Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|

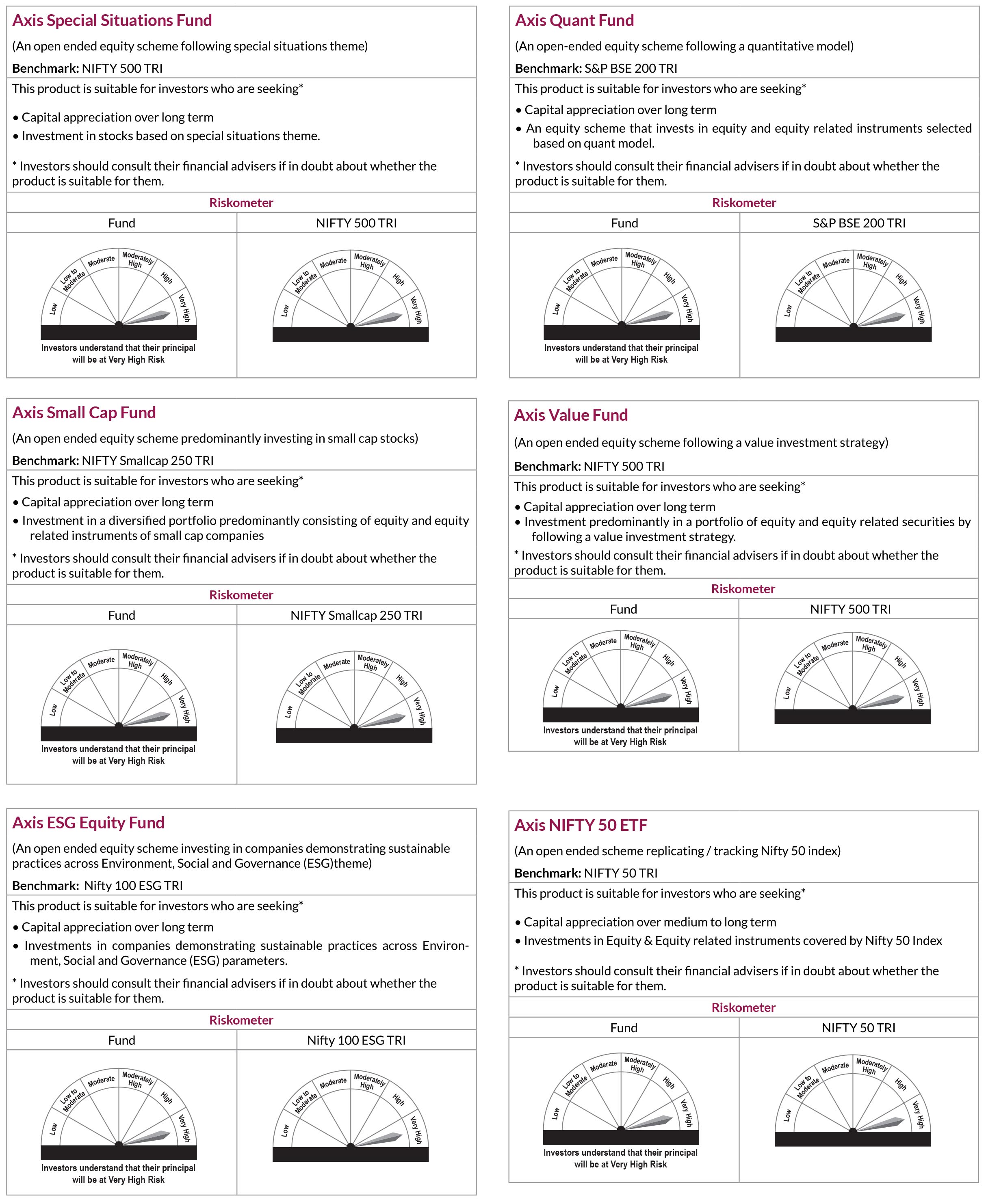

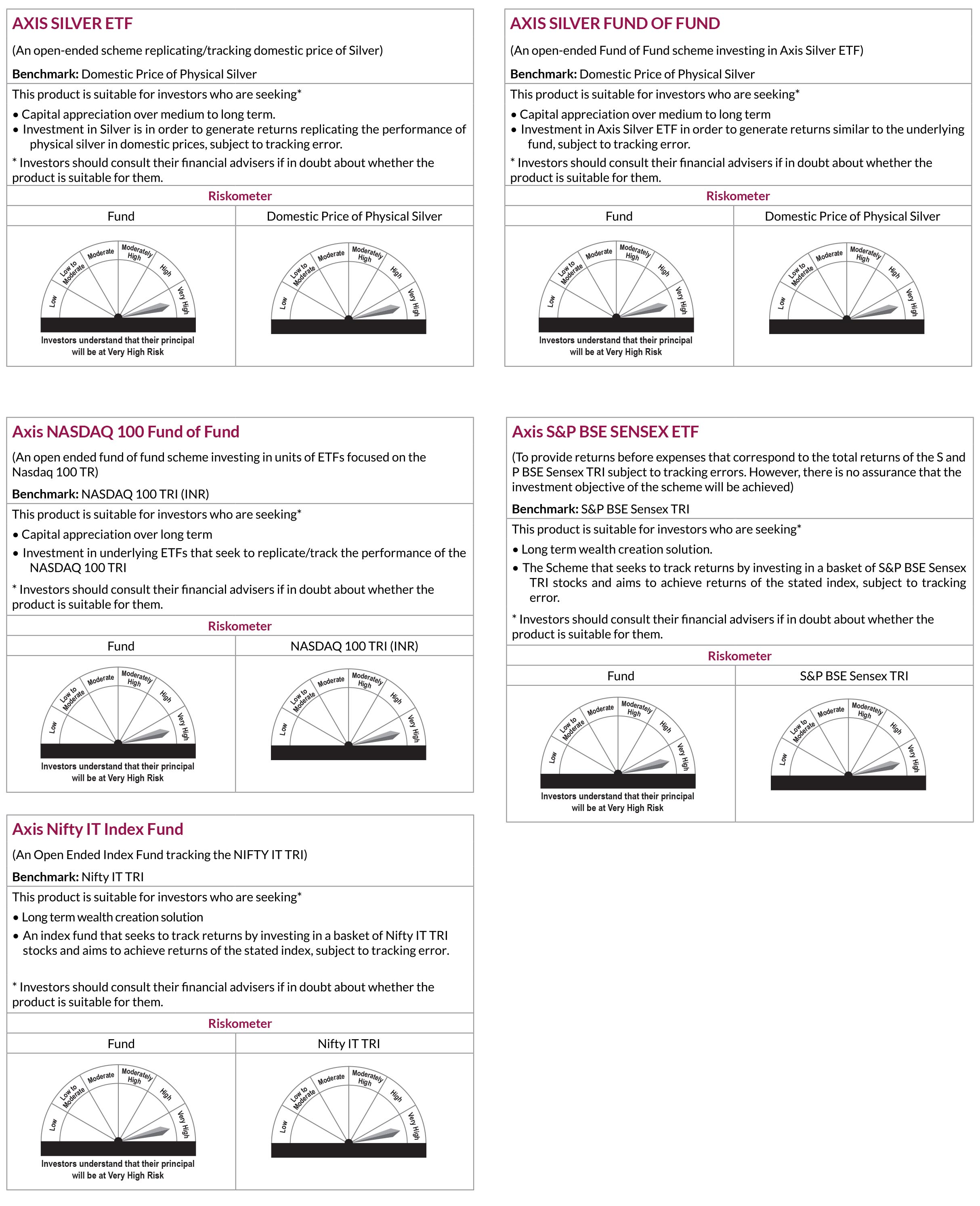

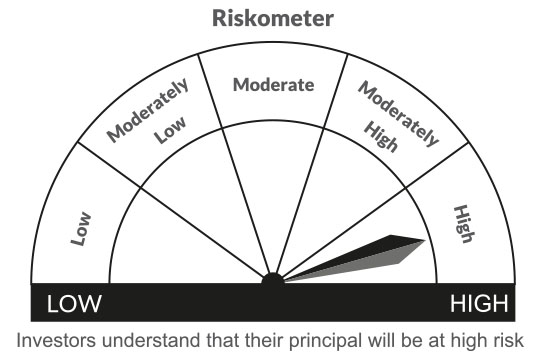

| AXIS ESG EQUITY FUND (An open-ended equity scheme investing in companies demonstrating sustainable practices across Environment, Social and Governance (ESG)

theme) This product is suitable for investors who are seeking* • Capital appreciation over long term • Investments in companies demonstrating sustainable practices across Environment, Social and Governance (ESG) parameters. |

|

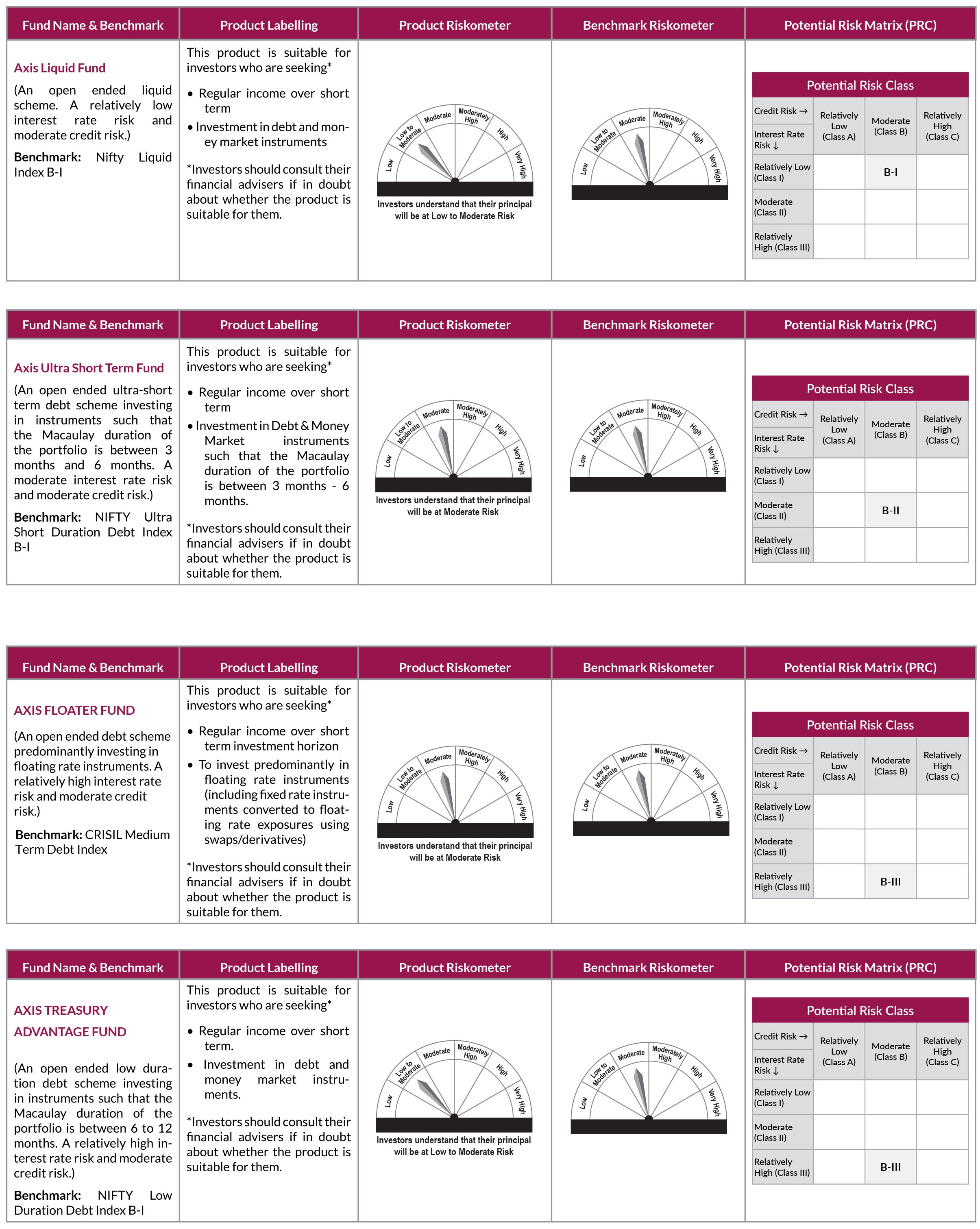

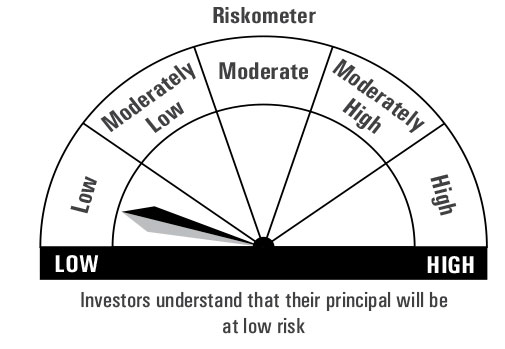

| AXIS LIQUID FUND (An open ended liquid scheme) This product is suitable for investors who are seeking* • Regular income over short term • Investment in debt and money market instruments |

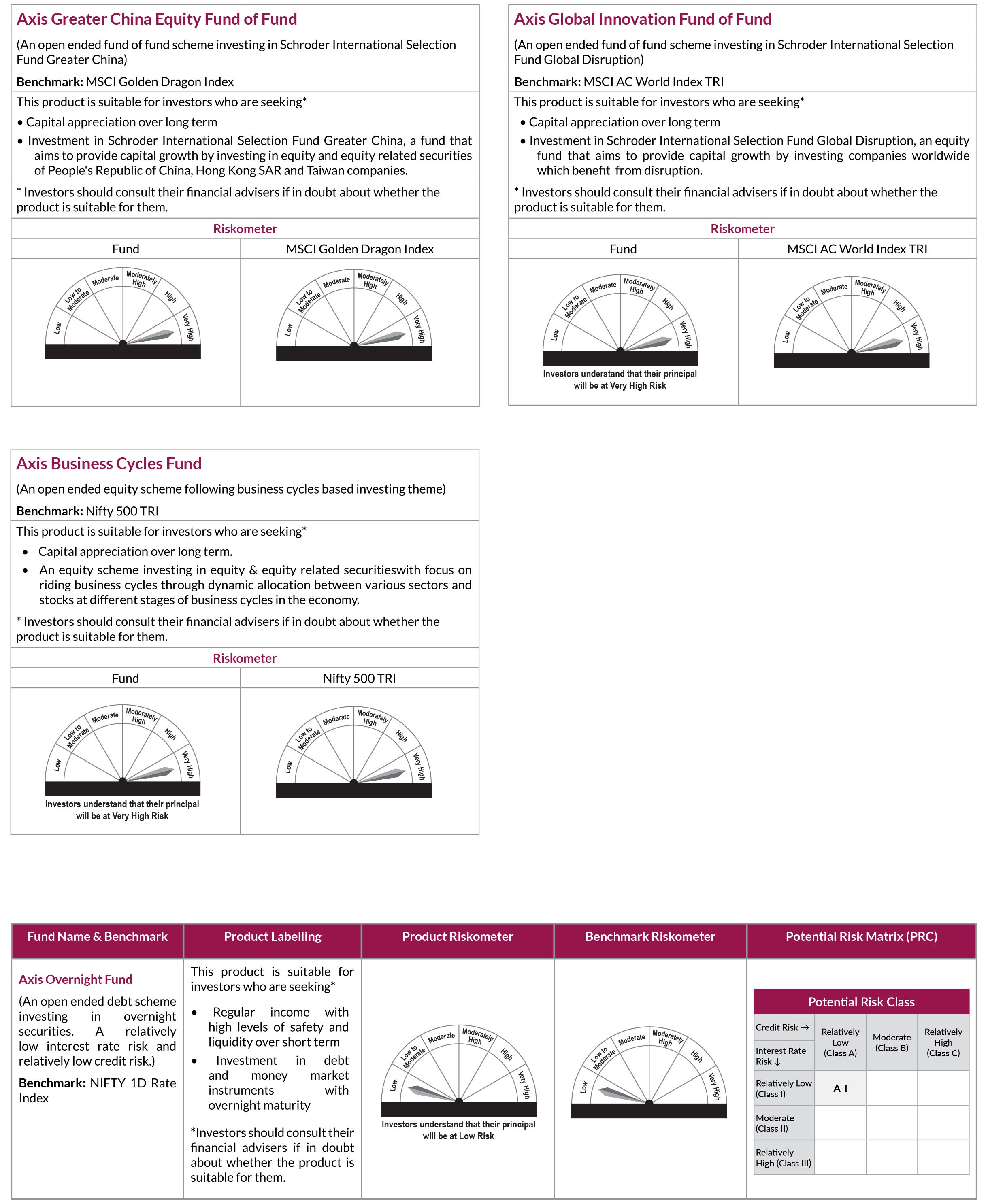

| AXIS OVERNIGHT FUND (An open-ended debt scheme investing in overnight securities) This product is suitable for investors who are seeking* • Regular income with high levels of safety and liquidity over short term. • Investment in debt and money market instruments with overnight maturity |

|

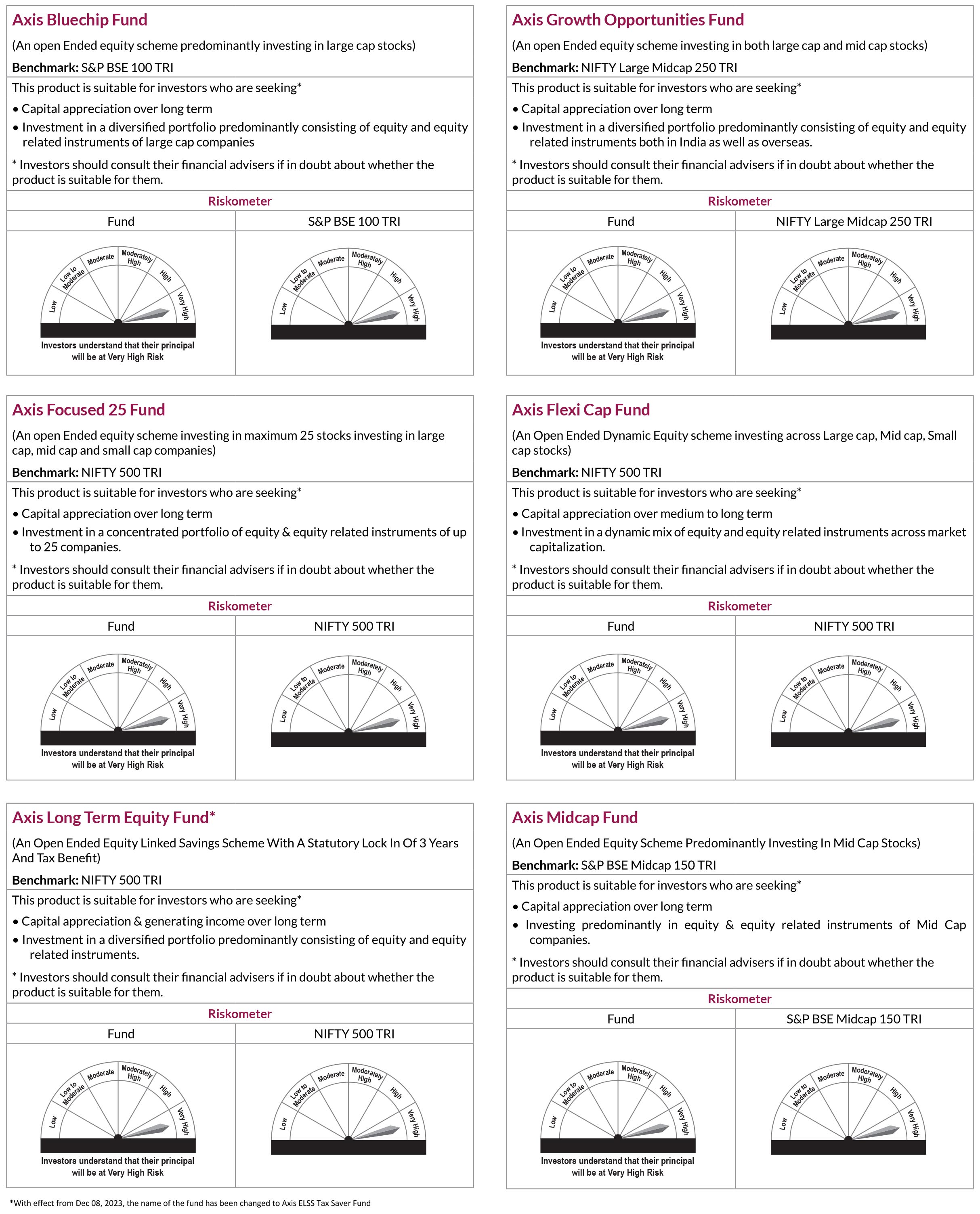

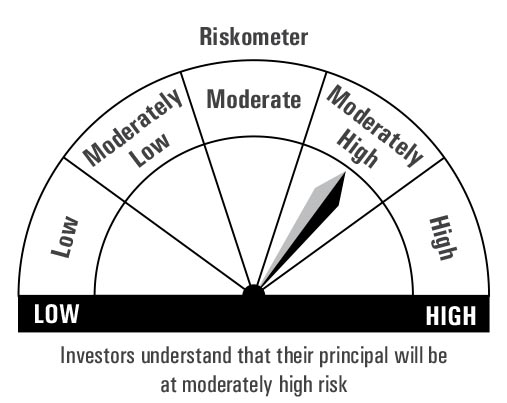

| AXIS BLUECHIP FUND (An open ended equity scheme predominantly investing in large cap stocks) This product is suitable for investors who are seeking* • Capital appreciation over long term • Investment in a diversified portfolio predominantly consisting of equity and equity related instruments of large cap companies |

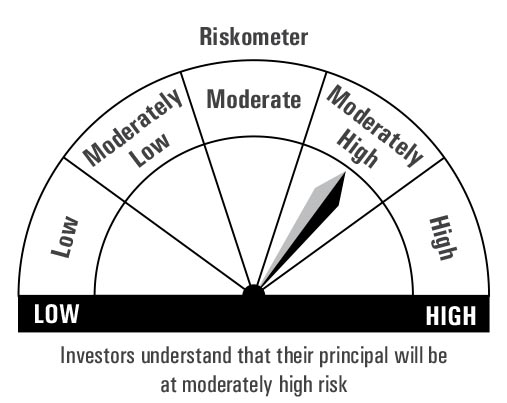

| AXIS FOCUSED 25 FUND (An open ended equity scheme investing in maximum 25 stocks investing in large cap, mid cap and small cap companies.) This product is suitable for investors who are seeking* • Capital appreciation over long term • Investment in a concentrated portfolio of equity & equity related instruments of up to 25 companies |

| AXIS LONG TERM EQUITY FUND (An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit) This product is suitable for investors who are seeking* • Capital appreciation & generating income over long term • Investment in a diversified portfolio predominantly consisting of equity and equity related instruments |

| AXIS MIDCAP FUND (An open ended equity scheme predominantly investing in Mid Cap stocks) This product is suitable for investors who are seeking* • Capital appreciation over long term • Investing predominantly in equity & equity related instruments of Mid Cap companies. |

| AXIS MULTICAP FUND (An open ended equity scheme investing across large cap, mid cap, small cap stocks) This product is suitable for investors who are seeking* • Capital appreciation over medium to long term • Investment in a diversified portfolio consisting of equity and equity related instruments across market capitalization. |

| AXIS TRIPLE ADVANTAGE FUND (An open ended scheme investing in equity, debt and gold) This product is suitable for investors who are seeking* • Capital appreciation & generating income over long term • Investment in a diversified portfolio of equity and equity related instruments, fixed income instruments & gold exchange traded funds |

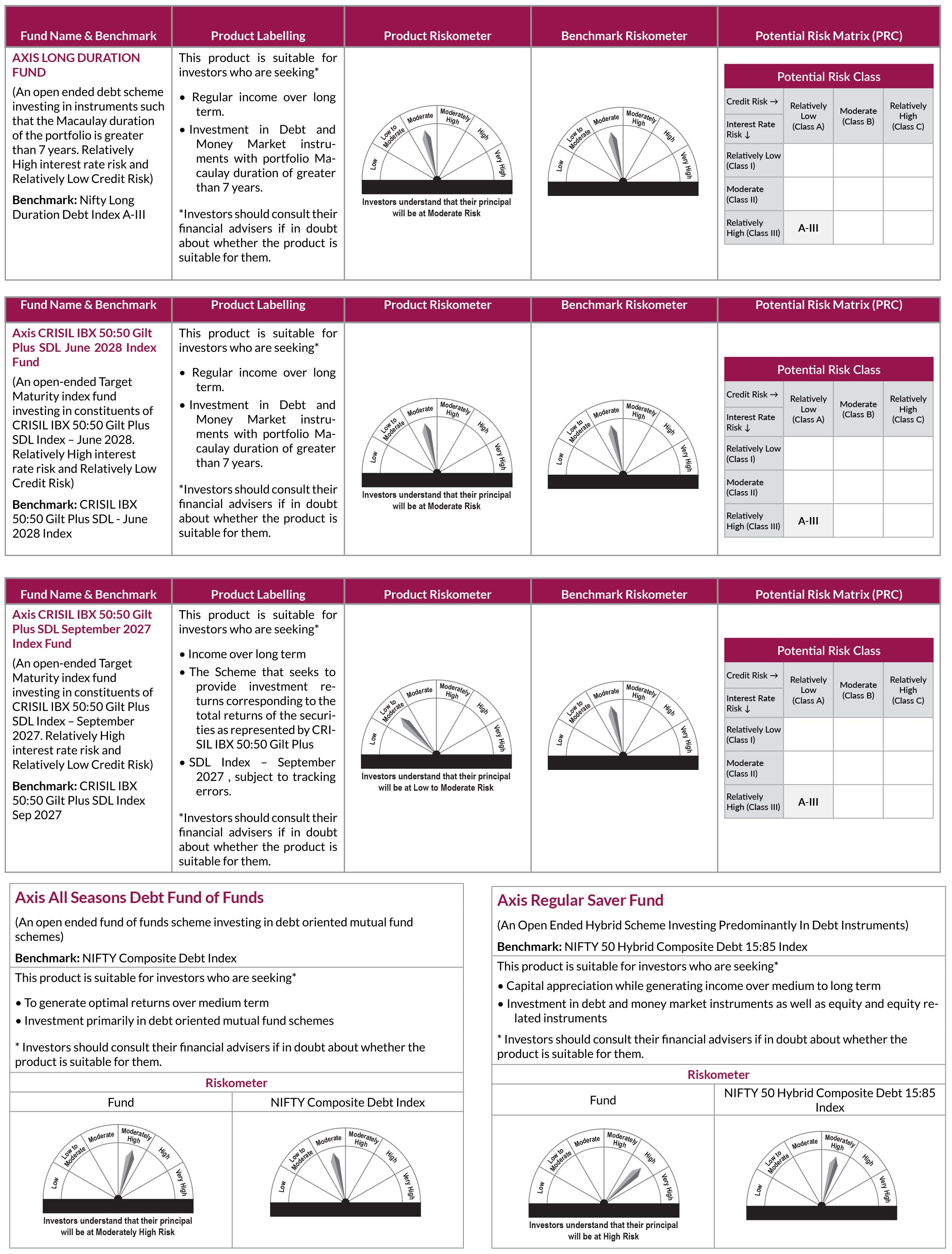

| AXIS REGULAR SAVER FUND (An open ended hybrid scheme investing predominantly in debt instruments) This product is suitable for investors who are seeking* • Capital appreciation while generating income over medium to long term • Investment in debt and money market instruments as well as equity and equity related instruments |

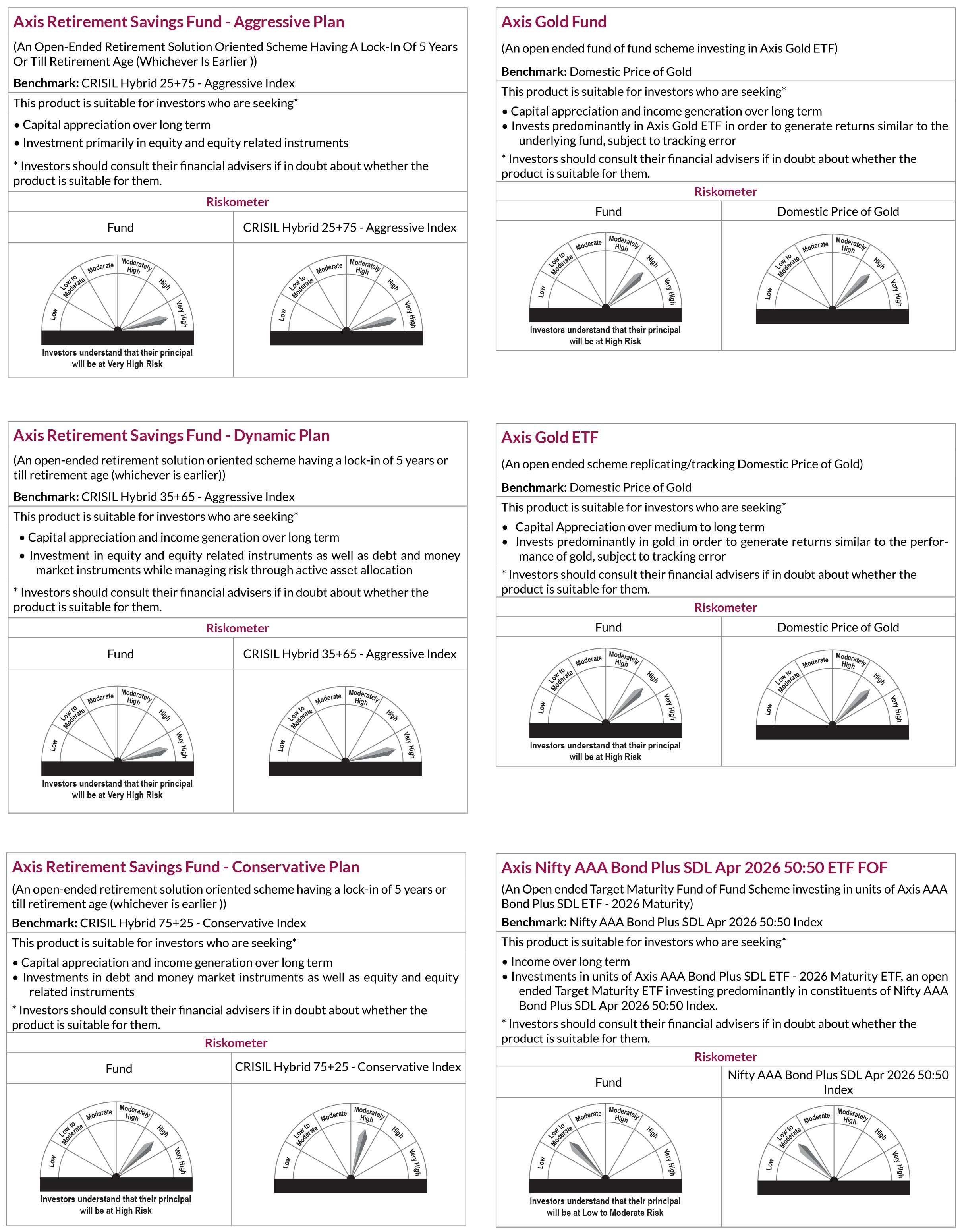

| AXIS GOLD ETF (An open ended scheme replicating/tracking Domestic Price of Gold) This product is suitable for investors who are seeking* • Capital Appreciation over medium to long term • Invests predominantly in gold in order to generate returns similar to the performance of gold, subject to tracking error |

| AXIS GOLD FUND (An open ended fund of fund scheme investing in Axis Gold ETF) This product is suitable for investors who are seeking* • Capital Appreciation over medium to long term • Invests predominantly in Axis Gold ETF in order to generate returns similar to the underlying fund, subject to tracking error |

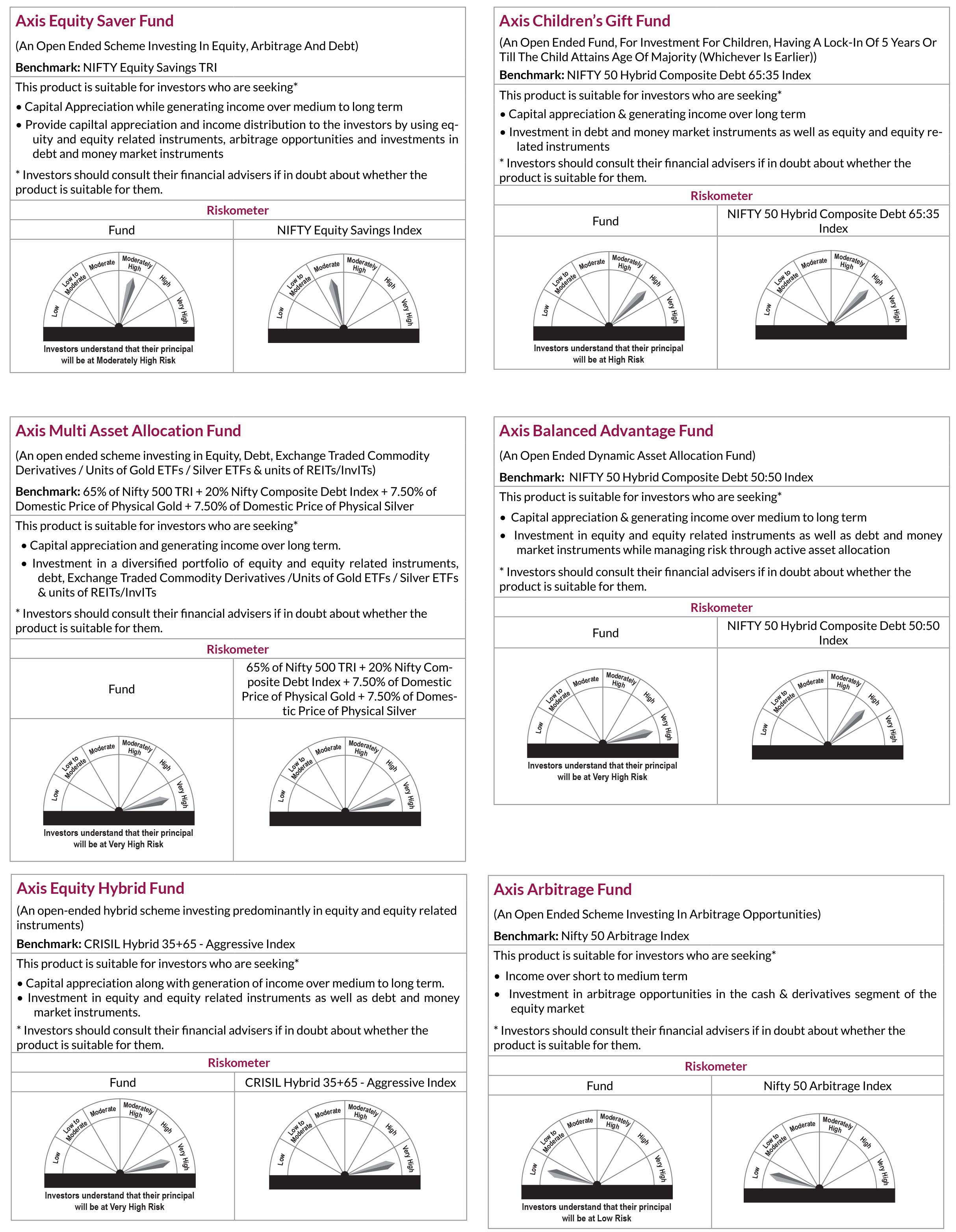

| AXIS EQUITY SAVER FUND (An Open Ended Scheme Investing In Equity, Arbitrage And Debt) This product is suitable for investors who are seeking* • Capital Appreciation while generating income over medium to long term • Provide capiltal appreciation and income distribution to the investors by using equity and equity related instruments, arbitrage opportunities and investments in debt and money market instruments |

| AXIS CHILDREN'S GIFT FUND (An open ended fund for investment for children, having a lock-in of 5 years or till the child attains age of

majority (whichever is earlier)) This product is suitable for investors who are seeking* • Capital appreciation & generating income over long term • Investment in debt and money market instruments as well as equity and equity related instruments |

| AXIS DYNAMIC EQUITY FUND (An open ended dynamic assetallocation fund) This product is suitable for investors who are seeking* • Capital appreciation & generating income over medium to long term • Investment in equity and equity related instruments as well as debt and money market instruments while managing risk through active asset allocation |

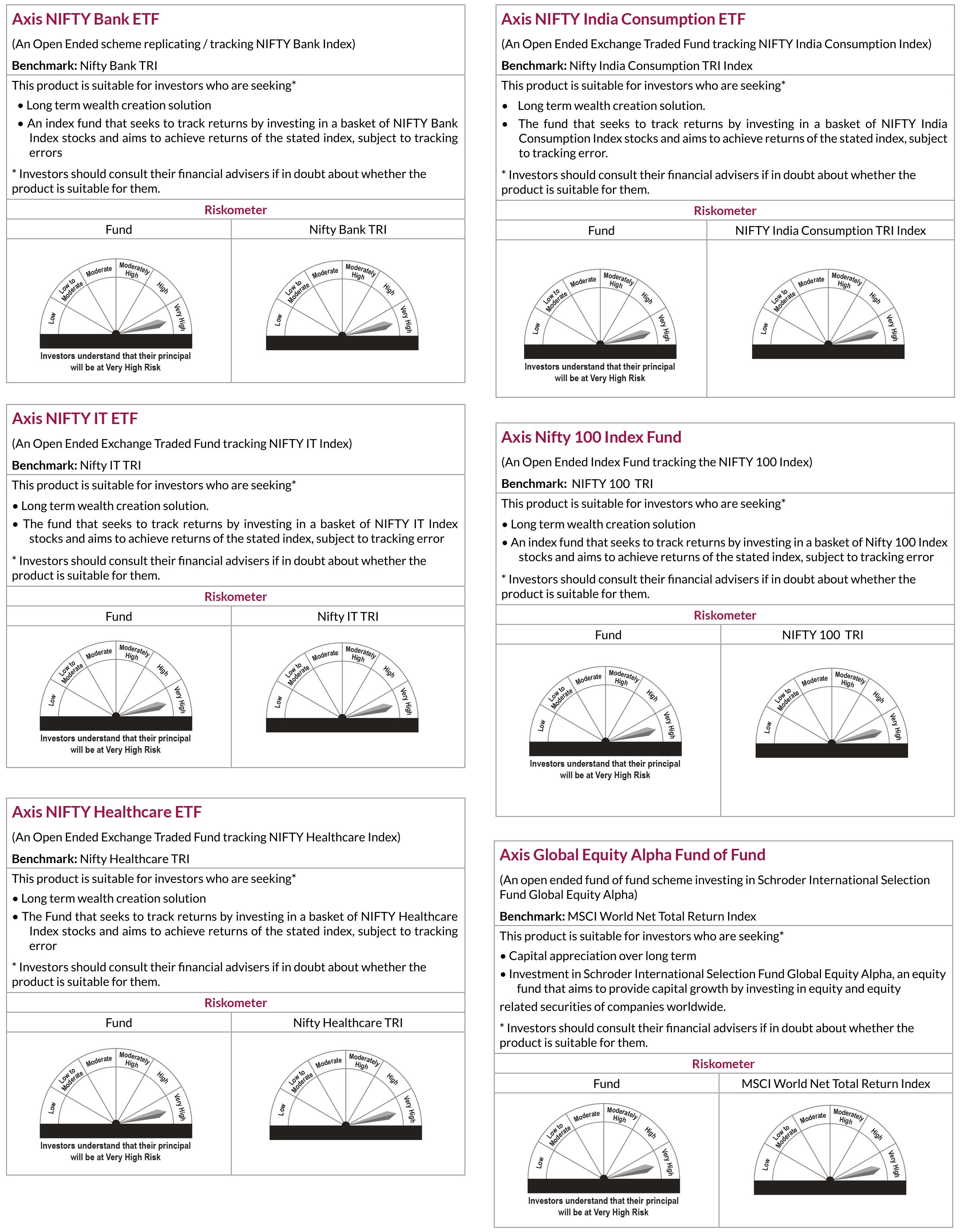

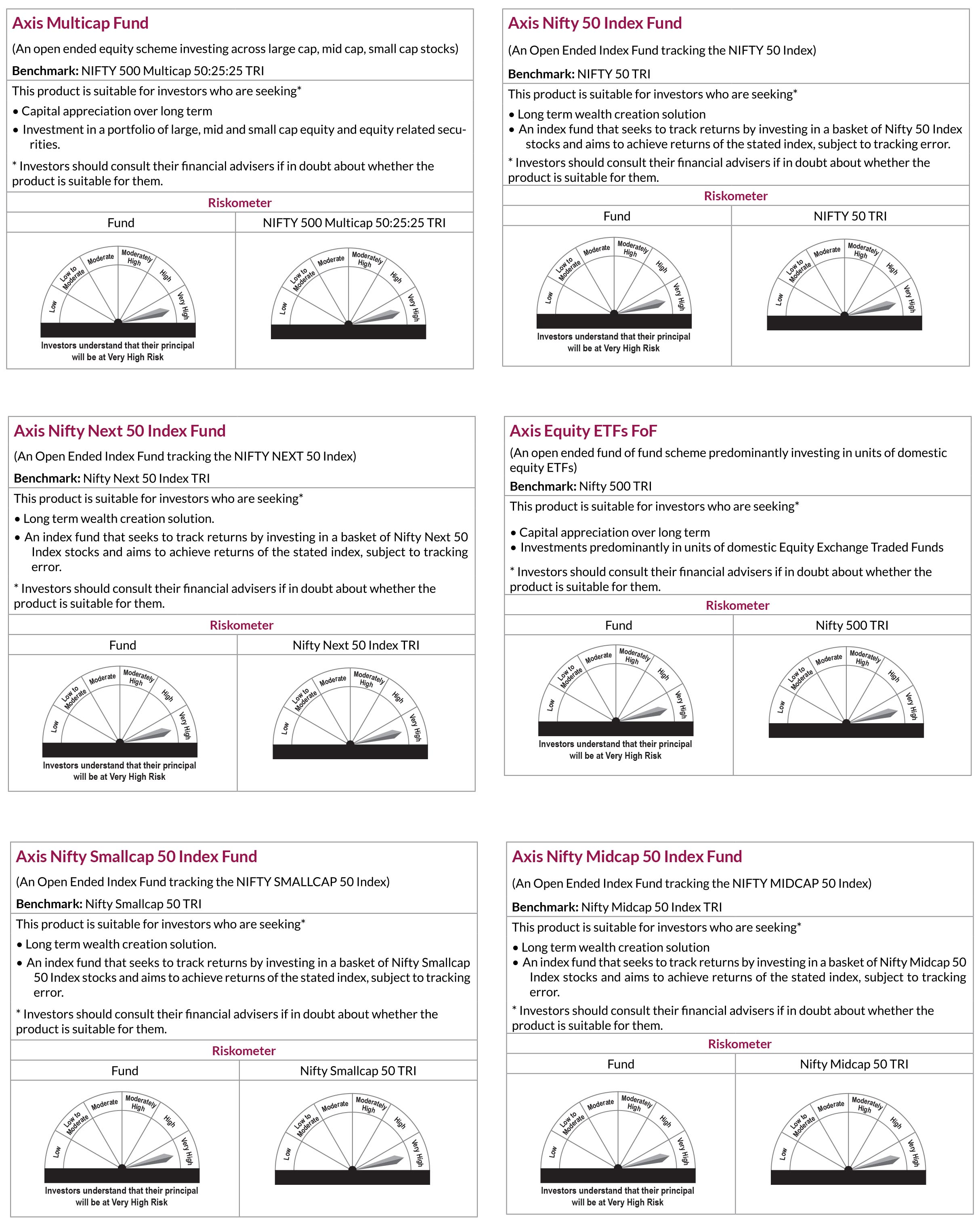

| AXIS NIFTY ETF (An open ended Scheme replicating/ tracking Nifty 50 Index) This product is suitable for investors who are seeking* • Capital appreciation over medium to long term • Investments in Equity & Equity related instruments covered by Nifty 50 Index |

| AXIS EQUITY HYBRID FUND (An open-ended hybrid scheme investing predominantly in equity and equity related instruments) This product is suitable for investors who are seeking* • Capital appreciation along with generation of income over medium to long term. • Investment in equity and equity related instruments as well as debt and money market instruments. |

| AXIS SMALL CAP FUND (An open ended equity scheme predominantly investing in small cap stocks) This product is suitable for investors who are seeking* • Capital appreciation over long term. • investment in a diversified portfolio predominantly consisting of equity and equity related instruments of small cap companies. |

| AXIS GROWTH OPPORTUNITIES FUND (An Open-ended Equity Scheme investing in both large cap and mid cap stocks) This product is suitable for investors who are seeking* • Capital appreciation over long term. • investment in a diversified portfolio predominantly consisting of equity and equity related instruments both in India as well as overseas. |

| AXIS EQUITY ADVANTAGE FUND SERIES 1 (A close-ended Equity Scheme) This product is suitable for investors who are seeking* • Capital appreciation over medium to long term. • Investment in a diversified portfolio of predominantly equity and equity related instruments across market cap while managing risk through active hedging strategies |

| AXIS EQUITY ADVANTAGE FUND SERIES 2 (A close-ended Equity Scheme) This product is suitable for investors who are seeking* • Capital appreciation over medium to long term • Investment in a diversified portfolio of predominantly equity and equity related instruments across market cap while managing risk through active hedging strategies |

| AXIS EMERGING OPPORTUNITIES FUND - SERIES 1 (A close-ended Equity Scheme) This product is suitable for investors who are seeking* • Capital appreciation over long term • Investment in a diversified portfolio of equity and equity related instruments of midcap companies. |

| AXIS EMERGING OPPORTUNITIES FUND - SERIES 2 (A close-ended Equity Scheme) This product is suitable for investors who are seeking* • Capital appreciation over long term • Investment in a diversified portfolio of equity and equity related instruments of midcap companies. |

| AXIS CAPITAL BUILDER FUND - SERIES 4 (A close ended equity scheme investing across large caps, mid caps and small cap stocks) This product is suitable for investors who are seeking* • Capital appreciation over long term • Investment in a diversified portfolio of predominantly equity and equity related instruments across market capitalisation. |

| AXIS CAPITAL BUILDER FUND - SERIES 1 (A close ended equity scheme investing across large caps, mid caps and small cap stocks) This product is suitable for investors who are seeking* • Capital appreciation over long term • Investment in a diversified portfolio of predominantly equity and equity related instruments across market capitalisation. |

| AXIS HYBRID FUND - SERIES 5 (42 months close ended debt scheme) This product is suitable for investors who are seeking* • Capital appreciation while generating income over medium to long term • Investment in debt and money market instruments as well as equity and equity related instruments. |

| AXIS HYBRID FUND - SERIES 6 (42 months close ended debt scheme) This product is suitable for investors who are seeking* • Capital appreciation while generating income over medium to long term • Investment in debt and money market instruments as well as equity and equity related instruments. |

| AXIS HYBRID FUND - SERIES 7 (42 months close ended debt scheme) This product is suitable for investors who are seeking* • Capital appreciation while generating income over medium to long term • Investment in debt and money market instruments as well as equity and equity related instruments. |

| AXIS NIFTY 100 INDEX FUND (An Open Ended Index Fund tracking the NIFTY 100 Index)) This product is suitable for investors who are seeking* • Long term wealth creation solution • An index fund that seeks to track returns by investing in a basket of Nifty 100 Index stocks and aims to achieve returns of the stated index, subject to tracking error |

|

| AXIS HYBRID FUND - SERIES 35 (1359 days close ended debt scheme) This product is suitable for investors who are seeking* • Capital appreciation while generating income over medium to long term • Investment in debt and money market instruments as well as equity and equity related instruments |

| AXIS RETIREMENT SAVINGS FUND - AGGRESSIVE PLAN (An open-ended retirement solution oriented scheme having a lock -in of 5 years or till retirement age

(whichever is earlier) This product is suitable for investors who are seeking* • Capital appreciation over long term • Investment primarily in equity and equity related instruments |

| AXIS RETIREMENT SAVINGS FUND - CONSERVATIVE PLAN(An open-ended retirement solution oriented scheme having a lock -in of 5 years or till retirement age

(whichever is earlier) This product is suitable for investors who are seeking* • Capital appreciation and income generation over long term • Investments in debt and money market instruments as well as equity and equity related instruments |

| AXIS RETIREMENT SAVINGS FUND - DYNAMIC PLAN (An open-ended retirement solution oriented scheme having a lock -in of 5 years or till retirement age

(whichever is earlier) This product is suitable for investors who are seeking* • Capital appreciation and income generation over long term • Investment in equity and equity related instruments as well as debt and money market instruments while managing risk through active asset allocation |

|

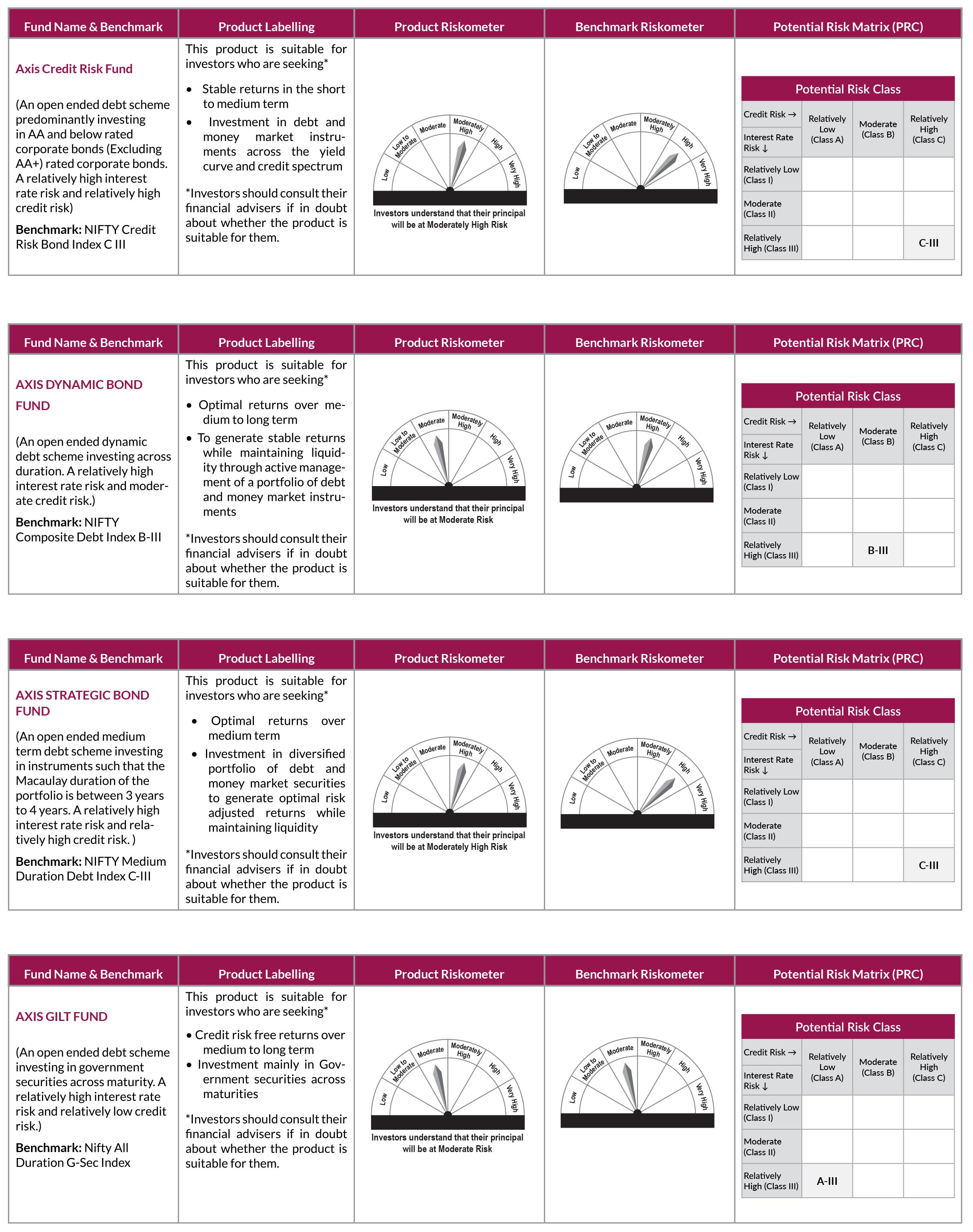

| AXIS GILT FUND (An open ended debt scheme investing in government securities across maturity) This product is suitable for investors who are seeking* • Credit risk free returns over medium to long term • Investment mainly in Government securities across maturities |

| AXIS DYNAMIC BOND FUND (An open ended dynamic debt scheme investing across duration) This product is suitable for investors who are seeking* • Optimal returns over medium to long term • To generate stable returns while maintaining liquidity through active management of a portfolio of debt and money market instruments |

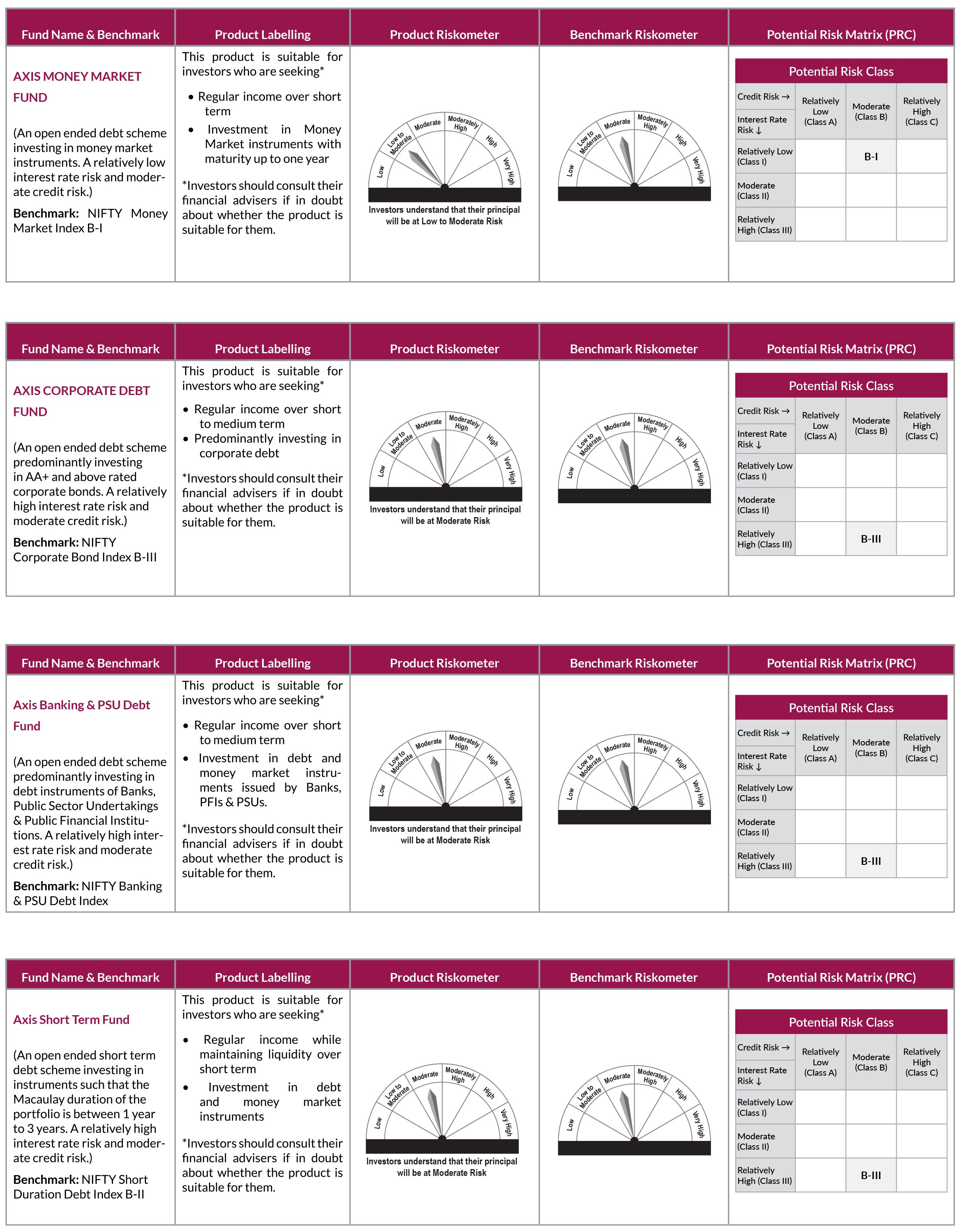

| AXIS CORPORATE DEBT FUND (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds) This product is suitable for investors who are seeking* • Regular income over short to medium - term • Predominantly investing in corporate debt |

| AXIS STRATEGIC BOND FUND (An open ended medium term debt scheme investing in instruments such that the Macaulay duration of

the portfolio is between 3 years to 4 years) This product is suitable for investors who are seeking* • Optimal returns over medium term • Investment in diversified portfolio of debt and money market securities to generate optimal risk adjusted returns while maintaining liquidity |

| AXIS ARBITRAGE FUND (An open ended scheme investing in arbitrage opportunities) This product is suitable for investors who are seeking* • Income over short to medium term • Investment in arbitrage opportunities in the cash & derivatives segment of the equity market |

| AXIS CREDIT RISK FUND (An open ended debt scheme predominantly investing in AA and below rated corporate bonds (excluding AA+

rated corporate bonds) This product is suitable for investors who are seeking* • Stable returns in the short to medium term • Investment in debt and money market instruments across the yield curve and credit spectrum |

| AXIS ALL SEASONS DEBT FUND OF FUNDS (An open-ended fund of funds scheme investing in debt oriented mutual fund schemes) This product is suitable for investors who are seeking* • To generate optimal returns over medium term • Investment primarily in debt oriented mutual fund schemes |

|

| AXIS SHORT TERM FUND (An open ended short term debt scheme investing in instruments such that the Macaulay duration of the

portfolio is between 1 year to 3 years) This product is suitable for investors who are seeking* • Regular income while maintaining liquidity over short term • Investment in debt and money market instruments |

| AXIS BANKING & PSU DEBT FUND (An open ended debt scheme predominantly investing in debt instruments of Banks, Public Sector

Undertakings & Public Financial Institutions) This product is suitable for investors who are seeking* • Regular income over short to medium term • Investment in debt and money market instruments issued by banks, PFIs & PSUs |

| AXIS TREASURY ADVANTAGE FUND (An open ended low duration debt scheme investing in instruments such that the Macaulay

duration of the portfolio is between 6 to 12 months) This product is suitable for investors who are seeking* • Regular income over short term • Investment in debt and money market instruments |

| AXIS ULTRA SHORT TERM FUND (An open ended ultra-short term debt scheme investing in instruments with Macaulay duration

between 3 months and 6 months) This product is suitable for investors who are seeking* • Regular income over short term • Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 months - 6 months. |

| AXIS MONEY MARKET FUND (An open ended debt scheme investing in money market instruments) This product is suitable for investors who are seeking* • Regular income over short term • Investment in Money Market instruments with maturity up to one year |

Please click here for NAV, TER, Riskometer & Statutory Details.