► Markets do remain overvalued across the investment part of the economy and we may see

normalisation of valuations in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Expect lower interest rates in the second half of Fy25.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-3-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-3-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

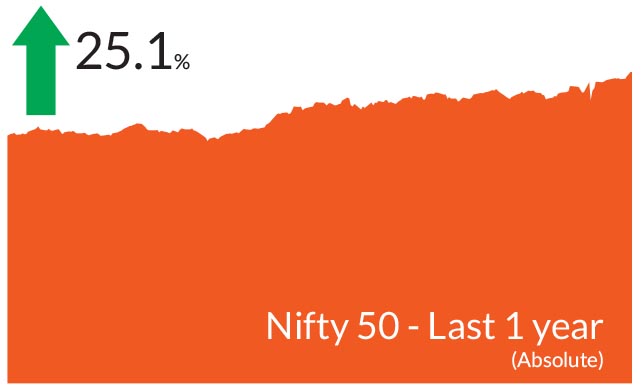

After the initial bout of volatility on the day of electoral outcome, India

equites rose notably over the month buoyed by encouraging economic

data, robust flows and optimism around the new government's

upcoming budget. The BSE Sensex and the NIFTY 50 ended 7% and

6.6% up respectively. Amongst other indices, both the mid-caps and

small caps gained during the month. The NIFTY Midcap 100 ended the

month higher 7.8% while NIFTY Small Cap 100 ended 9.7% up. The

number of stocks trading above their respective 200- day moving

averages was higher at 88% in June vs. 73% in May. The advancedecline

line was up 13% in June while volatility was down.

Bond markets witnessed an action packed month on account of the electoral outcome, monetary policy and the inclusion of Indian government bonds in JP Morgan Indices. The ruling party secured a third consecutive term albeit with a lower number of seats than expected. The volatility seen on the day of election results was reversed through the course of the month. Nonetheless, the yields on the 10 year government bonds ended 3 bps higher at 7.03%. Foreign Portfolio Investors (FPI) flows was positive in June and stood at US$1.8 bn over the month. Year to date, cumulative debt inflows amounted to US$8.3 bn. The month also finally saw the first of the interest rate cuts coming from the central banks in developed economies. Yields on US Treasuries ended 19 bps lower on weaker macroeconomic data.

► Inflationary pressures down : Headline inflation was lower at 4.75% vs 4.83% in the previous month. Both headline and core inflation came a tad softer than expected and unless we see any surprises from monsoon we do not expect any upside in CPI trajectory in near term.

Opec+ extended their cut which led to rise in Brent prices by 5% over last one month. Other commodities especially base metals lost shine in the last month and most of them corrected by 2-5%. Overall, we do not expect crude to add to inflationary pressures.

► Banking liquidity continues to be in deficit : Banking liquidity has remained in deficit for last three months due to lack of spending due to elections. In addition, we had an announcement of more than expected RBI dividend last month, which has led to build up of government balances over Rs 5 trn as of June 21, 2024. In next one month, we have approx. Rs 1.5 trn of government bond maturities and we would also have accelerated spending as government is already trailing on its expenditure spending for the year. This could lead to improvement in banking liquidity which should be positive for short end - bond market curve (up to 2 years)

► Inclusion in JP Morgan indices : Finally, Indian govt bonds were included in JP Morgan Indices from 28 June and we should expect approx. US$ 15-20 bn of inflows till March 2025. So far, approx. US$ 10 bn of inflows have already been seen till date and we expect another US$15-20 bn of flows till March 2025.

Bond markets witnessed an action packed month on account of the electoral outcome, monetary policy and the inclusion of Indian government bonds in JP Morgan Indices. The ruling party secured a third consecutive term albeit with a lower number of seats than expected. The volatility seen on the day of election results was reversed through the course of the month. Nonetheless, the yields on the 10 year government bonds ended 3 bps higher at 7.03%. Foreign Portfolio Investors (FPI) flows was positive in June and stood at US$1.8 bn over the month. Year to date, cumulative debt inflows amounted to US$8.3 bn. The month also finally saw the first of the interest rate cuts coming from the central banks in developed economies. Yields on US Treasuries ended 19 bps lower on weaker macroeconomic data.

Key Market Events

► The start of Interest rate cuts : The central banks of Europe, Switzerland and Canada pivoted on the interest rate cycle, with all of them delivering rate cuts and guidance for further cuts due to falling inflation trajectory. In the US, macro data including retail sales, employment and inflation, continued to be weak with the second quarter data weaker than the first quarter. Meanwhile, the Reserve Bank of India (RBI) kept interest rates unchanged but upgraded the growth outlook. In contrast, the Bank of Japan remain an outlier and expecting to raise interest rates based on macro data underscoring its ability to push up borrowing costs from near zero levels.► Inflationary pressures down : Headline inflation was lower at 4.75% vs 4.83% in the previous month. Both headline and core inflation came a tad softer than expected and unless we see any surprises from monsoon we do not expect any upside in CPI trajectory in near term.

Opec+ extended their cut which led to rise in Brent prices by 5% over last one month. Other commodities especially base metals lost shine in the last month and most of them corrected by 2-5%. Overall, we do not expect crude to add to inflationary pressures.

► Banking liquidity continues to be in deficit : Banking liquidity has remained in deficit for last three months due to lack of spending due to elections. In addition, we had an announcement of more than expected RBI dividend last month, which has led to build up of government balances over Rs 5 trn as of June 21, 2024. In next one month, we have approx. Rs 1.5 trn of government bond maturities and we would also have accelerated spending as government is already trailing on its expenditure spending for the year. This could lead to improvement in banking liquidity which should be positive for short end - bond market curve (up to 2 years)

► Inclusion in JP Morgan indices : Finally, Indian govt bonds were included in JP Morgan Indices from 28 June and we should expect approx. US$ 15-20 bn of inflows till March 2025. So far, approx. US$ 10 bn of inflows have already been seen till date and we expect another US$15-20 bn of flows till March 2025.

Market View

Equity MarketsThe most awaited event, i.e., the elections has finally passed. Markets have witnessed runup as well as volatility based on this event. With markets making lifetime highs every month, investors should be mindful of potential market volatility ahead and rebalance their portfolios accordingly. Any declines are likely opportunities to increase exposure to equities. At Axis, we always maintain an asset allocation approach to investing based on investor goals, investment horizon and risk profile with a long term view. Markets remain overvalued across the investment part of the economy and we may see normalisation of valuations in some of these segments. Having said that, India remains one of the fastest growing economies globally. Macros remain strong with an easing inflation cycle, progress of monsoons and robust economic growth. The upcoming Union Budget in July, the earnings season and policy announcements would set the tone for equities in the near term.

We expect consumption to pick up going forward and there are little signs of uptick in the rural demand segment. A good monsoon, lower inflation and the festive season could further boost rural demand. In addition, a pickup in capex could likely lead to more job creation and thereby a boost in spending power aiding further consumption growth. The premiumisation theme continues and the beneficiaries are the various segments within consumer discretionary. Automobiles and real estate seen an upswing as did high end retail. The housing sector is seeing increasing absorption pan India and with the government's focus on affordable housing, building materials and ancillaries across the spectrum stand to gain. We retain our overweight stance in these sectors.

With the turnaround in capex and a revival in government spending, the entire curve of the capex cycle stands to benefit in light of multiple enablers such as deleveraged corporate balance sheets, healthy profitability, rising domestic demand, and increasing capacity utilization. Accordingly, we are overweight on the infrastructure, manufacturing, utilities and transport. We maintain a bias to holdings in sectors that can benefit from government policies such as energy, defense, power. The banking sector could gain from decadal low NPAs, better capital ratios and a surge in credit demand. In the pharmaceutical industry, we anticipate the favorable pricing conditions to persist and intensify. Conversely, we have an underweight in the export-oriented segment, attributing this to the decline in global economic growth.

Debt Markets

Overall, bond markets traded in a narrow range through June with little movement both at the shorter and longer end of the curve. Looking ahead, we anticipate that bond yields will trend lower due to sustained foreign portfolio investor (FPI) debt inflows and increased spending in July. All eyes are on the upcoming budget, and we do not foresee significant market movements before its release. Our expectation is that the government will prioritize fiscal consolidation, infrastructure investment, and policy continuity. Specifically, we believe that the fiscal deficit target for FY25 will be maintained at 5.1%, with the additional buffer of 0.3-0.4% of GDP resulting from excess RBI dividends allocated to welfare and capex spending.

Although few central banks have initiated rate cuts, we anticipate that neither the US nor India will implement rate cuts until December 2024. The RBI will remain cautious due to robust growth indicators and monsoon uncertainties. Meanwhile, in the US, a larger-than-expected fiscal deficit will likely maintain US yields within a certain range, despite softer macroeconomic data.

Our core view continues to remain constructive on rates due to positive demand supply dynamics especially for Indian government bonds, lower headline and a stable outlook on the external front. We expect 50 bps of rate cut in this cycle in next 12 months. In anticipation of continued FPI flows due to JP Morgan inclusion and expectations of improvement in banking liquidity our portfolio has tilted towards a higher allocation to Gsecs and 1-3 year corporate bonds.

Risks to view

Market positioning is heavy (both traders and investors), which means everyone is positioned for rally in bonds. Any surprises on borrowing in the budget, like additional borrowing can lead to volatility and rise in yields by 10-20 bps.

Positioning & Strategy

We do expect the 10-year bond yields to trade in a narrow range of 7.00-7.20% in the near term and to soften to 6.75% over the next few quarters. Investors need to be patient on the rate cut cycle which could be delayed to the second half of FY25.

Accordingly, from a strategy perspective, we will maintain an overweight duration stance within the respective scheme mandates. Accordingly, investors should continue to build and hold duration across their portfolios. In addition, investors should be patient for further rally as rate cuts have been delayed to H2FY25. With positive demand supply outlook for bonds, FPI flows via JP Morgan Indices starting June 2024 and possibility of a lower government borrowing in July, investors could use this opportunity to invest in Short to Medium term funds with tactical allocation to gilt funds.

Source: Bloomberg, Axis MF Research.