Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

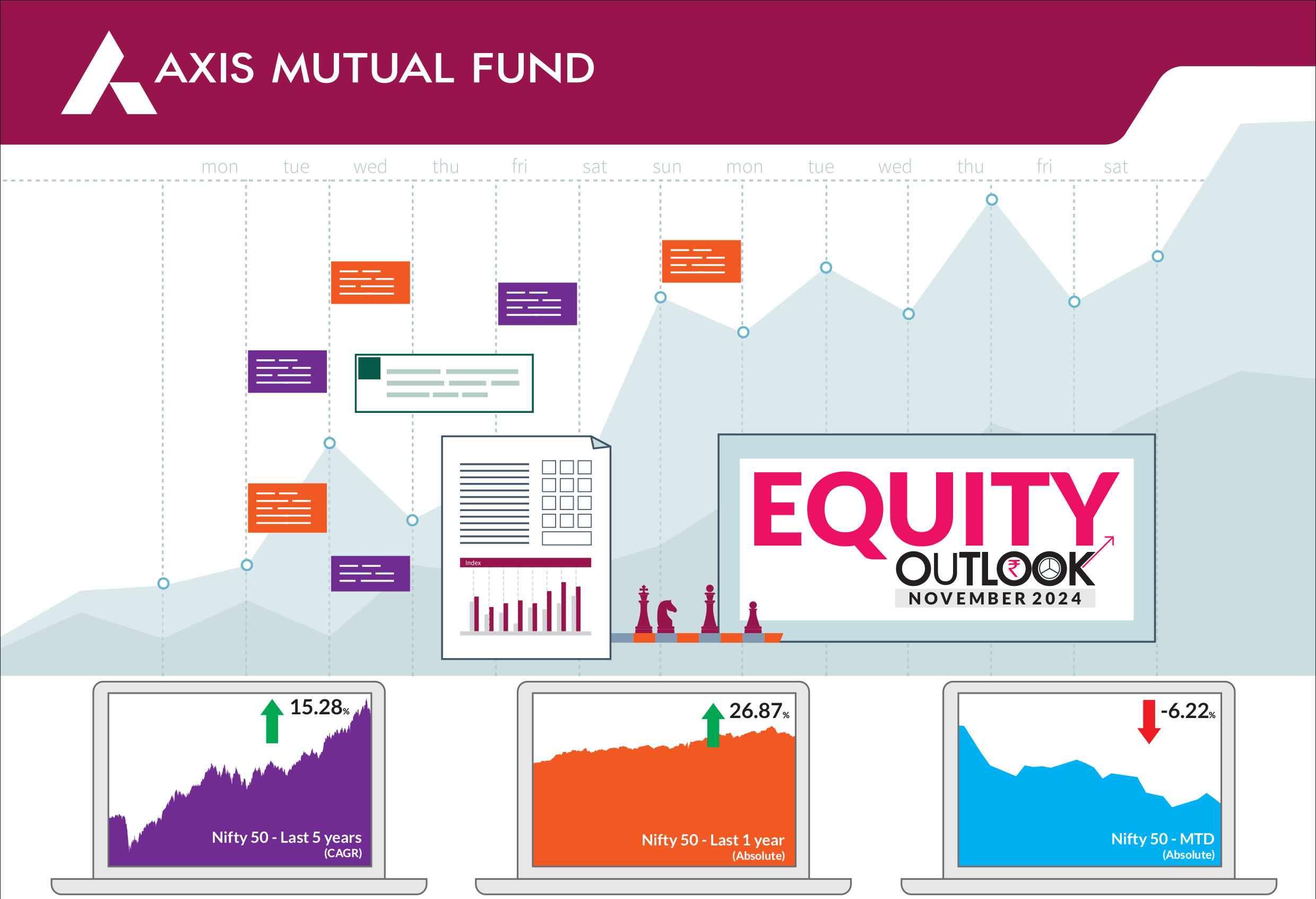

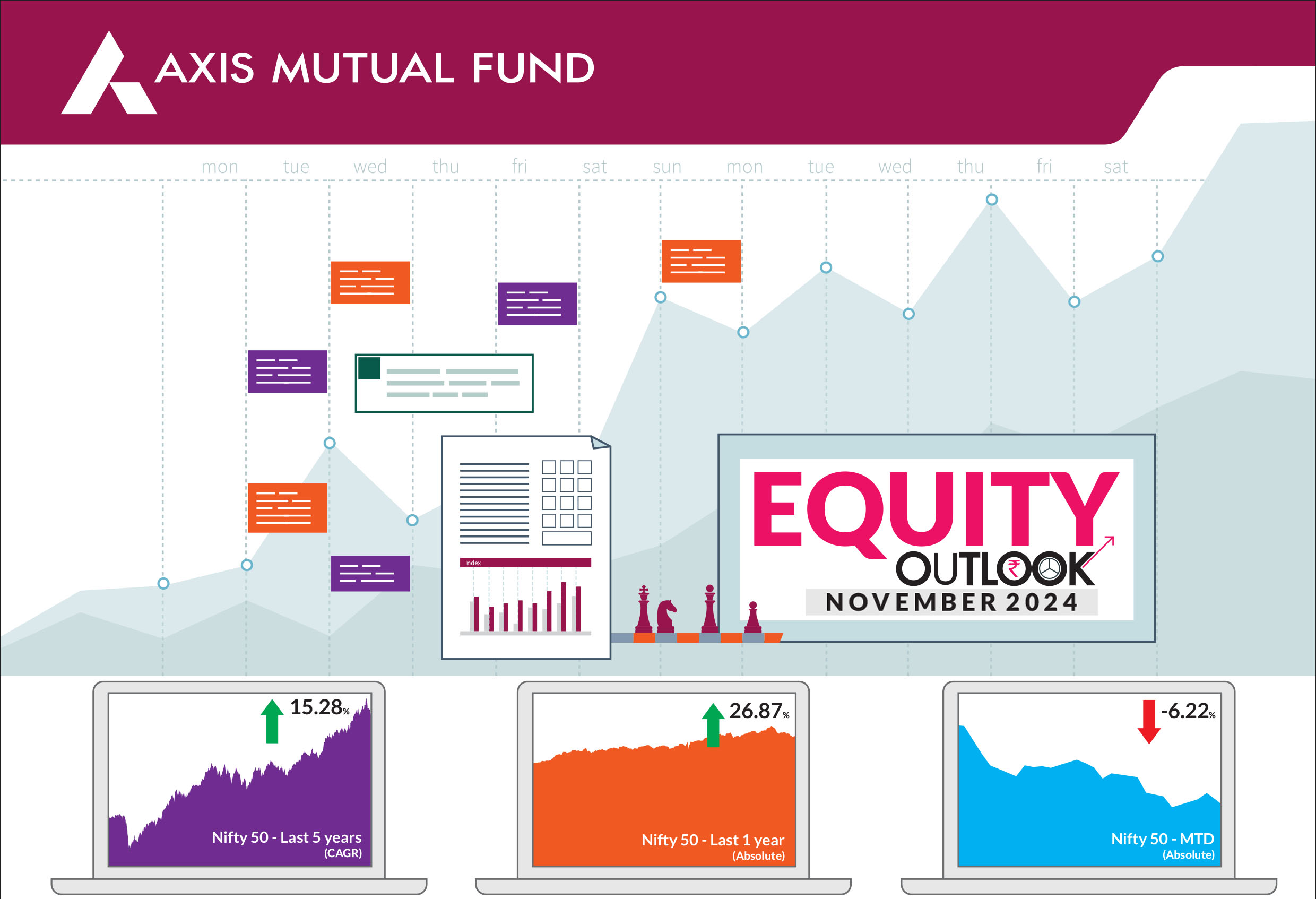

Indian equites ended October lower in a month marked by volatility. Globally, equities were impacted for many reasons - geopolitical conflicts between Iran and Israel, stimulus measures by China, rising crude oil and commodity prices and the uncertainty regarding the upcoming presidential elections in the US. India too was impacted by global developments. In addition, weaker than expected second quarter results, elevated valuations and foreign fund outlows resulted in markets retreating from all-time highs. To set the context, NSE 500 saw 175 stocks fall 25% from their highs in October while benchmark indices witnessed a fall of 8-10% from their lifetime highs seen in September. The BSE Sensex and the NIFTY 50 ended the month lower by 5.8% and 6.2% respectively. The NIFTY Midcap 100 ended the month lower 6.7% while NIFTY Small Cap 100 ended 3.2% lower and outperformed both large and mid caps. |

|

The second quarter earnings season has been weak so far and in line with expectations of slowing underlying growth. Companies have broadly disappointed across sectors. Consumer companies reported weak prints so far, with suggestive of a challenging demand environment. Demand has been subdued for the urban market, while rural growth contributed positively to overall growth. IT companies reported healthy performance but outlook remains somewhat cautious. Banks have done reasonably well, with moderate credit growth, stable NIMs and asset quality. Automobiles saw results aligned with expectations, mainly driven by domestic two wheeler volume growth and a sequential recovery in exports. Within consumers, results so far have been slightly lower than expected. Earnings growth for pharma companies remained healthy particularly for the domestic formulation business. Looking ahead, slowing global growth, interest rate cuts in India, the outcome of US presidential elections and geopolitical stress are the events to look out for. Given the 8-10% fall from record highs, Indian indices are now at relatively attractive valuations. Particularly in the large cap segment, valuation concerns have been declining, and concerns have shifted towards earnings growth. Our advice to our investors is to view any declines and volatility to increase exposure to equities and stay invested based on investor goals, investment horizon and risk profile with a long-term view. Overall, against the slowing global backdrop, India maintains its position as one of the fastest growing economies globally. Macros remain strong with an easing inflation cycle, good monsoons and robust economic growth. At a sector level, we remain positive on our themes of being overweight consumption, manufacturing, infrastructure and being underweight exports. Overall, we have reduced our overweight in automobiles and increased exposure to pharmaceuticals and banks. We maintain an overweight in capital goods and within this segment, we believe power will be a sustainable theme followed by defence. As the festive season wraps up, we will see its impact on consumption in a few weeks when the monthly high-frequency indicators are released. Overall, we believe that India's consumption story is fundamentally strong. The housing sector has seen increased absorption across India, and with the government's emphasis on affordable housing, building materials and related industries are poised to benefit. Separately, multiple enablers such as deleveraged corporate balance sheets, healthy profitability, rising domestic demand, and increasing capacity utilization bodes well for the capex cycle. |

Source: Bloomberg, Axis MF Research.