Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

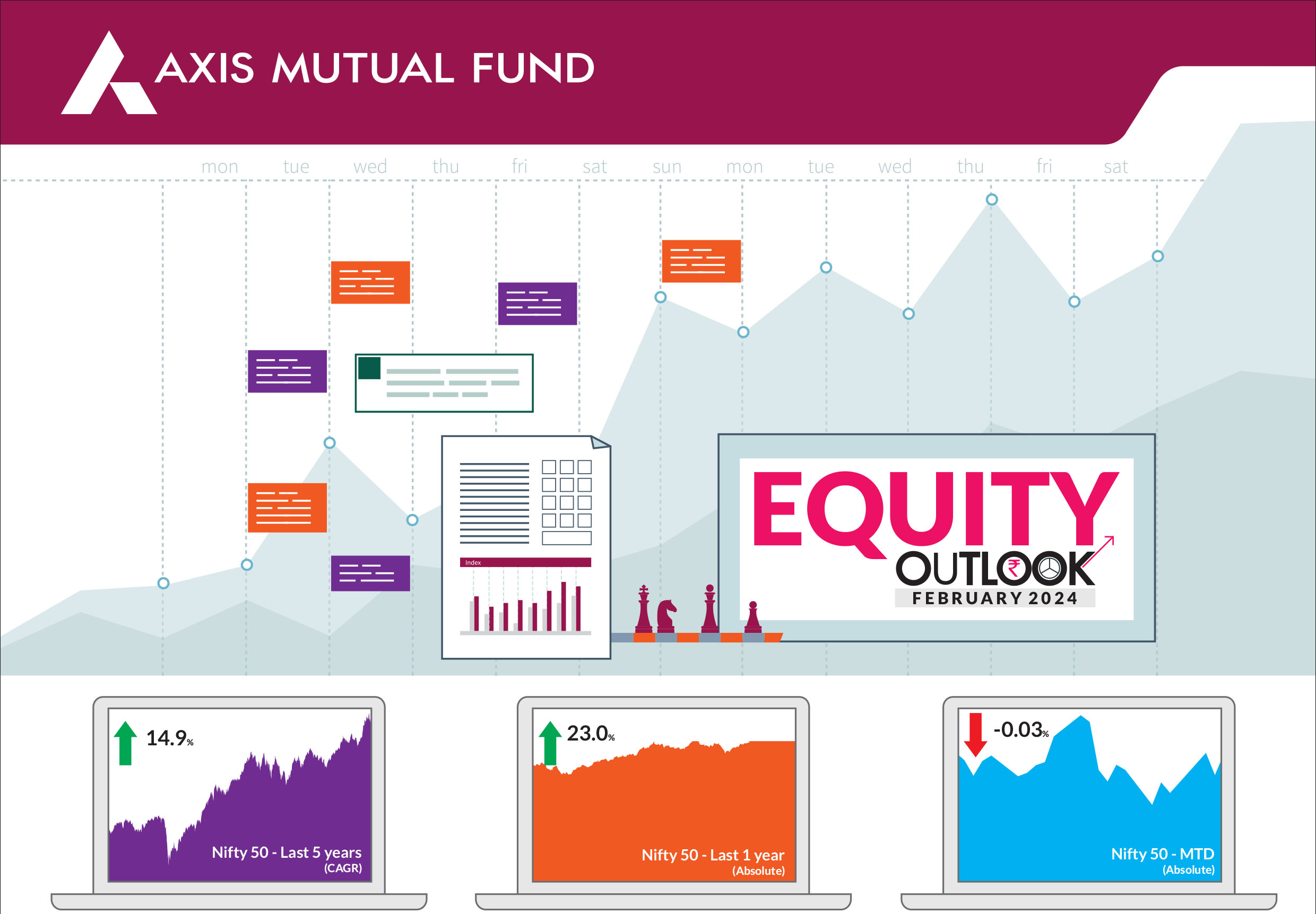

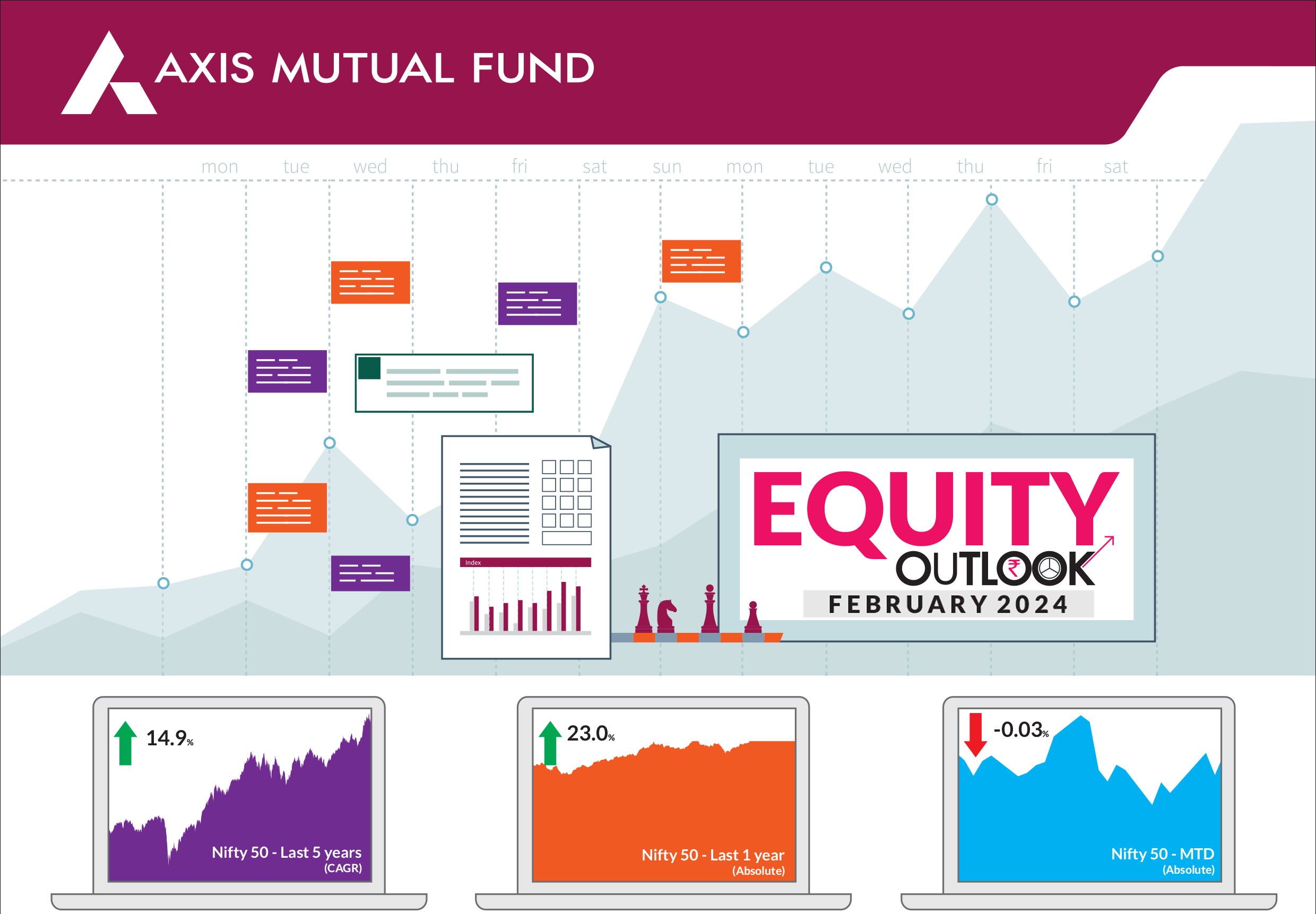

After a strong 2023 and two months of consecutive positive returns, Indian equities posted mixed returns. The S&P BSE Sensex ended 0.7% lower and the NIFTY 50 managed to stay afloat, and ended flat. In contrast the NIFTY Midcap 100 & NIFTY Small cap 100 ended the month up 5.2% & 5.8% respectively. Market breadth was strong as seen in the advance/decline ratio while volatility was higher compared to the previous month. Markets were influenced by the ongoing earnings season, expectations from the interim budget, the Federal Reserve policy meeting and tensions in the Middle East. Nonetheless, despite the volatility, India moved a rank higher in terms of equity market capitalisation, pushing Hong Kong to the fifth spot. Following robust inflows of US$7.9 bn in December, FPI turned net sellers in January, with outflows of US$3.1 bn. Domestic Institutional Investors (DIIs) emerged as the key counterpoint to FPI selling, pumping in US$ 3.3 bn into equities. This sustained buying spree by DIIs, primarily insurance companies and mutual funds, provided much-needed support to the markets. While the broader market remained range-bound, sector-specific trends painted a different picture. Infrastructure and real estate stocks, buoyed by positive budget expectations, outperformed. Conversely, IT and pharma stocks faced headwinds due to global uncertainties and regulatory concerns. |

|

The Q3FY24 results season is underway and so far, 16 Sensex and 18 Nifty companies have reported revenue, EBITDA and net profit growth rates of 5%, 13% and 17% YoY, respectively. Profit growth was strongest for oil PSUs, construction materials, public sector banks and autos, while technology reported a decline in profit. Materials, consumer discretionary and energy led the beats vs. analysts /market expectations, while utilities missed the most. Margins expanded the most for materials, while financials reported the highest contraction. As widely expected, the vote on account / Interim Budget 2024-25 was more an affirmation of intent of the government outlining the fiscal strategy if it comes into power. Accordingly, the highlight of the Budget was the reduction in fiscal deficit to 5.1% by FY25, following the path of fiscal consolidation. The capex outlay has been another area of focus where the outlay has been increased to 11.11 lakh crore, up 11.1% for FY24, ie 3.4% of GDP. The government also spelled out its gross and net market borrowing which were albeit lower than FY24. The gross market borrowings will be Rs 14.13 lakh crore and net borrowing would be Rs 11.75 lakh crore. The budget, the last from the current government, ahead of the elections, retained income tax rates and slabs and refrained from any populist measures. Overall, the budget is favourable for equity markets given the higher capex spending and no measures taken on the direct taxes. The fact that government prioritized fiscal prudence over populist measures is commendable. We believe the boost to housing will have a multiplier effect on the economy, benefitting construction related sectors and cement, steel etc. Overall, the government's intent to boost economic growth can be seen. During the period, value outperformed all styles, while PSUs outperformed the broader markets. We have increased exposure across the investment segment of the markets, and have been adding breadth to our portfolios. We have introduced PSUs in some of our funds and remain positive automobiles, pharma, real estate and underweight banks but overweight NBFCs. January showed how volatility could play out and corrections are periods when one should remain invested. A rotation to large-caps may be imminent and some caution in mid-caps is warranted bringing us to the important aspect that's valuations. Currently, valuations in India are expensive relative to the Asian peers and India remains the most expensive market (on both forward P/E and trailing P/B basis). With interim budget finally out of the way, all focus remains on the upcoming elections. The budget stayed clear of any populist measures which markets had anticipated could boost consumption. It remains to be seen how the consumption story could play out given the lack of any triggers. Post elections, the private sector will drive India's capex and in effect growth story. In the near term, slowing growth in the developed economies could exert pressure on external demand thereby acting as a drag on exports. Nonetheless, we believe India has the right ingredients in place to set the momentum further over the medium to long term. Our country continues to be one of the few geographies globally that continues to record strong GDP growth and the multiple positive drivers should help it sustain over the medium to long term. |

Source: Bloomberg, Axis MF Research.