|

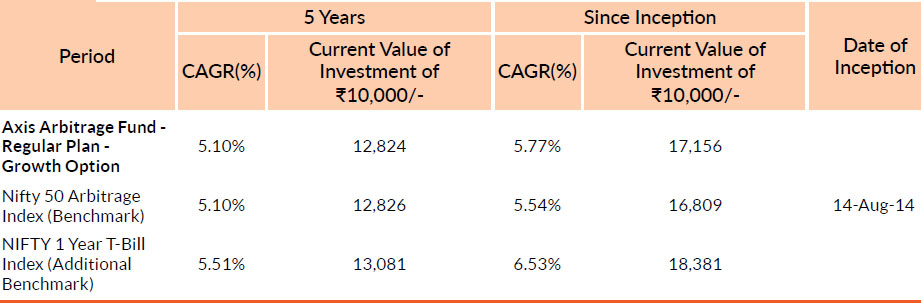

DATE OF ALLOTMENT | 14th August 2014 |

|

MONTHLY AVERAGE | 3,863.14Cr. |

| AS ON 31st March, 2024 | 3,931.16Cr. | |

|

BENCHMARK | Nifty 50 Arbitrage Index |

|

Residual Maturity@* | 298 days |

| Modified Duration@* | 285 days | |

| Macaulay Duration@* | 290 days | |

| Annualised Portfolio YTM* | 7.81% | |

| Adjusted YTM# | 7.83% | |

|

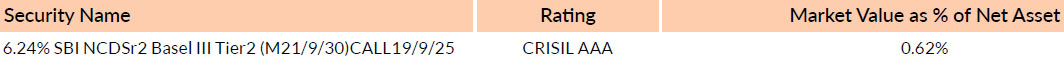

#Portfolio YTM adjusted for bank

bonds with optionality by

considering their Yield To Call at

respective call dates *in case of semi annual YTM, it will be annualised *As per AMFI Best Practices Guidelines Circular No. 88 / 2020 -21-Additional Disclosures in Monthly Factsheets. @ Based on debt portfolio only. For instruments with put/call option, the put/call date has been taken as the maturity date. & The yield to maturity given above is based on the portfolio of funds as on date given above. This should not be taken as an indication of the returns that maybe generated by the fund and the securities bought by the fund may or may not be held till their respective maturities. The calculation is based on the invested corpus of the debt portfolio. | ||

|

FUND MANAGER | |

| Mr. Karthik Kumar Work experience: 14 years.He has been managing this fund since 3rd July 2023 | ||

| Mr. Devang Shah Work experience: 18 years.He has been managing this fund since 14th August 2014 | ||

| Mr. Sachin Jain Work experience: 10 years.He has been managing this fund since 9th November 2021 | ||

| Mr. Ashish Naik Work experience: 15 years.He has been managing this fund since 4th May 2022 | ||

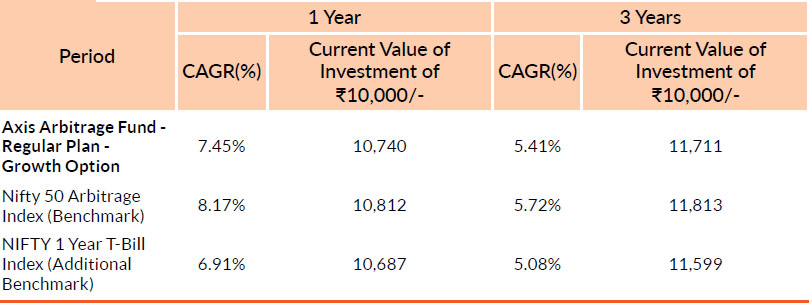

Past performance may or may not be sustained in future. Different plans have different expense structure. Karthik Kumar is managing the scheme since 3rd July 2023 and he manages 15 schemes of Axis Mutual Fund & Devang Shah is managing the scheme since 14th August 2014 and he manages 14 schemes of Axis Mutual Fund & Sachin Jain is managing the scheme since 9th November 2021 and he manages 17 schemes of Axis Mutual Fund & Ashish Naik is managing the scheme since 4th May 2022 and he manages 17 schemes of Axis Mutual Fund . Please refer to annexure for performance of schemes managed by the fund managers. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹10.

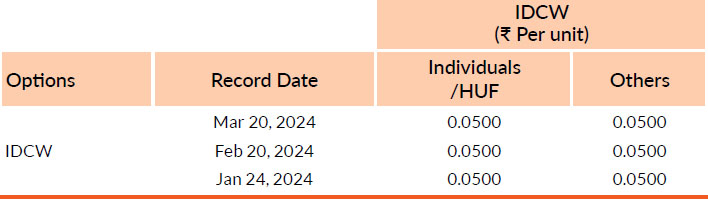

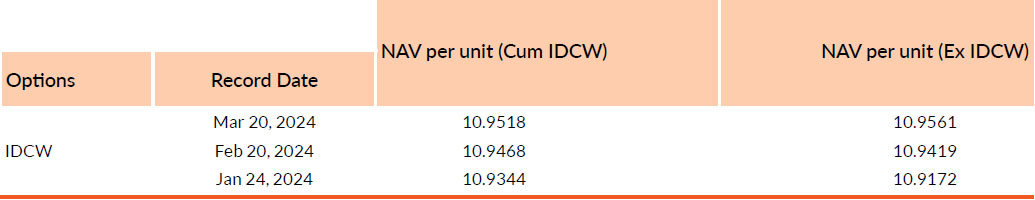

Pursuant to payment of Distribution (of Income & Capital), the NAV of the above stated IDCW options of the scheme/plan would fall to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future. Face value of units is ₹ 10. IDCW means Income Distribution cum Capital Withdrawal.

Entry Load : NA

Exit Load : If redeemed/switched out within 15 days from the date of investment/allotment: 0.25%. If redeemed/switched out after 15 days from the date of investment/allotment: Nil

Please click here for NAV, TER, Riskometer & Statutory Details.