► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

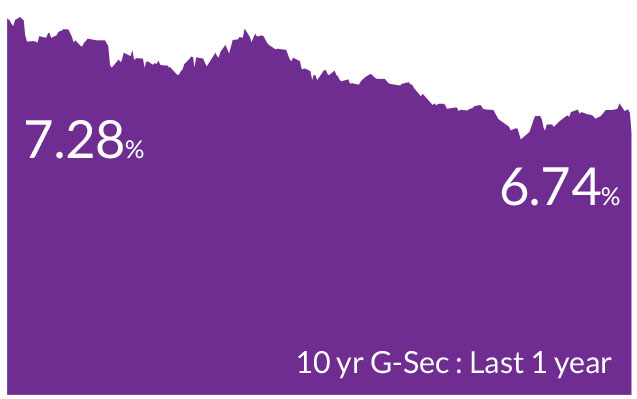

► Expect lower interest rates in the second half of FY25.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-2-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro funda mentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-2-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro funda mentals.

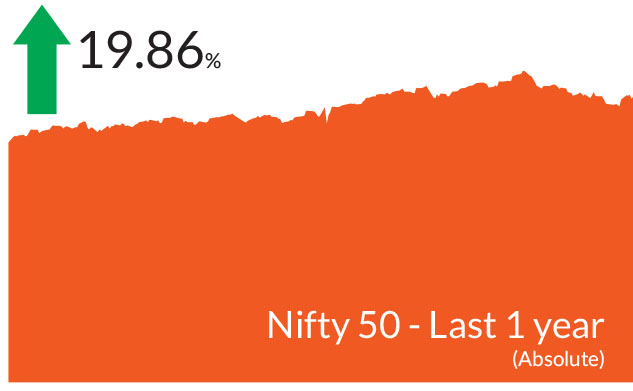

Indian equites ended November better than October, first declining

then advancing in the last 10 days of the month. Weaker than expected

second quarter results, foreign fund outflows and geopolitical

uncertainty led to volatility during the month. The BSE Sensex and the

NIFTY 50 ended the month higher by 0.5% while Nifty ended lower by

0.3%. The NIFTY Midcap 100 ended the month higher by 0.5% while

NIFTY Small Cap 100 ended 0.3% higher. Nevertheless, from the 11%

declines seen from record highs, markets have recovered approx. 3%

from the lows.

The highlight of the month was complete red sweep in US elections which has raised some important concerns in near term like (1) impact of tariffs on China and rest of world, (2) trajectory for US inflation and Fed rate cut cycle and (3) impact on EM flows, currencies and monetary policies. US yields ended lower by 15 bps, crude and dollar remained range bound as market awaits timing and actual execution of Republican policies. Bond markets yields in India have rallied by 5-10 bps across the curve in anticipation of some action by the Reserve Bank of India (RBI) due to significantly tight liquidity and unexpected GDP numbers.

► Inflationary pressures rise, growth moderates : Headline inflation breached the 6% mark, and touched 6.2% vs 5.49% in September, due to rising vegetable prices. We anticipate headline CPI to head lower after November and expect food prices to moderate as winter sets in. We do not foresee any changes in the full-year CPI projections.

The second quarter GDP data for FY 25 came at a shocking and disappointing figure of 5.4% due to lower capex, government spending and slowing consumption. Slowing high frequency indicators, lower Q1/ Q2 GDP and muted festive season indicates RBI might be negatively surprised on GDP forecasts and hence we expect them to revise down their GDP projections by 40-50 bps for FY25.

► RBI maintains pause but cuts CRR rates : The RBI maintained a pause on repo rate but lowered the Cash Reserve Ratio (CRR) by 50 bps to 4% in two equal tranches of 25 bps each with effect from the fortnight beginning December 14, 2024 and December 28, 2024. This reduction in CRR (the first since March 2020) will release approx. Rs 1,16,000 cr in the banking system. Additionally, the RBI has lowered the GDP growth estimate for FY25 to 6.6%, with expectations of a rebound later. Similarly, the central bank has revised its inflation target upward to 4.8%, anticipating it to decrease subsequently.

► Higher interest rates on FCNR deposits to attract foreign inflows : In order to attract more capital inflows, the RBI decided to increase the interest rate ceilings on FCNR(B) deposits. Accordingly, effective from December 6,2024 , banks can now offer rates up to the Overnight Alternative Reference Rate (ARR) + 400 basis points for deposits with maturities between 1 year and less than 3 years as against 250 bps at present. Similarly, for deposits of 3 to 5 years maturity, the ceiling has been increased to overnight ARR plus 500 bps as against 350 bps at present. This relaxation will be available till March 31, 2025 and help in attracting forex inflows.

► Banking liquidity in deficit : Banking liquidity moved into deficit due to big reduction in core liquidity on account of forex outflows. Banking liquidity is expected to be neutral to deficit for most of January to March 2025. Consequently, the operative rate may be close to or higher than the repo rate, leading to increased volatility in money market yields. This financial year, we are witnessing relatively slower credit growth. The incremental FY Credit/Deposit ratio is approximately 60%, compared to over 85% last year, while deposit growth has been robust.

The highlight of the month was complete red sweep in US elections which has raised some important concerns in near term like (1) impact of tariffs on China and rest of world, (2) trajectory for US inflation and Fed rate cut cycle and (3) impact on EM flows, currencies and monetary policies. US yields ended lower by 15 bps, crude and dollar remained range bound as market awaits timing and actual execution of Republican policies. Bond markets yields in India have rallied by 5-10 bps across the curve in anticipation of some action by the Reserve Bank of India (RBI) due to significantly tight liquidity and unexpected GDP numbers.

Key Market Events

►US elections, rate cuts and impact globally : As mentioned, the immediate concerns globally are the impact of tariffs on the world and the rate cuts and inflation. Fed continued with a 25 bps cut and we expect them to deliver another 25 bps in December cumulatively reducing rates by 100 bps this year. The FOMC minutes from the November 6-7 meeting show optimism among Federal Reserve officials that inflation is subsiding while the labor market remains robust but indicated that the pace of further interest rate cuts will be gradual.► Inflationary pressures rise, growth moderates : Headline inflation breached the 6% mark, and touched 6.2% vs 5.49% in September, due to rising vegetable prices. We anticipate headline CPI to head lower after November and expect food prices to moderate as winter sets in. We do not foresee any changes in the full-year CPI projections.

The second quarter GDP data for FY 25 came at a shocking and disappointing figure of 5.4% due to lower capex, government spending and slowing consumption. Slowing high frequency indicators, lower Q1/ Q2 GDP and muted festive season indicates RBI might be negatively surprised on GDP forecasts and hence we expect them to revise down their GDP projections by 40-50 bps for FY25.

► RBI maintains pause but cuts CRR rates : The RBI maintained a pause on repo rate but lowered the Cash Reserve Ratio (CRR) by 50 bps to 4% in two equal tranches of 25 bps each with effect from the fortnight beginning December 14, 2024 and December 28, 2024. This reduction in CRR (the first since March 2020) will release approx. Rs 1,16,000 cr in the banking system. Additionally, the RBI has lowered the GDP growth estimate for FY25 to 6.6%, with expectations of a rebound later. Similarly, the central bank has revised its inflation target upward to 4.8%, anticipating it to decrease subsequently.

► Higher interest rates on FCNR deposits to attract foreign inflows : In order to attract more capital inflows, the RBI decided to increase the interest rate ceilings on FCNR(B) deposits. Accordingly, effective from December 6,2024 , banks can now offer rates up to the Overnight Alternative Reference Rate (ARR) + 400 basis points for deposits with maturities between 1 year and less than 3 years as against 250 bps at present. Similarly, for deposits of 3 to 5 years maturity, the ceiling has been increased to overnight ARR plus 500 bps as against 350 bps at present. This relaxation will be available till March 31, 2025 and help in attracting forex inflows.

► Banking liquidity in deficit : Banking liquidity moved into deficit due to big reduction in core liquidity on account of forex outflows. Banking liquidity is expected to be neutral to deficit for most of January to March 2025. Consequently, the operative rate may be close to or higher than the repo rate, leading to increased volatility in money market yields. This financial year, we are witnessing relatively slower credit growth. The incremental FY Credit/Deposit ratio is approximately 60%, compared to over 85% last year, while deposit growth has been robust.

Market View

Equity MarketsThe results season was muted and disappointing in many aspects as both topline and bottomline earnings growth was visibly under pressure. This quarter saw a slowdown across all three major economic pillars - consumption, capex and exports - leading to a broad-based impact on the overall earnings. IT sector saw limited uptick in growth; however, the midcaps in this spaced posted better results than large caps. Auto earnings were mixed with two wheelers segment posting better earnings than the passenger vehicles due to higher volume growth. Better results exhibited by companies in the capex space could further improve once government spending and private sector capex picks up. Banks have done reasonably well, with moderate credit growth, stable NIMs and asset quality. Within consumers, results so far have been slightly lower than expected. Earnings growth for pharma companies remained healthy particularly for the domestic formulation business.

Meanwhile, the recently released GDP data showed a growth of 5.4% in Q2FY25, the slowest since Q3FY23. The slowdown was evident in both capex and private consumption. Consumption growth despite decelerating from 1QFY25 was relatively strong at 6% vs 7.4% in Q1FY25 while investment growth decelerated to 5.4% from 7.5% in the same period. GVA slowed to 5.6% in from 6.8% in the previous quarter, with net indirect taxes continuing to decline in the current quarter. By sector, industry remained weak at 3.9% with manufacturing & electricity being a drag. Services sector remained steady at 7.1%.

As we head into the last month of 2024, most of the triggers have passed, be it the US elections the Maharashtra state elections. Markets would closely monitor the outcome of RBIs monetary policy. Despite the consolidation and fall from record highs, markets may still witness some more volatility. From an investors perspective, these declines are good opportunities to add into their existing holdings.

Overall, even as growth has been slowing down globally and in India, we remain one of the fastest growing economies globally. Our long term themes of being overweight consumption, manufacturing, infrastructure and underweights exports still holds true.in the short to medium term, based on the cyclicality of the market, we do rotate positions across sectors and market caps. Valuations remain relatively high for mid and small caps while they are reasonable in large caps. We are overweight consumer discretionary due to strong performance in luxury spending. We favor capital goods, particularly in the Power sector, where robust order books provide healthy medium-term visibility. Our exposure to pharma has increased, driven by steady growth in both domestic and export markets. CDMO players are also expected to perform well. Additionally, the Hospital and Diagnostics industries are showing good growth and expansion. However, we have reduced our positions in financials due to headwinds such as slowing growth and pressure on Net Interest Margins (NIMs), caused by asset quality concerns in retail and slow deposit growth. We are underweight in consumer staples due to weakness in urban consumption, despite a recovery in rural demand. We are also underweight in oil and gas and its derivatives, anticipating softness due to slower global growth.

Debt Markets

Today's monetary policy event underscores the Reserve Bank of India's (RBI) shift towards supporting growth. The central bank's CRR cut will inject liquidity amounting to Rs 1,16,000 crore into the banking system, with an even larger multiplier effect.

We had been of the view that banking liquidity would remain largely in deficit for Jan- March 2025 quarter unless RBI intervenes in form of CRR cuts and the announcement today is indicative of the RBI being mindful of the deficit in the banking system. We expect markets to rally by 8-10 bps across the curve and yields to trend lower as markets could start pricing in a 25 bps cut in February policy.

We believe that from February, every policy meeting will be an opportunity for a rate cut based on the below

1) By the next policy meeting, the central bank would have clarity on inflation and growth numbers to some extent

2) The Union Budget would be rolled out and if government continues on the path of fiscal consolidation, which we believe it would, monetary easing will be the likely outcome

3) Donald Trump would be sworn in as the President of the US on January 20, 2025 and by the time of our policy meeting, all the currency movements and market reactions would be priced in

Bond and currencies despite a complete red sweep did not react much as Trump trade which is Dollar strengthening and rise in US yields was largely priced in last month. As said above earlier, we expect the Fed to lower rates in December monetary policy meeting. Weaker than expected China policy announcements also weighed on Crude and commodity prices.

Source: Bloomberg, Axis MF Research.