| DATE OF ALLOTMENT | 5th January 2010 |

| MONTHLY AVERAGE | 33,640.88Cr. |

| AS ON 30th June, 2023 | 33,987.01Cr. | |

| BENCHMARK | S&P BSE 100 TRI |

| STATISTICAL MEASURES | (3 YEARS) |

| Standard Deviation | 11.67% | |

| Beta | 0.92 | |

| Sharpe Ratio** | 0.84 | |

| **Risk-free rate assumed to be 6.9% (MIBOR as on 30-06-2023) - Source: www.fimmda.org Please note that as per AMFI guidelines for factsheet, the ratios are calculated based on month rolling returns (absolute) for last 3 years. Data as on 30th June 2023. | ||

| PORTFOLIO TURNOVER (1 YEAR) | 0.34 times |

| Source: ACEMF | ||

| FUND MANAGER | |

| Mr. Shreyash Devalkar | ||

| Work experience: 19 years.He has been managing this fund since 23rd November 2016 | ||

| Mr. Vinayak Jayanath (for foreign securities) | ||

| Work experience: 7 years.He has been managing this fund since 17th January, 2023 | ||

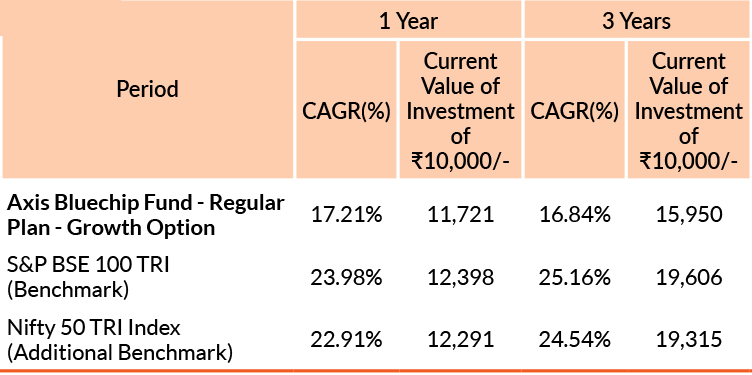

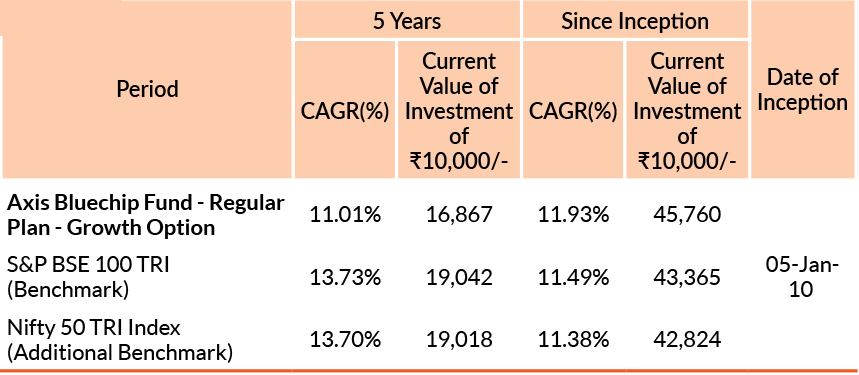

Past performance may or may not be sustained in future. Different plans have different expense structure. Shreyash Devalkar is managing the scheme since 23rd November 2016 and he manages 6 schemes of Axis Mutual Fund & Vinayak Jayanath is managing the scheme since 17th January 2023 and he manages 17 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹ 10.

Pursuant to payment of Distribution (of Income & Capital), the NAV of the above stated IDCW options of the scheme/plan would fall to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future.

Face value of units is ₹ 10. IDCW means Income Distribution cum Capital Withdrawal.

Entry Load : NA

Exit Load : If redeemed / switched-out within 12 months from the date of allotment, For 10 % of investments: Nil, For remaining investments: 1%, If redeemed /

switched - out after 12 months from the date of allotment:NIL

Please click here for NAV, TER, Riskometer & Statutory Details.