► Equity market valuations are broadly reasonable adjusted for the cyclical low in earnings and

potential for revival going forward.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Expect lower interest rates by the second half of 2024.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year duration and 3-5-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year duration and 3-5-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

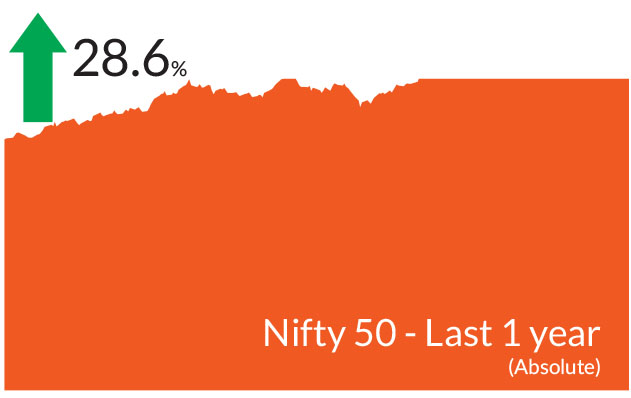

Indian equities faced volatility in the first half of the month but

rebounded in the later half closing on a higher note. The S&P BSE

Sensex and the NIFTY 50 ended 1.6% higher each. Mid-caps and small

caps saw a sharp correction this month and underperformed the

frontline indices. The NIFTY Midcap 100 ended the month down 0.5%

while NIFTY Small cap 100 ended lower 4.4%. Market volatility was

lower compared to the previous month while the advance decline line

was down 14% in March.

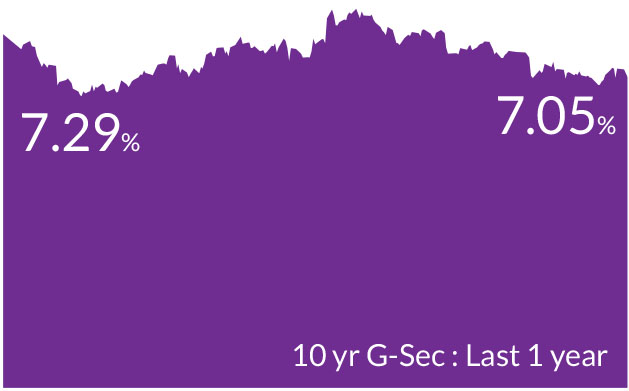

Bond markets were quite lackluster this month as investors assessed the outlook for interest rates in light of higher than expected inflation data in the US. Most markets have now aligned to realistic expectations of interest rate cuts. Yields on US Treasuries ended the month slightly lower at 4.20%. Indian government bond yields hovered in a tight range through the month and fell marginally by 3 bps to 7.05%. Foreign Portfolio Investors (FPI) flows were buyers of government bonds to the tune of US$1.6 bn over the month and year to date, debt inflows total to US$6.7 bn.

The European Central Bank (ECB) has flagged a possible rate cut for June, depending on whether wage growth continues to moderate. Meanwhile, the Reserve Bank of India (RBI) left its interest rates unchanged in the policy meeting on 5th April.

As anticipated, the Bank of Japan ended its yield curve control and raised interest rates for the first time since 2007, effectively putting an end to the world's only negative rates regime. Surprisingly, market reactions were muted and the central bank continued to buy Japanese government bonds. In China, macroeconomic indicators particularly manufacturing data has showed signs of a rebound. Additionally, the central bank has introduced several policy measures related to the real estate sector.

► Inflationary pressures slow down but oil prices up: CPI stayed unchanged at 5.1% in February while core CPI declined further to 3.4%. This was led by a slowdown in prices across the board, for both core goods and services, from the previous month's levels. Going forward, a normal monsoon could lead to a downward trajectory in inflation in the second half of 2024.

► Lower H1 government borrowing: Out of gross market borrowing of Rs 14.13 trillion estimated for 2024-25, Rs 7.5 trillion, or 53%, is planned to be borrowed in the first half of FY 2024-25. Both gross and net borrowings are 15-25% lower than last year. A lower borrowing calendar augurs well for the bond markets and also shows the changing investor demand patterns. We expect alignment of higher supply in the second half with expected FPI flows on account of bond inclusion.

Bond markets were quite lackluster this month as investors assessed the outlook for interest rates in light of higher than expected inflation data in the US. Most markets have now aligned to realistic expectations of interest rate cuts. Yields on US Treasuries ended the month slightly lower at 4.20%. Indian government bond yields hovered in a tight range through the month and fell marginally by 3 bps to 7.05%. Foreign Portfolio Investors (FPI) flows were buyers of government bonds to the tune of US$1.6 bn over the month and year to date, debt inflows total to US$6.7 bn.

Key Market Events

► Global interest rate environment: Recent macroeconomic data in the US has exhibited mixed trends, and monthly inflation appears uneven but would gradually decline. During its policy meeting, the US Federal Reserve (Fed) decided to keep its key interest rate unchanged. Despite revising its inflation and growth forecasts upward, the Fed maintained its projection for three rate cuts throughout 2024. Notably, the Fed emphasized that it will refrain from reducing the target range until it gains greater confidence that inflation, currently hovering around 3%, is moving sustainably toward the Fed's 2% goal.The European Central Bank (ECB) has flagged a possible rate cut for June, depending on whether wage growth continues to moderate. Meanwhile, the Reserve Bank of India (RBI) left its interest rates unchanged in the policy meeting on 5th April.

As anticipated, the Bank of Japan ended its yield curve control and raised interest rates for the first time since 2007, effectively putting an end to the world's only negative rates regime. Surprisingly, market reactions were muted and the central bank continued to buy Japanese government bonds. In China, macroeconomic indicators particularly manufacturing data has showed signs of a rebound. Additionally, the central bank has introduced several policy measures related to the real estate sector.

► Inflationary pressures slow down but oil prices up: CPI stayed unchanged at 5.1% in February while core CPI declined further to 3.4%. This was led by a slowdown in prices across the board, for both core goods and services, from the previous month's levels. Going forward, a normal monsoon could lead to a downward trajectory in inflation in the second half of 2024.

► Lower H1 government borrowing: Out of gross market borrowing of Rs 14.13 trillion estimated for 2024-25, Rs 7.5 trillion, or 53%, is planned to be borrowed in the first half of FY 2024-25. Both gross and net borrowings are 15-25% lower than last year. A lower borrowing calendar augurs well for the bond markets and also shows the changing investor demand patterns. We expect alignment of higher supply in the second half with expected FPI flows on account of bond inclusion.

Market View

Equity MarketsFPI inflows in FY24 stood at Rs 2.08 lakh crore (US$21 bn). This was the highest FPI inflow since FY21 when the FPI investment stood at Rs 2.74 lakh crore. Furthermore, even domestic inflows (Rs 2.06 lakh crore) more than matched FPI flows. Meanwhile in the month of March, FPI inflows stood at Rs 35,098 cr (US$4.2 bn) while DIIs bought stocks to the tune of US$6.8 bn. Domestic mutual fund investors have been net buyers in equity-oriented schemes for 36 months in a row. Over the last 11 months, investments through systematic investment plans (SIPs) scaled multiple record highs.

Global rating agency Moody's earlier this month raised India's growth forecast for the 2024 calendar year to 6.8% and said that the country will remain the fastest growing among G20 countries. Economic growth as evidenced by the headline GDP print of 8.4% in Q3FY24 remains strong. Furthermore, inflation is slowing down and could give the central bank room for rate cuts in the latter half of the year.

With markets at or near all-time highs, investors should be cautious of potential volatility in the near term. Mid-caps and small caps have experienced a sharp run barring the last two months, valuations in India still remain expensive relative to the Asian peers and India remains the most expensive market (on both forward P/E and trailing P/B basis). Investors should focus on the long term rather than making short term decisions and utilise short term corrections to increase exposure to mutual funds.

Elections are finally around the corner and the outcome of these would set the tone for the markets. In particular, policy continuity is the key and could likely set the stage for a further rally in equities. The immediate near term trigger is the reporting season. Meanwhile, India's long term growth story remains intact. India is one of the fastest growing economies globally. Construction cycle is already underway with rise in Government Infra spending and the Real estate upturn. Rising private capex should further accelerate the capex cycle. Corporate balance sheets and Banks are in great shape laying a platform for a private capex cycle.

We anticipate that market dynamics will be influenced by favorable cyclical factors and capex-driven segments such as infrastructure, domestic oriented manufacturing, and utilities should benefit. Our portfolios are positioned accordingly and we are overweight these segments. We are also optimistic and overweight consumer discretionary sector, particularly automobiles and real estate. We also have exposure to sectors such as power, defense, and transportation that could benefit from government policies. As companies seek financing for expansion and new projects, banks are likely to see an increase in credit demand, which should bolster their performance. We expect the improved pricing environment to continue and strengthen in the pharmaceutical sector. We are underweight in the exports segment due to slowing global growth.

Debt Markets

Inflation across economies has peaked, and the pace is suggestive of a further slowdown. However, rising crude could likely push up inflation. We expect the Fed and other central banks including the ECB to start lowering rates from June onwards. Accordingly, given rate cuts are almost three months away, yields could have a limited upside. As expected, the RBI maintained a status quo in its policy meeting. We believe that the central bank would lower rates after the Fed. The only risk to our view is rising oil prices in the near term. If oil prices remain under control, we expect that inflation could touch 4% over the course of the year.

While inflation continues to moderate, economic growth as expected by the RBI remains high and India remains one of the fastest growing economy globally. Proactive liquidity management by the RBI has led to a shift in operative rate from 6.75% to 6.5% in the last 30 days. With policy rates remaining incrementally stable, we remain long duration across our portfolios within the respective scheme mandates. The path of fiscal consolidation, demand supply dynamics in government bonds and expectations of falling interest rates in the US, Europe and in India make an interesting theme for a long duration stance for investors.

As the fixed income curve is pricing in no rate cuts till December, we have retained our long duration stance across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to soften to 6.75% over the next few months.

From a strategy perspective, while the overall call is to play a falling interest rate cycle over the next 6-12 months, markets are likely to see sporadic rate movements. From a strategy perspective, we continue to add duration across portfolios within the respective investment mandates. Investors could use this opportunity to top up on duration products with a structural allocation to short and medium duration funds and a tactical play on Gilt funds. We have taken a tactical allocation to corporate and SDL bonds in the dynamic and Gilt Funds to take advantage of the spread compression on account of improved liquidity conditions and lower supply.

Source: Bloomberg, Axis MF Research.