► Equity market valuations are broadly reasonable adjusted for the cyclical low in earnings and

potential for revival going forward.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Broadly interest rate cycle and inflation cycle have peaked both in India and globally.

► Investors should add duration with every rise in yields.

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Investors should add duration with every rise in yields.

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

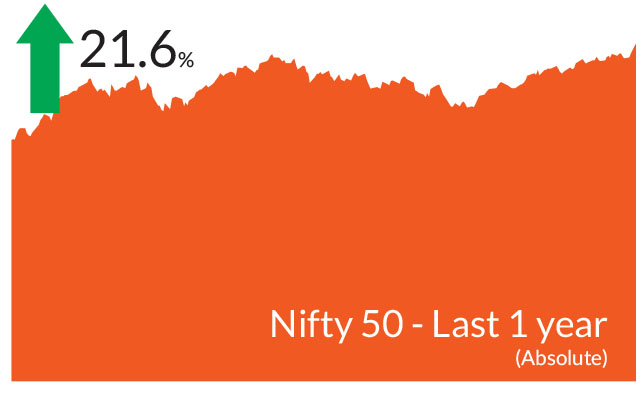

Indian equities had a spectacular month with benchmark indices

registering all-time highs amid strong foreign inflows, improving

outlook for corporate earnings and better than expected macros. The

BSE Sensex, Nifty 50 and the Nifty Bank scaled new lifetime highs and

the Nifty 50 surpassed the 19,000 mark. S&P BSE Sensex & NIFTY 50

ended the month up 3.4% and 3.5% respectively. NIFTY Midcap 100 &

NIFTY Small cap 100 continued to outperform their large cap peers, up

5.9% & 6.6% respectively. Market breadth remained strong while

volatility declined further over the month.

The guiding theme for debt markets was the monetary policy decisions by the Reserve Bank of India (RBI) and the central banks globally including the US Federal Reserve (Fed). Markets also witnessed oil production cuts by OPEC and a slew of positive macro data releases in India and the US. All these together led to a 10-12 bps rise in yields for all bonds over one year. Additionally, there was a broad based rise in global bond yields. The yield on the benchmark 10-year G-sec stood at 7.11%, up 12 bps from last month.

On the domestic front, as widely expected, CPI inflation declined to a 2- year low of 4.25% in May from 4.70% a month ago. Favourable base effects and a decline in food prices were the reason for the fall. One needs to see whether the monsoon is deficient due to a strong El-Nino and this could push up food prices. India's economic growth over the quarter remained resilient at 6.1%. Meanwhile, industrial production rose 4.2% in April, up from a revised 1.7% in March supported by investment and consumer demand. The broad-based rise growth indicates that despite weak external demand, lower inflation and higher capex supported industrial activity.

The RBI's Monetary Policy Committee (MPC) maintained a cautious stance ahead of the US Fed's June policy meet. While the central bank retained its status quo on interest rates, the MPC members stressed on the 4% target for headline inflation. The US Fed policy was a consensus pause but the policy members released Fed dot plot chart that showed two further potential hikes while the members were upbeat on macro economy data projections.

Private sector capital expenditure finally showed signs of a rebound, with the announcements more than doubling in FY23 from prepandemic levels and outpacing Central and state governments' capex plans for the year. Overall, new capex crossed the pre-pandemic peak and stood at Rs 12 trillion in the fourth quarter of FY23, according to data from CMIE. Furthermore, indicators such as capital utilisation and improving PAT/GDP ratio suggest that a broad-based capex revival is on the horizon.

The guiding theme for debt markets was the monetary policy decisions by the Reserve Bank of India (RBI) and the central banks globally including the US Federal Reserve (Fed). Markets also witnessed oil production cuts by OPEC and a slew of positive macro data releases in India and the US. All these together led to a 10-12 bps rise in yields for all bonds over one year. Additionally, there was a broad based rise in global bond yields. The yield on the benchmark 10-year G-sec stood at 7.11%, up 12 bps from last month.

On the domestic front, as widely expected, CPI inflation declined to a 2- year low of 4.25% in May from 4.70% a month ago. Favourable base effects and a decline in food prices were the reason for the fall. One needs to see whether the monsoon is deficient due to a strong El-Nino and this could push up food prices. India's economic growth over the quarter remained resilient at 6.1%. Meanwhile, industrial production rose 4.2% in April, up from a revised 1.7% in March supported by investment and consumer demand. The broad-based rise growth indicates that despite weak external demand, lower inflation and higher capex supported industrial activity.

The RBI's Monetary Policy Committee (MPC) maintained a cautious stance ahead of the US Fed's June policy meet. While the central bank retained its status quo on interest rates, the MPC members stressed on the 4% target for headline inflation. The US Fed policy was a consensus pause but the policy members released Fed dot plot chart that showed two further potential hikes while the members were upbeat on macro economy data projections.

Private sector capital expenditure finally showed signs of a rebound, with the announcements more than doubling in FY23 from prepandemic levels and outpacing Central and state governments' capex plans for the year. Overall, new capex crossed the pre-pandemic peak and stood at Rs 12 trillion in the fourth quarter of FY23, according to data from CMIE. Furthermore, indicators such as capital utilisation and improving PAT/GDP ratio suggest that a broad-based capex revival is on the horizon.

Market View

Equity MarketsIndia's GDP CAGR growth over the last 5 years stands at ~ 3.8% while nominal growth is ~9.7%. The spurt in GDP growth to above 6% on real GDP opens up a significant growth opportunity in our opinion across sectors. A confluence of cyclical & a structural tailwind are driving the recovery. Cyclically stronger balance sheets, improving macro stability - which reduces pressure on policymakers to tighten policy stance - and structural policy reforms are the keys to sustainable growth. However, some companies are likely to benefit over others on account of flexibility, product differentiation and market leadership. This pocket-wise growth rather than 'across the board' and active investing in growth and quality are likely to be key to alpha creation.

Our fund performance has seen a strong rebound driven by active stock selectin driving much of this recovery. This unique trait across portfolios has historically been key to long term wealth creation and this is reflected in our conviction plays across schemes.

Debt Markets

In the near term, bond markets might see a marginal upside of 5-10 bps in yields. We believe investors should use this rise in yields to increase duration across their investments. Structurally, we believe we are at peak of both inflation and interest rate cycle and anticipate limited upside in yields from this point. Banking liquidity should remain positive in near term and bond prices are indicative of the supply pressures within the bond markets. Consequently, in the next 3-6 months, we expect a fall of 20-40 bps in yields across the curve beyond 1 year. We do expect the yield curve to steepen post a first rate cut by the RBI. Demand from insurance and mutual funds could decline but Rs 2,000 note deposits in banks (~ Rs 2.25 trillion already deposited) will ensure more than sufficient SLR demand from banks in near term.

From a portfolio standpoint, in line with our medium-term view, our portfolios currently run duration at the higher end of the respective investment mandates. Our expectations of incrementally softening yields across the curve and a possible policy pivot in favor of softening rates in the latter half of the financial year, this has already been factored into the current portfolio positioning. Recovery in credit spreads over the last 3-4 months has also made corporate credit (AA & above) attractive from a risk reward standpoint. For investors with a medium-term investment horizon, we continue to believe actively managed duration strategies offer ideal investment solutions to capitalize on a falling interest rate outlook and attractive 'carry' opportunities as compared to comparable traditional investment solutions.

Source: Bloomberg, Axis MF Research.