|

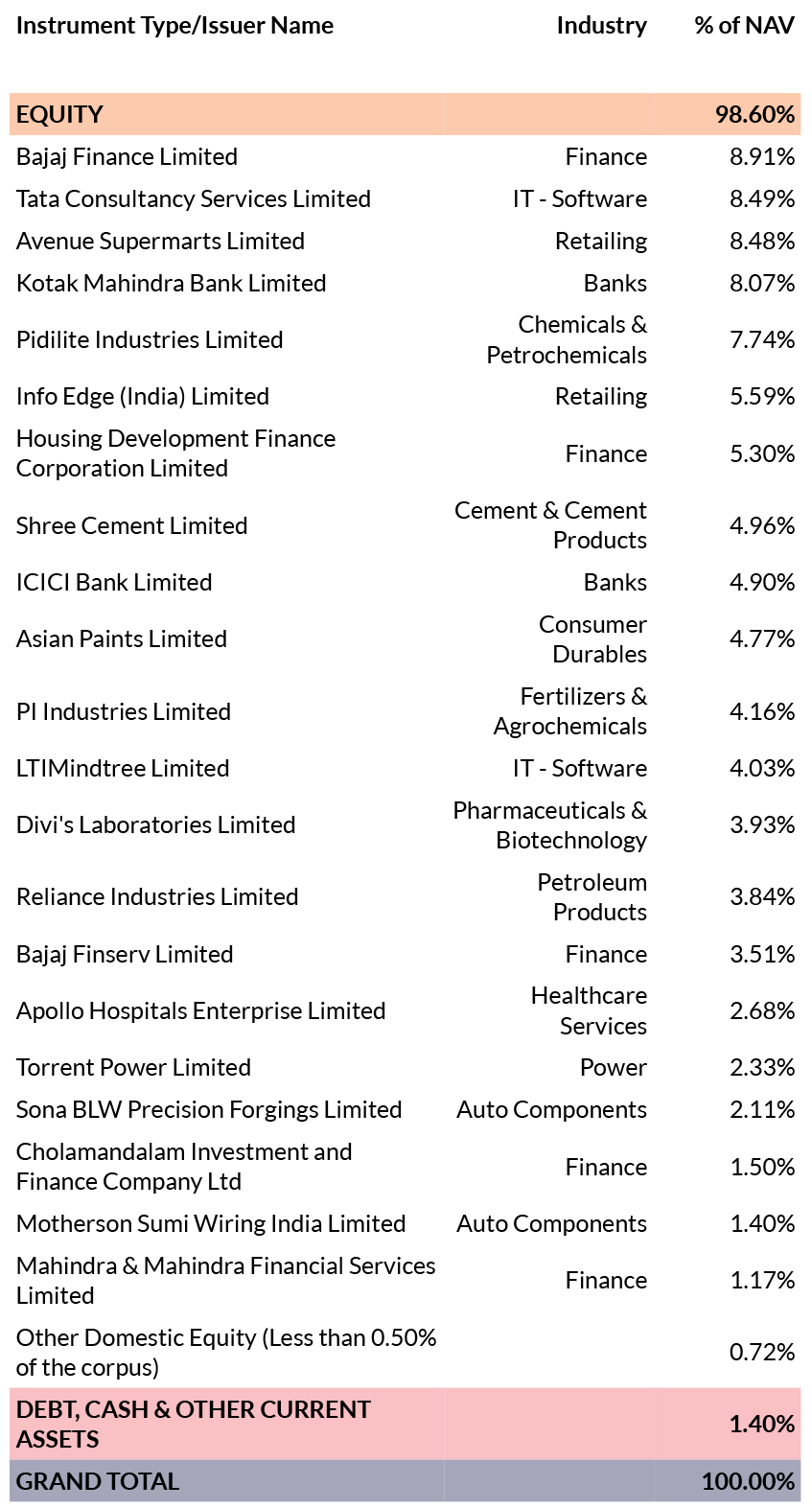

(An open ended equity scheme investing in maximum 25 stocks investing in large cap, mid cap and small cap companies) |

|

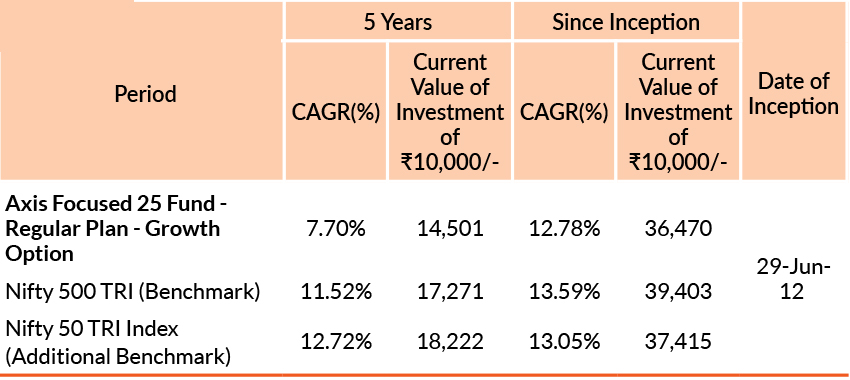

DATE OF ALLOTMENT | 29th June 2012 |

|

MONTHLY AVERAGE | 14,808.88Cr. |

| AS ON 31st March, 2023 | 14,700.66Cr. | |

|

BENCHMARK | Nifty 500 TRI |

|

STATISTICAL MEASURES | (3 YEARS) |

| Standard Deviation | 16.6% | |

| Beta | 0.97 | |

| Sharpe Ratio** | 0.58 | |

| **Risk-free rate assumed to be 7.79% (MIBOR as on 31-03-2023) - Source: www.fimmda.org Please note that as per AMFI guidelines for factsheet, the ratios are calculated based on month rolling returns (absolute) for last 3 years. Data as on 31st March 2023. | ||

|

PORTFOLIO TURNOVER (1 YEAR) | 1.80 times |

| Source ACEMF | ||

| FUND MANAGER | |

| Mr. Jinesh Gopani | ||

| Work experience: 21 years.He has been managing this fund since 7th June 2016 | ||

| Mr. Vinayak Jayanath (for foreign securities) | ||

| Work experience: 6 years.He has been managing this fund since 17th January 2023 | ||

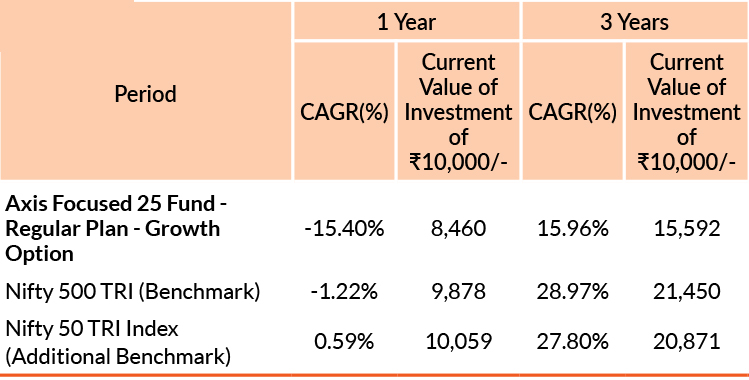

Past performance may or may not be sustained in future. Different plans have different expense structure. Jinesh Gopani is managing the scheme since 7th June 2016 and he manages 14 schemes of Axis Mutual Fund & Vinayak Jayanath is managing the scheme since 17th January 2023 and he manages 17 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹ 10.

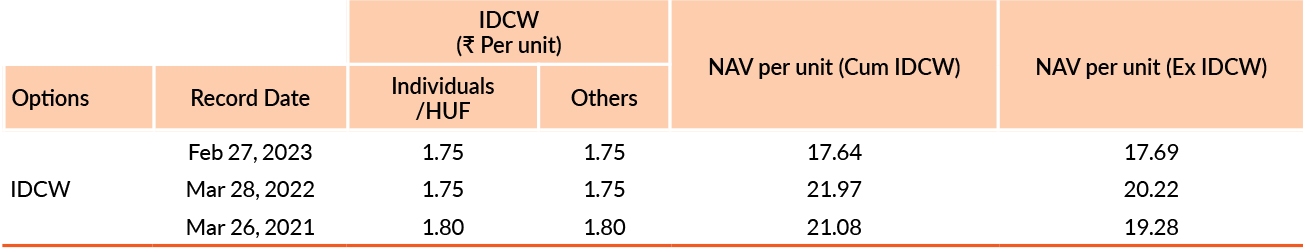

Pursuant to payment of Distribution (of Income & Capital), the NAV of the above stated IDCW options of the scheme/plan would fall to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future.

Face value of units is ₹ 10. IDCW means Income Distribution cum Capital Withdrawal.

Entry Load : NA

Exit Load : If redeemed / switched-out within 12 months from the date of allotment, For 10 % of investments: Nil, For remaining investments:

1%, If redeemed / switched - out after 12 months from the date of allotment:NIL

Please click here for NAV, TER, Riskometer & Statutory Details.