Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

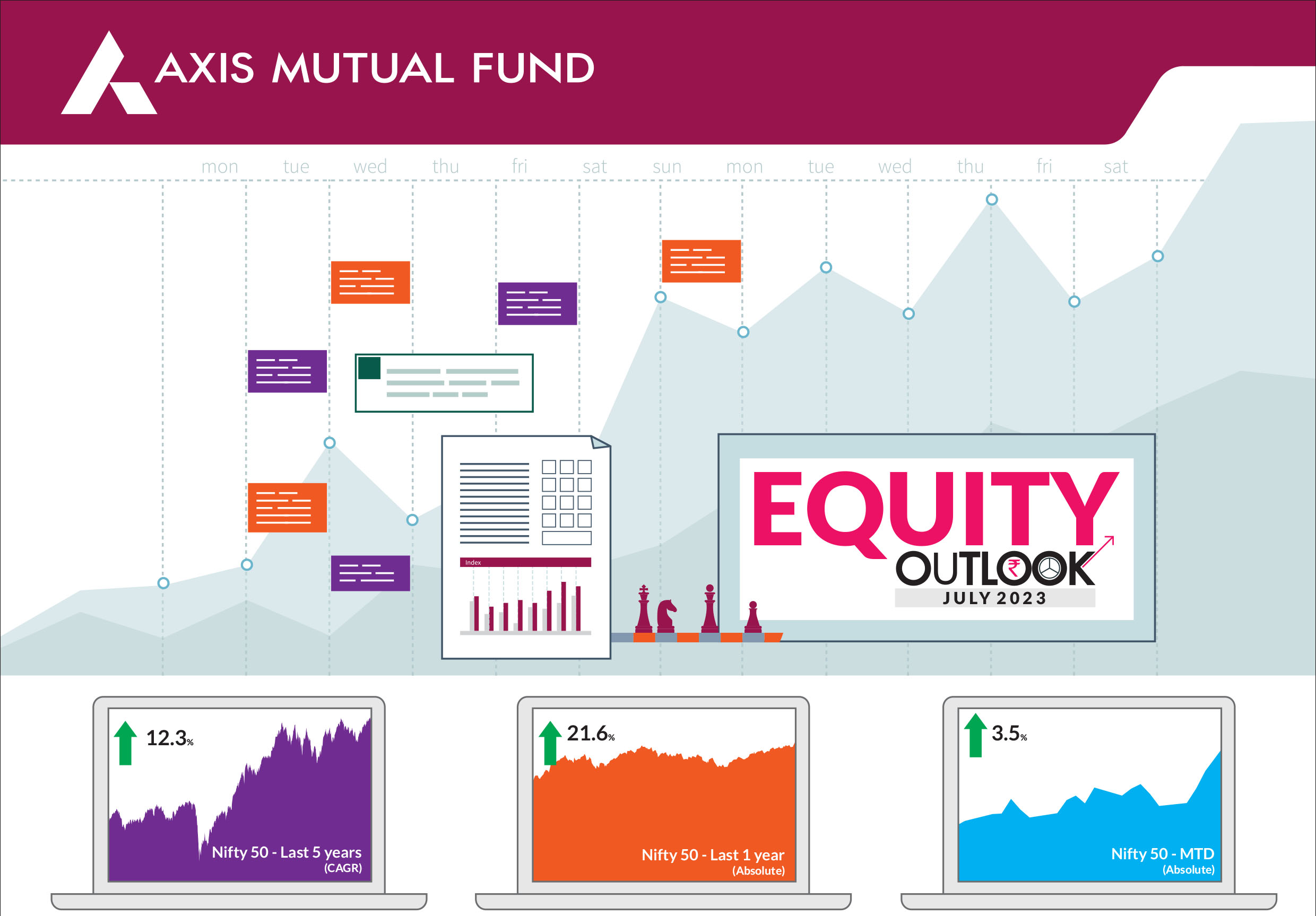

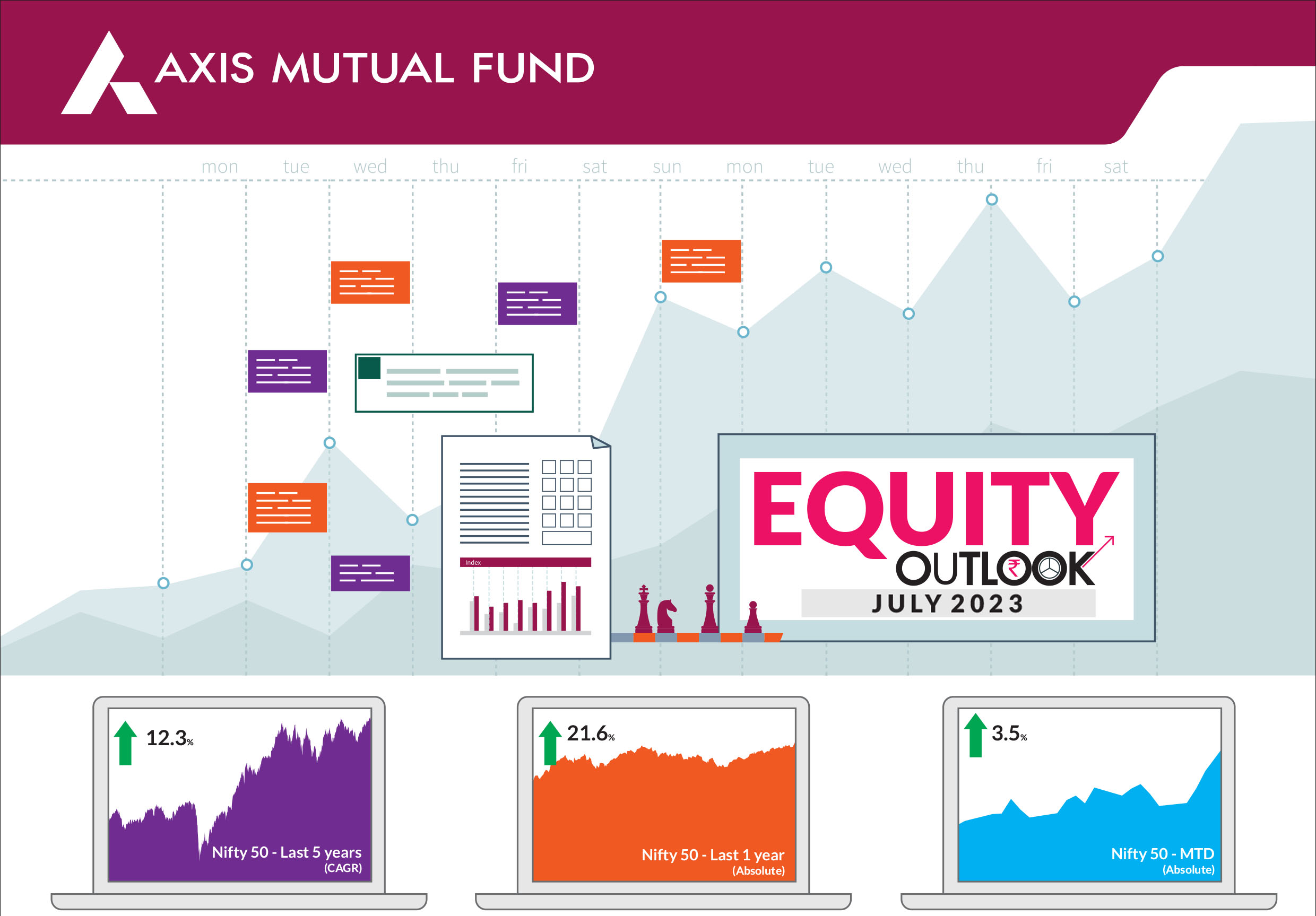

Indian equities had a spectacular month with benchmark indices registering all-time highs amid strong foreign inflows, improving outlook for corporate earnings and better than expected macros. The BSE Sensex, Nifty 50 and the Nifty Bank scaled new lifetime highs and the Nifty 50 surpassed the 19,000 mark. S&P BSE Sensex & NIFTY 50 ended the month up 3.4% and 3.5% respectively. NIFTY Midcap 100 & NIFTY Small cap 100 continued to outperform their large cap peers, up 5.9% & 6.6% respectively. Market breadth remained strong while volatility declined further over the month. |

|

A pause by the RBI, receding inflationary pressures and falling crude prices bode well for rate sensitives and sectors with structural drivers such as automobiles, infrastructure, capital goods and financials. India seems to be in a sweet spot, and performing better than its global peers. Headline inflation came in lower than expected giving the MPC headroom on policy action. We reckon, if not for a deficient monsoon so far, inflation would be well under the central bank's target. Further, GDP numbers have also been buoyed by strong high frequency numbers on industrial production. The improvement has been broad-based, led by infrastructure & construction, supported by capital and consumer non-durable goods output growth. Private sector capital expenditure finally showed signs of a rebound, with the announcements more than doubling in FY23 from pre-pandemic levels and outpacing Central and state governments' capex plans for the year. Overall, new capex crossed the pre-pandemic peak and stood at Rs 12 trillion in the fourth quarter of FY23, according to data from CMIE. Furthermore, indicators such as capital utilisation and improving PAT/GDP ratio suggest that a broad-based capex revival is on the horizon. India's GDP CAGR growth over the last 5 years stands at ~ 3.8% while nominal growth is ~9.7%. The spurt in GDP growth to above 6% on real GDP opens up a significant growth opportunity in our opinion across sectors. A confluence of cyclical & a structural tailwind are driving the recovery. Cyclically stronger balance sheets, improving macro stability - which reduces pressure on policymakers to tighten policy stance - and structural policy reforms are the keys to sustainable growth. However, some companies are likely to benefit over others on account of flexibility, product differentiation and market leadership. This pocket-wise growth rather than 'across the board' and active investing in growth and quality are likely to be key to alpha creation. Our fund performance has seen a strong rebound driven by active stock selectin driving much of this recovery. This unique trait across portfolios has historically been key to long term wealth creation and this is reflected in our conviction plays across schemes. |

Source: Bloomberg, Axis MF Research.