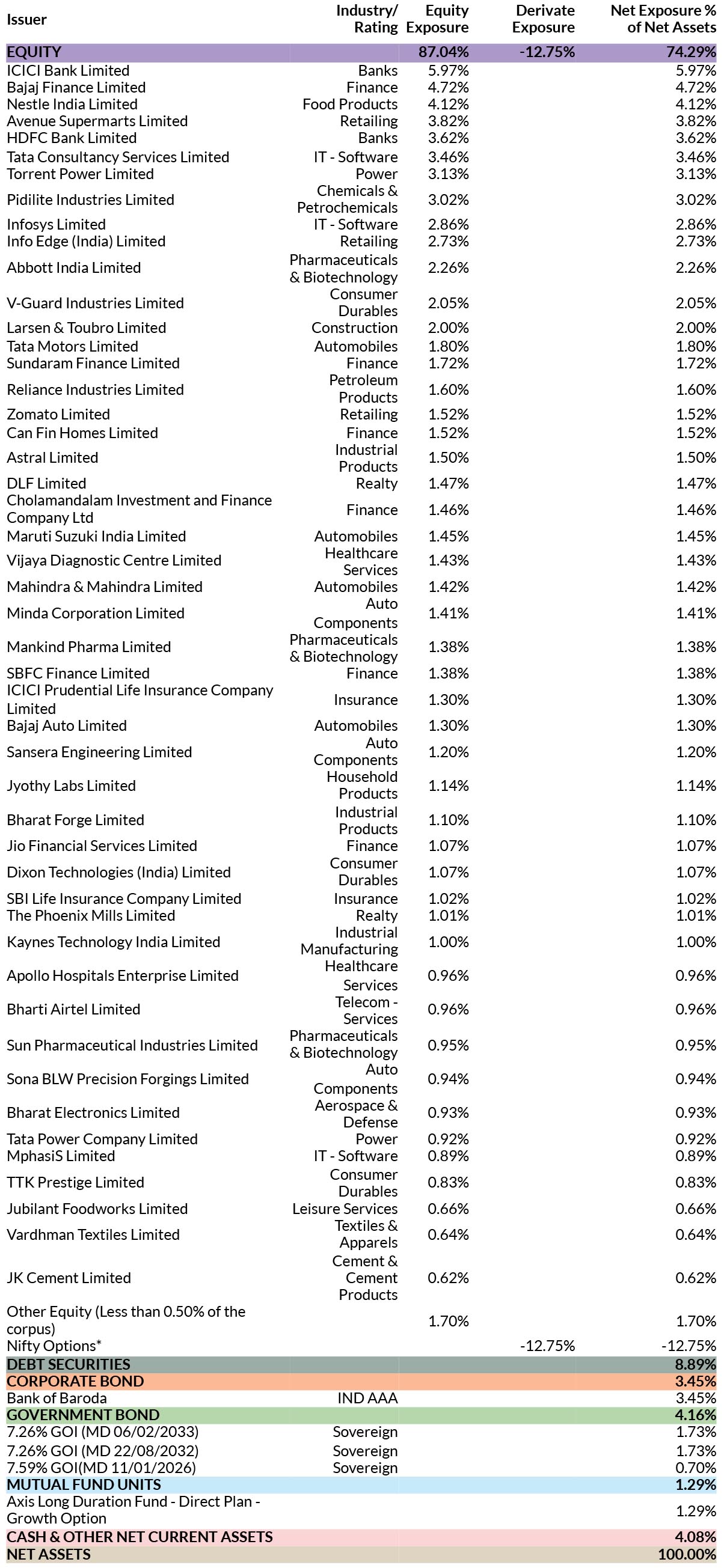

|

(An open-ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier )) |

|

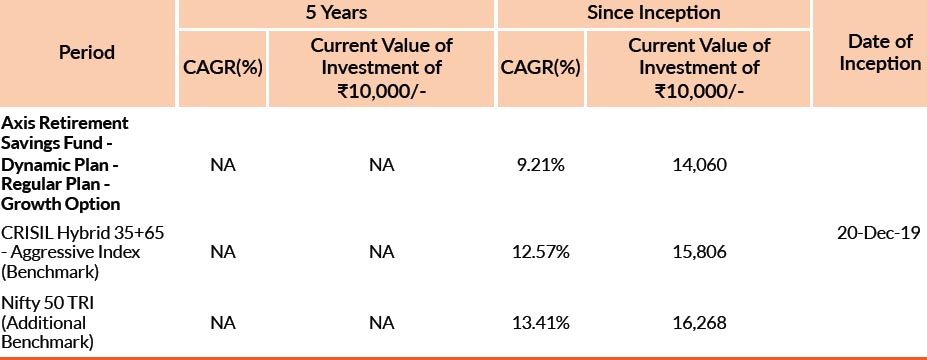

DATE OF ALLOTMENT | 20th December 2019 |

|

MONTHLY AVERAGE | 292.82Cr. |

| AS ON 31st October, 2023 | 286.71Cr. | |

|

BENCHMARK | CRISIL Hybrid 35+65 - Aggressive Index |

|

Lock In | 5 Years |

|

Residual Maturity@* | 9.32 years |

| Modified Duration@* | 5.52 years | |

| Macaulay Duration@* | 5.82 years | |

| Portfolio YTM* (Annualised) | 7.40% | |

| Adjusted YTM# | 7.42% | |

|

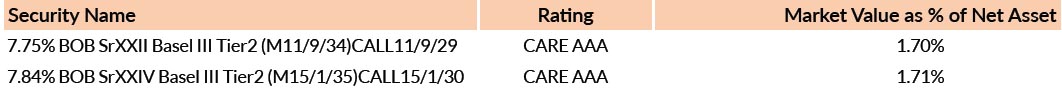

*in case of semi annual YTM, it will be annualised #Portfolio YTM adjusted for bank bonds with optionality by considering their Yield To Call at respective call dates *As per AMFI Best Practices Guidelines Circular No. 88 / 2020 -21-Additional Disclosures in Monthly Factsheets. @ Based on debt portfolio only. For instruments with put/call option, the put/call date has been taken as the maturity date. & The yield to maturity given above is based on the portfolio of funds as on date given above. This should not be taken as an indication of the returns that maybe generated by the fund and the securities bought by the fund may or may not be held till their respective maturities. The calculation is based on the invested corpus of the debt portfolio. | ||

|

FUND MANAGER | |

| Mr. R. Sivakumar Work experience: 24 years.He has been managing this fund since 20th December 2019 | ||

| Mr. Nitin Arora Work experience: 12 years.He has been managing this fund since 26th May 2023 | ||

| Mr. Vinayak

Jayanath (for foreign securities) Work experience: 7 years.He has been managing this fund since 17th January 2023 | ||

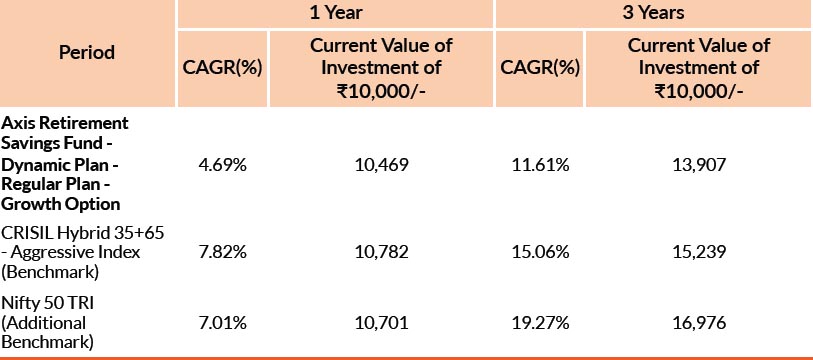

Past performance may or may not be sustained in future. Different plans have different expense structure. R Sivakumar is managing the scheme since 20th December 2019 and he manages 10 schemes of Axis Mutual Fund & Nitin Arora is managing the scheme since 26th May 2023 and he manages 6 schemes of Axis Mutual Fund & Vinayak Jayanath is managing the scheme since 17th January 2023 and he manages 17 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹10.

Entry Load : NA

Exit Load : Nil

Please click here for NAV, TER, Riskometer & Statutory Details.