•

Broadly interest rate cycle and

inflation cycle have peaked

both in India and globally.

• Investors should add duration

with every rise in yields.

•

Mix of 10-year duration and

2-4-year duration assets are

best strategies to invest in the

current macro environment.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals.

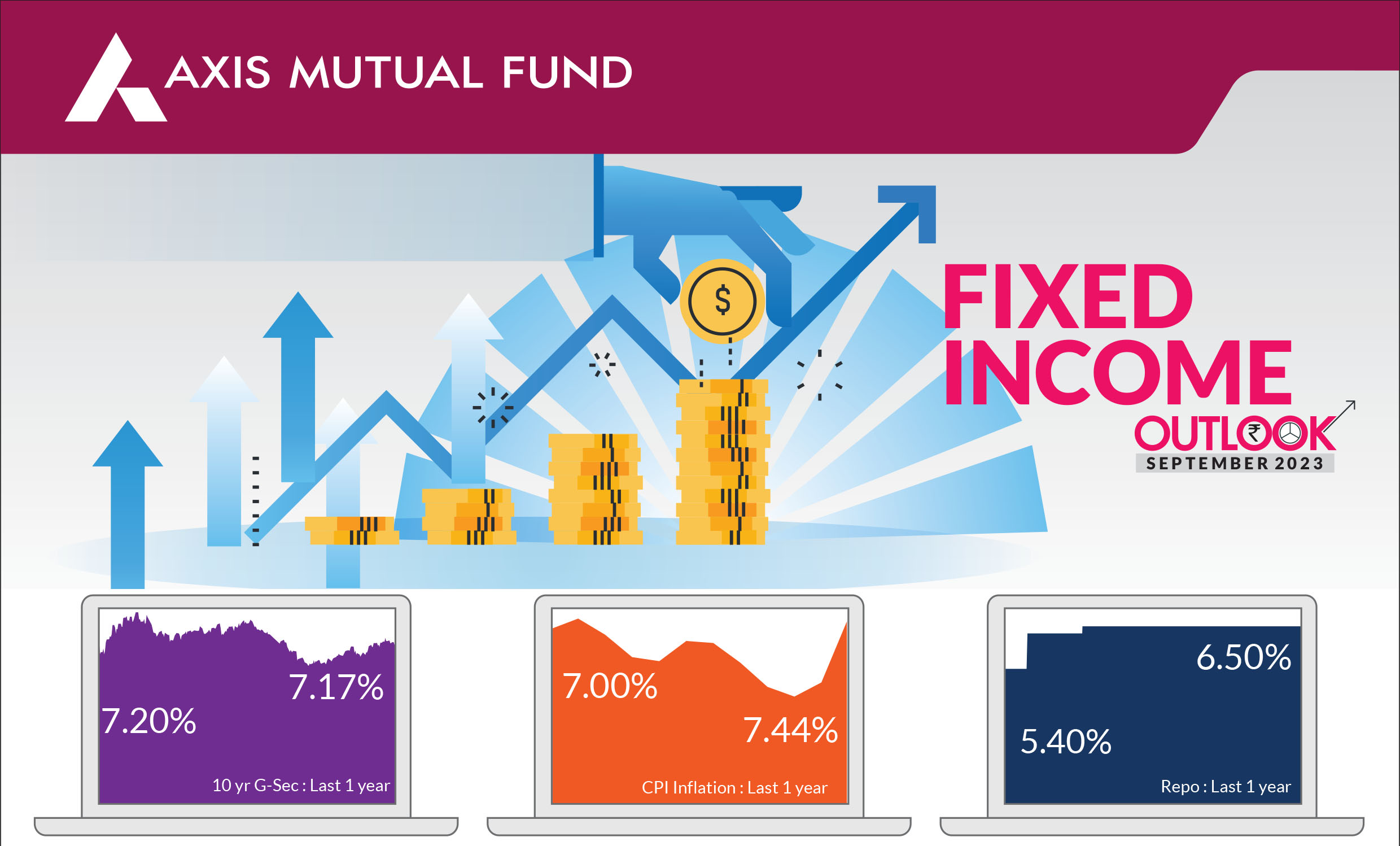

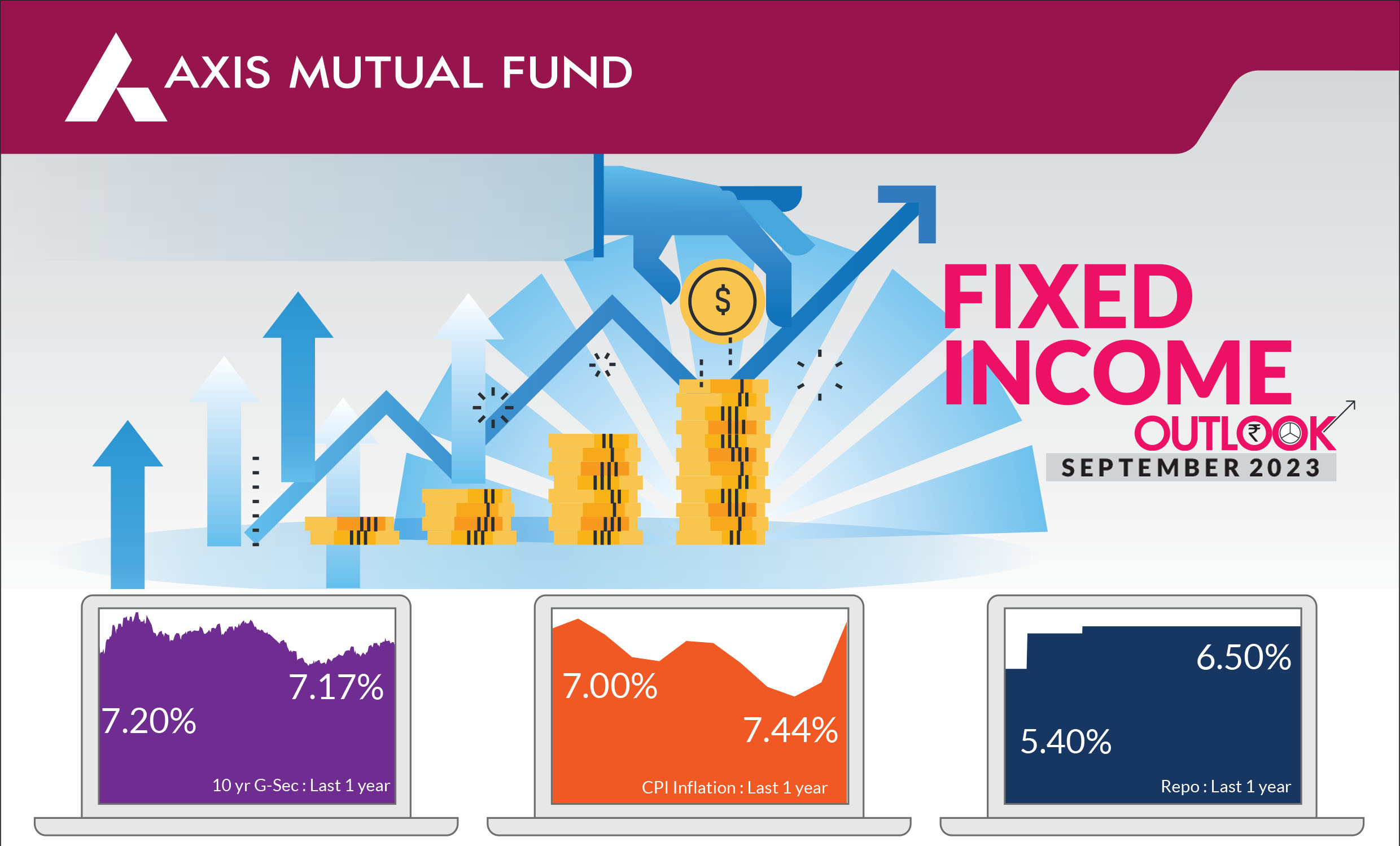

Indian government bond yields traded in a band of 7-8 bps through most of the month, but ended little changed at 7.17%. The key factors driving the bond markets were rising US Treasury yields, an increased issuance calendar in the US, and a combination of mixed data releases from US, which suggested that interest rates could remain at elevated levels for some time.

► US Treasury yields rise over the

month:

A slew of factors such as (a)

increased debt issuance from $733

billion to $1 trillion over the July-

September period, (b) a higher fiscal

deficit and (c) expectations of

elevated interest rates in light of a

relative stronger macroeconomic

scenario led to a surge in bond yields.

The 10-year Treasury saw yields rising to highs of 4.34% over the period before

cooling off to end at 4.11%. A significant event that did not have much of an impact

was the downgrade of long term debt from AAA to AA+. Incoming data has been

pointing to a softening scenario, however jobs data suggested an addition to jobs

but a high unemployment rate at the same time.

► Inflationary pressures may cool down:

Headline inflation surprised with a print of

7.44% vs a revised 4.9% in June due to a sharp rise in vegetable prices. Core

inflation, on the other hand, moderated to 5% in July from 5.2% in June. On a

positive note, food inflation is expected to subside with the arrival of fresh stock

and government measures to bring down tomato prices. The government banned

non-basmati rice exports and levied a 40% tax on onion exports to tame inflation.

In addition, the government lowered cooking gas prices by Rs 200 a cylinder which

will be favourable. The key risks are a second round impact of spike in food

inflation and deficient rains. El-Nino impact in August has led to a cumulative

rainfall deficiency at 8% below normal and almost 39-40% of India's districts have

received scarce rains.

► RBI reins in liquidity through temporary measures: The minutes of RBI's monetary policy meeting suggest that the central bank is not overly concerned about volatility in inflation but will be quick footed to address any second round impact on core inflation. Earlier in the month, in its monetary policy meeting, the Reserve Bank of India (RBI) maintained a hawkish pause on interest rates but brought in a surprise CRR action of 10% on incremental deposits made between May 19 and July 28, 2023 and committed to review the action on or before 8 September 2023. The excess liquidity gave way to an orchestrated deficit since the measure and yields witnessed a rise more over the shorter end of the yield curve. We expect the advance tax collections in this month and the festive season to further add to the deficit. The minutes of the RBI's monetary policy meeting reiterated focus on price stability, anchoring inflationary expectations and achieving the 4% target over the medium term.

► Higher growth momentum: India remained the fastest growing economy with GDP accelerating 7.8% in Q1FY24 vs 6.1% in Q4FY24 and just a tad below RBI's projection of 8%. Investment growth outpaced consumption and services sector maintained a strong momentum led by financial services while exports was a drag. Going forward, the growth momentum could likely weaken due to softer consumption, albeit. The festive season may lend some cheer. A sustained capex recovery, healthy corporate and bank balance sheets, and governments pend ahead of state /central elections could support growth.

► RBI reins in liquidity through temporary measures: The minutes of RBI's monetary policy meeting suggest that the central bank is not overly concerned about volatility in inflation but will be quick footed to address any second round impact on core inflation. Earlier in the month, in its monetary policy meeting, the Reserve Bank of India (RBI) maintained a hawkish pause on interest rates but brought in a surprise CRR action of 10% on incremental deposits made between May 19 and July 28, 2023 and committed to review the action on or before 8 September 2023. The excess liquidity gave way to an orchestrated deficit since the measure and yields witnessed a rise more over the shorter end of the yield curve. We expect the advance tax collections in this month and the festive season to further add to the deficit. The minutes of the RBI's monetary policy meeting reiterated focus on price stability, anchoring inflationary expectations and achieving the 4% target over the medium term.

► Higher growth momentum: India remained the fastest growing economy with GDP accelerating 7.8% in Q1FY24 vs 6.1% in Q4FY24 and just a tad below RBI's projection of 8%. Investment growth outpaced consumption and services sector maintained a strong momentum led by financial services while exports was a drag. Going forward, the growth momentum could likely weaken due to softer consumption, albeit. The festive season may lend some cheer. A sustained capex recovery, healthy corporate and bank balance sheets, and governments pend ahead of state /central elections could support growth.

Market view

As mentioned earlier, headline inflation is sharply above RBI's comfort zone. However, these levels seem transient and we believe that the RBI would be watchful but not as concerned. CPI should cool off soon and we can already see a drop in vegetable prices as a result of the measures taken by the government. Meanwhile, a truant monsoon could play spoilsport; August had a deficit after the surplus in July.The minutes of the Fed meeting indicate that the central bank could perhaps hike interest rates one last time. Major indicators are pointing to a softening bias and inflationary pressures too seem to be subdued. The increasing mortgage rates, higher bankruptcies and credit card defaults could fuel the slowdown. Right now, it's a wait and watch approach and we reiterate our earlier view that we do not see rate cuts before the first quarter of 2024.

China, meanwhile, has been struggling and a broad array of data shows intensifying pressure on the economy from all fronts. The rate cuts by China's central bank underline the loss of post covid economic rebound. At the same time aggressive monetary easing, when the developed economies still remain in a tightening mode could put pressure on the currency, lead to capital outflows, and other financial stability challenges. The positive here is the outlook on commodities which is expected to be tempered down.

Most part of the fixed income curve is pricing in no cuts for the next one year. We believe that we are at peak of interest rate cycles, globally as well as in India and probability of further hikes are limited. Policy actions and commentary are in line with our view. We retain our thesis of peak rates within the current market environment. With policy rates remaining incrementally stable, we have added duration gradually across our portfolios within the respective scheme mandates.

We do expect the 10-year bond yields to touch 6.75% by April - June 2024. Investors should use the uptick in yields to increase duration and should stick to short to medium term funds with tactical allocation to long / dynamic bond funds in this macro environment. One can expect yields to be lower by 25-40 bps in next 6-12 months across the curve. Investors can look at actively managed strategies to capitalize from fluctuations in rate movements. While the overall strategy is to play flat/falling interest rate cycle over the next 18-24 months, markets are likely to see sporadic rate movements. In such a scenario, active funds are ideally positioned to toggle across duration and the ratings curve to optimize medium term returns.

Source: Bloomberg, Axis MF Research.