► Equity market valuations are broadly reasonable adjusted for the cyclical low in earnings and

potential for revival going forward.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

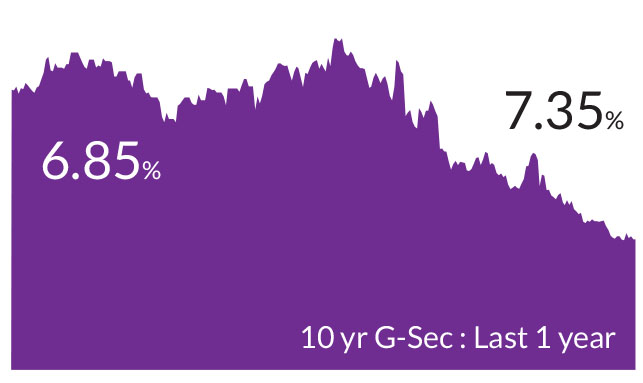

► Yield curve flat - Duration plays can be played in the 2-4 year segment.

► Budget strikes a balance between the need for growth and fiscal consolidation.

► Spreads between G-Sec/AAA & SDL/AAA have seen some widening.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Budget strikes a balance between the need for growth and fiscal consolidation.

► Spreads between G-Sec/AAA & SDL/AAA have seen some widening.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

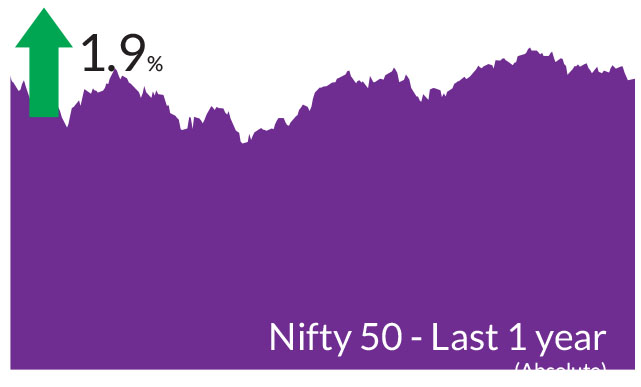

Indian markets started the year on a week note with S&P BSE Sensex &

NIFTY 50 ending the month down 2.1% & 2.4% respectively. Mid and

small caps also trended in line with NIFTY Midcap 100 & NIFTY Small

cap 100 ending the month down 2.6% & 2.4% respectively. India was the

only major outlier in the month as China (+11.8% MoM) and the Euro

area (+8.6% MoM) delivered strong positive returns.

► Economic Survey - Resilient Growth: The Economic Survey highlights healthy growth expectations for FY2024 supported by domestic demand specifically improving capex outlook. The survey highlights the need to be watchful of risks from external factors. The two key drivers of growth have been private consumption and capital formation. The complete reopening of the economy, increasing vaccination coverage, in addition to pent-up demand have allowed domestic consumption to pick up in a meaningful manner. Better job market prospects helped uplift consumer sentiment, which plays a fundamental role in facilitating consumption activity.

► Inflation Moderates, Oil comfortably placed: Retail Inflation in India continued its moderation. CPI inflation stood at 5.72% in December compared to 5.88% in November 2022. The fall in headline inflation in December was led by food items, with food inflation tumbling to 4.19% - also the lowest in a year. Within food, vegetables prices fell the most, with the index down 12.7% in December compared to November. Core CPI remained sticky at 6.3%. Brent crude ended the month at US$86/barrel while the India crude basket followed suit and ended the month at US$82/barrel.

► US Fed - Are Rates Peaking?: The upcoming US Fed action could likely signal peaking of global interest rates. Despite a series of rate hikes, the developed world has slowly edged back to growth reinforcing confidence of policy makers in the underlying health of the global economy.

Key Market Events

► Budget 2023 - Strengthening the Growth Ship: Budget 2023 was well received as it struck a much needed balance between the need for growth and fiscal consolidation. The government's agenda largely remains unchanged as it drives the investment push from the top and engages all levers to ensure that the Indian economy remains the fastest growing large economy on the planet. The sharp increase in capital expenditure could be seen as a ploy to complete and take credit for the vast investments in infrastructure done over the last 8 years rightfully so given that 2024 will be an election year.► Economic Survey - Resilient Growth: The Economic Survey highlights healthy growth expectations for FY2024 supported by domestic demand specifically improving capex outlook. The survey highlights the need to be watchful of risks from external factors. The two key drivers of growth have been private consumption and capital formation. The complete reopening of the economy, increasing vaccination coverage, in addition to pent-up demand have allowed domestic consumption to pick up in a meaningful manner. Better job market prospects helped uplift consumer sentiment, which plays a fundamental role in facilitating consumption activity.

► Inflation Moderates, Oil comfortably placed: Retail Inflation in India continued its moderation. CPI inflation stood at 5.72% in December compared to 5.88% in November 2022. The fall in headline inflation in December was led by food items, with food inflation tumbling to 4.19% - also the lowest in a year. Within food, vegetables prices fell the most, with the index down 12.7% in December compared to November. Core CPI remained sticky at 6.3%. Brent crude ended the month at US$86/barrel while the India crude basket followed suit and ended the month at US$82/barrel.

► US Fed - Are Rates Peaking?: The upcoming US Fed action could likely signal peaking of global interest rates. Despite a series of rate hikes, the developed world has slowly edged back to growth reinforcing confidence of policy makers in the underlying health of the global economy.

Market View

Equity MarketsValuations have dropped marginally but remain elevated from an overall standpoint. We note, select pockets of the markets especially the one's over-owned by retail and domestic funds have begun to show signs of froth. Further, the valuation premia offered to select companies where growth is lacking is increasingly unjust especially as base effects wean away super normal growth.

Our portfolios favour large caps where companies continue to deliver on growth metrics. Corporate earnings of our portfolio companies continue to give us confidence in the strength of our portfolio companies. From a risk perspective, in the current context, given rising uncertainties our attempt remains to minimize betas in our portfolios. The markets have kept 'quality' away from the limelight for over 18 months, making valuations of these companies relatively cheap both from a historical context and a relative market context.

While we remain cautious of external headwinds, strong discretionary demand evident from high frequency indicators and stable government policies give us confidence that our portfolios are likely to weather the ongoing challenges. Markets at all-time highs also point to a valuation risk in select pockets which we will look to avoid.

Debt Markets

The budget was cheered by the markets. The short end of the yield curve moved favourably as a lower borrowing target implies opportunities for other market participants to borrow to cater to the surging credit growth in the economy. We also anticipate a materially calmer RBI in light of the prevailing economic situation and stable inflation. The yield curve continues to remain flat offering competitive rates across much of the short and medium term segments.

The current curve remains very flat with everything in corporate bonds beyond 1 year up to 15 years is available @7.5-7.65% range. We expect the curve to remain flat for most part of 2023. We expect long bonds to trade in a range for most part of 2023 (7-7.5%) falling CPI, weaker growth and strong investor demand would keep yields under check despite high G-Sec supply next year.

We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios.

For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios. This however does not imply approaching the extreme long end of the yield curves as inherent volatility could be a factor in the near term.

The current yield curve presents material opportunities for investors in the 4-year segment. This category also offers significant margin of safety given the steepness of the curve. For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. Spreads between GSec/ AAA & SDL/AAA have seen some widening over the last month which could make a case for allocations into high quality corporate credit strategies. Lower rated credits with up to 18-month maturity profiles can also be considered as ideal 'carry' solutions in the current environment.

Source: Bloomberg, Axis MF Research.