Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

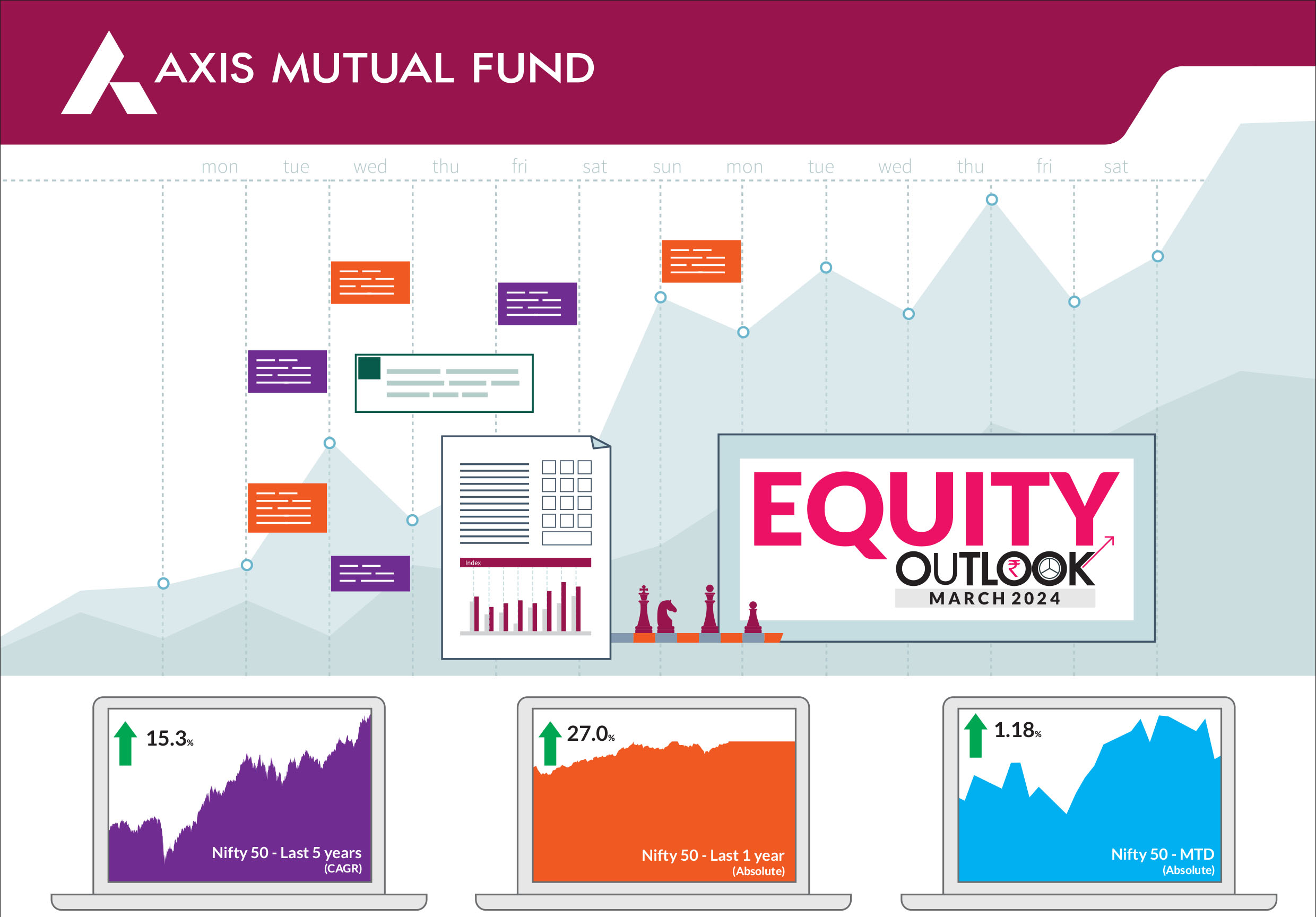

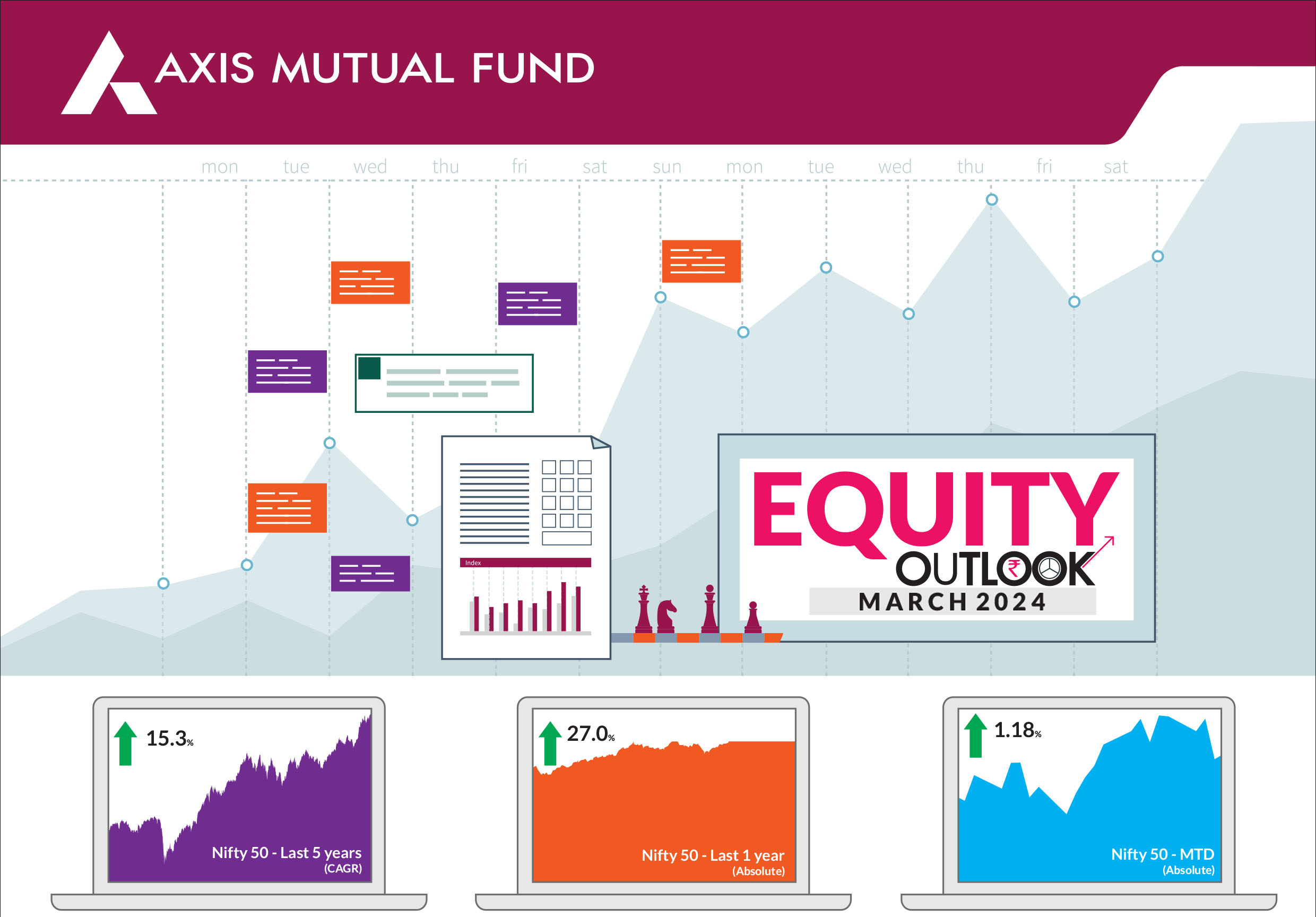

Indian equities witnessed bouts of volatility in February but ended the month higher with the Nifty 50 touching all-time highs. The S&P BSE Sensex ended 1% higher and the NIFTY 50 was up 1.2%. Mid-caps and small caps were subdued to some extent than the frontline indices and both the NIFTY Midcap 100 & NIFTY Small cap 100 ended the month slightly down 0.5% and 0.3%. Market volatility was lower compared to the previous month while the advance decline line was down 13% in February. |

|

The Q3FY24 earnings season concluded, and earnings growth trend remained intact, with margins expanding for the fourth consecutive quarter. Broad market earnings outperformed the narrow market. With markets at or near all-time highs, investors should be cautious of potential volatility in the near term. Valuations in India are expensive relative to the Asian peers and India remains the most expensive market (on both forward P/E and trailing P/B basis). Mid-caps and small caps have experienced a sharp run, so a rotation into large caps may be warranted. Investors should focus on the long term rather than making short term decisions. We are almost heading into elections in the next two months and that could set the tone for the markets in the near term. Nonetheless, the positive long-term drivers remain in place. We believe India is on a higher growth trajectory and continues to be one of the few geographies globally that continues to record strong GDP growth. Macro indicators suggest that India's twin deficits (current account and fiscal) as well the currency are under control. Inflation although uneven over the past few months is expected to head lower as reiterated by the Reserve Bank of India. Economic growth remains strong, as evidenced bythe headline GDP print of 8.4% in Q3FY24. There have been positive revisions to the H1FY24 data as well. This growth was driven by capex. Construction was the fastest-growing component, while consumption within the rural economy was weak. We believe India's capex cycle is expected to receive a boost from increased government spending and an upturn in the real estate market. Corporate balance sheets are healthy, providing a foundation for a private capex cycle. As widely expected, the RBI kept interest rates on hold and is expected to lower them in the second half of the year, which should benefit rate-sensitive segments. In the near term, slowing growth in developed economies could exert pressure on external demand, acting as a drag on exports. We anticipate that market dynamics will be influenced by favorable cyclical factors and capex-driven segments such as infrastructure, domestic oriented manufacturing, and utilities should be the beneficiaries. Our portfolios are positioned accordingly and we are overweight these segments. We are also optimistic and overweight consumer discretionary sector, particularly automobiles and real estate. We also have exposure to sectors such as power, defense, and transportation that could benefit from government policies. As companies seek financing for expansion and new projects, banks are likely to see an increase in credit demand, which should bolster their performance. In the pharmaceutical sector, the upcycle in the US generics market is still young, and we expect the improved pricing environment to continue and strengthen. We are underweight in the exports segment due to slowing global growth. Indian mutual fund industry body, AMFI, advised fund houses to implement investor protection measures for small-cap and mid-cap investments due to concerns about high valuations and the sharp run up in these. We would like to reiterate to our investors that our midcap and small cap funds have sufficient exposure to cash and large caps, which can help maintain high liquidity in the portfolio. |

Source: Bloomberg, Axis MF Research.