FAQs on Axis Nasdaq 100 Fof

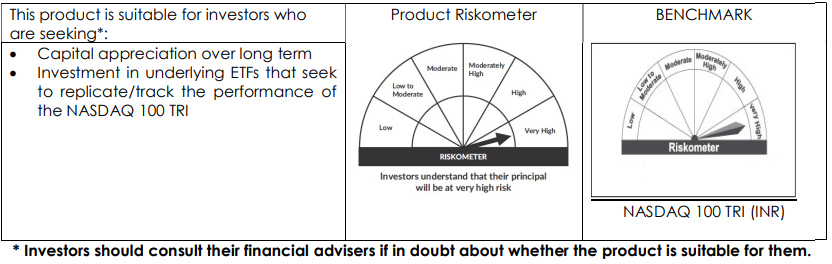

Axis NASDAQ 100 Fund of Fund is an open ended fund of fund scheme investing in units of ETFs focused on the Nasdaq 100 TRI. The fund aims to mimic movements and returns of NASDAQ, subject to tracking errors.

A fund of fund is a mutual fund scheme that invests in other funds.

The Nasdaq 100 is one of the world’s preeminent large-cap growth indexes. It includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. While technology is a dominant segment in the index, it is well-balanced by sectors such as consumer services, healthcare, consumer goods, and industrials amongst others.

The scheme follows NASDAQ 100 TRI (INR) as a benchmark.

Axis NASDAQ 100 Fund of Fund will invest in one or more in one or more ETFs mentioned below to achieve its investment objective:

• iShares NASDAQ 100 UCITS ETF

• Invesco EQQQ NASDAQ-100 UCITS ETF

• Xtrackers Nasdaq 100 UCITS ETF

The fund is suitable for investors seeking exposure to the international market and innovative companies to generate capital appreciation over the long term.

Investing in international markets enables access to opportunities not available in India. It also helps diversify portfolio risk due to lower correlation of Indian and US markets.

India’s geo-political situation and INR’s tendency to depreciate would have a positive impact on your returns. However, considering that the equity risk is far greater than the currency risk involved, investors should not base their investment only on the currency viewpoint.

The following people are eligible to apply to Axis NASDAQ 100 FoF for subscribing to the Scheme units:

• Resident individuals over 18, can singly or jointly (limited to three) or on anyone or survivor basis.

• Minor (as sole/first holder only) through a natural guardian (father or mother) or a legal guardian appointed by a court. There cannot be a joint holding with a minor investor.

• Non-Resident Indians (NRIs) / Persons of Indian origin (PIOs) / Overseas Citizen of India (OCI) residing abroad can invest on a repatriation basis or non-repatriation basis;

• Such other category of person(s) permitted to make investments and as may be specified by the AMC / Trustee from time to time.

• For further details, investors are requested to refer Scheme Information Document / Key Information Memorandum.

Transactions in this fund can be through:

• Axis MF Online

• Axis MF Mobile

• MF Utility

• Channel Distributors

• Other Electronic Mode

The minimum application amount is Rs. 500 and in multiples of Re. 1/- thereafter. The minimum additional purchase amount is Rs. 100 and in multiples of Re. 1/- thereafter. Minimum application amount is applicable only at the time of creation of new folio and at the time of first investment in a plan.

• If redeemed / switched-out within 7 Days from the date of allotment, exit load is 1%;

• If redeemed / switched-out after 7 days of allotment, exit load is Nil.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.