|

(An open ended fund of funds scheme investing in debt oriented mutual fund schemes) |

|

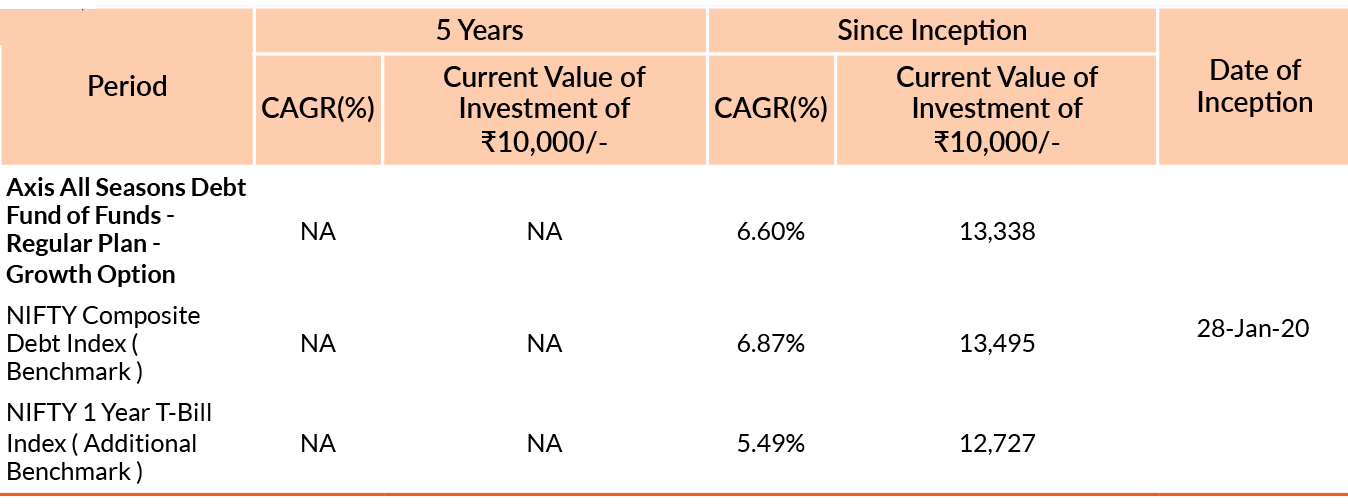

DATE OF ALLOTMENT | 28th January 2020 |

|

MONTHLY AVERAGE | 163.84Cr. |

| AS ON 31st July, 2024 | 136.30Cr. | |

|

BENCHMARK | NIFTY Composite Debt Index |

|

FUND MANAGER | |

| Mr. Devang Shah Work experience: 19 years. He has been managing this fund since 1st February 2023 | ||

| Mr. Hardik Shah Work experience: 15 years. He has been managing this fund since 5th April 2024 | ||

| Ms. Anagha Darade Work experience: 11 years. She has been managing this fund since 5th April 2024 | ||

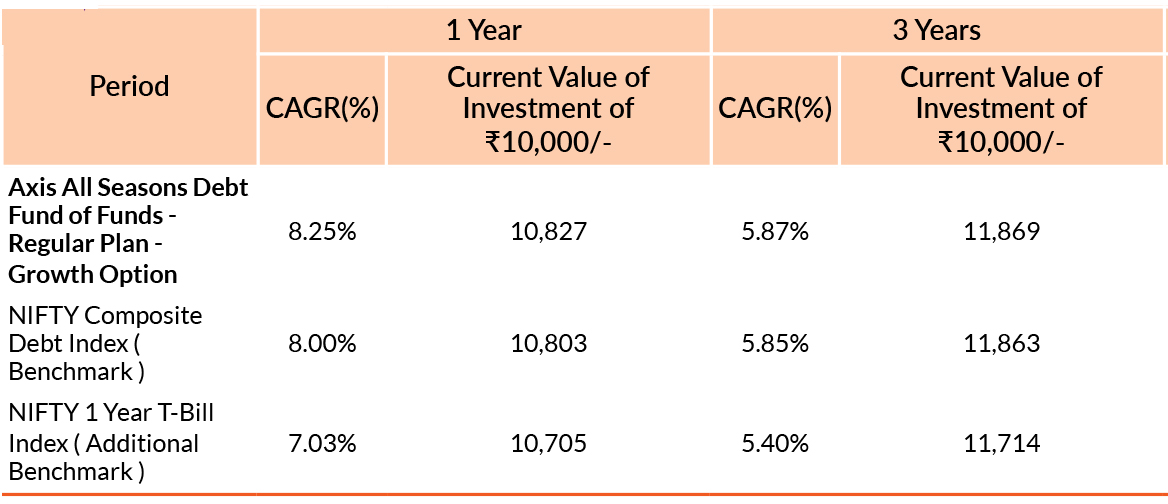

Past performance may or may not be sustained in future. Different plans have different expense structure. Devang Shah is managing the scheme since 1st February 2023 and he manages 22 schemes of Axis Mutual Fund & Hardik Shah is managing the scheme since 5th April 2024 and he manages 17 schemes of Axis Mutual Fund & Anagha Darade is managing the scheme since 5th April 2024 and she manages 1 schemes of Axis Mutual Fund . Please refer to annexure for performance of schemes managed by the fund manager. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹10.

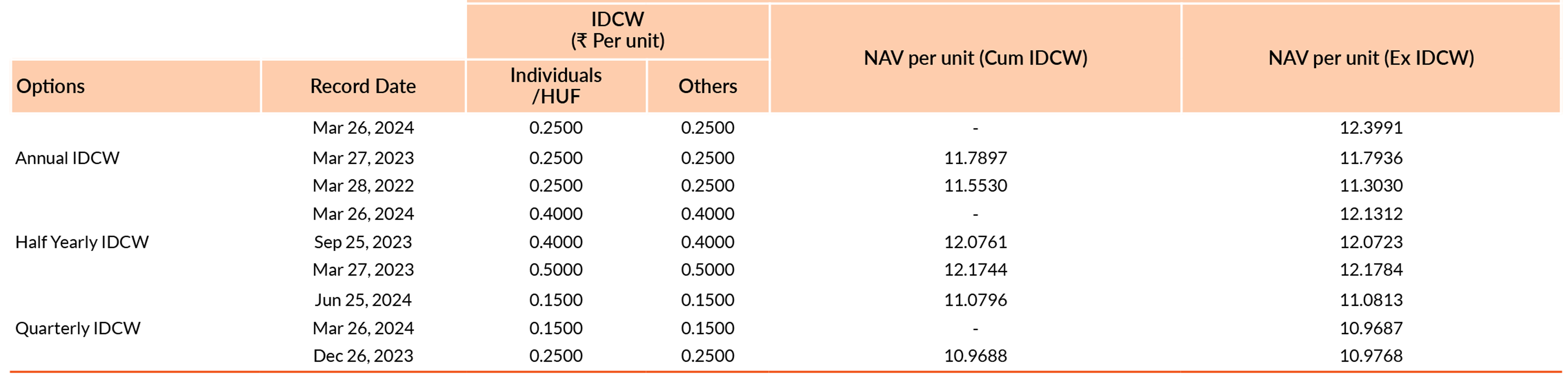

Pursuant to payment of Distribution (of Income & Capital), the NAV of the above stated IDCW options of the scheme/plan would fall to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future. Face value of units is ₹ 10. IDCW means Income Distribution cum Capital Withdrawal.

Entry Load :NA

Exit Load :

If redeemed/switch out within 3 months from the date of allotment

- For 10% of investment : Nil

- For remaining investment : 0.5%

If redeemed/switch out after 3 months from the date of allotment: Nil

Please click here for NAV, TER, Riskometer & Statutory Details.