Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

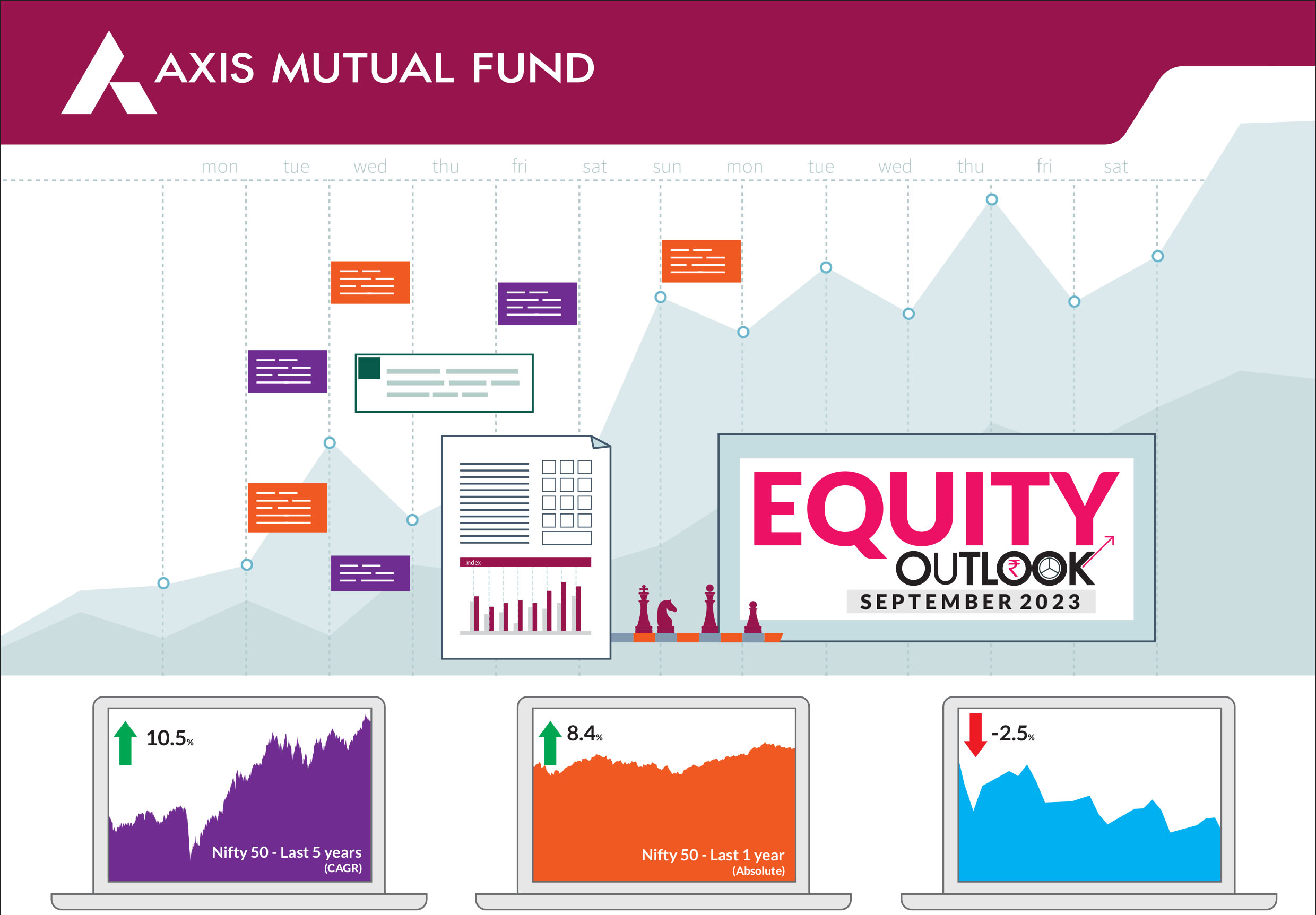

Following four months of consistent positive returns, Indian equities retreated on the back of relatively weak FPI flows and higher yields on US Treasuries. In addition, the downgrade of US credit rating from AAA to AA+ by Fitch, higher oil prices, slowing demand in China and a weak monsoon dampened investor sentiment. After hitting lifetime highs in July, benchmark indices witnessed profit booking and during the entire month, benchmark indices remained in a sideways to negative zone. Both S&P BSE Sensex & NIFTY 50 ended the month down 2.5% each. In contrast, NIFTY Midcap 100 & NIFTY Smallcap 100 continued to outperform their large-cap peers, up 3.7% and 4.6% respectively. Market breadth remained strong with the advance/decline ratio up over the month while volatility was up compared to the previous month. |

|

India maintained its tag of the fastest-growing economy with a GDP print of 7.8% v/s 6.1% in the previous quarter well supported by greater capital expenditure and the services sector. On the policy front, the RBI kept rates unchanged citing insipid monsoons and transitionary inflation in the second half of the year. Headline July inflation figures came in at 7.44% vs 4.9% in June 2023. Core inflation held steady, at 5% in July v/s 5.2% in June. The Q1FY24 results season ended on a strong note. Consumer demand was robust as represented by performance across the auto and financial sectors. The auto sector benefited from weaker raw material prices in addition to strong demand in the build-up to the festive season. Likewise, state-run banks and small banks showed impressive category-specific results. Earnings momentum was also supported by the hospitality and travel sector. IT, cement, chemicals, and metals faced headwinds due to weaker realizations, higher costs and global demand constraints. Going forward, the sharp outperformance of the mid and small-cap sectors and the rich valuations across sectors could cap gains. The gains in the last few months have rendered valuations expensive v/s regional peers. However, India's strong macroeconomic position, improving profitability and volumes in the consumption sectors, and the resilient growth narrative are likely to limit downside. The key drivers for markets in the next few months will be the festive season-led recovery and the state elections later this year. Over the last year, we have diversified our portfolios from concentrated holdings to a broader number which has led to a wider exposure across sectors. The rationale being that the market offers lot more opportunities more so in niche holdings. For instance, in the capital goods and power sectors, we prefer niche names than the traditional ones. This is where active stock selection comes into play. Given that markets have seen a strong run in the last few months, we suggest investors should maintain a diversified approach to investing wherein risks from one asset class are balanced by the other. Furthermore, large, mid and small caps all complement each other, and rather than viewing these sectors against each other, investors should maintain their exposure to all these and keep rebalancing over a period of time. |

Source: Bloomberg, Axis MF Research.