•

Yield curve flat - Duration plays

can be played in the 2-4 year

segment.

• Elevated levels can be used to

lock in longer term rates.

•

Spreads between G-Sec/AAA

& SDL/AAA have seen some

widening.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals.

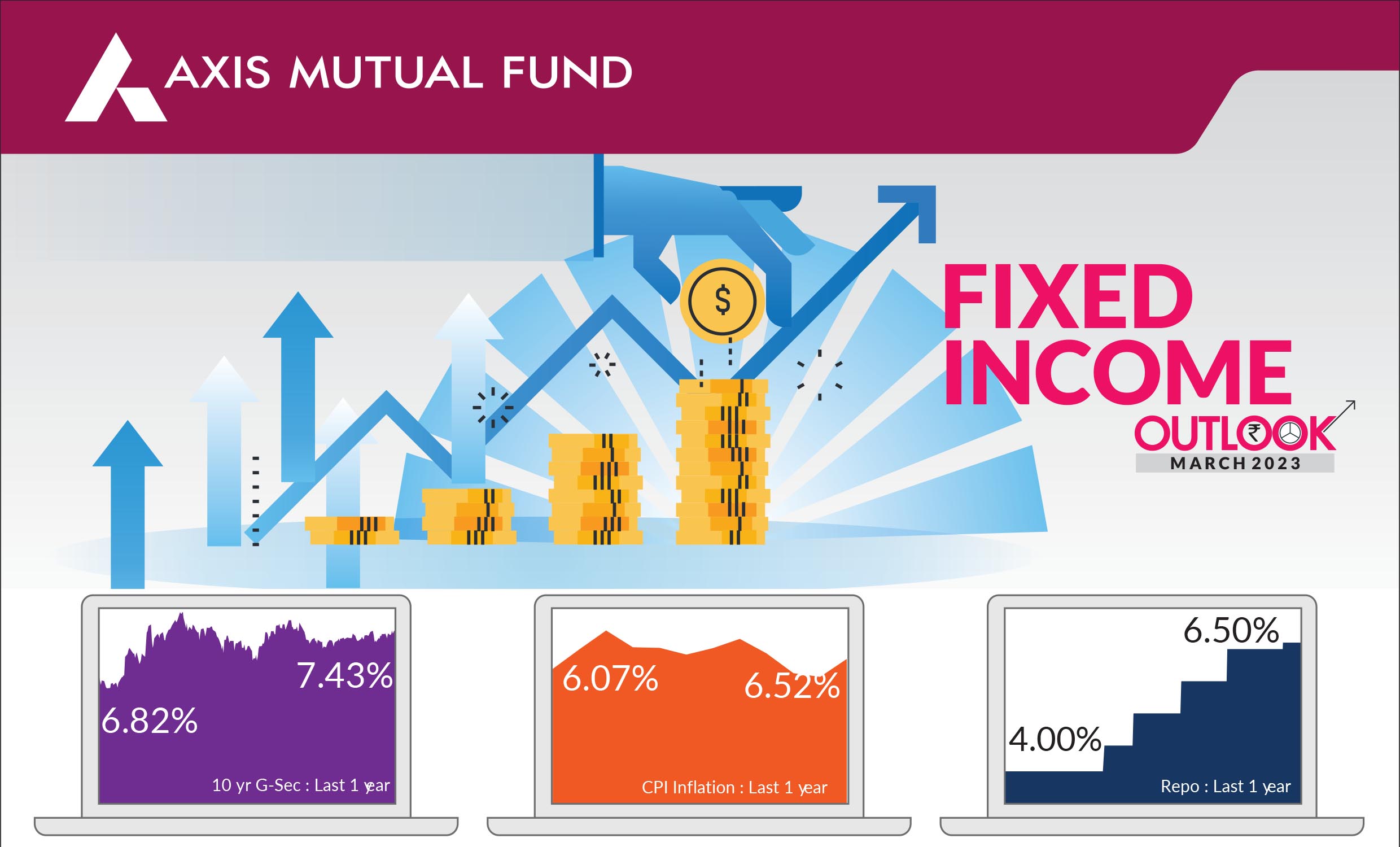

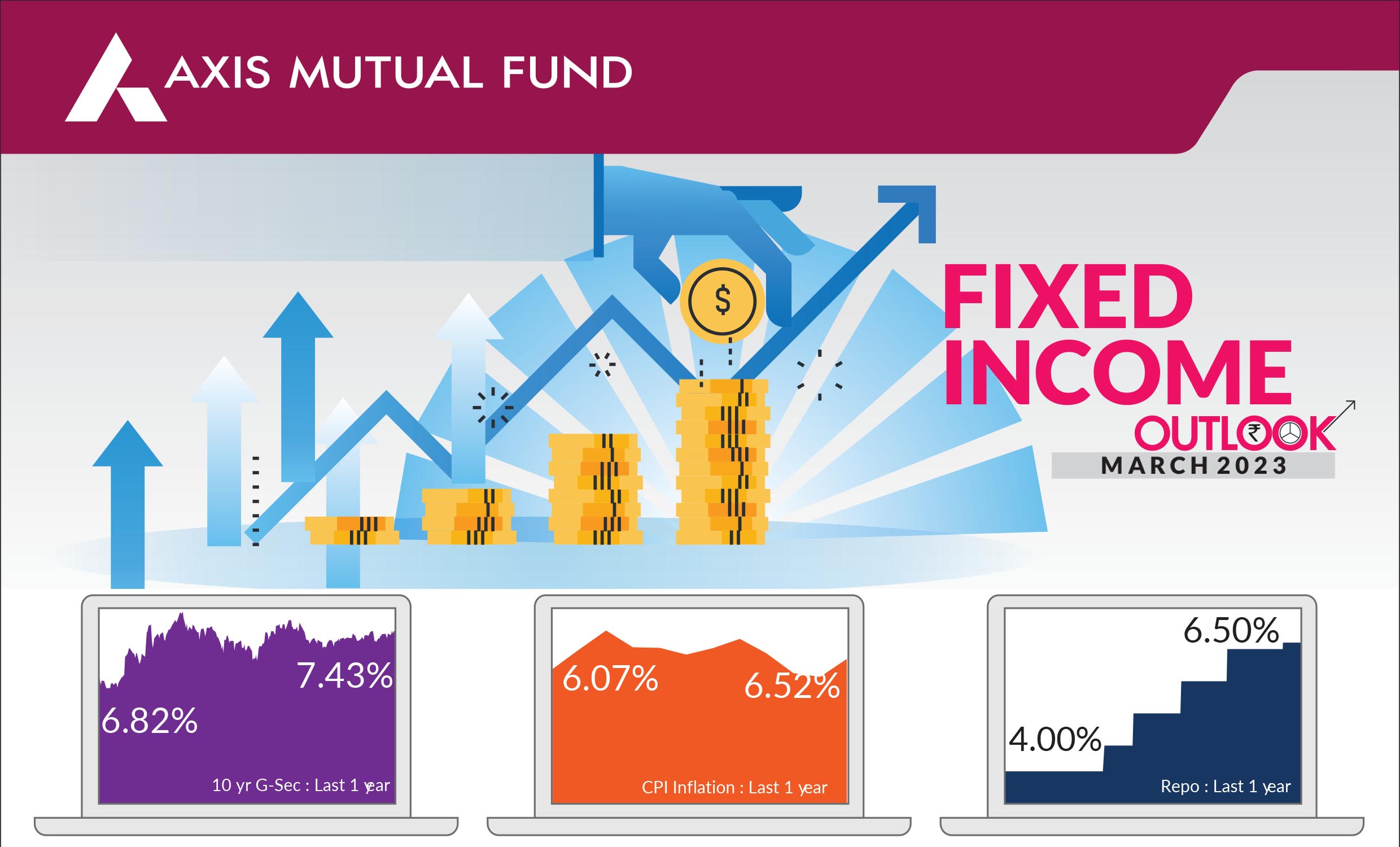

► Bond yields spike, 10 Year @7.43%: A deficit liquidity position, surge in

borrowing requirements and global risks have pushed bond yields

materially higher last month Money market rates drifted higher

between 30-45bps while 1-3-

year segment moved higher

by 30bps . The move is

typically seen during the last

quarter of the year when

liquidity tightness is seen.

Elevated levels can be used to

lock in longer term rates.

► Q3 GDP Growth @4.4% - Below Estimates: GDP growth for Q3 FY23

moderated to 4.4% well below market consensus expectations of 4.7%

driven by weaker-than-expected growth in private consumption and

decline in government consumption. Drag from lower net indirect

taxes also contributed to the downward surprise. The domestic

demand-side breakdown showed that gross fixed capital formation

rose the fastest (at 8.3% YoY). Further, net exports were less of a drag,

since imports moderated more than exports. This was widely expected

and has confirmed estimates basis high frequency indicators.

► Current Account Moderation - Positive for the INR: India's current

account dynamics are changing as rapidly on the way down as they did

on the way up. Recall, the CAD in the July-September quarter doubled

to a 9-year high of 4.4% of GDP. Since then there have been significant

improvements. The January trade deficit narrowed to a 12-month low

of $17.8 bn from a $26bn average in the July-September quarter. The

real story however has been the continuing positive surprise on the

services side, with the new-found buoyancy on service exports only

getting stronger. With this, the current account is on course to printing

close to balance in the current quarter. This could provide much

needed support to the INR.

► Inflation spike surprises, Rates view remains constructive: Retail Inflation surprised on the upside with inflation for January 2023 at 6.52%, well above the RBI's upper band. Brent crude ended the month at US$84/barrel while the India crude basket followed suit and ended the month at US$82/barrel. We believe both inflation and rates are peaking and inflation should now soften gradually in line with lower commodity prices. Interest rates are likely to remain stable from here on given the gradual build-up of stress in the economy as borrowing costs rise.

► Inflation spike surprises, Rates view remains constructive: Retail Inflation surprised on the upside with inflation for January 2023 at 6.52%, well above the RBI's upper band. Brent crude ended the month at US$84/barrel while the India crude basket followed suit and ended the month at US$82/barrel. We believe both inflation and rates are peaking and inflation should now soften gradually in line with lower commodity prices. Interest rates are likely to remain stable from here on given the gradual build-up of stress in the economy as borrowing costs rise.

Market yields have risen sharply over the last month. The current curve

remains very flat with everything in corporate bonds beyond 1 year up to 15

years is available @7.5-7.65% range. We expect the curve to remain flat for

most part of 2023. We expect long bonds to trade in a range for most part of

2023 (7-7.5%) falling CPI, weaker growth and strong investor demand

would keep yields under check despite high G-Sec supply next year.

We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios.

For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios. This however does not imply approaching the extreme long end of the yield curves as inherent volatility could be a factor in the near term.

For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. Spreads between G-Sec/AAA & SDL/AAA have seen some widening over the last month which could make a case for allocations into high quality corporate credit strategies. Lower rated credits with up to 18- month maturity profiles can also be considered as ideal 'carry' solutions in the current environment.

We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios.

For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios. This however does not imply approaching the extreme long end of the yield curves as inherent volatility could be a factor in the near term.

For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. Spreads between G-Sec/AAA & SDL/AAA have seen some widening over the last month which could make a case for allocations into high quality corporate credit strategies. Lower rated credits with up to 18- month maturity profiles can also be considered as ideal 'carry' solutions in the current environment.

Source: Bloomberg, Axis MF Research.