The investment objective of the scheme is to provide investment returns corresponding to the total returns of the securities as represented

by the Nifty SDL Sep 2026 Index before expenses, subject to tracking errors. However, there can be no assurance that the investment objective of the Scheme will be

achieved.

|

DATE OF ALLOTMENT | 22nd November 2022 |

|

MONTHLY AVERAGE | 77.43Cr. |

| AS ON 31st March, 2024 | 77.47Cr. | |

| RESIDUAL MATURITY | 2.36 years | MODIFIED DURATION* | 2.07 years | MACAULAY DURATION* | 2.14 years | Annualised Portfolio YTM * | 7.43% |

| *in case of semi annual YTM, it will be annualised | ||

|

BENCHMARK | Nifty SDL Sep 2026 Index |

| FUND MANAGER | |

| Mr. Aditya Pagaria Work experience: 15 years. He has been managing this fund since 22nd November 2022 | ||

| Mr. Sachin Jain Work experience: 10 years. He has been managing this fund since 1st February 2023 | ||

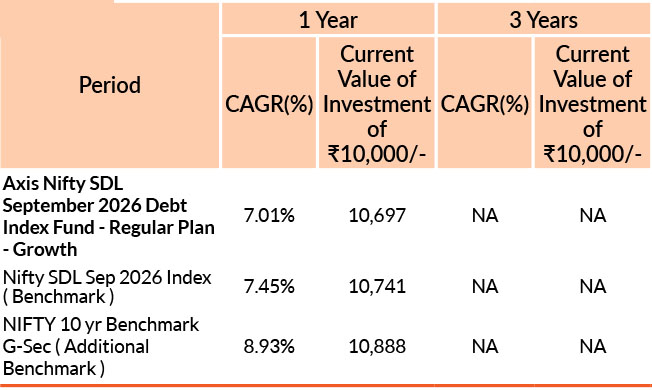

Past performance may or may not be sustained in future. Different plans have different expense structure. Aditya Pagaria is managing the scheme since 22nd November 2022 and he manages 17 schemes of Axis Mutual Fund & Sachin Jain is managing the scheme since 1st February 2023 and he manages 17 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager.Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹10.

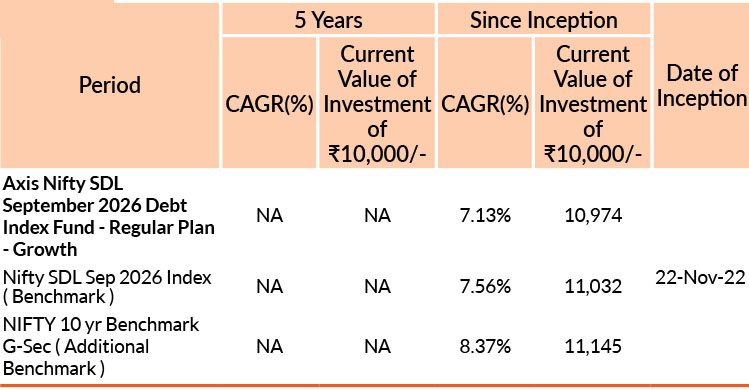

| Fund Name | Date | Tracking Difference (Annualised) | ||||

| 1 year | 3 year | 5 year | 10 year | Since Inception | ||

| Axis Nifty SDL September 2026 Debt Index Fund | 28-Mar-24 | -0.51 | -- | -- | -- | -0.43 |

Entry Load :NA

Exit Load : If redeemed before 7 Day; Exit Load is 0.25%;

Please click here for NAV, TER, Riskometer & Statutory Details.