Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

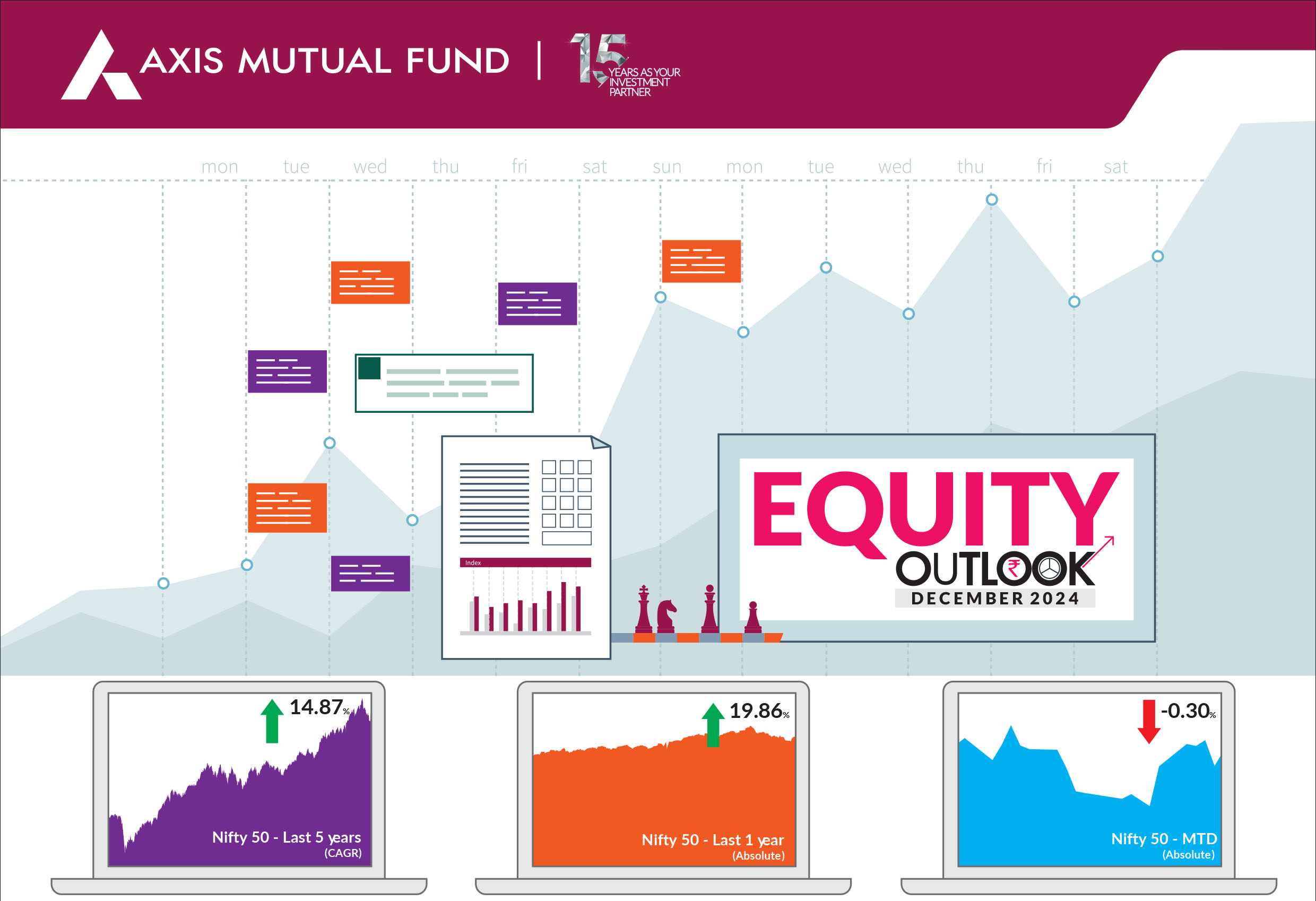

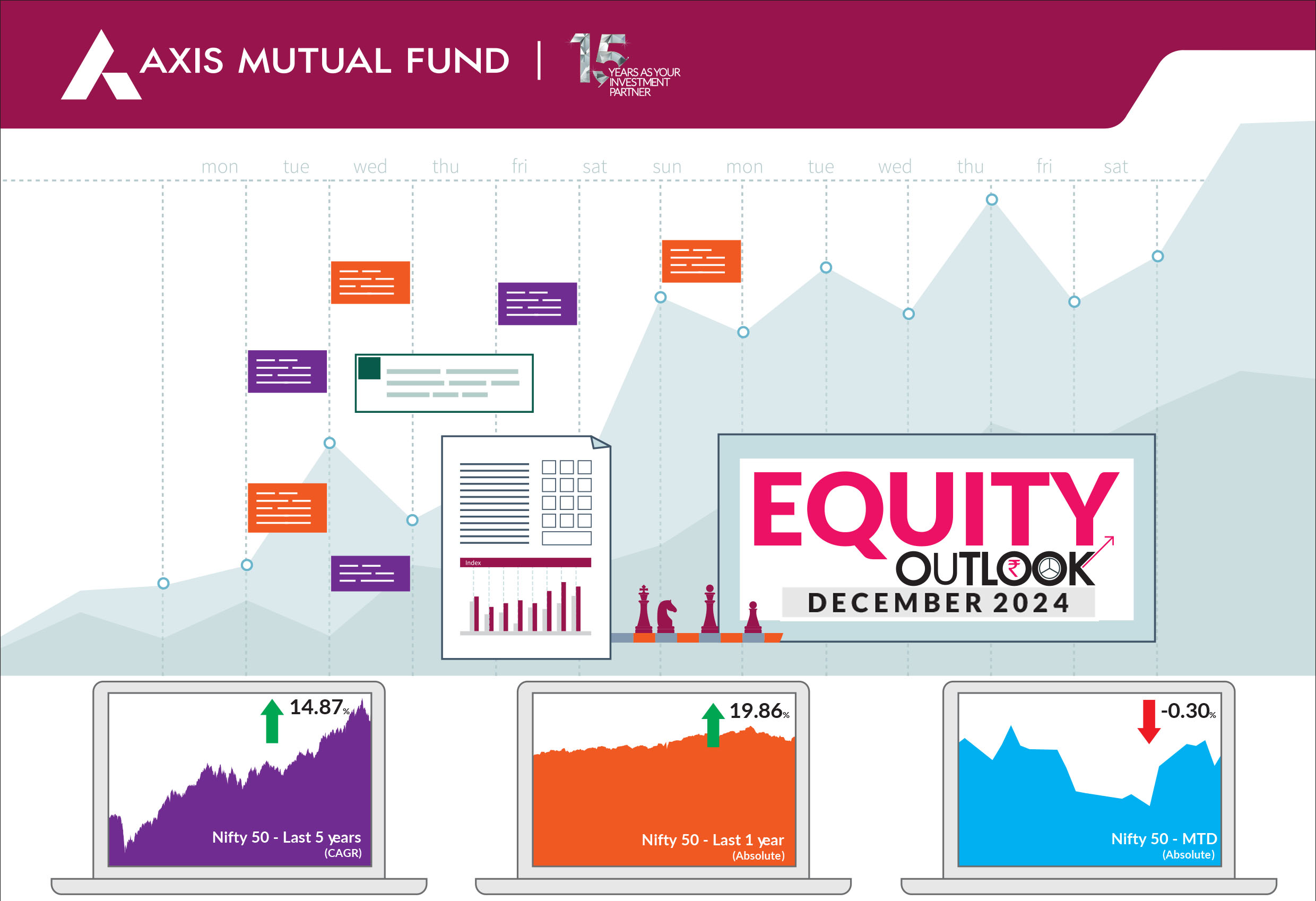

Indian equites ended November better than October, first declining then advancing in the last 10 days of the month. Weaker than expected second quarter results, foreign fund outflows and geopolitical uncertainty led to volatility during the month. The BSE Sensex and the NIFTY 50 ended the month higher by 0.5% while Nifty ended lower by 0.3%. The NIFTY Midcap 100 ended the month higher by 0.5% while NIFTY Small Cap 100 ended 0.3% higher. Nevertheless, from the 11% declines seen from record highs, markets have recovered approx. 3%. The key trigger - the US presidential elections culminated in Donald Trump nailing a comfortable victory against the Democratic nominee making a comeback as the President of the United States. US equities rose by 7% in November, buoyed by the outcome of the elections. One of the key impact could be tariffs by the Trump government that could have repercussions on countries such as China and Mexico. Any trade tariffs on China indirectly benefits India through China +1 strategy as was the case in 2016. |

|

The results season was muted and disappointing in many aspects as both topline and bottomline earnings growth was visibly under pressure. This quarter saw a slowdown across all three major economic pillars - consumption, capex and exports - leading to a broad-based impact on the overall earnings. IT sector saw limited uptick in growth; however, the midcaps in this spaced posted better results than large caps. Auto earnings were mixed with two wheelers segment posting better earnings than the passenger vehicles due to higher volume growth. Better results exhibited by companies in the capex space could further improve once government spending and private sector capex picks up. Banks have done reasonably well, with moderate credit growth, stable NIMs and asset quality. Within consumers, results so far have been slightly lower than expected. Earnings growth for pharma companies remained healthy particularly for the domestic formulation business. Meanwhile, the recently released GDP data showed a growth of 5.4% in Q2FY25, the slowest since Q3FY23. The slowdown was evident in both capex and private consumption. Consumption growth despite decelerating from 1QFY25 was relatively strong at 6% vs 7.4% in Q1FY25 while investment growth decelerated to 5.4% from 7.5% in the same period. GVA slowed to 5.6% in from 6.8% in the previous quarter, with net indirect taxes continuing to decline in the current quarter. By sector, industry remained weak at 3.9% with manufacturing & electricity being a drag. Services sector remained steady at 7.1%. As we head into the last month of 2024, most of the triggers have passed, be it the US elections the Maharashtra state elections. Markets would closely monitor the outcome of RBIs monetary policy. Despite the consolidation and fall from record highs, markets may still witness some more volatility. From an investors perspective, these declines are good opportunities to add into their existing holdings. Overall, even as growth has been slowing down globally and in India, we remain one of the fastest growing economies globally. Our long term themes of being overweight consumption, manufacturing, infrastructure and underweights exports still holds true.in the short to medium term, based on the cyclicality of the market, we do rotate positions across sectors and market caps. Valuations remain relatively high for mid and small caps while they are reasonable in large caps. We are overweight consumer discretionary due to strong performance in luxury spending. We favor capital goods, particularly in the power sector, where robust order books provide healthy medium-term visibility. Our exposure to pharma has increased, driven by steady growth in both domestic and export markets. CDMO players are also expected to perform well. Additionally, the hospital and diagnostics industries are showing good growth and expansion. However, we have reduced our positions in financials due to headwinds such as slowing growth and pressure on Net Interest Margins (NIMs), caused by asset quality concerns in retail and slow deposit growth. We are underweight in consumer staples due to weakness in urban consumption, despite a recovery in rural demand. We are also underweight in oil and gas and its derivatives, anticipating softness due to slower global growth. |

Source: Bloomberg, Axis MF Research.