•

Expect lower interest rates in

the second half of 2024.

• Investors should add duration

with every rise in yields, as

yield upside limited.

•

Mix of 10-year duration and

3-5-year duration assets are

best strategies to invest in the

current macro environment.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals.

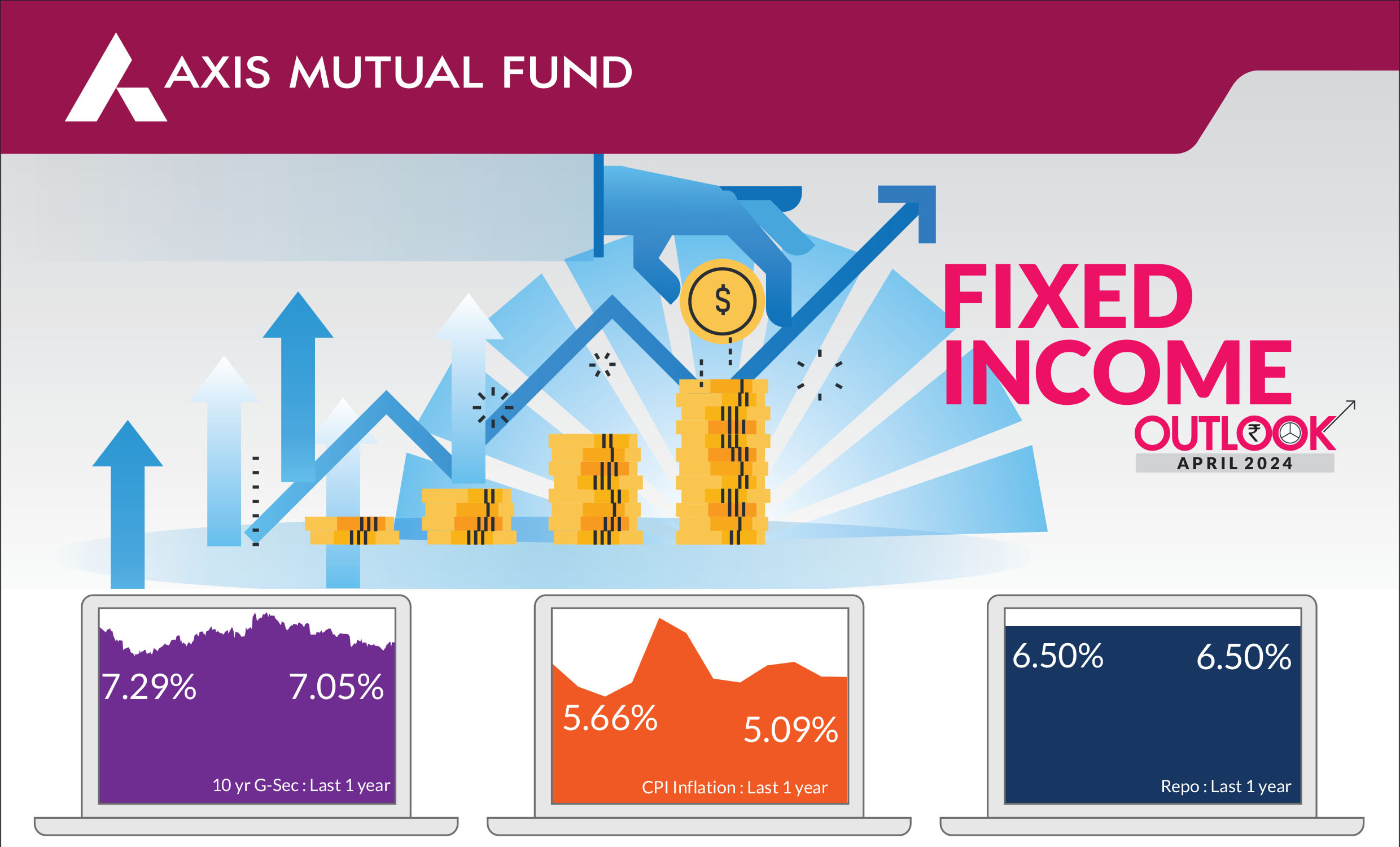

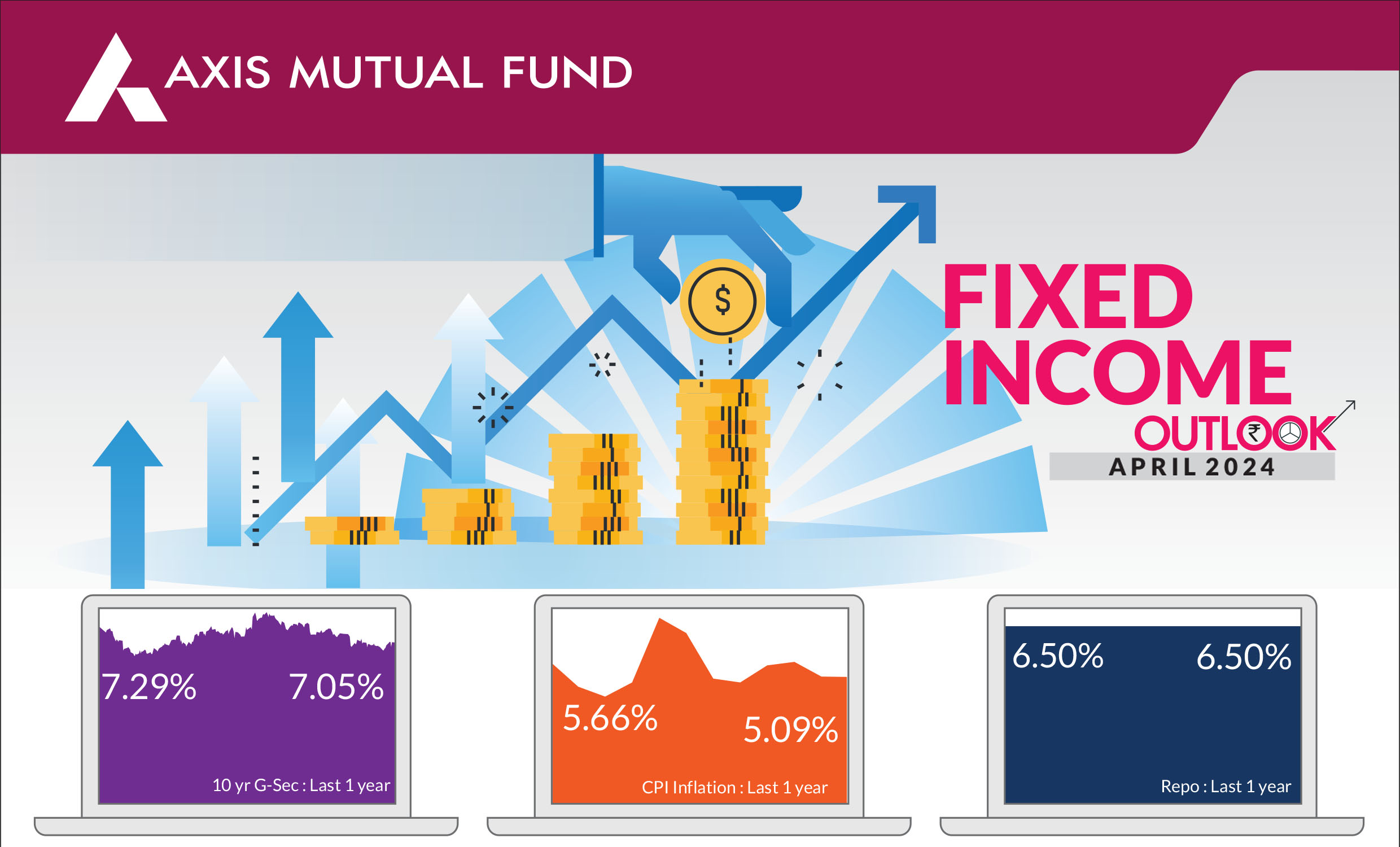

Bond markets were quite lackluster this month as investors assessed the outlook for interest rates in light of higher than expected inflation data in the US. Most markets have now aligned to realistic expectations of interest rate cuts. Yields on US Treasuries ended the month slightly lower at 4.20%. Indian government bond yields hovered in a tight range through the month and fell marginally by 3 bps to 7.05%. Foreign Portfolio Investors (FPI) flows were buyers of government bonds to the tune of US$1.6 bn over the month and year to date, debt inflows total to US$6.7 bn.

► Global interest rate environment:

Recent macroeconomic data in the

US has exhibited mixed trends, and monthly inflation appears uneven but

would gradually decline. During its policy meeting, the US Federal Reserve

(Fed) decided to keep its key interest rate unchanged. Despite revising its

inflation and growth forecasts upward, the Fed maintained its projection for

three rate cuts throughout 2024. Notably, the Fed emphasized that it will

refrain from reducing the target range until it gains greater confidence that

inflation, currently hovering around 3%, is moving sustainably toward the

Fed's 2% goal.

The European Central Bank (ECB) has flagged a possible rate cut for June, depending on whether wage growth continues to moderate. Meanwhile, the Reserve Bank of India (RBI) left its interest rates unchanged in its policy meeting on 5th April.

As anticipated, the Bank of Japan ended its yield curve control and raised interest rates for the first time since 2007, effectively putting an end to the world's only negative rates regime. Surprisingly, market reactions were muted and the central bank continued to buy Japanese government bonds. In China, macroeconomic indicators particularly manufacturing data has showed signs of a rebound. Additionally, the central bank has introduced several policy measures related to the real estate sector.

The European Central Bank (ECB) has flagged a possible rate cut for June, depending on whether wage growth continues to moderate. Meanwhile, the Reserve Bank of India (RBI) left its interest rates unchanged in its policy meeting on 5th April.

As anticipated, the Bank of Japan ended its yield curve control and raised interest rates for the first time since 2007, effectively putting an end to the world's only negative rates regime. Surprisingly, market reactions were muted and the central bank continued to buy Japanese government bonds. In China, macroeconomic indicators particularly manufacturing data has showed signs of a rebound. Additionally, the central bank has introduced several policy measures related to the real estate sector.

► Inflationary pressures slow down but oil prices up:

CPI stayed unchanged at

5.1% in February while core CPI declined further to 3.4%. This was led by a

slowdown in prices across the board, for both core goods and services, from

the previous month's levels. Going forward, a normal monsoon could lead to a

downward trajectory in inflation in the second half of 2024.

► Lower H1 government borrowing: Out of gross market borrowing of Rs 14.13 trillion estimated for 2024-25, Rs 7.5 trillion, or 53%, is planned to be borrowed in the first half of FY 2024-25. Both gross and net borrowings are 15-25% lower than last year. A lower borrowing calendar augurs well for the bond markets and also shows the changing investor demand patterns. We expect alignment of higher supply in the second half with expected FPI flows on account of bond inclusion.

► Lower H1 government borrowing: Out of gross market borrowing of Rs 14.13 trillion estimated for 2024-25, Rs 7.5 trillion, or 53%, is planned to be borrowed in the first half of FY 2024-25. Both gross and net borrowings are 15-25% lower than last year. A lower borrowing calendar augurs well for the bond markets and also shows the changing investor demand patterns. We expect alignment of higher supply in the second half with expected FPI flows on account of bond inclusion.

Market view

Inflation across economies has peaked, and the pace is suggestive of a further slowdown. However, rising crude could likely push up inflation. We expect the Fed and other central banks including the ECB to start lowering rates from June onwards. Accordingly, given rate cuts are almost three months away, yields could have a limited upside. In line with our view, the RBI maintained a status quo and we believe that the central bank would lower rates after the Fed. The only risk to our view is rising oil prices in the near term. If oil prices remain under control, we expect that inflation could touch 4% over the course of the year.While inflation continues to moderate, economic growth as expected by the RBI remains high and India remains one of the fastest growing economy globally. Proactive liquidity management by the RBI has led to a shift in operative rate from 6.75% to 6.5% in the last 30 days. With policy rates remaining incrementally stable, we remain long duration across our portfolios within the respective scheme mandates. The path of fiscal consolidation, demand supply dynamics in government bonds and expectations of falling interest rates in the US, Europe and in India make an interesting theme for a long duration stance for investors.

Positioning & Strategy

As the fixed income curve is pricing in no rate cuts till December, we have retained our long duration stance across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to soften to 6.75% over the next few months.

From a strategy perspective, while the overall call is to play a falling interest rate cycle over the next 6-12 months, markets are likely to see sporadic rate movements. From a strategy perspective, we continue to add duration across portfolios within the respective investment mandates. Investors could use this opportunity to top up on duration products with a structural allocation to short and medium duration funds and a tactical play on Gilt funds. We have taken a tactical allocation to corporate and SDL bonds in the dynamic and Gilt Funds to take advantage of the spread compression on account of improved liquidity conditions and lower supply.

Source: Bloomberg, Axis MF Research.