•

Yield curve flat - Duration plays

can be played in the 2-4 year

segment.

• Elevated levels can be used to

lock in longer term rates.

•

Spreads between G-Sec/AAA

& SDL/AAA have seen some

widening.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals.

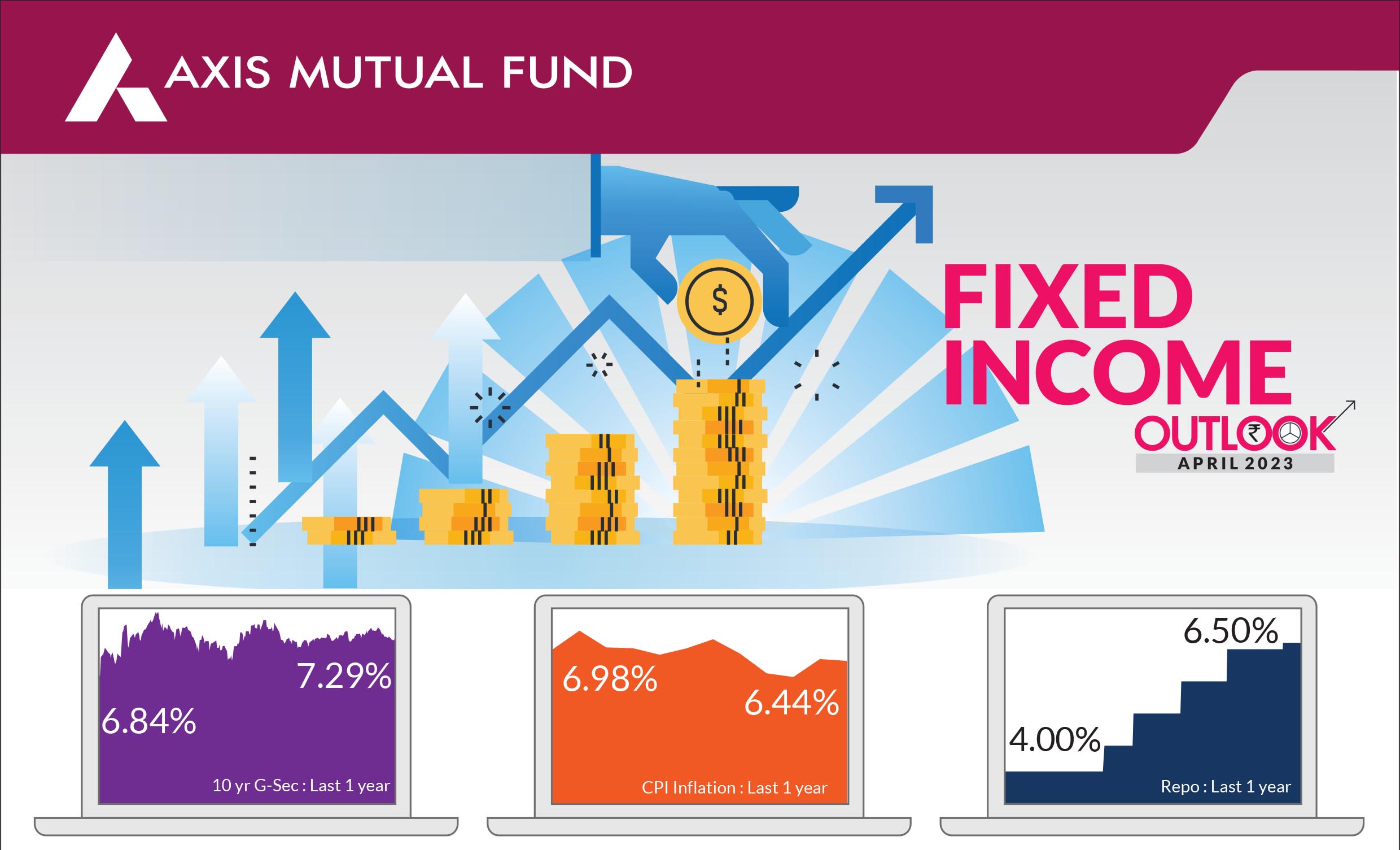

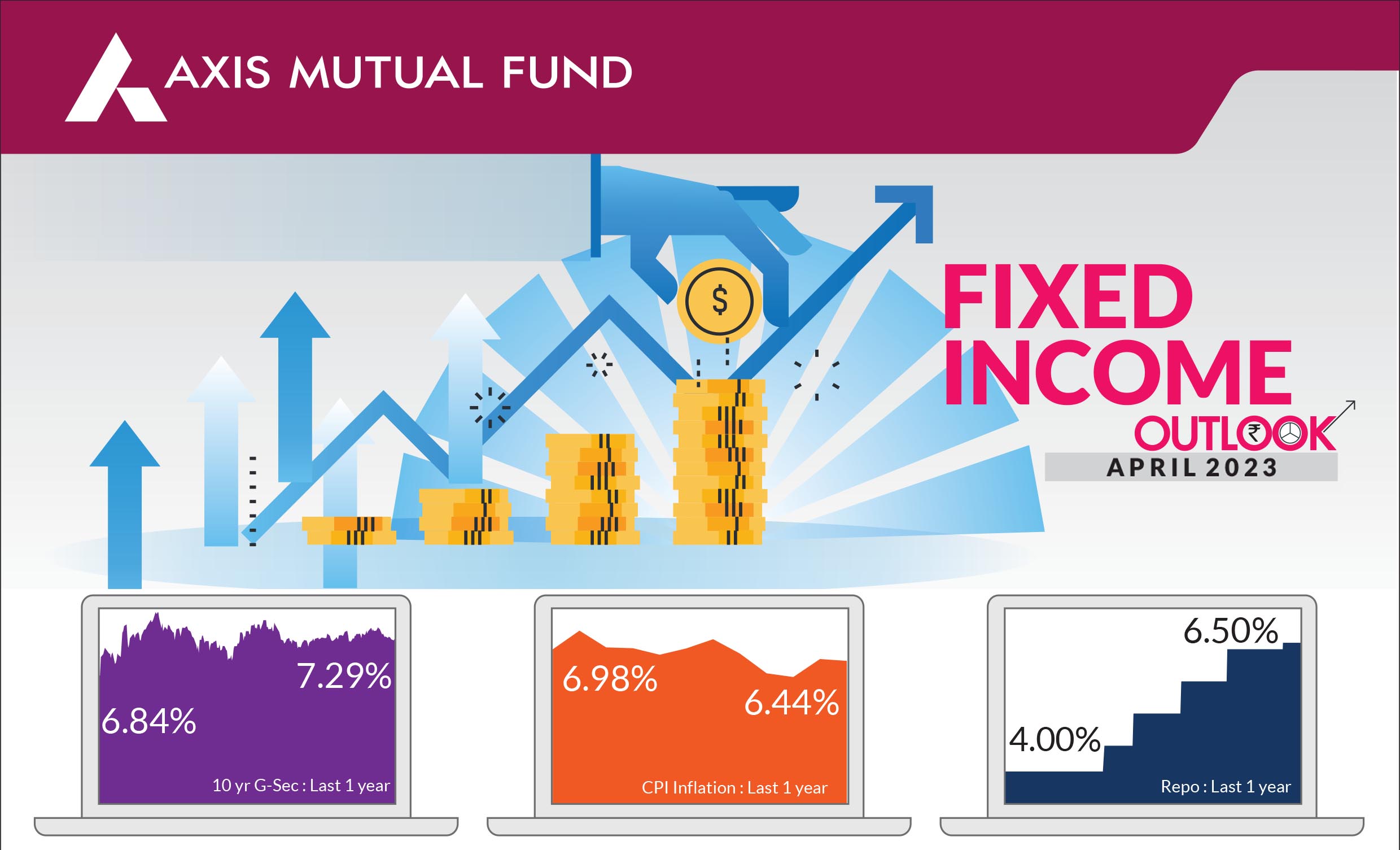

► Inflation & Rates - RBI commentary keenly awaited: India

remains a key beneficiary from falling oil prices. The ripple

effects of lower

commodity prices are

likely to help sooth

inflation in the latter half

of the year. Domestic CPI

for the month of February

stood at an elevated 6.4%. Initial signs of an inflation cool off

have been witnessed in the US with inflation core PCE falling

below 5%. Prices of Timber and the metal complex have

already retraced to pre-covid levels signaling a stabilization of

prices in the aftermath of global supply chain issues. RBI

comments post policy on April 6th are likely to be triggers for

market movements for the month.

► MF Taxation Change - Life after Mar 31st doesn't change

much: The Finance ministry made some surprise amendments

to the Finance Bill 2023 before passing it through both houses

of parliament. Amongst them were removal of LTCG benefits

to select categories of mutual fund schemes. For investors,

while the new taxation structure may seem detrimental in the

near term, the market linked nature of the products and single

point taxation at the time of redemption make debt mutual

funds relatively attractive as compared to comparable fixed

savings instruments.

► Positive Comments from the US Fed - US Rates drop: The US

Fed raised rates by 25bps as expected. The commentary

coupled with tightness in system liquidity due to the banking crisis were seen as indications of a pause/peaking interest

rates. US bond yields dropped significantly through the month

with maximum gains coming in the 2-4-year segment (75-

80bps drop). Positive inflation data trends, make the case of

incrementally stable rates stronger.

The current curve remains very flat with everything in corporate

bonds beyond 1 year up to 15 years is available @7.5-7.80%

range. We expect the curve to remain flat for most part of 2023

with long bonds trading in a range for most part of 2023 (7.25-

7.75%). Falling CPI, weaker growth and strong investor demand

would keep yields under check despite high G-Sec supply next

year.

We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios.

For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios. For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. Spreads between G-Sec/AAA & SDL/AAA have seen some widening over the last month which could make a case for allocations into high quality corporate credit strategies. Lower rated credits with up to 18-month maturity profiles can also be considered as ideal 'carry' solutions in the current environment.

We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios.

For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios. For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. Spreads between G-Sec/AAA & SDL/AAA have seen some widening over the last month which could make a case for allocations into high quality corporate credit strategies. Lower rated credits with up to 18-month maturity profiles can also be considered as ideal 'carry' solutions in the current environment.

Source: Bloomberg, Axis MF Research.