|

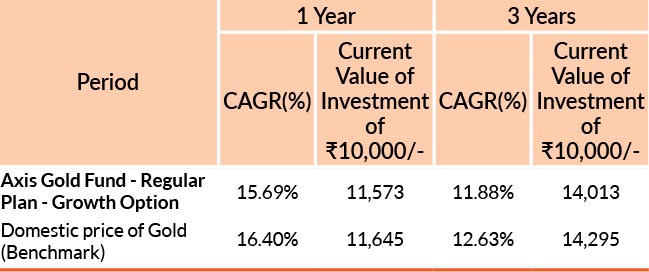

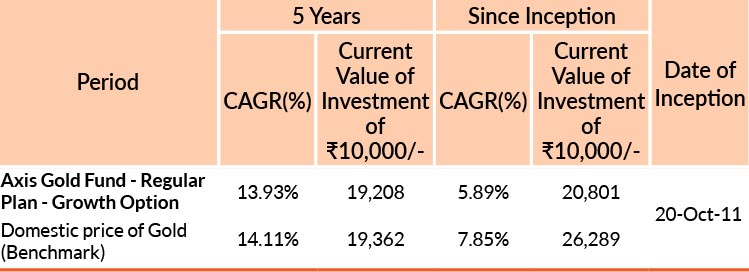

DATE OF ALLOTMENT | 20th October 2011 |

|

MONTHLY AVERAGE | 513.94Cr. |

| AS ON 31st July, 2024 | 500.49Cr. | |

|

BENCHMARK | Domestic Price Of Gold |

|

FUND MANAGER | |

| Mr. Aditya Pagaria Work experience: 16 years.He has been managing this fund since 9th November 2021 | ||

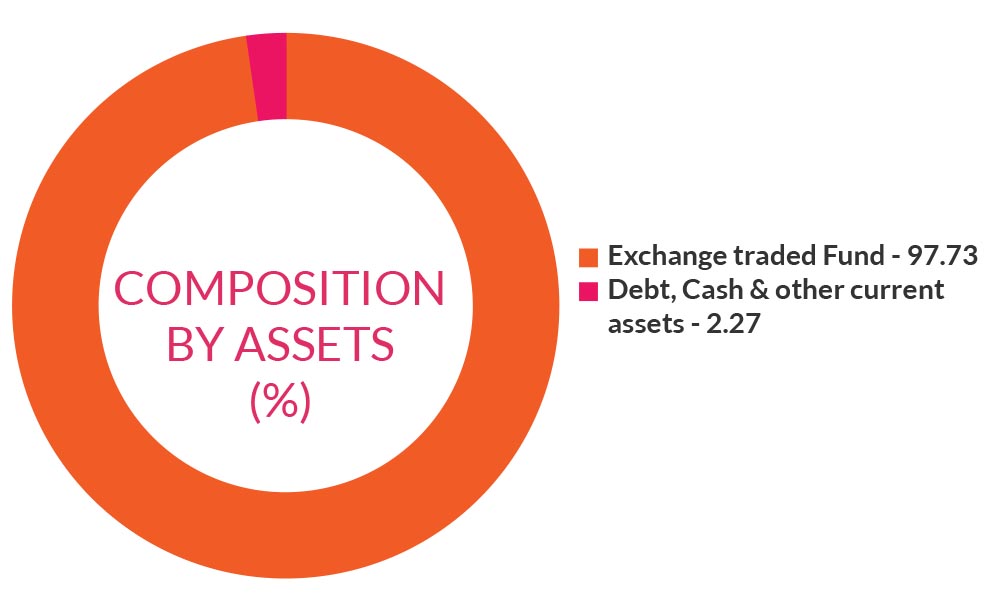

| Instrument Type/ Issuer Name | % OF NAV |

| EXCHANGE TRADED FUND | 97.73% |

| Axis Gold ETF | 97.73% |

| DEBT, CASH & OTHER CURRENT ASSETS | 2.27% |

| GRAND TOTAL | 100.00% |

Past performance may or may not be sustained in future. Different plans have different expense structure. Aditya Pagaria is managing the scheme since 9th November 2021 and he manages 20 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹ 10.

Entry Load : NA

Exit Load : Exit Load of 1% is payable if Units are redeemed / switched-out within

15 days from the date of allotment.

Note: Investors will be bearing the recurring expenses of the scheme, in addition to the expenses of the

schemes, in which Fund of Funds schemes make investments.

Please click here for NAV,

TER,

Riskometer &

Statutory Details.