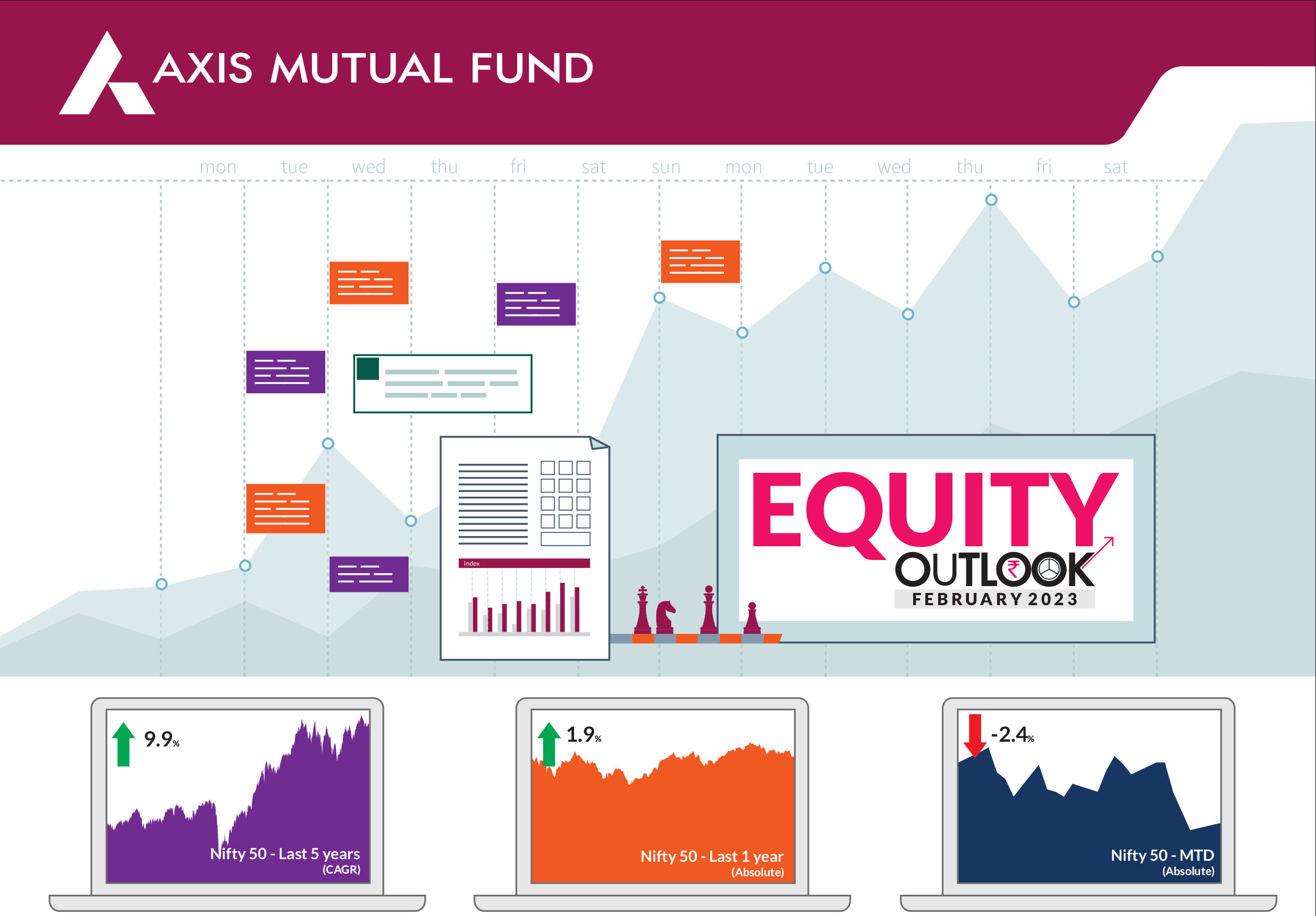

Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

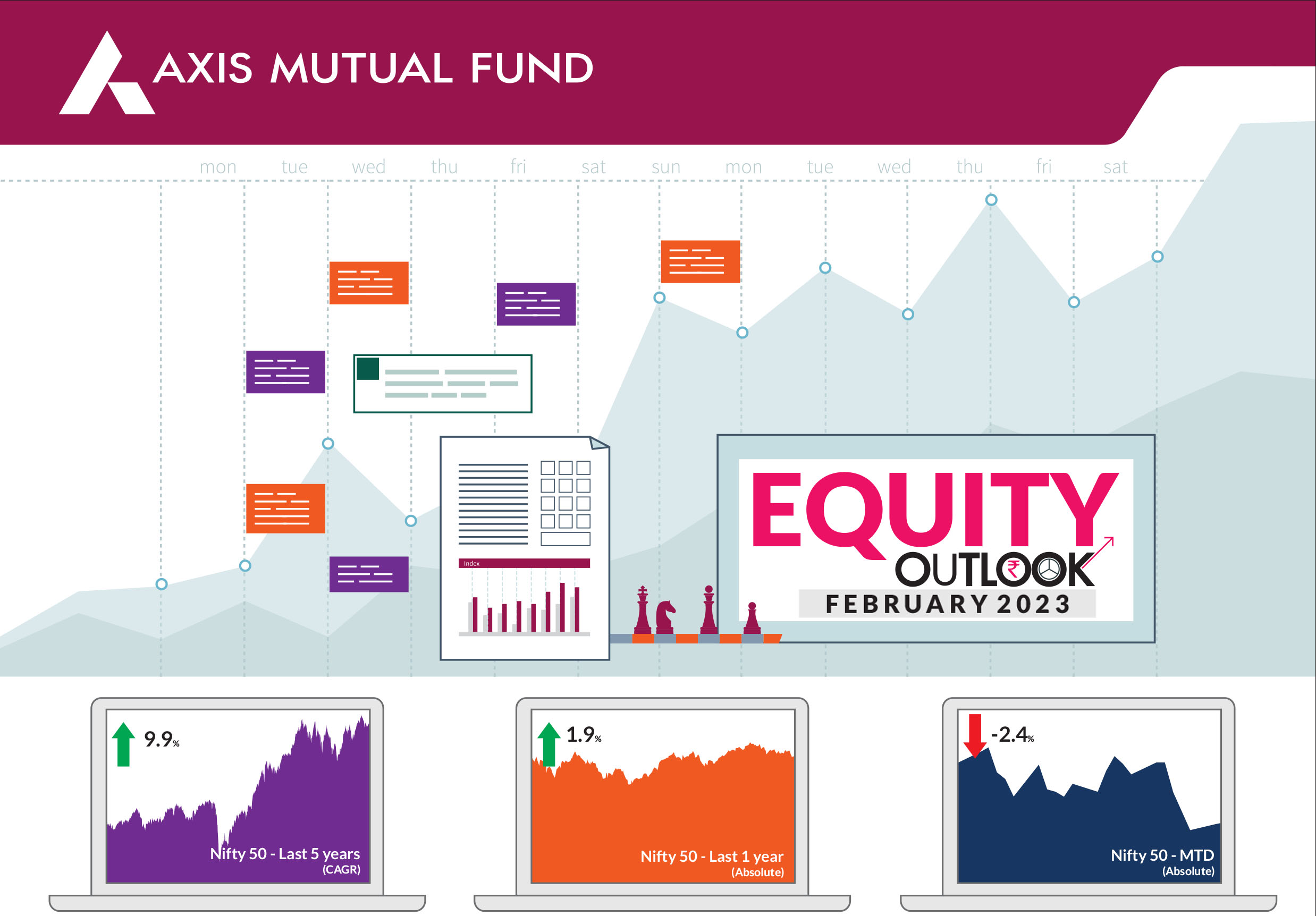

Indian markets started the year on a weak note with S&P BSE

Sensex & NIFTY 50 ending the month down 2.1% & 2.4%

respectively. Mid and small caps also trended in line with NIFTY

Midcap 100 & NIFTY Small cap 100 ending the month down 2.6%

& 2.4% respectively. India was the only major outlier in the month

as China (+11.8% MoM) and the Euro area (+8.6% MoM)

delivered strong positive returns.

Budget 2023 was well received as it struck a much needed balance between the need for growth and fiscal consolidation. The government's agenda largely remains unchanged as it drives the investment push from the top and engages all levers to ensure that the Indian economy remains the fastest growing large economy on the planet. The sharp increase in capital expenditure could be seen as a ploy to complete and take credit for the vast investments in infrastructure done over the last 8 years rightfully so given that 2024 will be an election year.

In addition, we see 3 positives from the budget from a markets standpoint - Gradual and realistic fiscal consolidation path, improving quality of spending with targeted schemes around key focus areas (Key to drive consumption), and Push for social and digital infrastructure and India's climate change targets (Long Term driver for Capex in India).

Retail Inflation in India continued its moderation. CPI inflation stood at 5.72% in December compared to 5.88% in November 2022. The fall in headline inflation in December was led by food items, with food inflation tumbling to 4.19% - also the lowest in a year. Within food, vegetables prices fell the most, with the index down 12.7% in December compared to November. Core CPI remained sticky at 6.3%. Brent crude ended the month at US$86/barrel while the India crude basket followed suit and ended the month at US$82/barrel.

Valuations have dropped marginally but remain elevated from an overall standpoint. We note, select pockets of the markets especially the one's over-owned by retail and domestic funds have begun to show signs of froth. Further, the valuation premia offered to select companies where growth is lacking is increasingly unjust especially as base effects wean away super normal growth.

Our portfolios favour large caps where companies continue to deliver on growth metrics. Corporate earnings of our portfolio companies continue to give us confidence in the strength of our portfolio companies. From a risk perspective, in the current context, given rising uncertainties our attempt remains to minimize betas in our portfolios. The markets have kept 'quality' away from the limelight for over 18 months, making valuations of these companies relatively cheap both from a historical context and a relative market context.

While we remain cautious of external headwinds, strong discretionary demand evident from high frequency indicators and stable government policies give us confidence that our portfolios are likely to weather the ongoing challenges. Markets at all-time highs also point to a valuation risk in select pockets which we will look to avoid.

Budget 2023 was well received as it struck a much needed balance between the need for growth and fiscal consolidation. The government's agenda largely remains unchanged as it drives the investment push from the top and engages all levers to ensure that the Indian economy remains the fastest growing large economy on the planet. The sharp increase in capital expenditure could be seen as a ploy to complete and take credit for the vast investments in infrastructure done over the last 8 years rightfully so given that 2024 will be an election year.

In addition, we see 3 positives from the budget from a markets standpoint - Gradual and realistic fiscal consolidation path, improving quality of spending with targeted schemes around key focus areas (Key to drive consumption), and Push for social and digital infrastructure and India's climate change targets (Long Term driver for Capex in India).

Retail Inflation in India continued its moderation. CPI inflation stood at 5.72% in December compared to 5.88% in November 2022. The fall in headline inflation in December was led by food items, with food inflation tumbling to 4.19% - also the lowest in a year. Within food, vegetables prices fell the most, with the index down 12.7% in December compared to November. Core CPI remained sticky at 6.3%. Brent crude ended the month at US$86/barrel while the India crude basket followed suit and ended the month at US$82/barrel.

Valuations have dropped marginally but remain elevated from an overall standpoint. We note, select pockets of the markets especially the one's over-owned by retail and domestic funds have begun to show signs of froth. Further, the valuation premia offered to select companies where growth is lacking is increasingly unjust especially as base effects wean away super normal growth.

Our portfolios favour large caps where companies continue to deliver on growth metrics. Corporate earnings of our portfolio companies continue to give us confidence in the strength of our portfolio companies. From a risk perspective, in the current context, given rising uncertainties our attempt remains to minimize betas in our portfolios. The markets have kept 'quality' away from the limelight for over 18 months, making valuations of these companies relatively cheap both from a historical context and a relative market context.

While we remain cautious of external headwinds, strong discretionary demand evident from high frequency indicators and stable government policies give us confidence that our portfolios are likely to weather the ongoing challenges. Markets at all-time highs also point to a valuation risk in select pockets which we will look to avoid.

Source: Bloomberg, Axis MF Research.