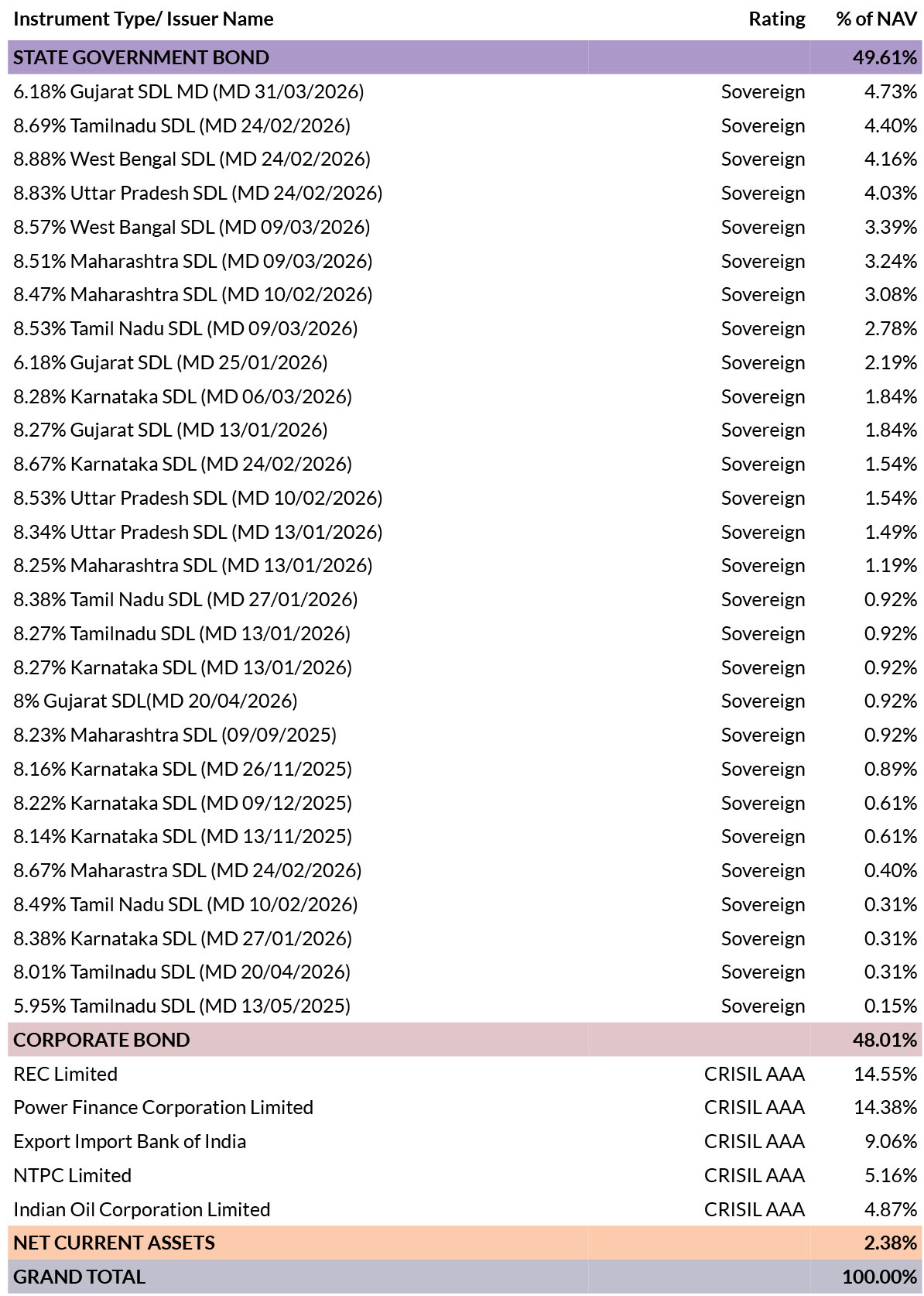

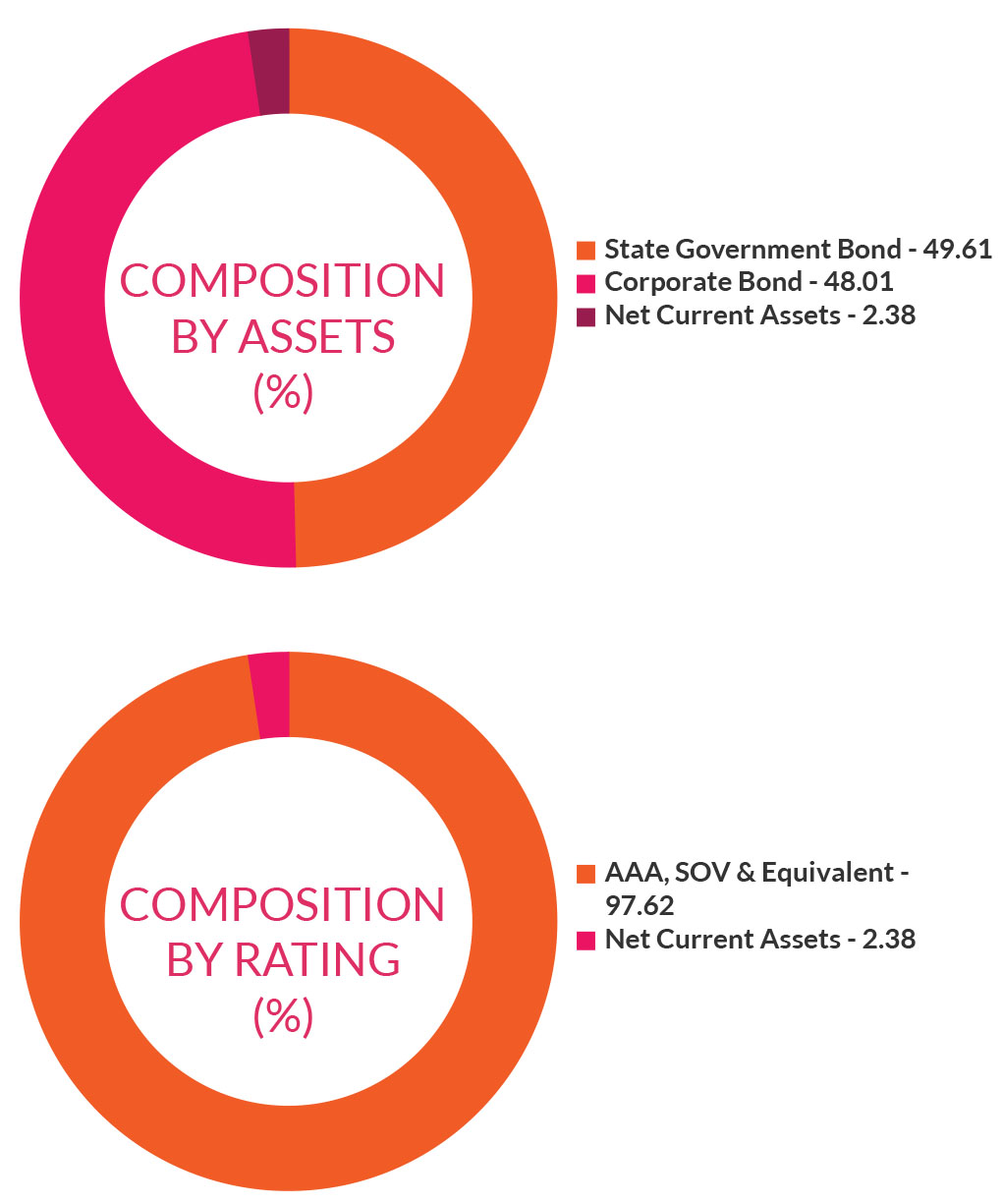

To replicate Nifty AAA Bond Plus SDL Apr 2026 50:50 Index by investing in bonds of issuers rated AAA and state development loans (SDL),

subject to tracking errors. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved.

|

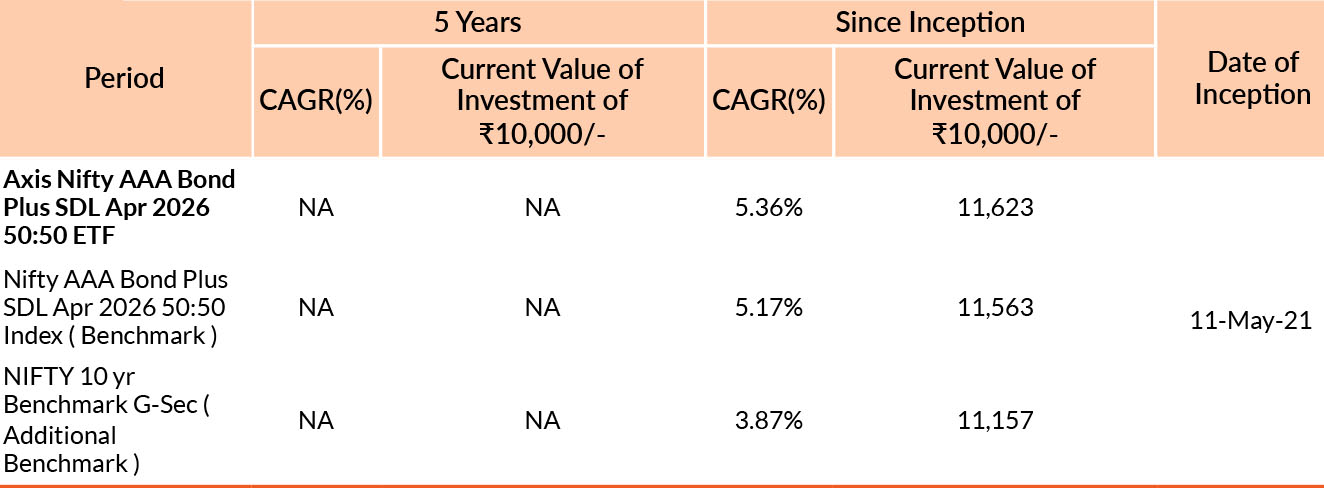

DATE OF ALLOTMENT | 11th May 2021 |

|

MONTHLY AVERAGE | 1,590.67Cr. |

| AS ON 31st March, 2024 | 1,656.30Cr. | |

| RESIDUAL MATURITY | 1.8 years | MODIFIED DURATION* | 1.6 years | MACAULAY DURATION* | 1.69 years | Annualised Portfolio YTM * | 7.56% |

| *in case of semi annual YTM, it will be annualised | ||

|

BENCHMARK | Nifty AAA Bond Plus SDL Apr 2026 50:50 Index |

|

CREATION UNIT~ | 25,00,000 UNITS |

|

FUND MANAGER | |

| Mr. Aditya Pagaria Work experience: 15 years. He has been managing this fund since 11th May 2021 | ||

| Mr. Sachin Jain Work experience: 10 years. He has been managing this fund since 1st February 2023 | ||

|

iNAV | AXISBPINAV |

|

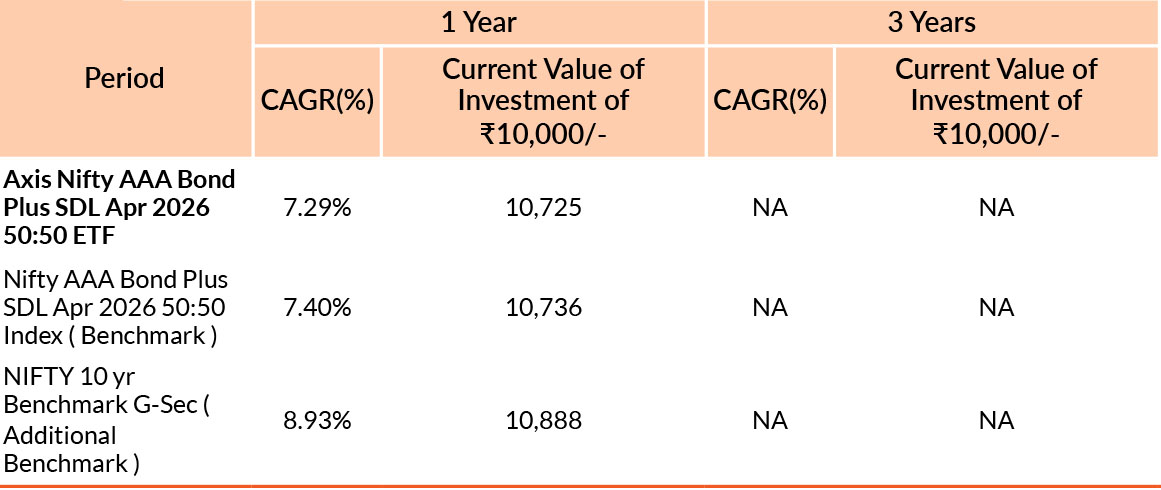

EXCHANGE SYMBOL/SCRIP CODE | AXISBPSETF |

Past performance may or may not be sustained in future. Different plans have different expense structure. Aditya Pagaria is managing the scheme since 11th May 2021 and he manages 17 schemes of Axis Mutual Fund & Sachin Jain is managing the scheme since 1st February 2023 and he manages 17 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager.Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹10.

| Fund Name | Date | Tracking Difference (Annualised) | ||||

| 1 year | 3 year | 5 year | 10 year | Since Inception | ||

| Axis Nifty AAA Bond Plus SDL Apr 2026 50:50 ETF | 28 Mar 2024 | -0.17 | -- | -- | -- | -0.1 |

Entry Load :NA

Exit Load : Nil

Please click here for NAV, TER, Riskometer & Statutory Details.