► Equity market valuations are broadly reasonable adjusted for the cyclical low in earnings and

potential for revival going forward.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Yield curve flat - Duration plays can be played in the 2-4 year segment.

► Elevated levels can be used to lock in longer term rates.

► Spreads between G-Sec/AAA & SDL/AAA have seen some widening.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Elevated levels can be used to lock in longer term rates.

► Spreads between G-Sec/AAA & SDL/AAA have seen some widening.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

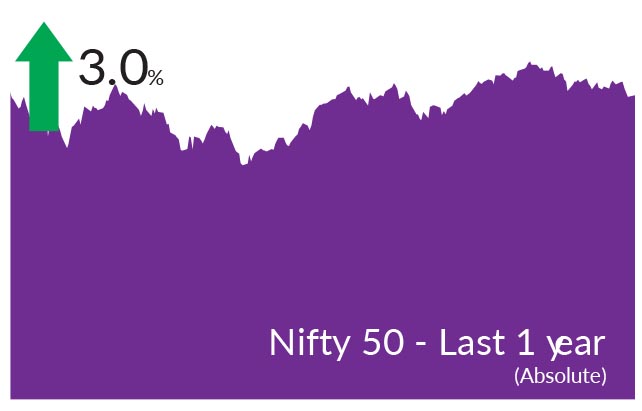

Indian markets continued their downward trajectory with a 3rd month

of investor pessimism in line with global markets. Globally, Hong Kong (-

9%), Brazil (-7%) and US Dow Jones (-4%) saw the largest drawdowns

while Taiwan (+2%) was an outlier. Investors' concerns around hawkish

policy stance by central banks, resurgent geopolitical tensions and

sharp moves in select stocks where corporate governance issues

remain in the limelight were prime reasons for the volatile month.

S&P BSE Sensex & NIFTY 50 ending the month down 1% & 2% respectively. Mid and small caps also trended in line with NIFTY Midcap 100 & NIFTY Small cap 100 ending the month down 1.8% & 3.6% respectively. FPI's continued to remain sellers in the Indian equity markets on concerns over market valuations and geopolitical risks.

► Q3 GDP Growth @4.4% - Below Estimates: GDP growth for Q3 FY23 moderated to 4.4% well below mar ket consensus expectations of 4.7% driven by weaker-than-expected growth in private consumption and decline in government consumption. Drag from lower net indirect taxes also contributed to the downward surprise. The domestic demand-side breakdown showed that gross fixed capital formation rose the fastest (at 8.3% YoY). Further, net exports were less of a drag, since imports moderated more than exports. This was widely expected and has confirmed estimates basis high frequency indicators.

► Current Account Moderation - Positive for the INR: India's current account dynamics are changing as rapidly on the way down as they did on the way up. Recall, the CAD in the July-September quarter doubled to a 9-year high of 4.4% of GDP. Since then there have been significant improvements. The January trade deficit narrowed to a 12-month low of $17.8 bn from a $26bn average in the July-September quarter. The real story however has been the continuing positive surprise on the services side, with the newfound buoyancy on service exports only getting stronger. With this, the current account is on course to printing close to balance in the current quarter. This could provide much needed support to the INR.

► Inflation spike surprises, Rates view remains constructive: Retail Inflation surprised on the upside with inflation for January 2023 at 6.52%, well above the RBI's upper band. Brent crude ended the month at US$84/barrel while the India crude basket followed suit and ended the month at US$82/barrel. We believe both inflation and rates are peaking and inflation should now soften gradually in line with lower commodity prices. Interest rates are likely to remain stable from here on given the gradual build-up of stress in the economy as borrowing costs rise.

S&P BSE Sensex & NIFTY 50 ending the month down 1% & 2% respectively. Mid and small caps also trended in line with NIFTY Midcap 100 & NIFTY Small cap 100 ending the month down 1.8% & 3.6% respectively. FPI's continued to remain sellers in the Indian equity markets on concerns over market valuations and geopolitical risks.

Key Market Events

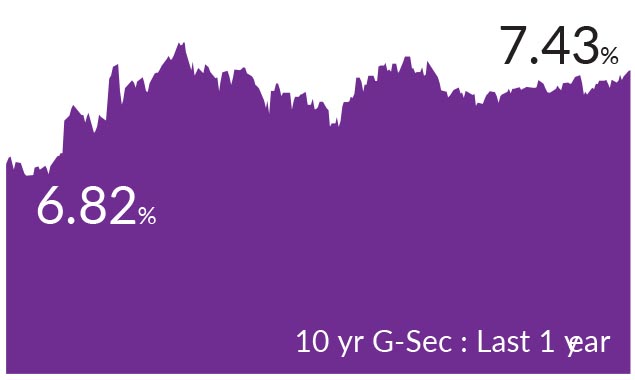

► Bond yields spike, 10 Year @7.43%: A deficit liquidity position, surge in borrowing requirements and global risks have pushed bond yields materially higher last month Money market rates drifted higher between 30-45bps while 1-3-year segment moved higher by 30 bps. The move is typically seen during the last quarter of the year when liquidity tightness is seen. Elevated levels can be used to lock in longer term rates.► Q3 GDP Growth @4.4% - Below Estimates: GDP growth for Q3 FY23 moderated to 4.4% well below mar ket consensus expectations of 4.7% driven by weaker-than-expected growth in private consumption and decline in government consumption. Drag from lower net indirect taxes also contributed to the downward surprise. The domestic demand-side breakdown showed that gross fixed capital formation rose the fastest (at 8.3% YoY). Further, net exports were less of a drag, since imports moderated more than exports. This was widely expected and has confirmed estimates basis high frequency indicators.

► Current Account Moderation - Positive for the INR: India's current account dynamics are changing as rapidly on the way down as they did on the way up. Recall, the CAD in the July-September quarter doubled to a 9-year high of 4.4% of GDP. Since then there have been significant improvements. The January trade deficit narrowed to a 12-month low of $17.8 bn from a $26bn average in the July-September quarter. The real story however has been the continuing positive surprise on the services side, with the newfound buoyancy on service exports only getting stronger. With this, the current account is on course to printing close to balance in the current quarter. This could provide much needed support to the INR.

► Inflation spike surprises, Rates view remains constructive: Retail Inflation surprised on the upside with inflation for January 2023 at 6.52%, well above the RBI's upper band. Brent crude ended the month at US$84/barrel while the India crude basket followed suit and ended the month at US$82/barrel. We believe both inflation and rates are peaking and inflation should now soften gradually in line with lower commodity prices. Interest rates are likely to remain stable from here on given the gradual build-up of stress in the economy as borrowing costs rise.

Market View

Equity MarketsSince the start of the year, markets have become more sanguine as winners of last year - momentum and beta have given way to fundamentals and quality. The limelight on corporate governance has also brought back focus on companies with a proven management track record and profit pedigree. Many of these names today trade at attractive valuations in contrast to the rest of the market. The winners of 2023 is likely to look starkly different from 2022. This coupled with buoyancy on the economic front bode well for investors looking to build a highly quality centric portfolio.

Currently, our portfolios favour large caps where companies continue to deliver on growth metrics. Corporate earnings of our portfolio companies continue to give us confidence in the strength of our portfolio companies. From a risk perspective, in the current context, given rising uncertainties our attempt remains to minimize betas in our portfolios. The markets have kept 'quality' away from the limelight for over 18 months, making valuations of these companies relatively cheap both from a historical context and a relative market context.

While we remain cautious of external headwinds, strong discretionary demand evident from high frequency indicators and stable government policies give us confidence that our portfolios are likely to weather the ongoing challenges. Markets at all-time highs also point to a valuation risk in select pockets which we will look to avoid.

Debt Markets

Market yields have risen sharply over the last month. The current curve remains very flat with everything in corporate bonds beyond 1 year up to 15 years is available @7.5-7.65% range. We expect the curve to remain flat for most part of 2023. We expect long bonds to trade in a range for most part of 2023 (7-7.5%) falling CPI, weaker growth and strong investor demand would keep yields under check despite high GSec supply next year.

We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios.

For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios. This however does not imply approaching the extreme long end of the yield curves as inherent volatility could be a factor in the near term.

For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. Spreads between G-Sec/AAA & SDL/AAA have seen some widening over the last month which could make a case for allocations into high quality corporate credit strategies. Lower rated credits with up to 18-month maturity profiles can also be considered as ideal 'carry' solutions in the current environment.

Source: Bloomberg, Axis MF Research.