Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

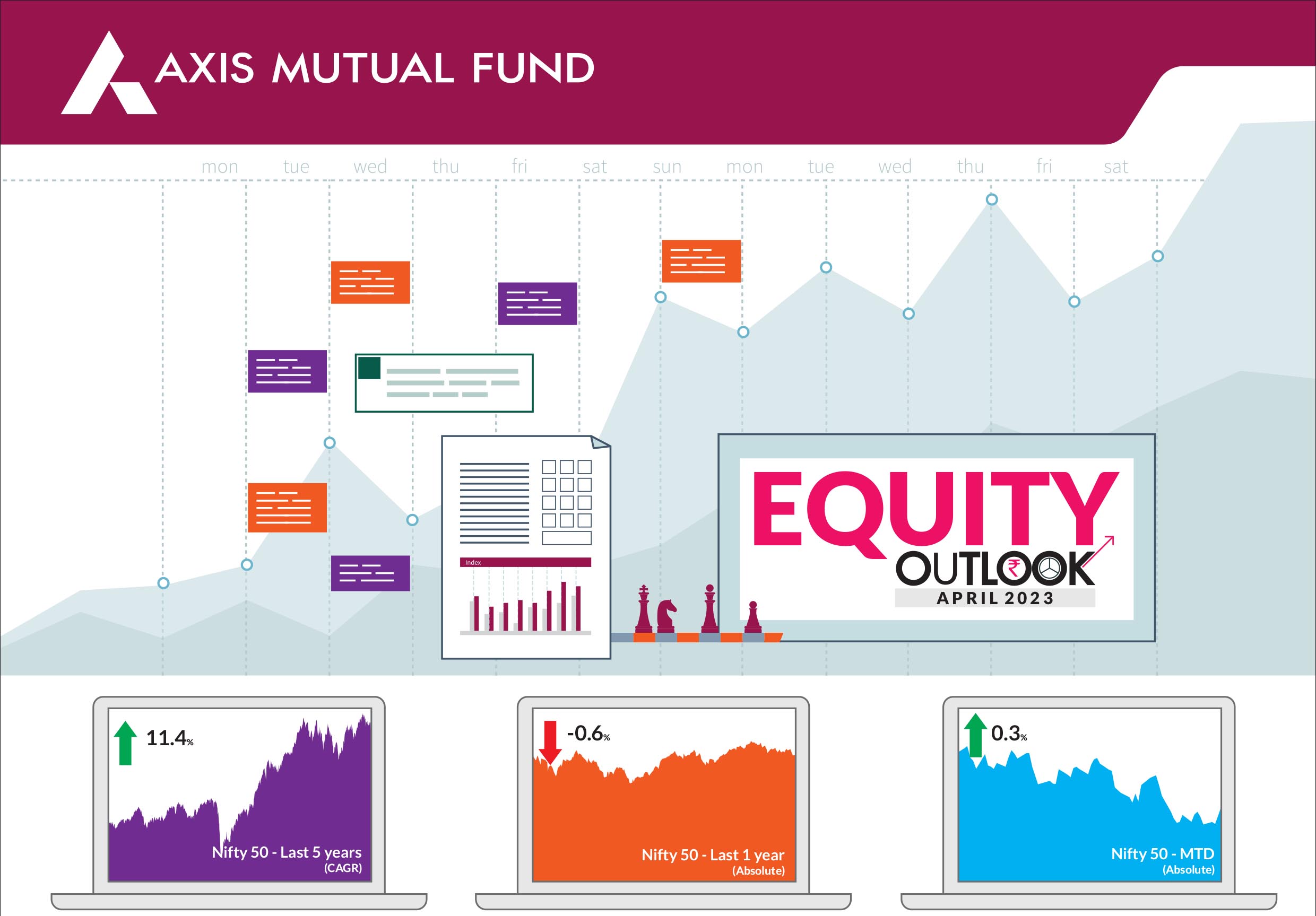

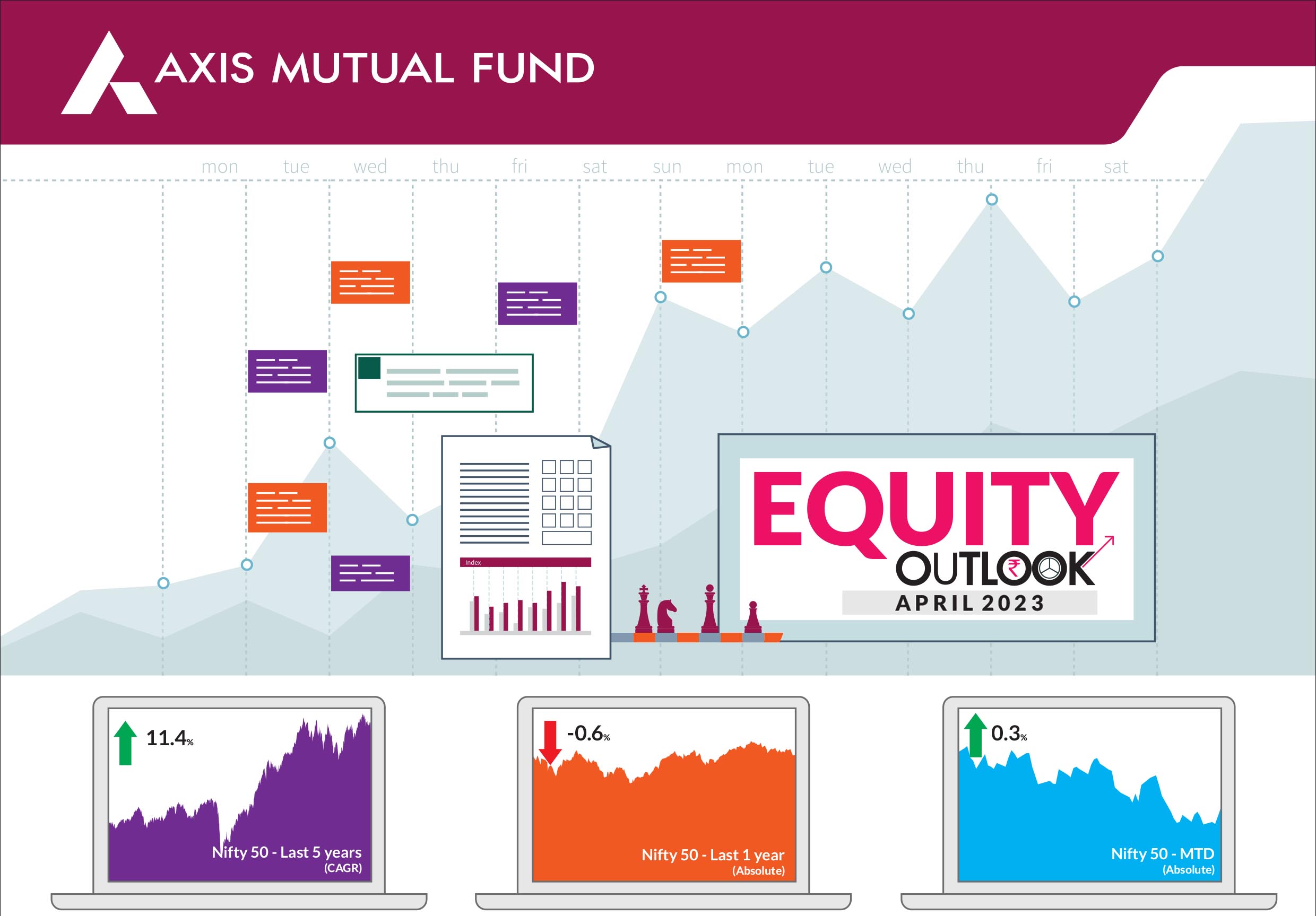

Indian markets continued to see weakness amidst heightened volatility driven by global factors. S&P BSE Sensex & NIFTY 50 ended the month marginally positive. NIFTY Midcap 100 & NIFTY Small cap 100 ending the month down 0.3% & 1.8% respectively. FPI's were buyers for the first time this calendar year investing ~$1 billion in the equity markets for the month of March 2023. |

|

India remains a key beneficiary from falling oil prices. The ripple effects of lower commodity prices are likely to help sooth inflation in the latter half of the year. Domestic CPI for the month of February stood at an elevated 6.4%. Initial signs of an inflation cool off have been witnessed in the US with inflation core PCE falling below 5%. Prices of Timber and the metal complex have already retraced to pre-covid levels signalling a stabilization of prices in the aftermath of global supply chain issues. With this another factor affecting the Quality style, Interest rates, are likely to have peaked providing much needed buoyancy to stock prices. From an earnings standpoint, we believe the next few quarters are likely to see base effects kick in across corporate earnings. Similar trends are already visible in high frequency numbers. Credit growth which is currently trending at 15-16% could also see some degree of moderation to pre-covid levels of 11-12%. During such phases, competitive intensity returns as companies fight for growth and the winners are often, market leaders and disruptors. We have witnessed 'momentum' & 'beta' plays making way for 'fundamentals' and 'quality'. The limelight on corporate governance has also brought back focus on companies with a proven management track record and profit pedigree. Many of these names today trade at attractive valuations in contrast to the rest of the market. The winners of 2023 is likely to look starkly different from 2022. This coupled with buoyancy on the economic front bode well for investors looking to build a highly quality centric portfolio. Currently, our portfolios favour large caps where companies continue to deliver on growth metrics. Corporate earnings of our portfolio companies continue to give us confidence in the strength of our portfolio companies. From a risk perspective, in the current context, given rising uncertainties our attempt remains to minimize betas in our portfolios. The markets have kept 'quality' away from the limelight for over 18 months, making valuations of these companies relatively cheap both from a historical context and a relative market context. While we remain cautious of external headwinds, strong discretionary demand evident from high frequency indicators and stable government policies give us confidence that our portfolios are likely to weather the ongoing challenges. Markets at all-time highs also point to a valuation risk in select pockets which we will look to avoid. |

Source: Bloomberg, Axis MF Research.