FAQs on Axis Nifty 50 Index Fund

The Nifty 50 is a diversified index of 50 stocks across 13 sectors, used for benchmarking, derivatives, and index funds.

The Axis Nifty 50 Index Fund is a mutual fund that aims to replicate the performance of the Nifty 50 index. Nifty 50 index consists of the 50 largest and liquid stocks listed on the National Stock Exchange (NSE) of India. The fund seeks to offer investors returns that closely match the performance of the index, providing diversified exposure to major blue-chip companies in India.

Since its inception, the Nifty 50 index fund has performed quite similarly to the Nifty 50 index, which represents the performance of the top 50 large-cap stocks.

The minimum lump sum investment is ₹100.

Axis Nifty 50 Index Fund fits well into an investment portfolio as a tool for gaining broad exposure to the Indian equity market with minimal management fee. This is suitable for investors looking for diversified investment options.

Investment in Axis Nifty 50 Index Fund can be done through SIPs and lump sums, through the fund’s official website or Axis Mutual Fund App. Besides this, one can also consider investing in these funds through online mutual fund platforms, and financial advisors.

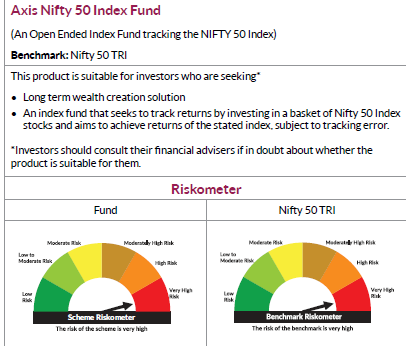

Investing in the Axis Nifty 50 Index fund carries multiple risks, including market risk, as the fund’s performance is directly tied to fluctuations of the Nifty 50 index. If the index declines, the fund’s value will also decrease.

Investing in the Axis Nifty 50 Index Fund offers several advantages.

1. It provides exposure to a diversified portfolio of 50 large-cap stocks across various sectors, which helps in spreading risk.

2. The fund aims to replicate the performance of the Nifty 50 Index subject to tracking error, ensuring that investors benefit from the growth of the top companies in India.

The Axis Nifty 50 Index Fund is suitable for investors who are looking for long-term capital appreciation and want to invest in a portfolio that mirrors the Nifty 50 Index. It is ideal for those who prefer a passive investment strategy and want to benefit from the performance of the top 50 companies in India without actively managing their investments

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.