► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Expect lower interest rates in the second half of Fy25.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-3-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-3-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

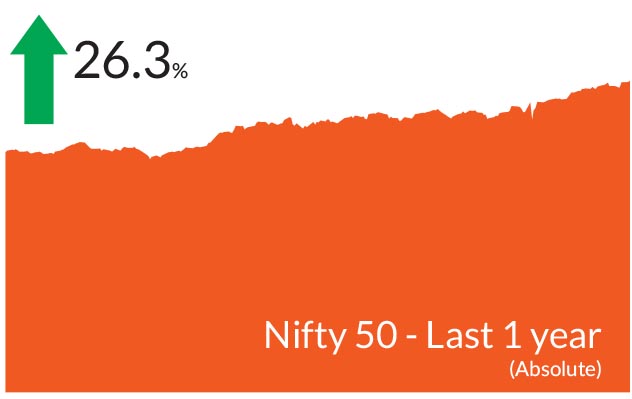

Indian equites advanced over the month buoyed by expectations from

the budget. Although markets saw a knee jerk reaction on the day of

budget, they subsequently recovered and crossed all time highs. The

BSE Sensex and the NIFTY 50 ended 3.4% and 3.9% up respectively.

Amongst other indices, both the mid-caps and small caps gained during

the month. The NIFTY Midcap 100 ended the month higher 5.8% while

NIFTY Small Cap 100 ended 4.5% up. The number of stocks trading

above their respective 200- day moving averages was higher at 95% in

July vs. 88% in June. The advance-decline line was up 3% in July while

volatility was down.

Overall, the month was positive for Indian Bonds given a better demand supply outlook, weaker oil and commodity prices and lower fiscal deficit numbers in the budget. Consequently, the yields on the 10 year government bonds ended 8 bps lower at 6.93%. Foreign Portfolio Investors (FPI) flows was positive in July and stood at US$2.7 bn over the month. Year to date, cumulative debt inflows amounted to US$10.9 bn. Yields on US Treasuries ended 37 bps lower at 4.03% on weaker macroeconomic data.

► Budget reaffirms path of consolidation and continuity : Budget continued on its path of fiscal consolidation and Policy continuity and the government reduced the fiscal deficit from 5.1% to 4.9% and the glide path suggested 4.5% in FY26. From the perspective of bond markets, there was no significant deviation from Interim budget both in terms of spending and borrowing numbers, hence the price reaction post the budget on yields was very muted.

► Inflationary pressures persist : Banking liquidity has remained in Headline inflation rose over the month to 5.1% from 4.75% in the previous month in light of higher food inflation. Nonetheless, we do not expect inflation to rise and a better monsoon coupled with favourable base effects could lead to lower CPI prints in July. Furthermore, crude oil was 6.6% lower over the month and we do not expect crude to add to inflationary pressures.

► Banking liquidity moves to surplus : Banking liquidity moved to surplus and the Overnight funding rate eased from 6.65-6.7% to 6.4-6.45%. Given the huge increase in banking liquidity due to the dividend by RBI and FPI flows over last two months, the central bank conducted small amount of OMO sales of Rs 7,500 cr to neutralize some of surplus liquidity, impact of the same on yields was insignificant.

Separately, RBI also released a consultation paper tweaking Bank Liquidity Coverage Ratio (LCR) requirement which if implemented would lead to additional demand for liquid assets particularly, government bonds of Rs 2 trillion from FY26.

► Indian currency weakens : In light of recent depreciation of Japanese Yen, Chinese Yuan, Indonesia rupiah and other emerging/developed markets currencies and looming fears of geopolitical risks/ trade wars and tariffs, markets are generally worried about possibility of near term rupee depreciation and its implications on monetary policy. We believe that rupee would continue to remain stable and do not expect any major volatility or depreciation in FY25.

Overall, the month was positive for Indian Bonds given a better demand supply outlook, weaker oil and commodity prices and lower fiscal deficit numbers in the budget. Consequently, the yields on the 10 year government bonds ended 8 bps lower at 6.93%. Foreign Portfolio Investors (FPI) flows was positive in July and stood at US$2.7 bn over the month. Year to date, cumulative debt inflows amounted to US$10.9 bn. Yields on US Treasuries ended 37 bps lower at 4.03% on weaker macroeconomic data.

Key Market Events

►Global interest rates : The gradual slowing of inflation and weakening pace of economic activity, particularly in the labour markets make a case for lower interest rates in the US. Yields on US Treasuries have started pricing in more than 250 bps rate cuts in next 12 months starting from September 2024. After having started the easing cycle, one can expect the central banks of Europe, Canada and Switzerland to further lower interest rates. In a surprise move, the Bank of Japan hiked interest rates. In India, higher growth coupled with sustained food inflation prompted the Reserve Bank of India (RBI) to remain on a pause in its August monetary policy.► Budget reaffirms path of consolidation and continuity : Budget continued on its path of fiscal consolidation and Policy continuity and the government reduced the fiscal deficit from 5.1% to 4.9% and the glide path suggested 4.5% in FY26. From the perspective of bond markets, there was no significant deviation from Interim budget both in terms of spending and borrowing numbers, hence the price reaction post the budget on yields was very muted.

► Inflationary pressures persist : Banking liquidity has remained in Headline inflation rose over the month to 5.1% from 4.75% in the previous month in light of higher food inflation. Nonetheless, we do not expect inflation to rise and a better monsoon coupled with favourable base effects could lead to lower CPI prints in July. Furthermore, crude oil was 6.6% lower over the month and we do not expect crude to add to inflationary pressures.

► Banking liquidity moves to surplus : Banking liquidity moved to surplus and the Overnight funding rate eased from 6.65-6.7% to 6.4-6.45%. Given the huge increase in banking liquidity due to the dividend by RBI and FPI flows over last two months, the central bank conducted small amount of OMO sales of Rs 7,500 cr to neutralize some of surplus liquidity, impact of the same on yields was insignificant.

Separately, RBI also released a consultation paper tweaking Bank Liquidity Coverage Ratio (LCR) requirement which if implemented would lead to additional demand for liquid assets particularly, government bonds of Rs 2 trillion from FY26.

► Indian currency weakens : In light of recent depreciation of Japanese Yen, Chinese Yuan, Indonesia rupiah and other emerging/developed markets currencies and looming fears of geopolitical risks/ trade wars and tariffs, markets are generally worried about possibility of near term rupee depreciation and its implications on monetary policy. We believe that rupee would continue to remain stable and do not expect any major volatility or depreciation in FY25.

Market View

Equity MarketsTwo of the most awaited events - the elections and budget have finally passed. Markets have witnessed runup as well as volatility based on these events and all indices touched lifetime highs. With slowing global growth particularly in the US and markets being overvalued across the investment part of the economy,we may see normalisation in some of these segments. After 3 years of above 20% earnings growth, a slowdown is visible this quarter and growth is likely to be less than 15% this year. In addition, equity supply has also picked up with stake sales by promoters, PE and large pipeline of IPOs. These could be the likely triggers going forward in addition to the outcome of US presidential elections and global geopolitics. Having said that, any declines are likely opportunities to increase exposure to equities. One must remember that markets never move in a straight line but in cycles and it would be prudent to stay invested at all times based on investor goals, investment horizon and risk profile with a long-term view. India remains one of the fastest growing economies globally. Macros remain strong with an easing inflation cycle, progress of monsoons and robust economic growth.

The government initiatives aimed at boosting employment is expected to aid consumption. Gradual signs are visible in the form of improving FMCG sales in rural areas, two wheeler sales and improving kharif crop sowing levels. We expect consumption growth to be broad based and an above normal monsoon coupled with the festive season to support this consumption. The trend of premiumisation continues, benefiting various segments within consumer discretionary. Automobiles, real estate, and high-end retail have all experienced growth. The housing sector is witnessing increased absorption across India, and with the government's emphasis on affordable housing, building materials and related industries are poised to benefit. We maintain our overweight stance in these sectors.

Even though there is no change in the capex expenditure compared to the interim budget, it is a 17% growth on YOY terms, which in itself is a healthy figure. The fiscal discipline by the government will translate to crowding in for private investments. With the government also emphasizing on private capex, the entire curve of the capex cycle stands to benefit in light of multiple enablers such as deleveraged corporate balance sheets, healthy profitability, rising domestic demand, and increasing capacity utilization. Accordingly, we are overweight on the infrastructure, manufacturing, utilities and transport. We maintain a bias to holdings in sectors that can benefit from government policies such as energy, defense, power. We have an underweight in the exportoriented segment, attributing this to global economic slowdown.

Debt Markets

Overall, the yields on 10-year Indian government bonds rallied by more than 10 bps over the month while those on the 10 year US Treasuries were down by more than 35 bps. Given the easing of banking liquidity, yields on short term/money market curve too saw a rally of 10-25 bps. Concurrent to our view, in its third policy of FY25, the RBI retained a pause on interest rates for the ninth consecutive time. The MPC noted that the outlook for domestic economic activity remains robust given strong domestic demand and a resilient macroeconomic environment. Expectations of La Nina and rising reservoir levels coupled with better kharif sowing would lead to better rural consumption. We believe that if monsoons are on track and food inflation subsides, there is very high probability of RBI changing its course on monetary policy from October. We expect RBI to deliver about 50 bps of rate cut in this rate cycle. Separately, rupee is at all-time low while the forex reserves are at an all time high of US$675 Bn, FPI flows in both debt and equity have been strong to the tune of US$7 bn and commodity prices weak

In light of weak macroeconomic data, US treasury yields have started pricing in more than 250 bps rate cuts in next 12 months starting from September 2024. US bond markets will continue to trade in a range of 3.75-4.25% as Fed starts to cut rate from September, high US fiscal deficits will not allow massive rally in US yields.

Our core view continues to remain constructive on rates due to positive demand supply dynamics especially for Indian government bonds, lower inflation and stable external sector outlook. Accordingly, we expect 50 bps of rate cut in this rate cut cycle. Our portfolio allocation has tilted towards a higher Gsec and 1-3 year corporate bonds in anticipation of continued FPI flows in government bonds due to JP Morgan inclusion and tweaking of LCR guidelines.

Source: Bloomberg, Axis MF Research.