FAQs on Axis Nifty Next 50 Index Fund

The NIFTY Next 50 is an index provided and maintained by NSE Indices. It represents the next level of liquid securities after the NIFTY 50.

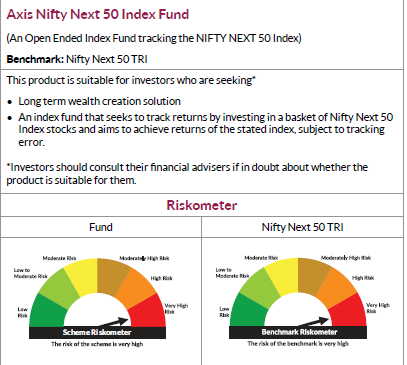

The Axis Nifty Next 50 Index fund is a fund that replicates the performance of the Nifty Next 50 index. The fund offers exposure to a diverse range of sectors and companies that are considered to have growth potential.

The fund is suitable for investors looking for long-term wealth creation. It is suitable for investors who are comfortable with taking significant risks. Also, the fund requires a long-term approach, so one has to stick with it for at least 5 years, as it’s subject to volatility.

The minimum investment required for the fund is a lumpsum investment of ₹100 and in multiples of Re. 1/- thereafter. The minimum investment for monthly SIP is ₹100 and in multiples of Re. 1/- thereafter.

One can invest in the Axis Nifty Next 50 Index Fund in various ways. One of the ways is through the Fund’s official website. Another is through online mutual fund platforms. These investments can be done through lump sum or SIPs.

The Axis Nifty Next 50 may be more volatile than the Nifty 50, which is more susceptible to market fluctuations.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.