•

Yield curve flat - Duration plays

can be played in the 2-4 year

segment.

• Budget strikes a balance

between the need for growth

and fiscal consolidation

•

Spreads between G-Sec/AAA

& SDL/AAA have seen some

widening.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals.

► Budget 2023 - Strengthening the Growth Ship: Budget 2023 was well

received as it struck a much needed balance between the need for growth

and fiscal consolidation. The government's agenda largely remains

unchanged as it drives the

investment push from the top

and engages all levers to ensure

that the Indian economy

remains the fastest growing

large economy on the planet.

The sharp increase in capital

expenditure could be seen as a ploy to complete and take credit for the vast

investments in infrastructure done over the last 8 years rightfully so given

that 2024 will be an election year.

► Economic Survey - Resilient Growth: The Economic Survey highlights

healthy growth expectations for FY2024 supported by domestic demand

specifically improving capex outlook. The survey highlights the need to be

watchful of risks from external factors. The two key drivers of growth have

been private consumption and capital formation. The complete reopening

of the economy, increasing vaccination coverage, in addition to pent-up

demand have allowed domestic consumption to pick up in a meaningful

manner. Better job market prospects helped uplift consumer sentiment,

which plays a fundamental role in facilitating consumption activity.

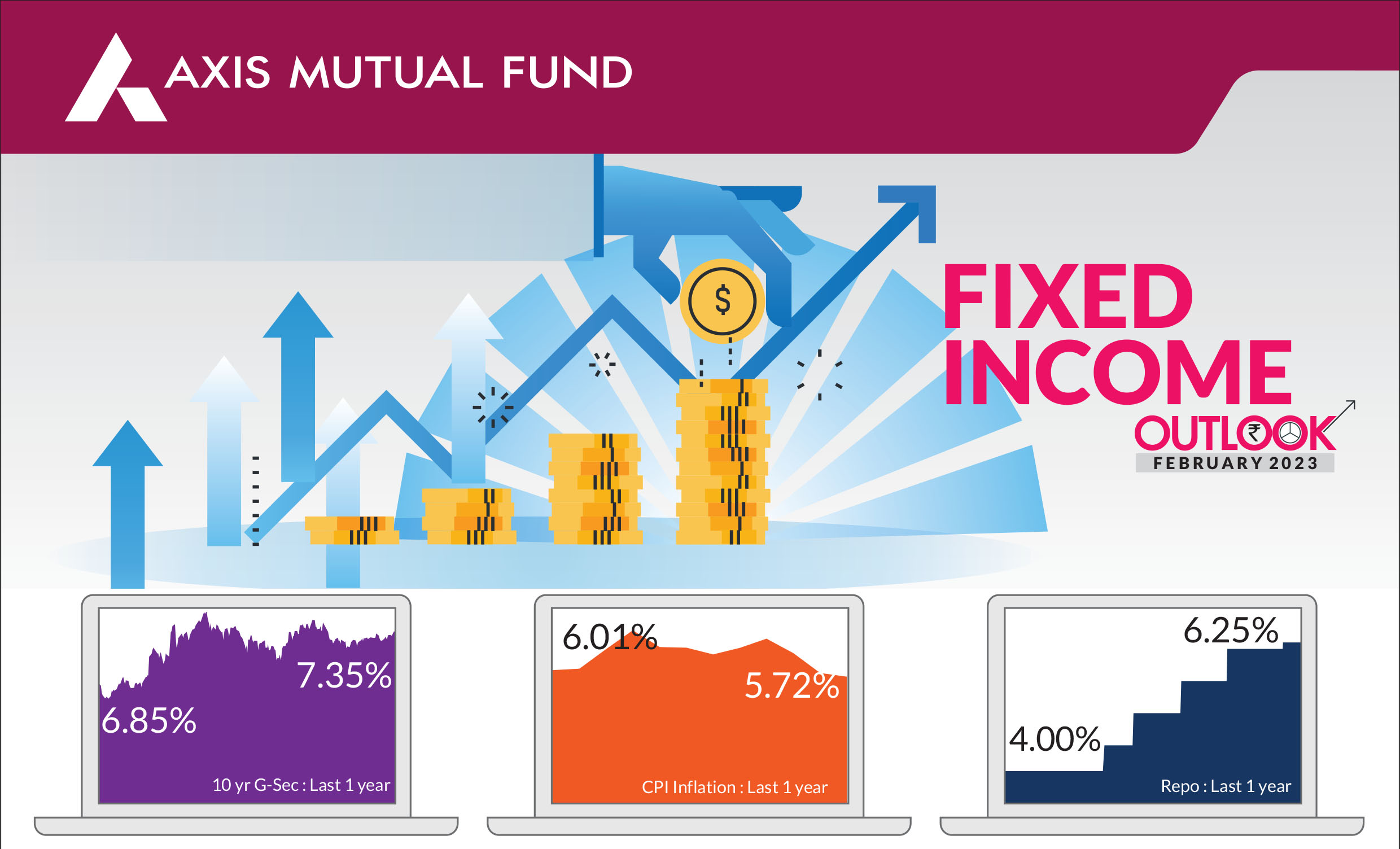

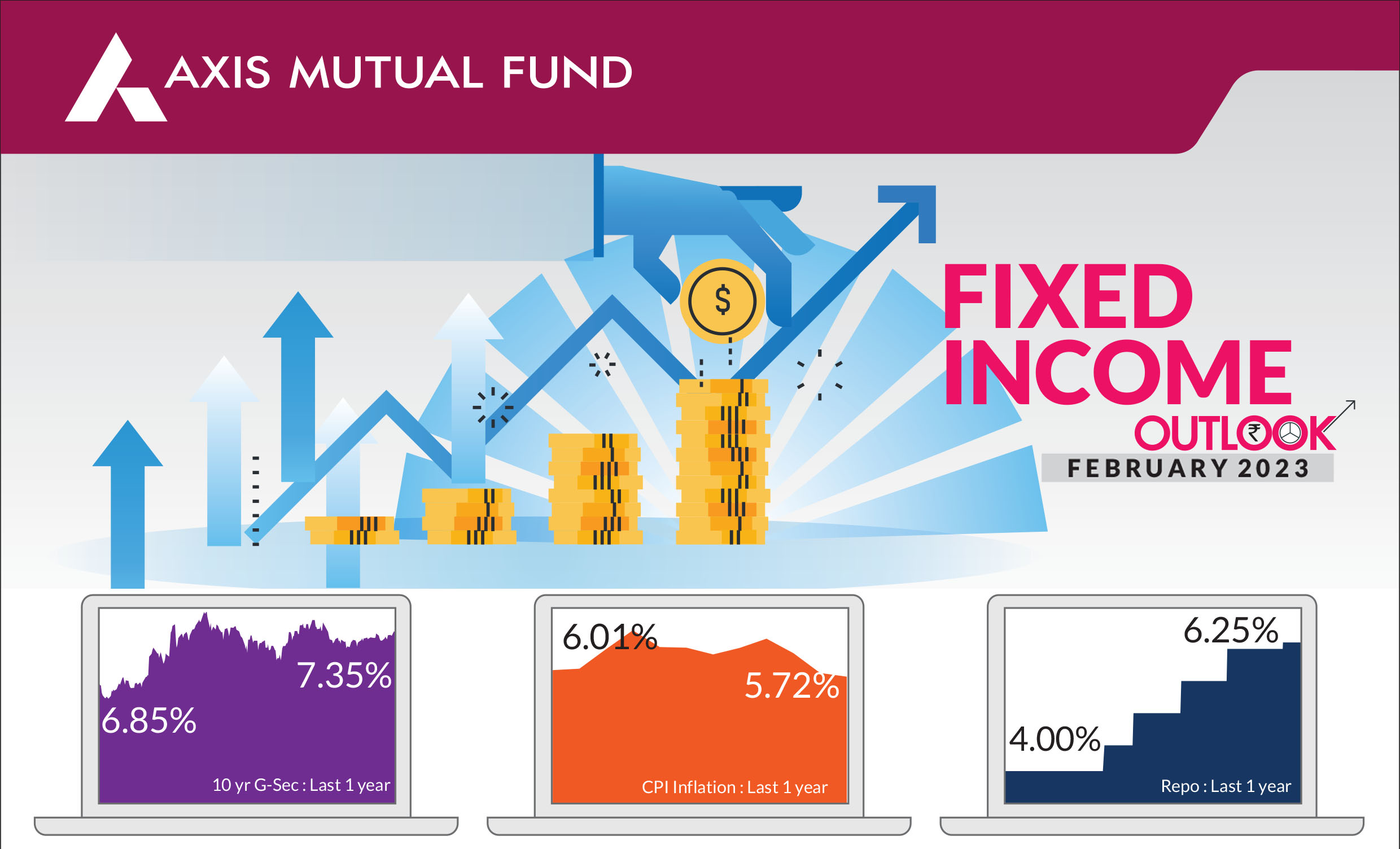

► Inflation Moderates, Oil comfortably placed: Retail Inflation in India

continued its moderation. CPI inflation stood at 5.72% in December

compared to 5.88% in November 2022. The fall in headline inflation in

December was led by food items, with food inflation tumbling to 4.19% -

also the lowest in a year. Within food, vegetables prices fell the most, with

the index down 12.7% in December compared to November. Core CPI

remained sticky at 6.3%. Brent crude ended the month at US$86/barrel

while the India crude basket followed suit and ended the month at

US$82/barrel.

► US Fed - Are Rates Peaking?: The upcoming US Fed action could likely signal peaking of global interest rates. Despite a series of rate hikes, the developed world has slowly edged back to growth reinforcing confidence of policy makers in the underlying health of the global economy.

► US Fed - Are Rates Peaking?: The upcoming US Fed action could likely signal peaking of global interest rates. Despite a series of rate hikes, the developed world has slowly edged back to growth reinforcing confidence of policy makers in the underlying health of the global economy.

The budget was cheered by the markets. The short end of the yield curve moved

favourably as a lower borrowing target implies opportunities for other market

participants to borrow to cater to the surging credit growth in the economy.

We also anticipate a materially calmer RBI in light of the prevailing economic

situation and stable inflation. The yield curve continues to remain flat offering

competitive rates across much of the short and medium term segments.

The current curve remains very flat with everything in corporate bonds beyond 1 year up to 15 years is available @7.5-7.65% range. We expect the curve to remain flat for most part of 2023. We expect long bonds to trade in a range for most part of 2023 (7-7.5%) falling CPI, weaker growth and strong investor demand would keep yields under check despite high G-Sec supply next year.

We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios.

For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios. This however does not imply approaching the extreme long end of the yield curves as inherent volatility could be a factor in the near term.

The current yield curve presents material opportunities for investors in the 4- year segment. This category also offers significant margin of safety given the steepness of the curve. For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. Spreads between G-Sec/AAA & SDL/AAA have seen some widening over the last month which could make a case for allocations into high quality corporate credit strategies. Lower rated credits with up to 18-month maturity profiles can also be considered as ideal 'carry' solutions in the current environment.

The current curve remains very flat with everything in corporate bonds beyond 1 year up to 15 years is available @7.5-7.65% range. We expect the curve to remain flat for most part of 2023. We expect long bonds to trade in a range for most part of 2023 (7-7.5%) falling CPI, weaker growth and strong investor demand would keep yields under check despite high G-Sec supply next year.

We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios.

For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios. This however does not imply approaching the extreme long end of the yield curves as inherent volatility could be a factor in the near term.

The current yield curve presents material opportunities for investors in the 4- year segment. This category also offers significant margin of safety given the steepness of the curve. For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. Spreads between G-Sec/AAA & SDL/AAA have seen some widening over the last month which could make a case for allocations into high quality corporate credit strategies. Lower rated credits with up to 18-month maturity profiles can also be considered as ideal 'carry' solutions in the current environment.

Source: Bloomberg, Axis MF Research.