Axis Liquid Fund

Scheme Type: Debt

Investment Objective

Benefits of

Axis Liquid Fund invests primarily in money market instruments such as certificate of deposits (CoD), treasury bills, commercial papers etc.

One should look at Axis Liquid Fund to park one's idle money or very short term money.

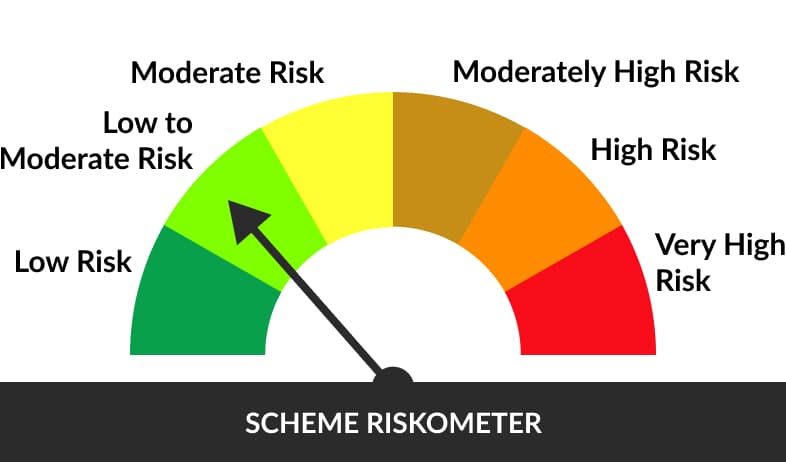

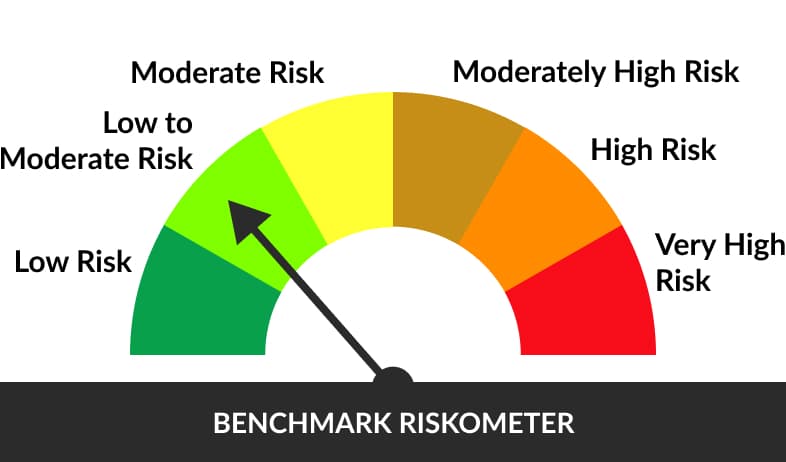

Highly liquid and low risk investment option for investors.

Insta redemption 24x7 - The insta redemption feature allows you to redeem your money instantly with a simple online request and the money is credited in the account in few minutes.

You can redeem up to 90% of current value of available units or maximum of Rs. 50,000 per day, whichever is lower.

Insta redemption facility is available 24X7 for resident Indian individual investors.

Fund Manager

Entry Load

Exit Load

Exit load as a % of redemption proceeds 0.007% 0.0065% 0.006% 0.0055% 0.005% 0.0045% Nil

- Regular income over short term.

- Investment in debt and money market instruments

- Lumpsum Investment :₹ 100

- Additional Investment :₹ 100

Goal Planning

Access all the goal features and benefits at No Cost.

Choose your goal

Issuers

IDCW

IDCW (₹ Per Unit) | NAV Per Unit |

| Record Date | Option | Individuals/HUF | Others | Cum IDCW | Ex IDCW |

| Dec 26, 2025 | Monthly Dividend | 4.810 | 4.810 | 1006.088 | 1001.278 |

| Nov 25, 2025 | Monthly Dividend | 4.583 | 4.583 | 1005.861 | 1001.278 |

| Oct 27, 2025 | Monthly Dividend | 5.244 | 5.244 | 1006.522 | 1001.278 |

Investment Packs

FAQs on Axis Liquid Fund

Axis Liquid Fund is an open ended liquid scheme whose investment objective is to provide a high level of liquidity with reasonable returns commensurating with low risk through a portfolio of money market and debt securities. However, there can be no assurance that the investment objective of the Scheme will be achieved.

Investing in a liquid fund is a good option for those who wish to park their money for a very short term. These funds are ideal for investors who wish to give their investment portfolio some liquidity. Some fund houses offer an instant redemption facility where the investor, upon redeeming his/her liquid fund units can receive the sum equivalent in their registered savings account within 24 hours. Hence, a lot of investors consider investing in liquid funds for building an emergency fund for life’s unforeseen exigencies.

Liquid funds work similarly to how most debt mutual funds work. We already know that debt funds have interest rate risk, credit risk, and liquidity risk. The investment objective of a liquid fund is to provide the investor with stable returns while maintaining a highly liquid portfolio. They invest in debt securities with high credit ratings. Debt securities have credit ratings based on that define their credibility and a liquid fund mostly invests in AAA and higher credit rated securities. They ensure that the average portfolio maturity is no longer than 91 days. This means that debt funds invest in debt instruments that have a very short maturity. They might be able to generate better capital appreciation than some conventional investment schemes.

Axis Liquid Fund invests primarily in money market instruments such as certificate of deposits (CoD), treasury bills, commercial papers, etc. One should look at Axis Liquid Fund to park one's idle money or very short term money. The fund offers a highly liquid and low risk investment option for investors. This fund has an ‘insta redemption’ feature that allows you to redeem your money instantly with a simple online request and the money is credited to the account in few minutes. Investors can redeem up to 90% of the current value of available units or a maximum of Rs. 50,000 per day, whichever is lower.

Axis Liquid Fund is a type of debt mutual fund that aims to offer high liquidity by investing in debt instruments while maintaining an average short portfolio maturity.