Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

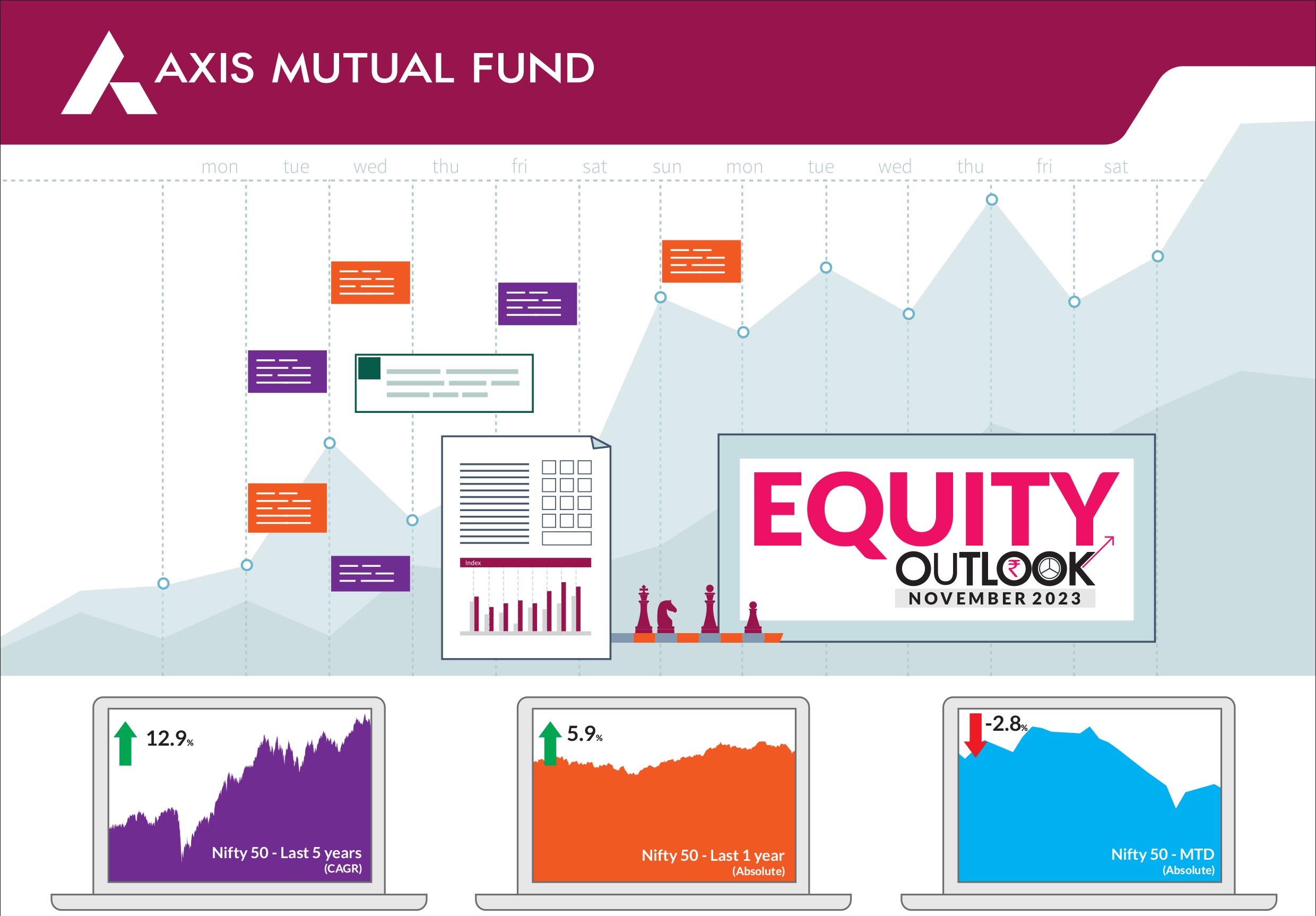

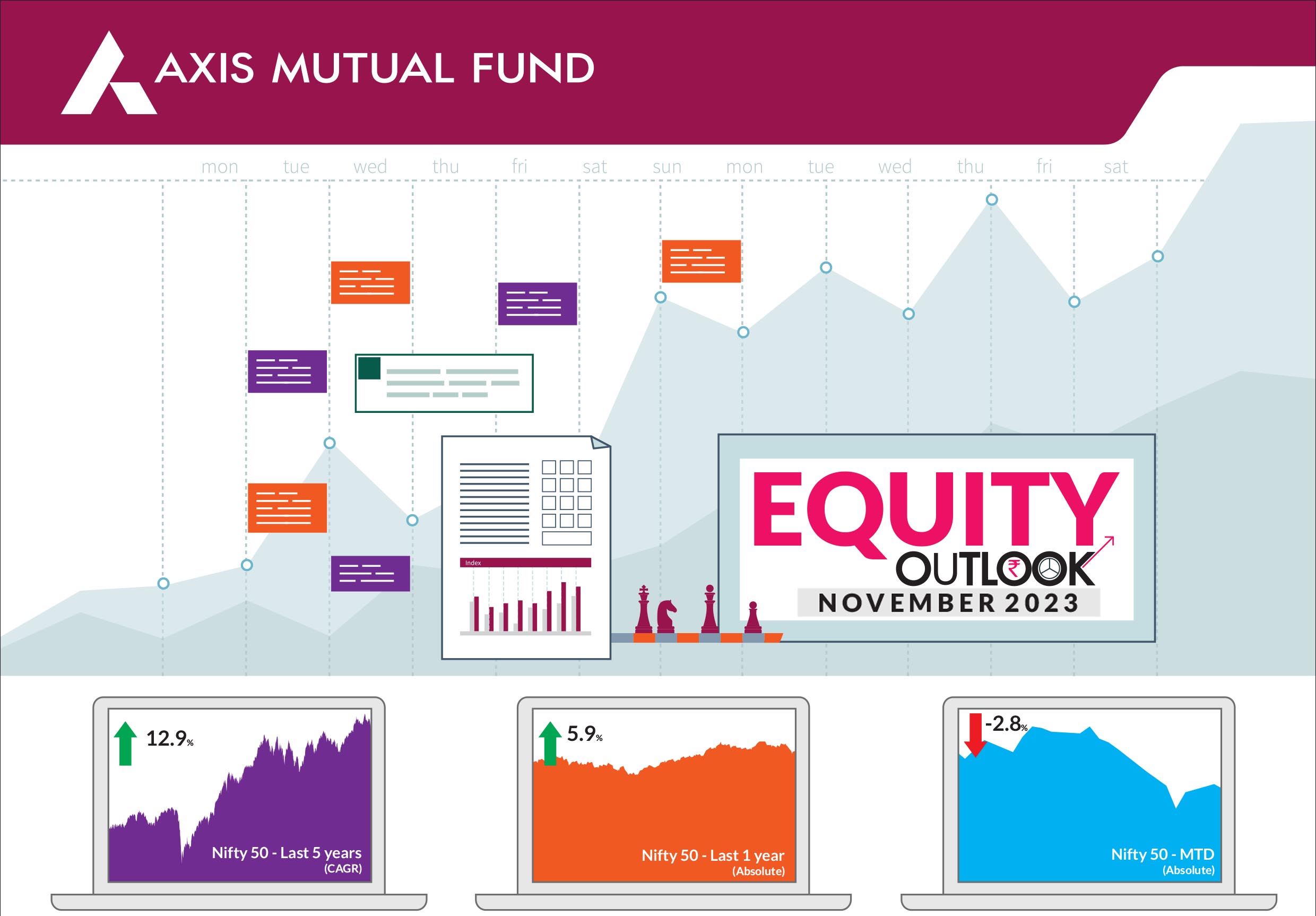

Globally two events dominated headlines through most of the month - rising US Treasury yields and the geopolitical conflict between Israel and Hamas. These led equities across the globe and in India to buckle under pressure as investors shifted to less riskier assets. The S&P BSE Sensex fell 3% while the NIFTY 50 ended 2.8% down. NIFTY Midcap 100 & NIFTY Smallcap 100 too declined by 4.1% and 0.8% respectively. For the first time in many months, the large caps outperformed midcaps but underperformed smallcaps. Market breadth weakened with the advance/decline ratio down in October while volatility was higher compared to the previous month. |

|

Headline inflation dropped to 5.02% due to lower vegetable prices. After double digit gains in September, crude oil process moderated ~8% despite the Israel-Hamas conflict. Markets globally have been cautious about the conflict given its potential to spread wide and far and any escalation of war could lead to attacks on oil tankers. Incoming macroeconomic data pointed to strength in the economy - GST collections, automobile sales, while industrial production and PMI indicators also showed strength. Markets have been witnessing bouts of consolidation and this will likely continue in the near term. Investors should be mindful of the volatility seen in the mid and small caps. This segment has more representation of B2B companies having exposure to investment and exports part of economy. Underperformance of consumption compared to investments and exports has helped the rally in mid-small cap so far. With expectations of a global slowdown, this could be impacted, although investment part of economy could continue to do well. We have always suggested to our investors to stay invested in the markets and use the bouts of volatility as opportunities to increase exposure to the markets. Patience is the biggest reward to long-term investors. Five states witness elections in November with the outcome in early December and this could provide fresh triggers to the market. Overall, India's growth story remains one of resilience compared to its regional peers and this will limit the downside despite a cyclical slowdown. Demand growth for cement and construction materials has been the highest in many years. With corporate balance sheets deleveraging, and a large part of operating cash flows in the last few years used to bring down debt; the debt-to-equity and debt-to-EBITDA ratios for major corporates are both near cyclical lows. Leverage among the lenders has also come down, partly due to fund-raising and partly due to several years of low credit growth, where surpluses have accumulated on balance sheets. These should offset the several headwinds faced by the economy. Even if the central bank keeps the repo rate unchanged going forward, financial conditions can continue to tighten as older loans roll over. The global economic slowdown has already brought down growth in goods and services; a likely US recession next year can intensify pressure in some of the export-driven sectors. |

Source: Bloomberg, Axis MF Research.