|

(An open ended fund of funds scheme investing in debt oriented mutual fund schemes) |

|

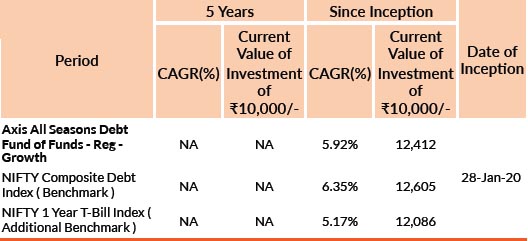

DATE OF ALLOTMENT | 28th January 2020 |

|

MONTHLY AVERAGE | 172.59Cr. |

| AS ON 31st October, 2023 | 173.17Cr. | |

|

BENCHMARK | NIFTY Composite Debt Index |

|

FUND MANAGER | |

| Mr. R Sivakumar Work experience: 24 years. He has been managing this fund since 28th January 2020 | ||

| Mr. Devang Shah Work experience: 18 years. He has been managing this fund since 1st February 2023 | ||

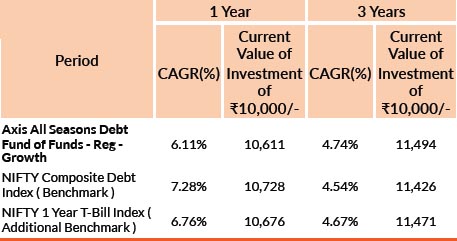

Past performance may or may not be sustained in future. Different plans have different expense structure. R Sivakumar is managing the scheme since 28th January 2020 and he manages 10 schemes of Axis Mutual Fund & Devang Shah is managing the scheme since 1st February 2023 and he manages 14 schemes of Axis Mutual Fund . Please refer to annexure for performance of schemes managed by the fund manager. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹10.

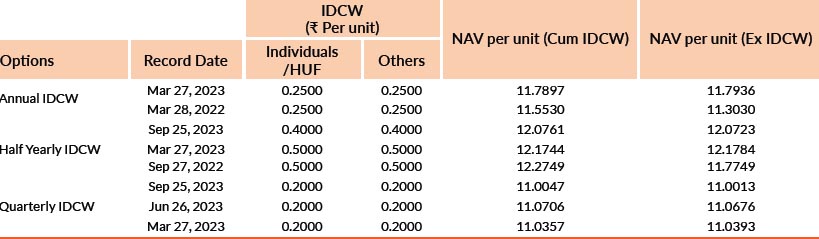

Pursuant to payment of Distribution (of Income & Capital), the NAV of the above stated IDCW options of the scheme/plan would fall to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future. Face value of units is ₹ 10. IDCW means Income Distribution cum Capital Withdrawal.

Entry Load :NA

Exit Load :

If redeemed/switch out within 12 months from the date of allotment

- For 10% of investment : Nil

- For remaining investment : 1%

If redeemed/switch out afer 12 months from the date of allotment: Nil

Please click here for NAV, TER, Riskometer & Statutory Details.