•

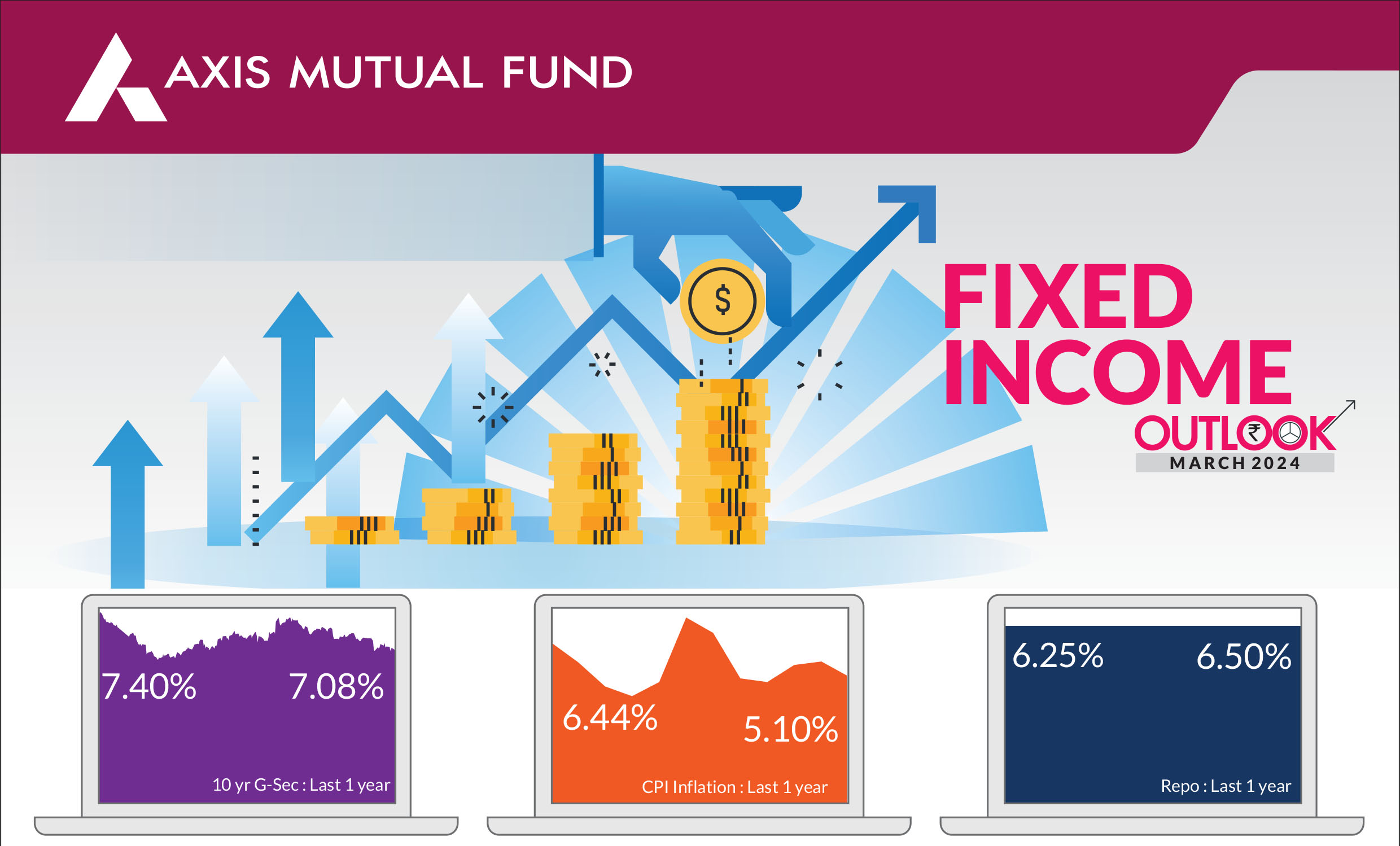

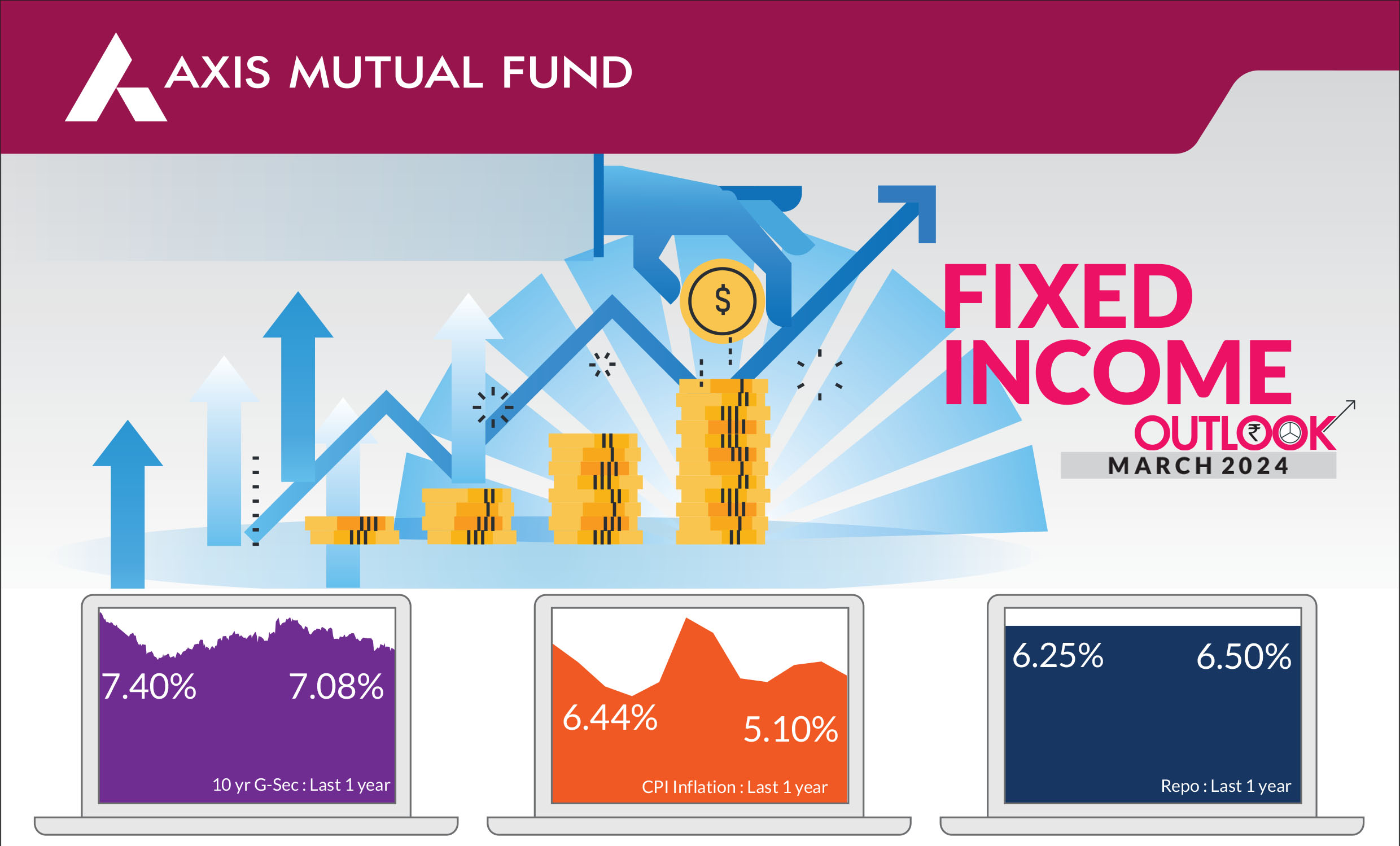

Expect lower interest rates by

the second half of 2024.

• Investors should add duration

with every rise in yields, as

yield upside limited.

•

Mix of 10-year duration and

3-5-year duration assets are

best strategies to invest in the

current macro environment.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals.

Bond markets were driven by the outlook for the US economy as higher inflation, low consumer confidence and pushed back expectations of interest rate cuts. Consequently, yields on US Treasuries rose over the month on tempered rate expectations. In contrast, Indian government bond yields fell for the fourth consecutive month, trading in a narrow band of 7.05-7.15% and ending at 7.08%. Another factor that helped subdue yields was the Foreign Portfolio Investors (FPI) flows into government bonds ahead of India's inclusion in the JP Morgan indices. FPI's were buyers of debt to the tune of US$2.7 bn (the highest in over six years).

► Global interest rate environment:

US Treasury yields further rose over the month as higher than expected

headline inflation led investors to shift expectations of interest rates cuts

from March to May/June. The yields on the 10-year benchmark Treasuries

rose 34 bps in February while the yields on the 2-year Treasuries ended 41

bps up at 4.62%. The European Central Bank (ECB) is also projected to lower

rates in June with inflation declining and economic growth stagnant while the

Bank of England could be the last of the central banks in the developed

markets to lower interest rates. Meanwhile, the Reserve Bank of India (RBI)

left its interest rates unchanged and revised its GDP forecasts.

In Japan, expectations are increasing for the Bank of Japan to end its eight year stretch of negative interest rates in April along with its yield curve policy. In China, investor confidence was boosted due to a series of government measures aimed at supporting both the economy and financial markets. This included a 25 basis point reduction in the 5-year Loan Prime Rate, which serves as the benchmark interest rate for mortgage loans.

In Japan, expectations are increasing for the Bank of Japan to end its eight year stretch of negative interest rates in April along with its yield curve policy. In China, investor confidence was boosted due to a series of government measures aimed at supporting both the economy and financial markets. This included a 25 basis point reduction in the 5-year Loan Prime Rate, which serves as the benchmark interest rate for mortgage loans.

► Inflationary pressures cool while oil prices heat up:

CPI slowed to 5.1% in

January, vs 5.7% in December, while core CPI moderated further to 3.6%. The

decline was led by a moderation in food prices increased, especially

vegetables. The government's proactive supply-side management and

progress on rabi sowing will provide some degree of comfort. Meanwhile, oil

prices stayed above the 80-mark for most part of February amid uncertainty

over the prospects of a ceasefire between Israel - Hamas leading to higher

shipping costs.

► Economic growth buoyant, macro steady: GDP growth improved to 8.4% in Q4FY24 as against the 8.1% seen in the previous quarter, led by a sharp increase in net indirect taxes. GVA which adds up production (across agriculture, industry and services) grew by 6.5% vs 7.7% in the previous quarter. Data pointed out to improving consumption albeit at a slower pace and robust trend in capex. Additionally, GDP numbers were revised for theprevious two years which also impacted growth due to base effect. Nominal growth for the quarter stood at 10.1%. Most monthly high frequency indicators remain robust. Private consumption (especially rural consumption) continues to remain weak and is a concern as it is much weaker than overall GDP growth. Meanwhile, RBI has upped its growth projection to 7.0% for FY24 (also projected 7.0% for FY25) due to strong growth in the first half of FY24.

► Economic growth buoyant, macro steady: GDP growth improved to 8.4% in Q4FY24 as against the 8.1% seen in the previous quarter, led by a sharp increase in net indirect taxes. GVA which adds up production (across agriculture, industry and services) grew by 6.5% vs 7.7% in the previous quarter. Data pointed out to improving consumption albeit at a slower pace and robust trend in capex. Additionally, GDP numbers were revised for theprevious two years which also impacted growth due to base effect. Nominal growth for the quarter stood at 10.1%. Most monthly high frequency indicators remain robust. Private consumption (especially rural consumption) continues to remain weak and is a concern as it is much weaker than overall GDP growth. Meanwhile, RBI has upped its growth projection to 7.0% for FY24 (also projected 7.0% for FY25) due to strong growth in the first half of FY24.

Market view

Inflation prints came higher than expected across economies, however, inflation is slowing down overall. Following Fed speak in late January, investors have pushed back expectations of rate cuts to May-June 2024 which aligns with our view on the US. We do believe that the ECB will also look at lowering interest rates around the same time as the Fed. We do believe that from here yields could have a limited upside as interest rate cuts are definitely on the cards. Even our central bank could take cues from the central banks of the US and Europe. Furthermore, RBI may want to lower interest rates after the elections are over.Concurrent to our view, the RBI retained a pause on interest rates for the sixth consecutive policy. The governor highlighted uncertainty around inflationary pressures in the near term, and added that the RBI was mindful of it and expected inflation to fall lower to 4% by Q2FY25. We had expected a change in liquidity stance which did not materialize. Nonetheless, as RBI mentioned, we do believe the central bank will effectively utilize liquidity management tools. The RBI is comfortable with the inflation trajectory and has revised its growth targets. With policy rates remaining incrementally stable, we remain long duration across our portfolios within the respective scheme mandates. The path of fiscal consolidation, demand supply dynamics in government bonds, a benign global environment and expectations of falling interest rates in the US, Europe and in India make an interesting theme for a long duration stance for investors.

Positioning & Strategy

Most part of the fixed income curve is pricing in cuts only after June 2024 and this goes well with our house view. With policy rates remaining incrementally stable, we have retained our long duration stance across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to soften to 6.75% over the next few months.

From a strategy perspective, while the overall call is to play a falling interest rate cycle over the next 6-12 months, markets are likely to see sporadic rate movements. From a strategy perspective, we continue to add duration across portfolios within the respective investment mandates. Investors could use this opportunity to top up on duration products with a structural allocation to short and medium duration funds and a tactical play on Gilt funds.

Source: Bloomberg, Axis MF Research.