year duration and 3-5-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year duration and 3-5-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

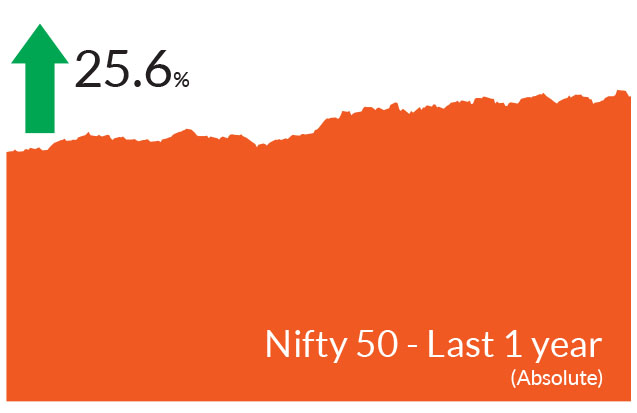

Indian equities faced bouts of volatility through the month given the

elections, geopolitical tensions and outflows, ending slightly lower. The

S&P BSE Sensex and the NIFTY 50 ended 0.7% and 0.3% down

respectively. Amongst other indices, mid-caps advanced but small caps

declined during the month. The NIFTY Midcap 100 ended the month

higher 1.7% while NIFTY Small Cap 100 ended lower 1.9%. The number

of stocks trading above their respective 200- day moving averages was

lower at 73% in May vs. 80% in April. The advance-decline line was

down 18% in May while volatility was high. May again was a month of

outflows by Foreign Portfolio Investors (FPIs) and they withdrew to the

tune of US$2.8 bn while domestic institutional investors remained

strong with inflows of US$5.4 bn. For 2024, FPI net selling stood at

US$3bn, while domestic institutions were net buyers at US$25bn.

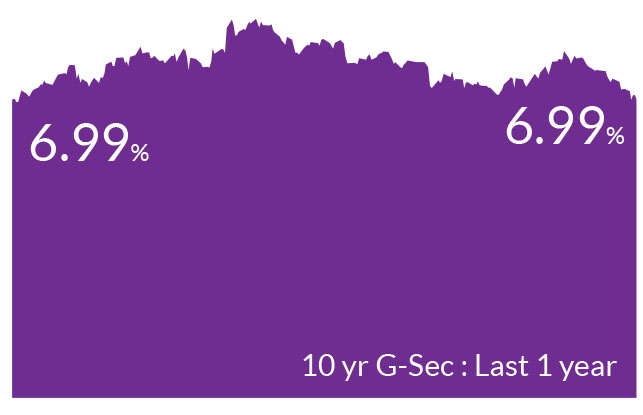

Bond markets were influenced by a dovish than expected monetary policy by the US Federal Reserve (Fed) and weaker macroeconomic data in the US. The yields on US Treasuries fell 20 bps, closing the month at 4.50%. In India, the Reserve Bank of India's (RBI) transfer of Rs 2.1 trillion by way of dividend to the government had a positive impact on bond yields, bringing them lower. Indian government bond yields fell 20 bps to 6.99%. Foreign Portfolio Investors (FPI) flows turned positive in May and stood at US$1 bn over the month. Year to date, cumulative debt inflows amounted to US$6.4 bn.

► Interest rate expectations : The month started with dovish than expected Fed policy wherein highlights were reduction in pace of Fed Balance sheet drawdown by US$ 35bn and continued focus on Inflation and incoming data. Macro data was a mixed bag but employment and inflation data came a tad softer than market expectations. Headline inflation was lower than expected at 0.1%. Based on these we retain our view that rates in US would remain higher for longer, though we believe that if data surprises on downside Fed would be looking at 1-2 rate cuts in 2024. The UK and the euro region may be the first ones to lower interest rates. Meanwhile, the Reserve Bank of India kept interest rates unchanged but upgraded the growth outlook.

► India's macro on a strong footing : The RBI paid a higher than expected dividend payout of Rs 2.1 trillion to the government, vs the expected Rs 0.9 trillion. This is likely to lead to lower market borrowings in the second half of the year and consequently lower bond yields. Furthermore, the higher dividend is positive for the government's fiscal consolidation plan per the interim budget to narrow the deficit to 5.1% of GDP in FY25. Headline inflation marginally softened to 4.83% in April however, food prices remained stubborn at 7.9% while core inflation moderated to 3.2%. Overall, both headline and core inflation have been on expected lines and with expectations of timely onset of monsoon we do not expect any upside in inflation trajectory in near term.

► Banking liquidity continues to be in deficit : Banking liquidity for month was in deficit given that April-May were the election season and as such there was a lack of government spending. In consultation with the central bank, the government announced buyback programs of short dated government bonds and also reduced size of Treasury bill auction calendar by Rs 60,000 cr to improve the banking liquidity.

► GDP growth and sovereign rating upgrade paints a positive picture : The 4QFY24 GDP growth surprised on the upside at 7.8%, even as GVA growth remained relatively muted at 6.3%. Consequently, FY2024 real GDP growth also surprised on the upside at 8.2%. The GVA-GDP gap remained wide, owing to higher net indirect taxes growth. Furthermore, S&P Global Ratings upgraded India's sovereign rating outlook to positive from stable while retaining the rating at 'BBB-' on robust growth and improved quality of government expenditure. The ratings agency said it could upgrade India's sovereign rating in the next two years if the country adopts a cautious fiscal and monetary policy that diminishes the government's elevated debt and interest burden while bolstering economic resilience.

Bond markets were influenced by a dovish than expected monetary policy by the US Federal Reserve (Fed) and weaker macroeconomic data in the US. The yields on US Treasuries fell 20 bps, closing the month at 4.50%. In India, the Reserve Bank of India's (RBI) transfer of Rs 2.1 trillion by way of dividend to the government had a positive impact on bond yields, bringing them lower. Indian government bond yields fell 20 bps to 6.99%. Foreign Portfolio Investors (FPI) flows turned positive in May and stood at US$1 bn over the month. Year to date, cumulative debt inflows amounted to US$6.4 bn.

Key Market Events

► Ruling party set for a third term : The ruling party secured a third consecutive term albeit with a lower number of seats than expected. In response to the surprising outcome, bond yields moved up approx. 10 bps on fears that a government led by a weak mandate could impact the fiscal consolidation trajectory. However, we believe that the government would likely remain committed to its path of fiscal consolidation. Equities faced a sharp reaction with frontline indices falling 5-6% but recovered somewhat in the next two days.► Interest rate expectations : The month started with dovish than expected Fed policy wherein highlights were reduction in pace of Fed Balance sheet drawdown by US$ 35bn and continued focus on Inflation and incoming data. Macro data was a mixed bag but employment and inflation data came a tad softer than market expectations. Headline inflation was lower than expected at 0.1%. Based on these we retain our view that rates in US would remain higher for longer, though we believe that if data surprises on downside Fed would be looking at 1-2 rate cuts in 2024. The UK and the euro region may be the first ones to lower interest rates. Meanwhile, the Reserve Bank of India kept interest rates unchanged but upgraded the growth outlook.

► India's macro on a strong footing : The RBI paid a higher than expected dividend payout of Rs 2.1 trillion to the government, vs the expected Rs 0.9 trillion. This is likely to lead to lower market borrowings in the second half of the year and consequently lower bond yields. Furthermore, the higher dividend is positive for the government's fiscal consolidation plan per the interim budget to narrow the deficit to 5.1% of GDP in FY25. Headline inflation marginally softened to 4.83% in April however, food prices remained stubborn at 7.9% while core inflation moderated to 3.2%. Overall, both headline and core inflation have been on expected lines and with expectations of timely onset of monsoon we do not expect any upside in inflation trajectory in near term.

► Banking liquidity continues to be in deficit : Banking liquidity for month was in deficit given that April-May were the election season and as such there was a lack of government spending. In consultation with the central bank, the government announced buyback programs of short dated government bonds and also reduced size of Treasury bill auction calendar by Rs 60,000 cr to improve the banking liquidity.

► GDP growth and sovereign rating upgrade paints a positive picture : The 4QFY24 GDP growth surprised on the upside at 7.8%, even as GVA growth remained relatively muted at 6.3%. Consequently, FY2024 real GDP growth also surprised on the upside at 8.2%. The GVA-GDP gap remained wide, owing to higher net indirect taxes growth. Furthermore, S&P Global Ratings upgraded India's sovereign rating outlook to positive from stable while retaining the rating at 'BBB-' on robust growth and improved quality of government expenditure. The ratings agency said it could upgrade India's sovereign rating in the next two years if the country adopts a cautious fiscal and monetary policy that diminishes the government's elevated debt and interest burden while bolstering economic resilience.

Market View

Equity MarketsThe upcoming budget and the government's 100-day plan, likely by July, would throw more light on policy trajectory, and the focus on capex vs. consumption would remain. With elections behind us, the private sector may now start implementing their plans. The capex cycle is already turning around, and government related infrastructure spending should get a boost. The real estate sector is also seeing a significant upturn. We expect that markets will be driven by positive cyclical trends, and sectors such as infrastructure, locally-focused manufacturing, and utilities are poised to gain. Our investment strategies are aligned with this outlook, and we have a higher allocation in these areas. Additionally, we maintain an overweight in the consumer discretionary sector, especially in the automotive and real estate industries. Our portfolio also includes investments in sectors such as energy, defense, and transport, which stand to benefit from government policies. With firms seeking funds for growth and new ventures, we expect a surge in credit demand, which is expected to enhance the banking sector's results. In the pharmaceutical industry, we anticipate the favorable pricing conditions to persist and intensify. Conversely, we have an underweight in the export-oriented segment, attributing this to the decline in global economic growth.

Investors should be prepared for potential market volatility ahead given the significant gains in the markets and consider any declines as opportunities to increase exposure to equities. At Axis, we always maintain an asset allocation approach to investing based on investor goals, investment horizon and risk profile with a long term view. Despite the volatility seen on the day of electoral outcome, markets do remain overvalued across the investment part of the economy and we may see normalisation of valuations in some of these segments.

Debt Markets

A dovish than expected Fed's monetary policy in May, weaker macro data in the US and the RBI's surprise gift to government in form of Rs 1.25 trillion higher dividend then expected has led to rally across bond and swap markets both in the US and India.

Yields are down in long tenure bonds by more than 20-30 bps in last one month. US 10-year treasuries are down from 4.75% to 4.30% and India 10-year bond yields traded below 7% after almost a year. Yields on money market (short term upto 1 year) saw an uptick earlier in the month because of tight banking liquidity which also rallied post announcement of T-bill borrowing cut and surplus RBI dividend. Government bonds and swaps outperformed corporate bonds/SDL's this month due to expected cut in government borrowing and rally in US treasuries.

We believe, in lieu of strong US and India growth, run up in commodity prices and geo political uncertainty, central banks across including RBI would not be in a hurry to cut rates. We expect RBI to retain a status quo in its June policy.

Short-term outlook

We expect bonds (10 year G-sec) to remain volatile and trade in a range 7-7.20%.

Fear of higher allocations to welfare schemes and higher borrowing in budget will lead markets to trade in a range. We are of the view that there will not be any significant changes in borrowing and fiscal deficit (5.1% of GDP) in final budget to be announced next month

Higher government spending and reversal of CIC will keep banking liquidity surplus in near term, which would be positive for short end of the curve (money market and short bonds 2-4 years)

Medium term outlook

Favorable demand supply dynamics for bonds and falling CPI trajectory will slowly and gradually take bond yields to 6.75-85% range

Investors will have to be patient for further rally in yields as it would commensurate with actual FPI flows, global rate cuts in H2 and sustained low inflation.

Risks to view

Higher than expected borrowing announcement in budget next month

FPI outflows in near term leading to INR volatility and depreciation

In its upcoming monetary policy, RBI could likely announce "Market Stabilsation Scheme" to neutralize part of excess liquidity, which can put brakes to rally in yields in near term.

From a strategy perspective, the overall call is to play a falling interest rate cycle over the next 6-12 months. Accordingly, investors should continue to build and hold duration across their portfolios. In addition, investors should be patient for further rally as rate cuts have been delayed to H2FY25. With positive demand supply outlook for bonds, FPI flows via JP Morgan Indices starting June 2024 and possibility of a lower government borrowing in July, investors could use this opportunity to invest in Short to Medium term funds with tactical allocation to gilt funds.

Source: Bloomberg, Axis MF Research.