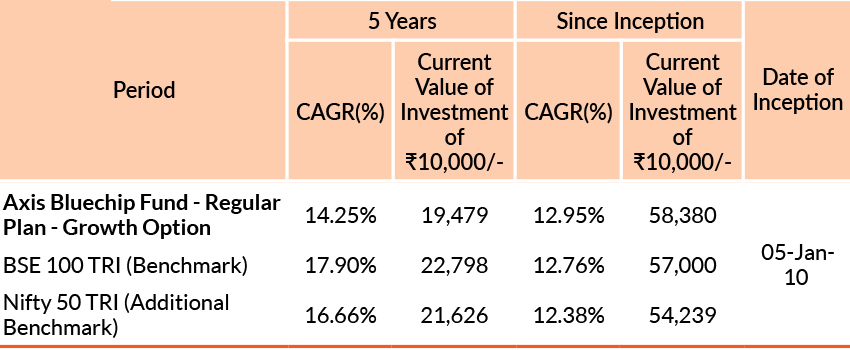

| DATE OF ALLOTMENT | 5th January 2010 |

| MONTHLY AVERAGE | 33,968.27Cr. |

| AS ON 30th June, 2024 | 34,520.15Cr. | |

| BENCHMARK | BSE 100 TRI |

| STATISTICAL MEASURES | (3 YEARS) |

| Standard Deviation | 13.25% | |

| Beta | 0.97 | |

| Sharpe Ratio** | 0.36 | |

| **Risk-free rate assumed to be 6.86% (MIBOR as on 30-06-2024) - Source: www.fimmda.org Computed for the 3-yr period ended June 28, 2024. Based on month-end NAV. | ||

| PORTFOLIO TURNOVER (1 YEAR) | 0.35 times |

| FUND MANAGER | |

| Mr. Shreyash Devalkar | ||

| Work experience: 20 years.He has been managing this fund since 23rd November 2016 | ||

| Mr. Ashish Naik | ||

| Work experience: 16 years.He has been managing this fund since 3rd August 2023 | ||

| Ms. Krishnaa N (for foreign securities) | ||

| Work experience: 4 years.She has been managing this fund since 1st March 2024 | ||

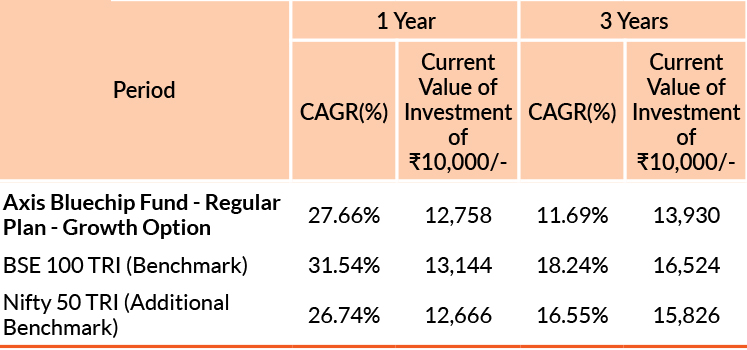

Past performance may or may not be sustained in future. Different plans have different expense structure. Shreyash Devalkar is managing the scheme since 23rd November 2016 and he manages 9 schemes of Axis Mutual Fund & Ashish Naik is managing the scheme since 3rd August 2023 and he manages 18 schemes of Axis Mutual Fund & Krishnaa N is managing the scheme since 1st March 2024 and she manages 18 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹ 10.

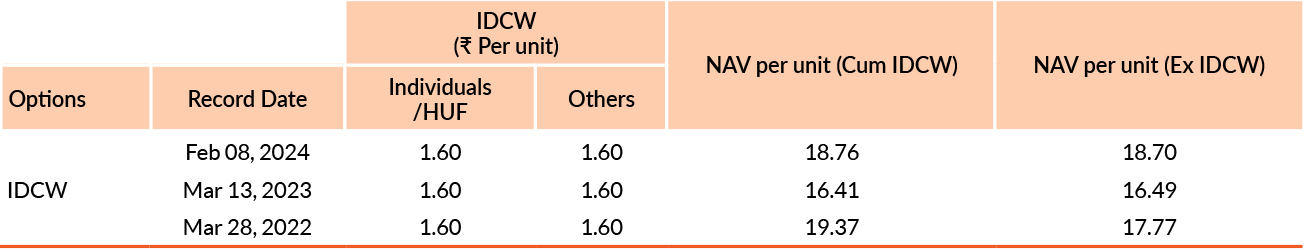

Pursuant to payment of Distribution (of Income & Capital), the NAV of the above stated IDCW options of the scheme/plan would fall to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future.

Face value of units is ₹ 10. IDCW means Income Distribution cum Capital Withdrawal.

Entry Load : NA

Exit Load : If redeemed / switched-out within 12 months from the date of allotment, For 10 % of investments: Nil, For remaining investments: 1%, If redeemed /

switched - out after 12 months from the date of allotment:NIL

Please click here for NAV, TER, Riskometer & Statutory Details.