► Equity market valuations are broadly reasonable adjusted for the cyclical low in earnings and

potential for revival going forward.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Broadly interest rate cycles have peaked both in India and globally.

► Investors should add duration with every rise in yields.

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Investors should add duration with every rise in yields.

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

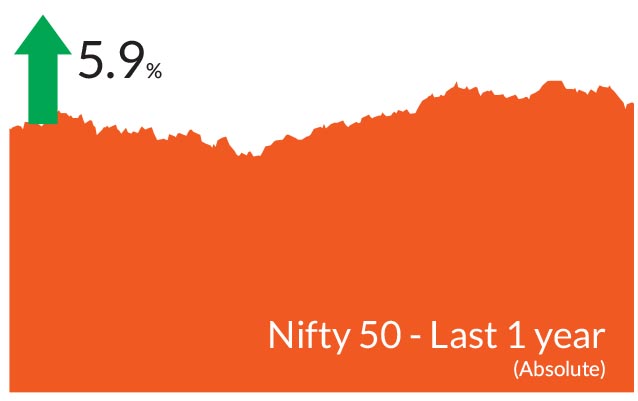

Globally two events dominated headlines through most of the month -

rising US Treasury yields and the geopolitical conflict between Israel

and Hamas. These led equities across the globe and in India to buckle

under pressure as investors shifted to less riskier assets. The S&P BSE

Sensex fell 3% while the NIFTY 50 ended 2.8% down. NIFTY Midcap

100 & NIFTY Smallcap 100 too declined by 4.1% and 0.8% respectively.

For the first time in many months, the large caps outperformed midcaps

but underperformed smallcaps. Market breadth weakened with the

advance/decline ratio down in October while volatility was higher

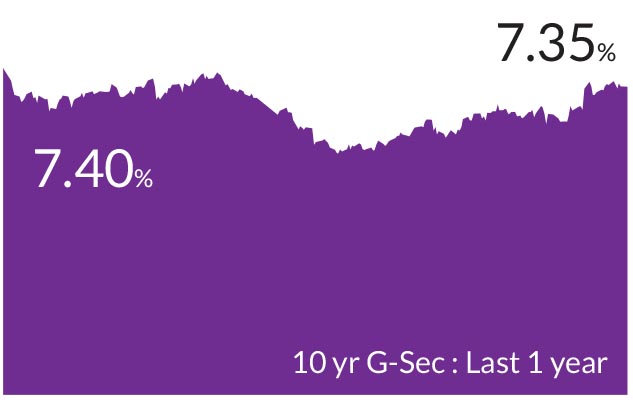

compared to the previous month. Indian government bond yields rose

higher over the month, trading in a wider band of 7.23-7.40%.

► Inflationary pressures dissipate while oil prices also fall: Headline inflation further moderated to 5.02% as against 6.8% seen in August following a broad based decline in vegetable prices. Core inflation, too retreated to 4.6% vs 4.8% in August. While inflation is within the central bank's band of 2-6%, the governor has emphasized that they are targeting the 4% midpoint thereby signaling no change to their stance on the monetary policy. However, the below average monsoon could keep prices elevated, particularly for cereals and pulses. Surprisingly, crude oil prices fell to below $90 even amid increasing fears of the conflict in West Asia intensifying further.

► Central banks remain on a pause: Central banks of the large developed economies are now on a pause mode. This includes the key ones, the US, Europe and the UK. "Higher for longer" theme prevails across economies. The focus has moved from how high interest rates can go up to how long will interest rates stay elevated. The RBI in its monetary policy meeting in early October held interest rates unchanged but surprised the markets with unexpected Open Market Operations (OMOs). The minutes of the meeting released later in the month outline the MPC's unanimous views on the transient spike in headline inflation, along with moderating core inflation, keeping policy rates steady and anchoring of inflationary expectations. On the growth front, all members were concurrent on the resilient trend in growth, driven by broad-based strength in domestic demand, notwithstanding weak global growth and uncertain macro environment.

Key Market Events

► US Treasury yields rise over the month, growth defies slowdown fears: The yields on the 10-year US Treasury briefly touched 5% before falling to 4.85-4.95% levels. Fiscal deficit in the US rose to ~$1.7 trn for the year ended September 2023 and this could likely keep yields elevated. The US economy resisted fears of an impending slowdown and posted stronger than expected growth. The country's GDP expanded 4.5% in Q3FY24 vs 2.1% in the previous quarter due to a tight jobs market and higher consumer spending. In a widely expected move, the Fed held the federal funds rate unchanged for the second consecutive month in a target range between 5.25%-5.5%. The Fed chairman Jerome Powell said that the process of bringing down inflation to 2% has a long way to go and they will remain data dependent. . However, we believe tighter financial conditions and higher treasury yields have resulted into an indirect rate hike.► Inflationary pressures dissipate while oil prices also fall: Headline inflation further moderated to 5.02% as against 6.8% seen in August following a broad based decline in vegetable prices. Core inflation, too retreated to 4.6% vs 4.8% in August. While inflation is within the central bank's band of 2-6%, the governor has emphasized that they are targeting the 4% midpoint thereby signaling no change to their stance on the monetary policy. However, the below average monsoon could keep prices elevated, particularly for cereals and pulses. Surprisingly, crude oil prices fell to below $90 even amid increasing fears of the conflict in West Asia intensifying further.

► Central banks remain on a pause: Central banks of the large developed economies are now on a pause mode. This includes the key ones, the US, Europe and the UK. "Higher for longer" theme prevails across economies. The focus has moved from how high interest rates can go up to how long will interest rates stay elevated. The RBI in its monetary policy meeting in early October held interest rates unchanged but surprised the markets with unexpected Open Market Operations (OMOs). The minutes of the meeting released later in the month outline the MPC's unanimous views on the transient spike in headline inflation, along with moderating core inflation, keeping policy rates steady and anchoring of inflationary expectations. On the growth front, all members were concurrent on the resilient trend in growth, driven by broad-based strength in domestic demand, notwithstanding weak global growth and uncertain macro environment.

Market View

Equity MarketsThe ongoing earnings season has been in line with market expectations; however, few bellwether companies in the IT segment did disappoint. Many banks and financial companies reported margin pressure due to lagged impact of repricing of the deposit book. Of the hits and misses, most beats were concentrated in Utilities, NBFC, Energy and Autos, while misses were Consumer Durables. Discretionary consumption volume growth across sectors remains low, pinning hopes on the festive season. B2B sectors/segments of companies reported strong volume growth due to higher government capex and lower commodity prices on annual basis, while volume growth in the exports segment took a hit.

We have always suggested to our investors to stay invested in the markets and use the bouts of volatility as opportunities to increase exposure to the markets. Patience is the biggest reward to long-term investors. Five states witness elections in November with the outcome in early December and this could provide fresh triggers to the market. Overall, India's growth story remains one of resilience compared to its regional peers and this will limit the downside despite a cyclical slowdown.

Demand growth for cement and construction materials has been the highest in many years. With corporate balance sheets deleveraging, and a large part of operating cash flows in the last few years used to bring down debt; the debt-to-equity and debt-to-EBITDA ratios for major corporates are both near cyclical lows. Leverage among the lenders has also come down, partly due to fund-raising and partly due to several years of low credit growth, where surpluses have accumulated on balance sheets. These should offset the several headwinds faced by the economy. Even if the central bank keeps the repo rate unchanged going forward, financial conditions can continue to tighten as older loans roll over. The global economic slowdown has already brought down growth in goods and services; a likely US recession next year can intensify pressure in some of the export-driven sectors.

Debt Markets

US Treasury yields briefly breached the 5% mark before retreating to 4.93% at end of October and 4.75% post the policy announcement. We expect the yields to trade in a higher range. Concurrent to our view, the Fed held interest rates unchanged and we believe that the top has already been reached. The US economy did exhibit strong growth contrary to market expectations, and the macro data also has been robust - a strong payrolls report, and rising retail sales. However, we still hold our view that growth has probably peaked and slowdown could become more apparent in the coming quarters. Our view is based on two reasons - slowdown in China that will have repercussions globally and "higher for longer rates" in the developed economies. Central banks will remain on hold until inflation sustains at lower levels and based on the strength of the economy. The struggle in US is becoming increasingly apparent through rising credit card defaults, higher number of corporate bankruptcy filings and the higher fiscal deficit. Likewise, the central banks too have reached a peak of their rate cycle and we expect growth to be subdued in these economies as well. Policy makers in China are trying to boost the economy with modest support for the property sector, infrastructure spending and consumption. However we believe these would have a limited impact in turning around the economy.

In India, headline inflation declined and is within RBI's comfort zone. While the central bank expects it to fall further, the effects of imported inflation (crude oil prices) and a deficit monsoon could set the momentum. Briefly, we could again see rising vegetable prices resulting into higher price pressures but we do not expect these to be a grave concern. We believe that the RBI will remain on a pause mode till the first half of 2024 and will make use of liquidity management tools to navigate any uncertainties emanating globally. The likely inclusion of government bonds in Bloomberg indices could further boost inflows. Most part of the fixed income curve is pricing in no cuts for the next one year. We reiterate that interest rates have peaked globally and in India. With policy rates remaining incrementally stable, we have added duration gradually across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to touch 6.75% by April - June 2024.

From a strategy perspective, we have added duration across portfolios within the respective investment mandates. We expect our duration call to add value in the medium term. Investors could use this opportunity to top up on duration products with a structural allocation to short and medium duration funds and a tactical play on GILT funds.

Source: Bloomberg, Axis MF Research.