► Equity market valuations are broadly reasonable adjusted for the cyclical low in earnings and

potential for revival going forward.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Interest rate cycles have peaked both globally and in India.

► Investors should add duration with every rise in yields.

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Investors should add duration with every rise in yields.

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

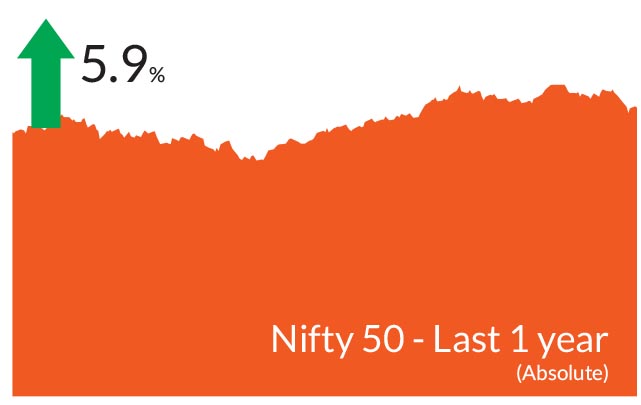

November turned out to be the best month for equities in 2023 amid an

increasing appetite for riskier assets coupled with decline in US

Treasury yields and in energy prices. The NIFTY 50 crossed the 20,000

mark again towards the end of the month, ending 5.5% higher while the

S&P BSE Sensex advanced 4.9%. NIFTY Midcap 100 & NIFTY Smallcap

100 too rose 10.4% and 12% respectively, outperforming the Sensex

and Nifty 50 in November. Market breadth was strong as seen in the

advance/decline ratio while volatility was higher compared to the

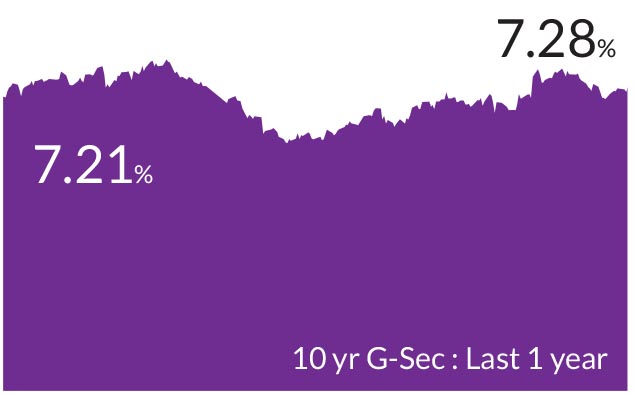

previous month. Indian government bond yields fell over the month,

trading in a band of 7.21-7.35% and ending at 7.28%.

► Inflationary pressures and oil prices head lower: Headline inflation edged further lower to 4.9% in October vs 5.02% in September despite a rise in the vegetable prices, particularly that of onions. Core inflation, too softened to 4.3% vs 4.6% in September. While inflation is within the central bank's band of 2-6%, it could rise further in the near term as the base effect wears off. However, inflation should soon be heading lower thereafter once the new crop comes in. In the upcoming monetary policy meeting between 6-8 December, we expect the Reserve Bank of India (RBI) to remain on hold. Crude oil prices declined over the month to $84 levels and briefly touched 77-78 levels during the month. This is despite OPEC and its allies reducing supply by 1 million barrels as the demand outlook remains weak.

► Economic growth remains resilient: India's GDP expanded 7.6% during the second quarter vs the 7.8% growth of the first quarter. While the numbers were a tad lower, they were better than the market expectations. Investments led the growth aided by government capex and government expenditure remained strong. Private consumption growth was weak. In 1HFY24, GDP growth at 7.7% led by investment growth at 9.5% while personal consumption growth was at 4.5%. Manufacturing sector growth at 13.9% was led by favorable base effects and high profitability aided by low input costs. Construction sector growth at 13.3% vs 7.9% in 1QFY24 continued to reflect the government's capex thrust.

Key Market Events

► US Treasury yields retreat over the month: US Treasury yields finally relented in November and edged lower amidst optimism that the US Federal Reserve (Fed) could be finally been at the peak of its interest rate hikes and no more hikes were in order. The yields on the 10-year Treasury fell to 4.3%, a significant decline of 63 bps from previous month's close of 4.93%. Meanwhile, the yields on the 2 year Treasuries have fallen lesser than the longer end leading to the yield curve getting less inverted to flat. Markets expect the Fed to remain on hold in its December policy meeting. Even as the GDP data remained strong, large amount of data is pointing to softer growth including the unemployment numbers. The US dollar has been weakening against the developed economies but gained ground against the emerging markets.► Inflationary pressures and oil prices head lower: Headline inflation edged further lower to 4.9% in October vs 5.02% in September despite a rise in the vegetable prices, particularly that of onions. Core inflation, too softened to 4.3% vs 4.6% in September. While inflation is within the central bank's band of 2-6%, it could rise further in the near term as the base effect wears off. However, inflation should soon be heading lower thereafter once the new crop comes in. In the upcoming monetary policy meeting between 6-8 December, we expect the Reserve Bank of India (RBI) to remain on hold. Crude oil prices declined over the month to $84 levels and briefly touched 77-78 levels during the month. This is despite OPEC and its allies reducing supply by 1 million barrels as the demand outlook remains weak.

► Economic growth remains resilient: India's GDP expanded 7.6% during the second quarter vs the 7.8% growth of the first quarter. While the numbers were a tad lower, they were better than the market expectations. Investments led the growth aided by government capex and government expenditure remained strong. Private consumption growth was weak. In 1HFY24, GDP growth at 7.7% led by investment growth at 9.5% while personal consumption growth was at 4.5%. Manufacturing sector growth at 13.9% was led by favorable base effects and high profitability aided by low input costs. Construction sector growth at 13.3% vs 7.9% in 1QFY24 continued to reflect the government's capex thrust.

Market View

Equity MarketsOverall, we believe that this coupled with robust economic indicators indicate that the economy remains strong. Private consumption remains a concern due to lower rural demand. On the other hand, government has been supporting growth through capex; however, we do expect a slowdown as we head into the lok sabha elections. The results of the state elections are out for all the five states and the Bhartiya Janata Party won in three states. Dubbed as a semi-final to the Lok Sabha elections 2024, this win has eased uncertainty over policy continuation. Adding to more strength in the economy, the PMI data showed that manufacturing continued to expand. The gauge of manufacturing remained above 50 for the 29th month in a row.

Going forward, domestic growth is likely to remain strong. Ahead of the general elections, we expect populist measures could likely lead to a spurt in spending, particularly in the rural areas. Post elections, we expect growth likely to be capex / investment driven and accompanied by improving credit availability. Rates have peaked, and we do not expect them to head lower before the first half of the next year. This sets the stage for outperformance for financials, consumer discretionary and industrial cyclicals. Additionally, earnings growth continues to stand out as evidenced by the second quarter earnings results. Based on this view, we remain constructive towards the investment part of the economy continues. Furthermore, we believe that consumption should improve over the next few months and this reflects in our portfolio holdings. We have added more breadth to our portfolios through the pharma and automobiles segment since last few months.

So far in 2023, equity markets had the strongest run in November and this underlines the importance of staying invested in the markets at all times. Markets may not always stay up but periods of declines should be seen as opportunities to add exposure to equities and this includes being invested across the funds irrespective of their market caps. In addition, given the fact that India remains on a higher growth trajectory, a shift in India's structural story and the government's strong focus on manufacturing, the wheels are set in motion in the medium to longer term.

Debt Markets

As we have been highlighting since last few months, interest rates have peaked globally, particularly in the US. Incrementally data such as housing, unemployment and inflation has started to gradually soften indicating a slowdown on the horizon. We expect the rates to stay steady before the Fed starts taking a dovish stance from February 2024 onwards.

On the domestic front, after the sell-off witnessed post the October monetary policy, yields are back to pre-policy levels last seen in October. We do not expect any surprises from the central bank and expect it to remain on a pause. On the macro front, softer inflation and a 15% fall in crude oil prices from their peaks have given leeway to the RBI and any inflation surprises in the November numbers will not be a cause of concern. In the last two months, ie post the October policy, the RBI indirectly engineered an interest rate hike through its hawkish stance and the threat of OMO sales. Consequently, the operative rate has been 6.75%, vs the 6.5%. We expect the RBI to revert to 6.5% by February 2024 and by April RBI would be at a dovish stance.

As compared to the other economies, India remains on a stronger growth trajectory. Incoming data has been firm and we do expect this to continue. The likely inclusion of government bonds in Bloomberg indices could boost inflows.

Most part of the fixed income curve is pricing in no cuts for the next six months. We reiterate that interest rates have peaked globally and in India. With policy rates remaining incrementally stable, we have maintained a long duration stance across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to touch 6.75% by April - June 2024.

From a strategy perspective, we continue to add duration across portfolios within the respective investment mandates. We expect our duration call to add value in the medium term. Investors could use this opportunity to top up on duration products with a structural allocation to short and medium duration funds and a tactical play on GILT funds.

Source: Bloomberg, Axis MF Research.