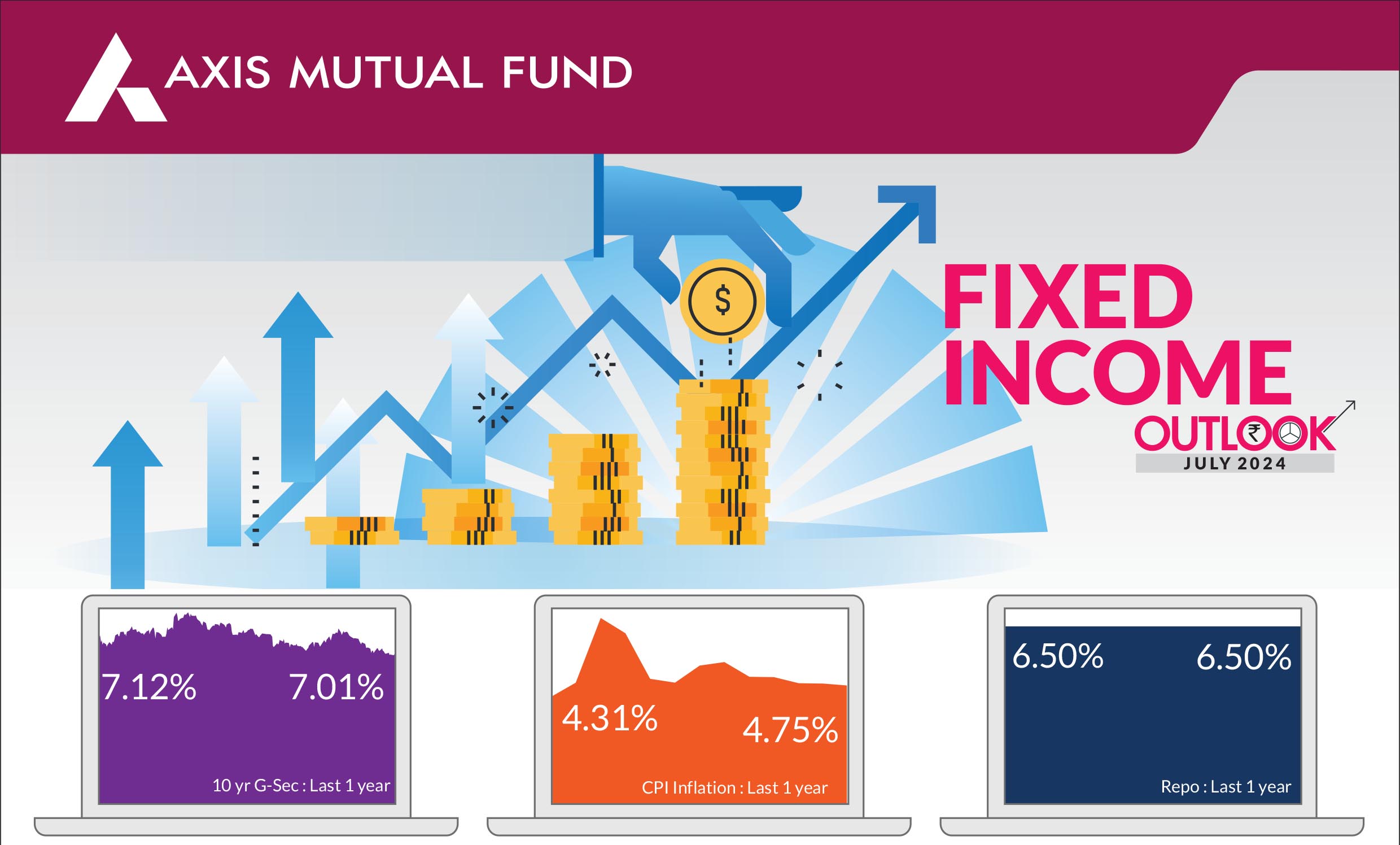

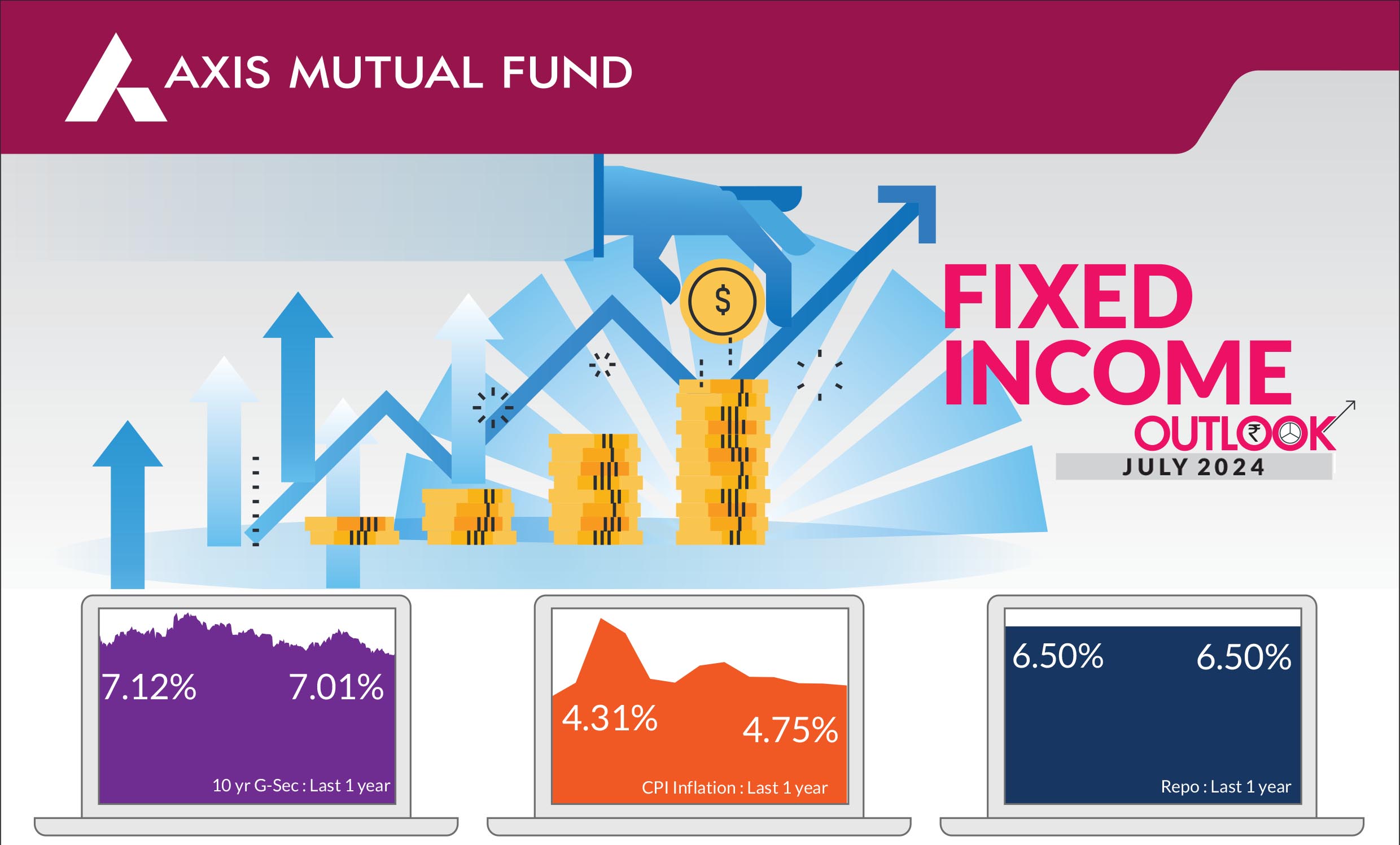

Bond markets witnessed an action packed month on account of the electoral outcome, monetary policy and the inclusion of Indian government bonds in JP Morgan Indices. The ruling party secured a third consecutive term albeit with a lower number of seats than expected. The volatility seen on the day of election results was reversed through the course of the month. Nonetheless, the yields on the 10 year government bonds ended 3 bps higher at 7.03%. Foreign Portfolio Investors (FPI) flows was positive in June and stood at US$1.8 bn over the month. Year to date, cumulative debt inflows amounted to US$8.3 bn. The month also finally saw the first of the interest rate cuts coming from the central banks in developed economies. Yields on US Treasuries ended 19 bps lower on weaker macroeconomic data.

Opec+ extended their cut which led to rise in Brent prices by 5% over last one month. Other commodities especially base metals lost shine in the last month and most of them corrected by 2-5%. Overall, we do not expect crude to add to inflationary pressures.

► Banking liquidity continues to be in deficit : Banking liquidity has remained in deficit for last three months due to lack of spending due to elections. In addition, we had an announcement of more than expected RBI dividend last month, which has led to build up of government balances over Rs 5 trn as of June 21, 2024. In next one month, we have approx. Rs 1.5 trn of government bond maturities and we would also have accelerated spending as government is already trailing on its expenditure spending for the year. This could lead to improvement in banking liquidity which should be positive for short end - bond market curve (up to 2 years)

► Inclusion in JP Morgan indices : Finally, Indian govt bonds were included in JP Morgan Indices from 28 June and we should expect approx. US$ 15-20 bn of inflows till March 2025. So far, approx. US$ 10 bn of inflows have already been seen till date and we expect another US$15-20 bn of flows till March 2025.

Market view

Overall, bond markets traded in a narrow range through June with little movement both at the shorter and longer end of the curve. Looking ahead, we anticipate that bond yields will trend lower due to sustained foreign portfolio investor (FPI) debt inflows and increased spending in July. All eyes are on the upcoming budget, and we do not foresee significant market movements before its release. Our expectation is that the government will prioritize fiscal consolidation, infrastructure investment, and policy continuity. Specifically, we believe that the fiscal deficit target for FY25 will be maintained at 5.1%, with the additional buffer of 0.3-0.4% of GDP resulting from excess RBI dividends allocated to welfare and capex spending.Although few central banks have initiated rate cuts, we anticipate that neither the US nor India will implement rate cuts until December 2024. The RBI will remain cautious due to robust growth indicators and monsoon uncertainties. Meanwhile, in the US, a larger-than-expected fiscal deficit will likely maintain US yields within a certain range, despite softer macroeconomic data.

Our core view continues to remain constructive on rates due to positive demand supply dynamics especially for Indian government bonds, lower headline and a stable outlook on the external front. We expect 50 bps of rate cut in this cycle in next 12 months. In anticipation of continued FPI flows due to JP Morgan inclusion and expectations of improvement in banking liquidity our portfolio has tilted towards a higher allocation to Gsecs and 1-3 year corporate bonds.

Risks to view

Market positioning is heavy (both traders and investors), which means everyone is positioned for rally in bonds. Any surprises on borrowing in the budget, like additional borrowing can lead to volatility and rise in yields by 10-20 bps.

Positioning & Strategy

We do expect the 10-year bond yields to trade in a narrow range of 7.00-7.20% in the near term and to soften to 6.75% over the next few quarters. Investors need to be patient on the rate cut cycle which could be delayed to the second half of FY25.

Accordingly, from a strategy perspective, we will maintain an overweight duration stance within the respective scheme mandates. Accordingly, investors should continue to build and hold duration across their portfolios. In addition, investors should be patient for further rally as rate cuts have been delayed to H2FY25. With positive demand supply outlook for bonds, FPI flows via JP Morgan Indices starting June 2024 and possibility of a lower government borrowing in July, investors could use this opportunity to invest in Short to Medium term funds with tactical allocation to gilt funds.

Source: Bloomberg, Axis MF Research.