Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

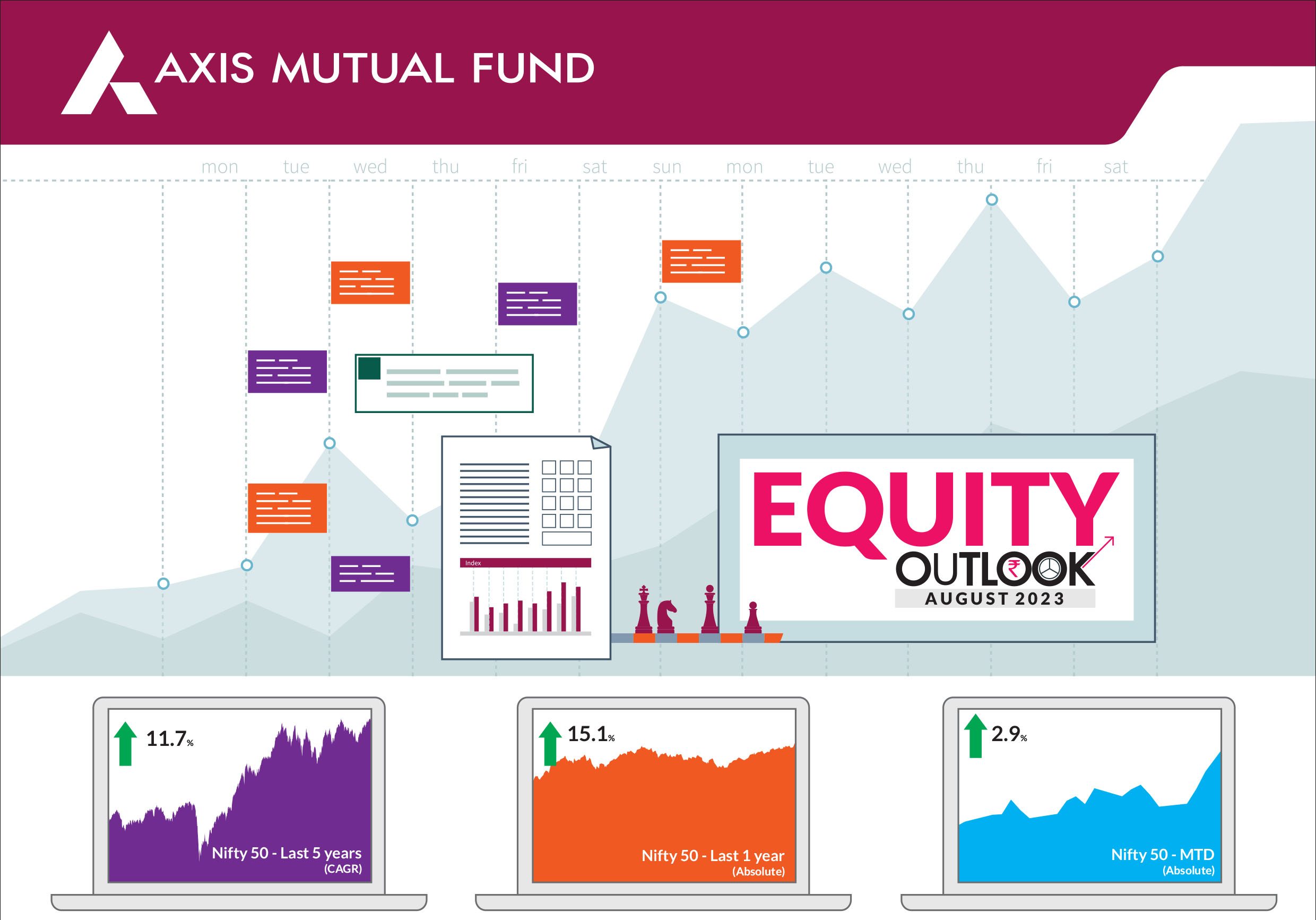

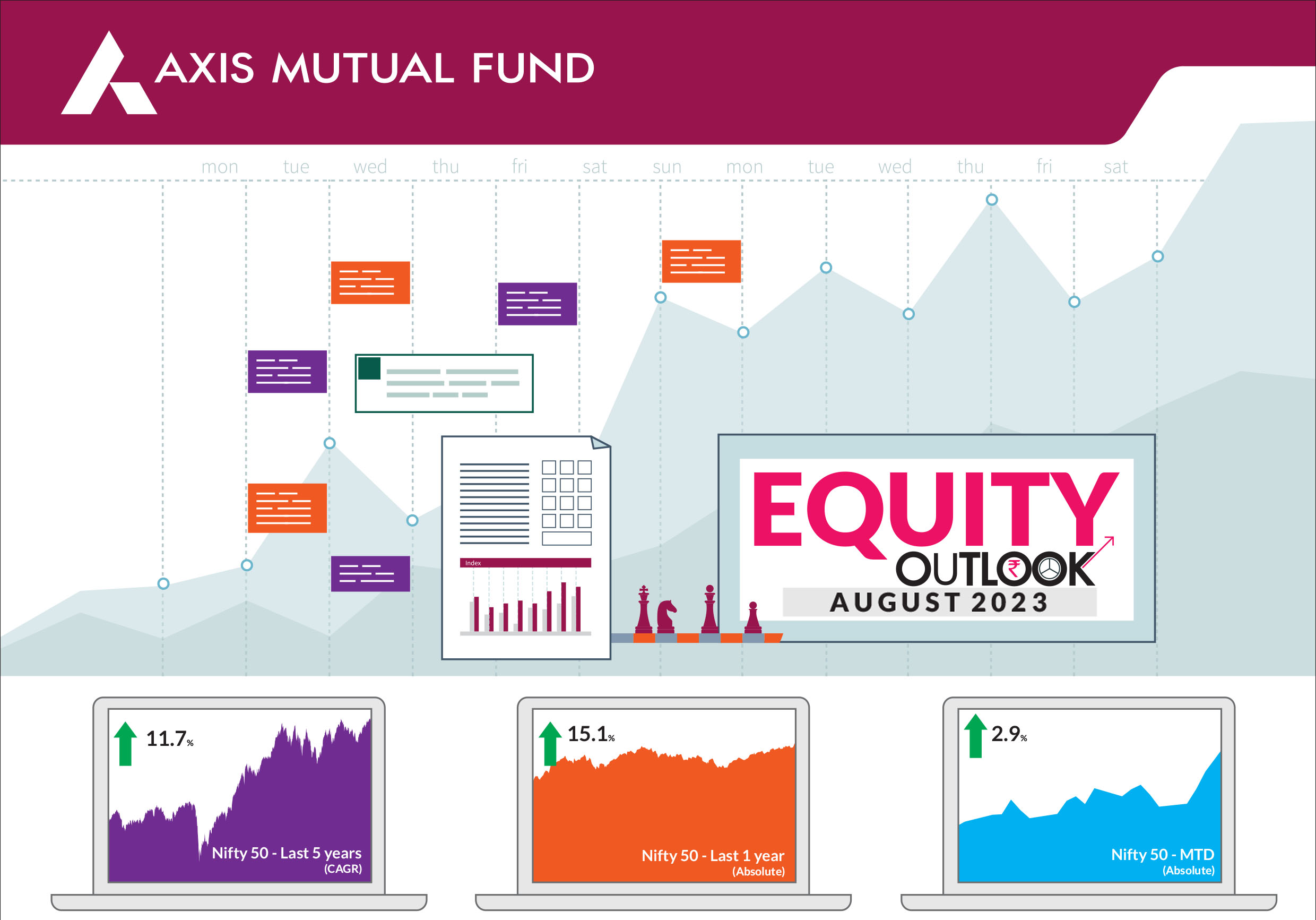

The positive momentum seen in the last three months continued in July. With the bulls taking charge of the stock markets since April, benchmark indices soared further and finally broke through the previous all-time highs in July. Going hand in hand with the strong FPI inflows was the beginning of the Q1FY24 earnings season. All indices scaled new lifetime highs, prominently the BSE Sensex crossed the 67,000 mark while the Nifty 50 inched close to the 20,000 mark. S&P BSE Sensex & NIFTY 50 ended the month up 2.8% and 2.9% respectively. NIFTY Midcap 100 & NIFTY Small cap 100 continued to outperform their large cap peers, up 5.5% & 8% respectively. Market breadth continued to remain strong while volatility declined further over the month. |

|

On the macroeconomic front, the economy was impacted primarily by rising vegetable prices that pushed headline inflation up to 4.8% in June. In the monetary policy meeting to be held on 8-10 August, we widely believe that the central bank would keep interest rates on hold even as inflation could touch 6% in the next two months. Separately, industrial production grew by 5.2% in May vs 4.2% in April led by infrastructure and capital goods. Separately, other indicators remained mixed to positive but monsoons picked up and across regions, rainfall reflected an above normal trend. A below normal monsoon could impact food prices. A suitable macro scenario bodes well for rate sensitives and sectors with structural drivers such as automobiles, infrastructure, capital goods and financials. So far, roughly 33 Nifty 50 companies have reported results, and the earnings season has been in line with estimates. Results of IT companies have been weaker while banks saw a steady improvement in margins and asset quality; and automobiles reported mixed results. Markets from here could see earnings led incremental gains. Some companies are likely to benefit over others on account of flexibility, product differentiation and market leadership. This pocket-wise growth rather than 'across the board' and active investing in growth and quality are likely to be key to alpha creation. Our fund performance has seen a strong rebound driven by active stock selection driving much of this recovery. This unique trait across portfolios has historically been key to long term wealth creation and this is reflected in our conviction plays across schemes. Accordingly, consumption and investment led sectors are the key themes. Within financials, we prefer select names that have seen an improvement in their balance sheets. Our allocations in select IT companies are purely stock specific strategies and in stories where we believe are likely disproportionate beneficiaries over the medium term. Markets at all-time highs also point to a valuation risk in select pockets which we will look to avoid. Meanwhile, the BSE Value Index has done relatively well compared to other style indices. |

Source: Bloomberg, Axis MF Research.