Markets do remain overvalued across the

investment part of the economy and we may

see normalisation of valuations in some of

these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

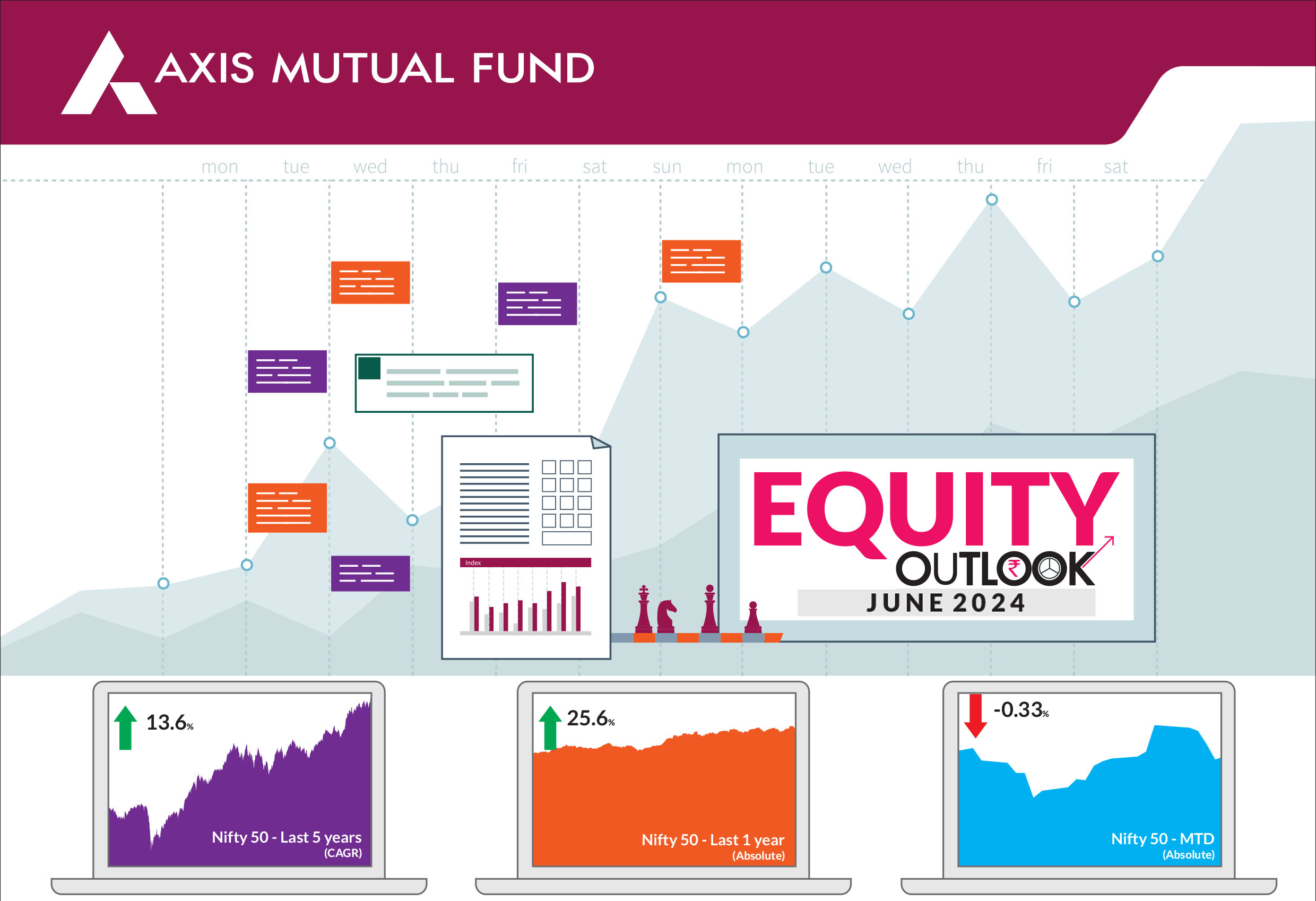

Indian equities faced bouts of volatility through the month given the elections, geopolitical tensions and outflows, ending slightly lower. The BSE Sensex and the NIFTY 50 ended 0.7% and 0.3% down respectively. Amongst other indices, mid-caps advanced but small caps declined during the month. The NIFTY Midcap 100 ended the month higher 1.7% while NIFTY Small Cap 100 ended lower 1.9%. The number of stocks trading above their respective 200- day moving averages was lower at 73% in May vs. 80% in April. The advance-decline line was down 18% in May while volatility was high. |

Following heightened anticipation and optimism around elections, the ruling party won the third consecutive term. Markets witnessed huge volatility as clearly the bar of expectations was quite high. Although this is a first coalition government for the ruling party after a span of two consecutive terms, we expect policy continuity. Looking ahead, investment-driven growth will be pivotal, with the government's emphasis on infrastructure, housing, energy transition, and manufacturing playing a crucial role. |

Investors should be prepared for potential market volatility ahead given the significant gains in the markets and consider any declines as opportunities to increase exposure to equities. At Axis, we always maintain an asset allocation approach to investing based on investor goals, investment horizon and risk profile with a long term view. Despite the volatility seen on the day of electoral outcome, markets do remain overvalued across the investment part of the economy and we may see normalisation of valuations in some of these segments. Nonetheless, India remains one of the fastest growing economies globally and this view stands confirmed by the growth data. The 4QFY24 GDP growth surprised on the upside at 7.8%, even as GVA growth remained relatively muted at 6.3%. Consequently, FY2024 real GDP growth also surprised on the upside at 8.2%. The GVA-GDP gap remained wide, owing to higher net indirect taxes growth. Furthermore, S&P Global Ratings upgraded India's sovereign rating outlook to positive from stable while retaining the rating at 'BBB-' on robust growth and improved quality of government expenditure. The ratings agency said it could upgrade India's sovereign rating in the next two years if the country adopts a cautious fiscal and monetary policy that diminishes the government's elevated debt and interest burden while bolstering economic resilience. The upcoming budget and the government's 100-day plan, likely by July, would throw more light on policy trajectory, and the focus on capex vs. consumption would remain. With elections behind us, the private sector may now start implementing their plans. The capex cycle is already turning around, and government related infrastructure spending should get a boost. The real estate sector is also seeing a significant upturn. We expect that markets will be driven by positive cyclical trends, and sectors such as infrastructure, locally-focused manufacturing, and utilities are poised to gain. Our investment strategies are aligned with this outlook, and we have a higher allocation in these areas. Additionally, we maintain an overweight in the consumer discretionary sector, especially in the automotive and real estate industries. Our portfolio also includes investments in sectors such as energy, defense, and transport, which stand to benefit from government policies. With firms seeking funds for growth and new ventures, we expect a surge in credit demand, which is expected to enhance the banking sector's results. In the pharmaceutical industry, we anticipate the favorable pricing conditions to persist and intensify. Conversely, we have an underweight in the export-oriented segment, attributing this to the decline in global economic growth. |

Source: Bloomberg, Axis MF Research.