•

Expect lower interest rates in

the second half of FY25.

• Investors should add duration

with every rise in yields, as

yield upside limited.

•

Mix of 10-year maturity and 1-

3-year maturity assets are

best strategies to invest in the

current macro environment.

•

Selective Credits continue to

remain attractive from a risk

reward perspective given the

improving macro fundamentals.

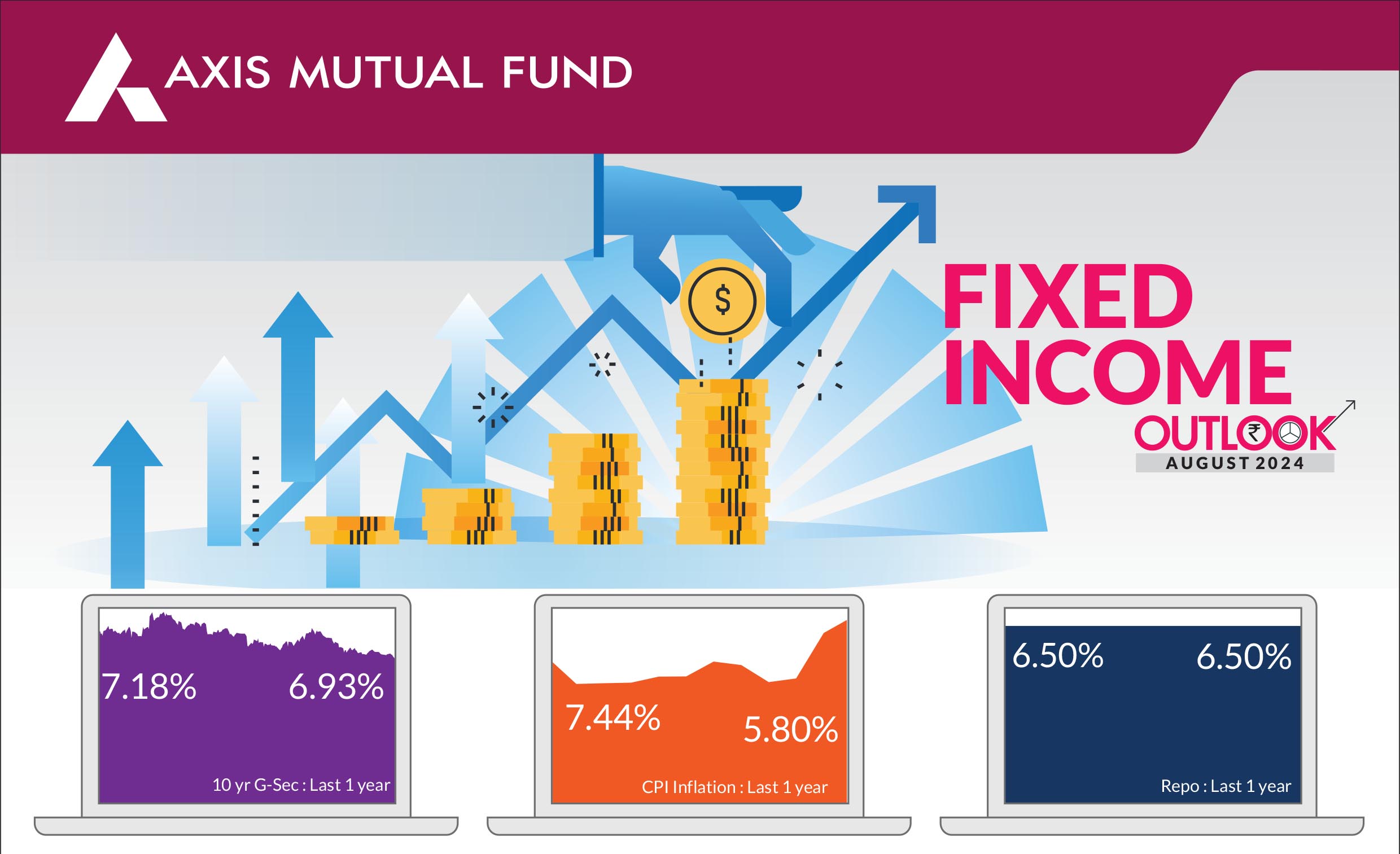

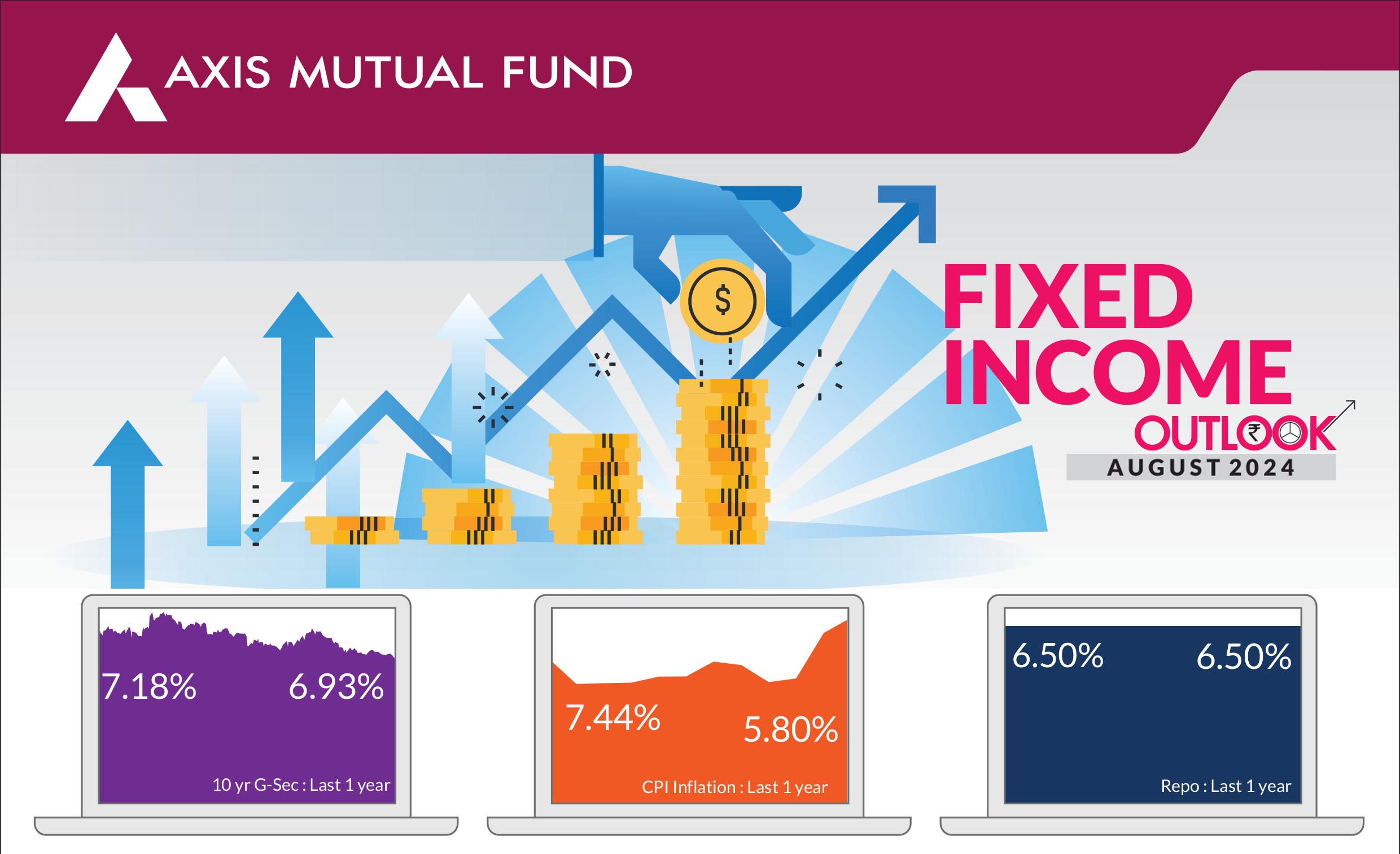

Overall, the month was positive for Indian Bonds given a better demand supply outlook, weaker oil and commodity prices and lower fiscal deficit numbers in the budget. Consequently, the yields on the 10 year government bonds ended 8 bps lower at 6.93%. Foreign Portfolio Investors (FPI) flows was positive in July and stood at US$2.7 bn over the month. Year to date, cumulative debt inflows amounted to US$10.9 bn. Yields on US Treasuries ended 37 bps lower at 4.03% on weaker macroeconomic data.

►Global interest rates :

The gradual slowing

of inflation and weakening pace of

economic activity, particularly in the

labour markets make a case for lower

interest rates in the US. Yields on US

Treasuries have started pricing in more

than 250 bps rate cuts in next 12 months

starting from September 2024. After

having started the easing cycle, one can

expect the central banks of Europe,

Canada and Switzerland to further lower interest rates. In a surprise move, the

Bank of Japan hiked interest rates. In India, higher growth coupled with sustained

food inflation prompted the Reserve Bank of India (RBI) to remain on a pause in its

August monetary policy.

► Budget reaffirms path of consolidation and continuity :

Budget continued on its

path of fiscal consolidation and Policy continuity and the government reduced the

fiscal deficit from 5.1% to 4.9% and the glide path suggested 4.5% in FY26. From

the perspective of bond markets, there was no significant deviation from Interim

budget both in terms of spending and borrowing numbers, hence the price

reaction post the budget on yields was very muted.

► Inflationary pressures persist : Banking liquidity has remained in Headline inflation rose over the month to 5.1% from 4.75% in the previous month in light of higher food inflation. Nonetheless, we do not expect inflation to rise and a better monsoon coupled with favourable base effects could lead to lower CPI prints in July. Furthermore, crude oil was 6.6% lower over the month and we do not expect crude to add to inflationary pressures.

► Banking liquidity moves to surplus : Banking liquidity moved to surplus and the Overnight funding rate eased from 6.65-6.7% to 6.4-6.45%. Given the huge increase in banking liquidity due to the dividend by RBI and FPI flows over last two months, the central bank conducted small amount of OMO sales of Rs 7,500 cr to neutralize some of surplus liquidity, impact of the same on yields was insignificant.

Separately, RBI also released a consultation paper tweaking Bank Liquidity Coverage Ratio (LCR) requirement which if implemented would lead to additional demand for liquid assets particularly, government bonds of Rs 2 trillion from FY26.

► Indian currency weakens : In light of recent depreciation of Japanese Yen, Chinese Yuan, Indonesia rupiah and other emerging/developed markets currencies and looming fears of geopolitical risks/ trade wars and tariffs, markets are generally worried about possibility of near term rupee depreciation and its implications on monetary policy. We believe that rupee would continue to remain stable and do not expect any major volatility or depreciation in FY25.

► Inflationary pressures persist : Banking liquidity has remained in Headline inflation rose over the month to 5.1% from 4.75% in the previous month in light of higher food inflation. Nonetheless, we do not expect inflation to rise and a better monsoon coupled with favourable base effects could lead to lower CPI prints in July. Furthermore, crude oil was 6.6% lower over the month and we do not expect crude to add to inflationary pressures.

► Banking liquidity moves to surplus : Banking liquidity moved to surplus and the Overnight funding rate eased from 6.65-6.7% to 6.4-6.45%. Given the huge increase in banking liquidity due to the dividend by RBI and FPI flows over last two months, the central bank conducted small amount of OMO sales of Rs 7,500 cr to neutralize some of surplus liquidity, impact of the same on yields was insignificant.

Separately, RBI also released a consultation paper tweaking Bank Liquidity Coverage Ratio (LCR) requirement which if implemented would lead to additional demand for liquid assets particularly, government bonds of Rs 2 trillion from FY26.

► Indian currency weakens : In light of recent depreciation of Japanese Yen, Chinese Yuan, Indonesia rupiah and other emerging/developed markets currencies and looming fears of geopolitical risks/ trade wars and tariffs, markets are generally worried about possibility of near term rupee depreciation and its implications on monetary policy. We believe that rupee would continue to remain stable and do not expect any major volatility or depreciation in FY25.

Market view

Overall, the yields on 10-year Indian government bonds rallied by more than 10 bps over the month while those on the 10 year US Treasuries were down by more than 35 bps. Given the easing of banking liquidity, yields on short term/money market curve too saw a rally of 10-25 bps. Concurrent to our view, in its third policy of FY25, the RBI retained a pause on interest rates for the ninth consecutive time. The MPC noted that the outlook for domestic economic activity remains robust given strong domestic demand and a resilient macroeconomic environment. Expectations of La Nina and rising reservoir levels coupled with better kharif sowing would lead to better rural consumption. We believe that if monsoons are on track and food inflation subsides, there is very high probability of RBI changing its course on monetary policy from October. We expect RBI to deliver about 50 bps of rate cut in this rate cycle. Separately, rupee is at all-time low while the forex reserves are at an all time high of US$675 Bn, FPI flows in both debt and equity have been strong to the tune of US$7 bn and commodity prices weakIn light of weak macroeconomic data, US treasury yields have started pricing in more than 250 bps rate cuts in next 12 months starting from September 2024. US bond markets will continue to trade in a range of 3.75-4.25% as Fed starts to cut rate from September, high US fiscal deficits will not allow massive rally in US yields.

Our core view continues to remain constructive on rates due to positive demand supply dynamics especially for Indian government bonds, lower inflation and stable external sector outlook. Accordingly, we expect 50 bps of rate cut in this rate cut cycle. Our portfolio allocation has tilted towards a higher Gsec and 1-3 year corporate bonds in anticipation of continued FPI flows in government bonds due to JP Morgan inclusion and tweaking of LCR guidelines.

Risks to view

a) A depreciation in rupee could prompt RBI to be on a cautious mode delaying rate cuts

b) Geopolitical risks can cause a flare up in crude oil prices and the Fed could be slower in lowering rates leading to a rise in bond yields

c) Elections in the US could lead to volatility in bond yields

Positioning & Strategy

We do expect the 10-year bond yields to trade in a narrow range of 6.85-7% in the near term and to soften below 6.75% over the next few quarters.

From a strategy perspective, we have maintained an overweight duration stance within the respective scheme mandates. Accordingly, investors should continue to build and hold duration across their portfolios. Investors could use this opportunity to invest in Short to Medium term funds with tactical allocation to gilt funds.

Source: Bloomberg, Axis MF Research.