Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

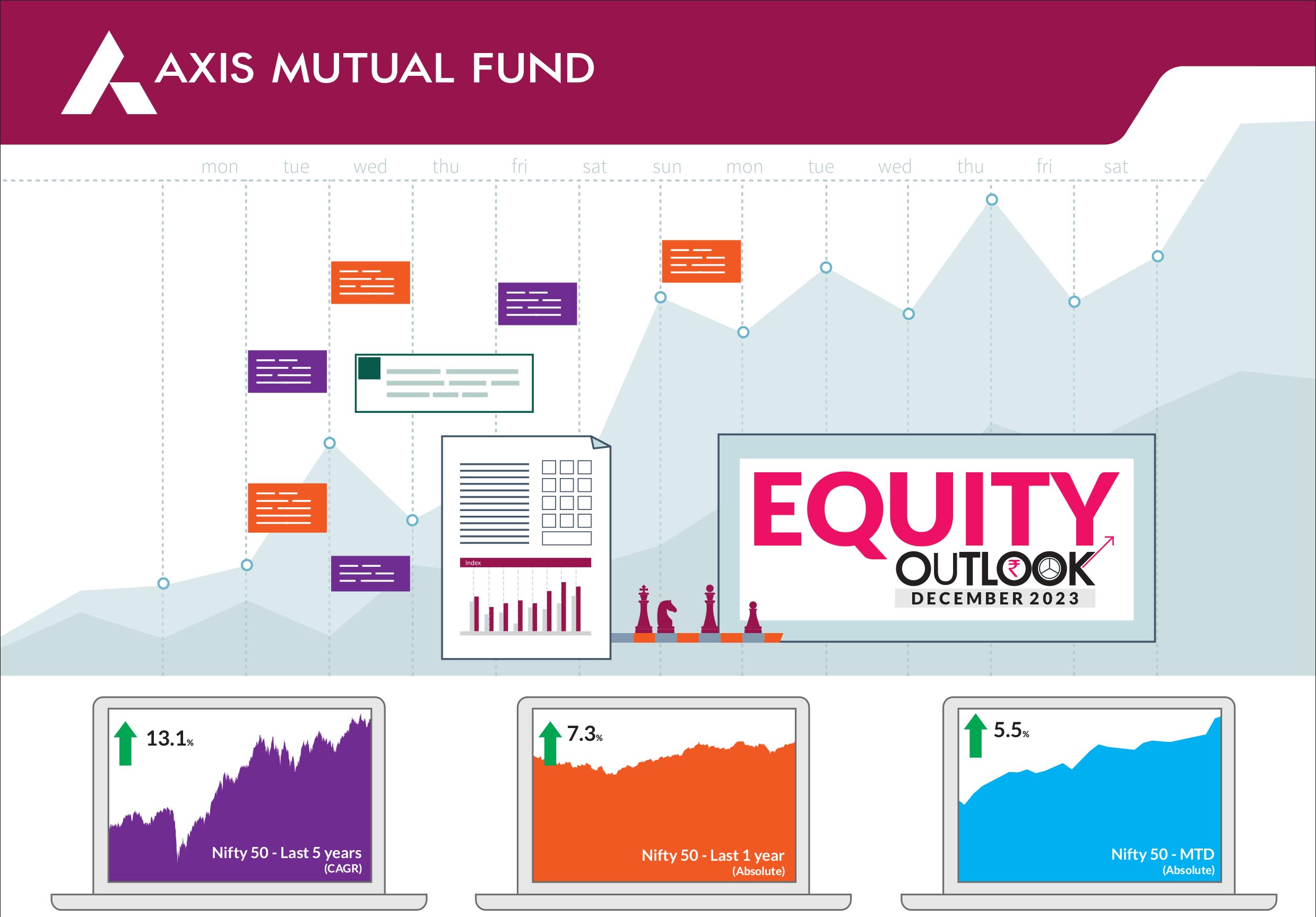

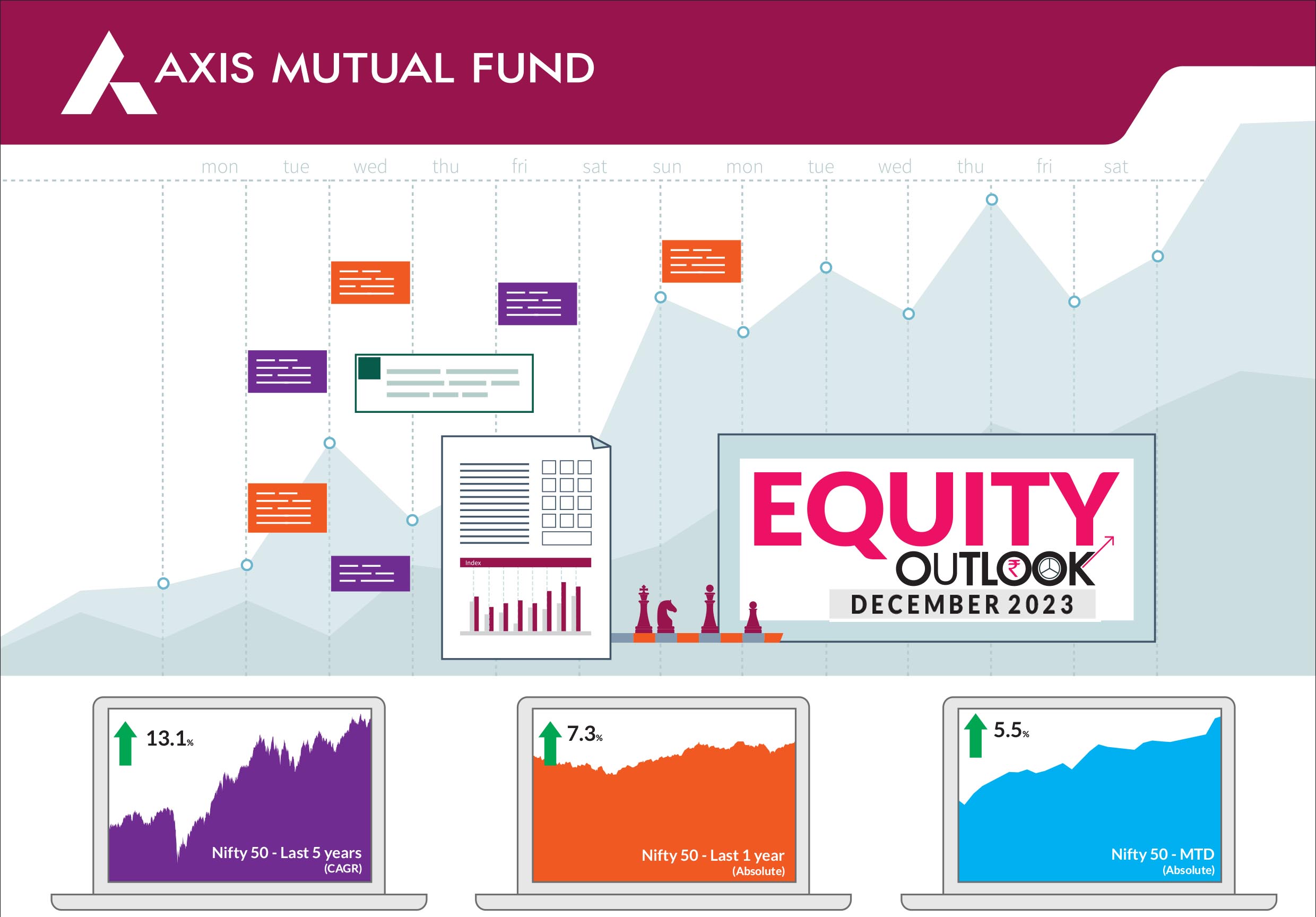

November turned out to be the best month for equities in 2023 amid an increasing appetite for riskier assets coupled with decline in US Treasury yields and in energy prices. The NIFTY 50 crossed the 20,000 mark again towards the end of the month, ending 5.5% higher while the S&P BSE Sensex advanced 4.9%. NIFTY Midcap 100 & NIFTY Smallcap 100 too rose 10.4% and 12% respectively, outperforming the Sensex and Nifty 50 in November. Market breadth was strong as seen in the advance/decline ratio while volatility was higher compared to the previous month. The combined market capitalisation as evidenced by the stocks listed on the BSE and the NSE surpassed the $4 trillion mark on 29th November 2023 for the first time ever. India is now the fifth country after the United States, China, Japan, and Hong Kong to achieve this milestone. The overall market capitalisation on the BSE touched Rs 333.29 lakh crore while that on the NSE touched 334.72 lakh crore. |

|

The second quarter GDP growth numbers at 7.6% suggested continued domestic momentum, with growth being well ahead of consensus and driven by manufacturing and construction growth. On the expenditure front, growth was led by investments due to front loading of capital expenditure by the state and central governments. Overall, we believe that this coupled with robust economic indicators indicate that the economy remains strong. Private consumption remains a concern due to lower rural demand. On the other hand, government has been supporting growth through capex; however, we do expect a slowdown as we head into the lok sabha elections. The results of the state elections are out for all the five states and the ruling party won in three out of five states. Dubbed as a semi-final to the Lok Sabha elections 2024, this win has eased uncertainty over policy continuation. Adding to more strength in the economy, the PMI data showed that manufacturing continued to expand. The gauge of manufacturing remained above 50 for the 29th month in a row. Headline inflation dropped to 4.87% vs 5.02% in September due to favourable base effects and no change in the prices of vegetables. Crude oil prices moderated over the month by approx 5% due to higher US crude inventories and lower demand. The Reserve Bank of India has been on hold since the last four monetary policy meetings and is further expected to remain on hold in its early December meeting. Even though the Israel Hamas conflict continues, it has ebbed in terms of the intensity. Going forward, domestic growth is likely to remain strong. Ahead of the general elections, we expect populist measures could likely lead to a spurt in spending, particularly in the rural areas. Post elections, we expect growth likely to be capex / investment driven and accompanied by improving credit availability. Rates have peaked, and we do not expect them to head lower before the first half of the next year. This sets the stage for outperformance for financials, consumer discretionary and industrial cyclicals. Additionally, earnings growth continues to stand out as evidenced by the second quarter earnings results. Based on this view, we remain constructive towards the investment part of the economy continues. Furthermore, we believe that consumption should improve over the next few months and this reflects in our portfolio holdings. We have added more breadth to our portfolios through the pharma and automobiles segment since last few months. So far in 2023, equity markets had the strongest run in November and this underlines the importance of staying invested in the markets at all times. Markets may not always stay up but periods of declines should be seen as opportunities to add exposure to equities and this includes being invested across the funds irrespective of their market caps. In addition, given the fact that India remains on a higher growth trajectory, a shift in India's structural story and the government's strong focus on manufacturing, the wheels are set in motion in the medium to longer term. |

Source: Bloomberg, Axis MF Research.